Why You Need S&P 500 Historical Data for Informed Investment Decisions

In today’s fast-paced and volatile financial markets, making informed investment decisions is crucial for achieving long-term financial goals. One of the most effective ways to make informed decisions is by leveraging historical market data, particularly the S&P 500 historical data. This data provides a wealth of information on market trends, patterns, and risks, enabling investors to make more accurate predictions and informed investment decisions.

Historical data is essential for understanding market trends and identifying patterns that may not be immediately apparent from current market data. By analyzing S&P 500 historical data, investors can gain valuable insights into how the market has responded to various economic and geopolitical events, and make more informed decisions about their investments. Furthermore, historical data can help investors to better understand the risks associated with their investments, and to develop strategies to mitigate those risks.

In addition, S&P 500 historical data can be used to download and analyze the performance of different asset classes, sectors, and industries, enabling investors to identify areas of strength and weakness. This information can be used to optimize portfolio returns, evaluate the performance of different investment strategies, and make more informed decisions about where to allocate investments.

How to Access Reliable S&P 500 Historical Data for Your Analysis

Access to reliable S&P 500 historical data is crucial for making informed investment decisions. Fortunately, there are several sources where investors can access high-quality historical data for their analysis. Government websites, financial databases, and online platforms are some of the most popular sources of S&P 500 historical data.

Government websites, such as the Federal Reserve Economic Data (FRED) database, provide free access to a vast array of historical data, including S&P 500 index data. These websites are reliable sources of data, and the data is often updated regularly to reflect changes in the market.

Financial databases, such as Quandl and Alpha Vantage, offer a wide range of historical data, including S&P 500 data. These databases often provide data in various formats, including CSV, Excel, and JSON, making it easy to download and analyze the data. Some financial databases also offer additional features, such as data visualization tools and APIs, to help investors work with the data more efficiently.

Online platforms, such as Yahoo Finance and Google Finance, also provide access to S&P 500 historical data. These platforms often offer a user-friendly interface, making it easy to download and analyze the data. Additionally, online platforms often provide real-time data, allowing investors to stay up-to-date with market trends and patterns.

When accessing S&P 500 historical data from these sources, it’s essential to ensure the data is reliable and accurate. Investors should always verify the data by cross-checking it with other sources and ensuring it is updated regularly. By accessing reliable S&P 500 historical data, investors can make more informed investment decisions and improve their overall investment performance.

The Benefits of Using S&P 500 Historical Data in Your Investment Strategy

Integrating S&P 500 historical data into an investment strategy can have a significant impact on investment performance. By leveraging historical data, investors can gain valuable insights into market trends, patterns, and risks, enabling them to make more informed investment decisions.

One of the primary benefits of using S&P 500 historical data is backtesting. Backtesting involves applying an investment strategy to historical data to evaluate its performance and identify potential areas for improvement. By backtesting a strategy using S&P 500 historical data, investors can gain a better understanding of how the strategy would have performed in different market conditions, allowing them to refine and optimize their approach.

S&P 500 historical data can also be used to evaluate the performance of different investment strategies. By analyzing how different strategies have performed in the past, investors can identify areas of strength and weakness, and make more informed decisions about which strategies to employ in their investment portfolios.

Furthermore, S&P 500 historical data can be used to optimize portfolio returns. By analyzing historical data, investors can identify the most profitable investment opportunities and allocate their resources accordingly. This can help to maximize returns and minimize risk, leading to improved investment performance.

In addition, S&P 500 historical data can be used to identify trends and patterns in the market. By analyzing historical data, investors can identify emerging trends and position their portfolios to take advantage of these trends. This can help to improve investment performance and reduce risk.

Overall, incorporating S&P 500 historical data into an investment strategy can have a significant impact on investment performance. By leveraging historical data, investors can gain valuable insights into market trends, patterns, and risks, enabling them to make more informed investment decisions and improve their overall investment performance.

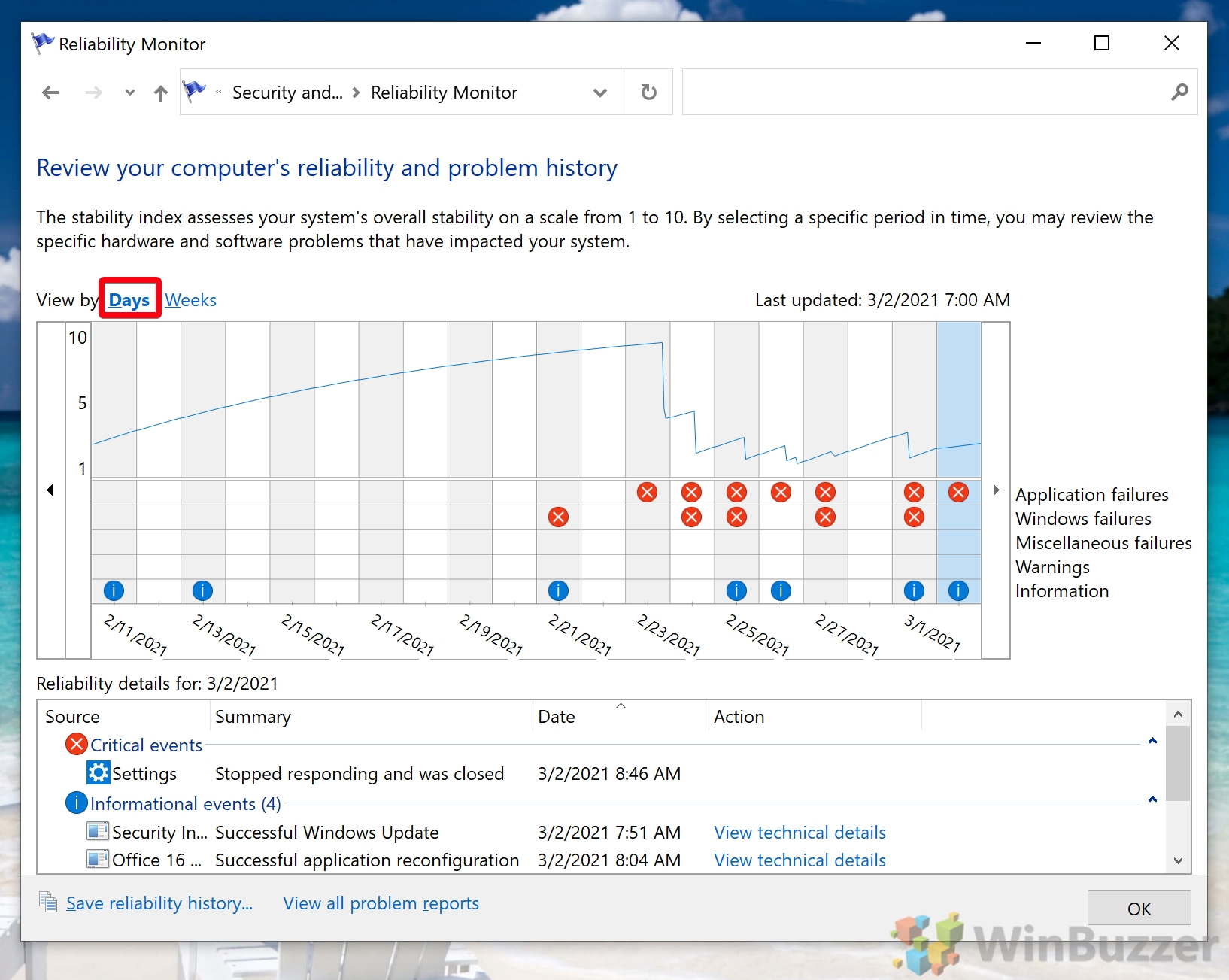

A Step-by-Step Guide to Downloading S&P 500 Historical Data

Downloading S&P 500 historical data is a crucial step in analyzing and utilizing this valuable resource. In this section, we will provide a step-by-step guide on how to download S&P 500 historical data from various sources, including Yahoo Finance, Quandl, and the Federal Reserve Economic Data (FRED) database.

**Downloading from Yahoo Finance**

To download S&P 500 historical data from Yahoo Finance, follow these steps:

1. Go to finance.yahoo.com and enter “S&P 500” in the search bar.

2. Click on the “Historical Data” tab.

3. Select the desired time period and frequency of data (e.g., daily, weekly, monthly).

4. Click “Download” to download the data in CSV format.

**Downloading from Quandl**

To download S&P 500 historical data from Quandl, follow these steps:

1. Go to quandl.com and search for “S&P 500” in the search bar.

2. Select the desired dataset (e.g., S&P 500 Index Prices).

3. Click on the “Download” button and select the desired format (e.g., CSV, Excel).

4. Choose the desired time period and frequency of data.

**Downloading from the Federal Reserve Economic Data (FRED) database**

To download S&P 500 historical data from the FRED database, follow these steps:

1. Go to fred.stlouisfed.org and search for “S&P 500” in the search bar.

2. Select the desired dataset (e.g., S&P 500 Index).

3. Click on the “Download” button and select the desired format (e.g., CSV, Excel).

4. Choose the desired time period and frequency of data.

By following these steps, investors can easily download S&P 500 historical data from various sources and begin analyzing and utilizing this valuable resource to inform their investment decisions.

Remember to always verify the accuracy and reliability of the data before using it in your investment strategy. Additionally, it’s essential to understand the different formats of S&P 500 historical data, including CSV, Excel, and JSON, to ensure seamless integration into your analysis.

Understanding the Different Formats of S&P 500 Historical Data

When working with S&P 500 historical data, it’s essential to understand the different formats in which the data is available. This knowledge will enable investors to seamlessly integrate the data into their analysis and make informed investment decisions.

**CSV (Comma Separated Values) Format**

The CSV format is one of the most popular formats for S&P 500 historical data. It’s a plain text file that uses commas to separate values, making it easy to import into spreadsheet software like Microsoft Excel or Google Sheets. CSV files are lightweight, easy to work with, and can be easily manipulated using programming languages like Python or R.

**Excel Format**

S&P 500 historical data is also available in Excel format, which is compatible with Microsoft Excel and other spreadsheet software. Excel files are more user-friendly than CSV files and offer advanced features like formulas, charts, and pivot tables. However, they can be larger in size and more difficult to work with programmatically.

**JSON (JavaScript Object Notation) Format**

JSON is a lightweight, human-readable format that’s widely used in web development. S&P 500 historical data in JSON format is ideal for web-based applications and can be easily parsed using programming languages like JavaScript or Python. JSON files are compact and efficient, making them suitable for large datasets.

**Other Formats**

In addition to CSV, Excel, and JSON, S&P 500 historical data may also be available in other formats like XML, HDF5, or MATLAB. It’s essential to understand the strengths and limitations of each format to choose the one that best suits your analysis needs.

By understanding the different formats of S&P 500 historical data, investors can efficiently download, manipulate, and analyze the data to make informed investment decisions. Whether you’re working with CSV, Excel, JSON, or other formats, it’s crucial to choose the format that best fits your analysis needs and workflow.

Common Challenges and Solutions When Working with S&P 500 Historical Data

While S&P 500 historical data is a valuable resource for investors, working with it can come with its own set of challenges. In this section, we’ll discuss common issues investors face when working with S&P 500 historical data and provide solutions to overcome them.

**Data Quality Issues**

One of the most common challenges investors face is data quality issues. This can include incorrect or missing values, inconsistent formatting, and errors in data entry. To overcome this challenge, investors should carefully review the data before using it in their analysis. They can also use data cleaning and preprocessing techniques to identify and correct errors.

**Inconsistencies and Missing Values**

Inconsistencies and missing values are another common challenge investors face when working with S&P 500 historical data. This can occur when data is missing or inconsistent across different sources. To overcome this challenge, investors can use data imputation techniques to fill in missing values and ensure consistency across different sources.

**Handling Large Datasets**

S&P 500 historical data can be massive, making it challenging to handle and analyze. To overcome this challenge, investors can use data compression techniques, such as gzip or zip, to reduce the size of the dataset. They can also use distributed computing or cloud-based services to process and analyze large datasets.

**Ensuring Data Security**

Finally, investors must ensure the security of their S&P 500 historical data. This can include protecting against data breaches, unauthorized access, and data loss. To overcome this challenge, investors can use encryption techniques, such as SSL or TLS, to protect their data. They can also use secure storage solutions, such as cloud-based storage services, to store their data.

By understanding these common challenges and solutions, investors can effectively work with S&P 500 historical data to make informed investment decisions. Whether you’re dealing with data quality issues, inconsistencies, or large datasets, there are solutions available to help you overcome these challenges and get the most out of your data.

Using S&P 500 Historical Data to Improve Your Investment Performance

By leveraging S&P 500 historical data, investors can gain valuable insights to improve their investment performance. Here are some examples of how investors can use S&P 500 historical data to their advantage:

**Identifying Trends**

S&P 500 historical data can help investors identify trends and patterns in the market. By analyzing historical data, investors can identify sectors or industries that have consistently outperformed the market over time. This information can be used to inform investment decisions and optimize portfolio returns.

**Optimizing Portfolios**

S&P 500 historical data can also be used to optimize portfolio returns. By analyzing the historical performance of different assets, investors can identify the optimal asset allocation for their portfolio. This can help investors maximize returns while minimizing risk.

**Evaluating Risk**

S&P 500 historical data can also be used to evaluate risk. By analyzing the historical volatility of different assets, investors can identify potential risks and take steps to mitigate them. This can help investors avoid costly mistakes and protect their investments.

**Backtesting Investment Strategies**

S&P 500 historical data can also be used to backtest investment strategies. By applying different investment strategies to historical data, investors can evaluate their effectiveness and identify areas for improvement. This can help investors refine their investment approach and achieve better results.

By using S&P 500 historical data in these ways, investors can gain a competitive edge in the market and improve their investment performance. Whether you’re a seasoned investor or just starting out, S&P 500 historical data is a valuable resource that can help you achieve your investment goals.

Best Practices for Storing and Managing S&P 500 Historical Data

Once you’ve downloaded S&P 500 historical data, it’s essential to store and manage it effectively to ensure data integrity, security, and ease of access. Here are some best practices for storing and managing S&P 500 historical data:

**Data Organization**

Organize your S&P 500 historical data in a logical and consistent manner. This can include creating separate folders for different time periods, asset classes, or data formats. A well-organized data storage system makes it easier to locate and access specific data points, reducing the time spent on data analysis.

**Backup Strategies**

Regularly back up your S&P 500 historical data to prevent data loss in the event of a system failure or data corruption. Consider using cloud-based storage services, such as Amazon S3 or Google Cloud Storage, which offer automatic backup and versioning features.

**Security Measures**

Implement robust security measures to protect your S&P 500 historical data from unauthorized access or data breaches. This can include encrypting data, using secure authentication protocols, and limiting access to authorized personnel.

**Data Validation**

Regularly validate your S&P 500 historical data to ensure accuracy and consistency. This can include checking for errors, inconsistencies, and missing values, and correcting them promptly.

**Data Compression**

Use data compression techniques, such as gzip or zip, to reduce the size of your S&P 500 historical data files. This can help improve data transfer speeds and reduce storage costs.

By following these best practices, investors can ensure that their S&P 500 historical data is stored and managed effectively, providing a solid foundation for informed investment decisions. Remember to download S&P 500 historical data from reliable sources, such as Yahoo Finance or Quandl, to ensure data accuracy and integrity.

:max_bytes(150000):strip_icc()/woman-holding-tampon-758312267-5c1416c3c9e77c0001c4fdbc.jpg)