Where is Depreciation Recorded in Financial Statements?

Depreciation, in accounting terms, represents the systematic allocation of an asset’s cost over its useful life. It acknowledges that assets, such as machinery or equipment, gradually lose value due to wear and tear, obsolescence, or usage. This process is crucial for accurately reflecting a company’s financial position. Understanding where depreciation expense is reported is essential for anyone analyzing financial statements. This article will explore the specific locations where depreciation appears in financial reports and its broader impact on a company’s overall financial health, particularly regarding where does depreciation go on the income statement. It sets the foundation for grasping depreciation’s significance within the larger context of financial reporting and analysis. The main question is, where does depreciation go on the income statement?

The allocation of an asset’s cost, represented by depreciation, directly impacts a company’s profitability. It ensures that expenses are matched with the revenues they generate over time. By understanding the principles of depreciation, stakeholders can gain valuable insights into a company’s asset management practices. Furthermore, they can asses its long-term sustainability. This exploration of depreciation’s place within financial statements is vital for informed decision-making. Knowing exactly where does depreciation go on the income statement is the first step.

Financial statements offer a comprehensive view of a company’s financial performance and position. Depreciation plays a significant role in shaping these statements. Therefore, knowing where does depreciation go on the income statement and balance sheet is crucial. By tracing its path through the income statement, balance sheet, and statement of cash flows, a clearer picture emerges of its overall effect. Examining real-world examples from company reports will further solidify understanding of how depreciation is reported in practice. It will reveal how it is managed, and its effect on financial ratios. This knowledge empowers stakeholders to interpret financial data accurately and make well-informed judgments.

How to Calculate Depreciation Expense

Understanding how to calculate depreciation expense is crucial for grasping its impact on financial statements. Several methods exist, each with its own approach to allocating an asset’s cost over its useful life. The straight-line method is the simplest, distributing the cost evenly over the asset’s life. For example, if a machine costs $10,000 and has a useful life of 5 years, the annual depreciation expense would be $2,000 ($10,000 / 5 years). The question of where does depreciation go on the income statement will be addressed later.

The declining balance method accelerates depreciation, recognizing more expense in the early years of an asset’s life. A common variation is the double-declining balance method, where the straight-line depreciation rate is doubled. Using the same $10,000 machine with a 5-year life, the straight-line rate would be 20% (1 / 5 years). Doubling it gives a 40% rate. In the first year, depreciation expense would be $4,000 ($10,000 x 40%). In subsequent years, the rate is applied to the asset’s book value (cost less accumulated depreciation). Remember that the question of does depreciation go on the income statement is key to understanding financial reporting.

The units of production method ties depreciation to the asset’s actual use. If the machine is expected to produce 100,000 units over its life, the depreciation expense per unit would be $0.10 ($10,000 / 100,000 units). If the machine produces 15,000 units in a year, the depreciation expense for that year would be $1,500 (15,000 units x $0.10/unit). Each of these methods provides a different way to determine the depreciation figure, which ultimately impacts where does depreciation go on the income statement and other financial statements. While these calculations might seem complex, they are essential to understanding the depreciation expense.

Depreciation’s Role on the Income Statement

The question of where does depreciation go on the income statement is crucial for understanding a company’s financial performance. Depreciation expense is indeed recorded on the income statement. It typically appears as part of operating expenses. In some cases, particularly for manufacturing companies, it may be included within the cost of goods sold (COGS). The specific line item may vary depending on the company’s industry and accounting practices, but it’s consistently found among the expenses.

The impact of depreciation on the income statement is significant. As an expense, depreciation directly reduces a company’s net income. A higher depreciation expense results in a lower net income, while a lower depreciation expense leads to a higher net income, all other factors being equal. It is important to understand the effect of depreciation on net income. This impacts profitability metrics such as earnings per share (EPS) and net profit margin. These metrics are vital for investors and analysts when assessing a company’s financial health and comparing it to its peers.

It’s important to recognize that depreciation is a non-cash expense. This means that while it reduces net income, it doesn’t involve an actual outflow of cash during the period. This distinction is important for understanding a company’s true cash flow, which is addressed in the statement of cash flows. Knowing where does depreciation go on the income statement is just the first step. Analyzing its impact alongside other financial statement items provides a more complete view of a company’s financial position and performance. So, does depreciation go on the income statement? Yes, and it plays a key role in determining a company’s reported profits.

The Balance Sheet Connection: Accumulated Depreciation

Accumulated depreciation appears on the balance sheet. It’s a contra-asset account. This means it reduces the book value of an asset. The book value is the original cost less accumulated depreciation. Does depreciation go on the income statement? Yes, but its cumulative effect shows up on the balance sheet. The balance sheet shows the asset’s net book value at a specific point in time. Understanding this connection is crucial for a complete financial picture. The income statement reflects the depreciation expense for a period. The balance sheet shows the accumulated effect of that expense over the asset’s life. This difference is important to note. One shows the expense for a period, the other shows the cumulative effect. Does depreciation go on the income statement? Yes, it’s a crucial part of financial reporting.

Think of it this way: Depreciation expense, reported on the income statement, is like a yearly payment on a loan. Accumulated depreciation, on the balance sheet, is like the total amount paid on that loan to date. Each year’s depreciation expense adds to the accumulated depreciation. This increases the accumulated depreciation balance. The balance sheet, therefore, reflects a running total. This total represents the total depreciation recorded to date for that specific asset. Does depreciation go on the income statement? Absolutely, and this impacts the balance sheet as well.

The relationship between depreciation expense and accumulated depreciation is direct. As depreciation expense increases, so does accumulated depreciation. This reduction in the asset’s book value reflects the asset’s decreasing value over time. This is due to wear and tear, obsolescence, or other factors. The income statement and balance sheet work together. They provide a comprehensive view of a company’s financial health. Does depreciation go on the income statement? Yes, and understanding its impact on the balance sheet is essential for accurate financial analysis.

Statement of Cash Flows and Depreciation

Depreciation, while impacting net income, is a non-cash expense. It doesn’t represent an actual outflow of cash. Therefore, the statement of cash flows treats depreciation differently than it does on the income statement, where it directly reduces net income. Does depreciation go on the income statement? Yes, it’s a crucial part of calculating net income. However, because it’s non-cash, it requires adjustment on the statement of cash flows. This adjustment ensures a more accurate reflection of a company’s actual cash flow from operations.

To arrive at the cash flow from operating activities, depreciation is added back to net income. This addition reverses the reduction caused by depreciation on the income statement. The result provides a clearer picture of cash generated or used by the business’s core operations. Adding back depreciation is a crucial step in reconciling net income to cash flow. This adjustment helps analysts and investors understand the actual cash generated, not just accounting profits. The question, “does depreciation go on the income statement?” is crucial, but understanding its treatment in the cash flow statement is equally important.

Understanding depreciation’s treatment on the statement of cash flows is vital for a complete financial picture. It highlights the difference between accounting profits (net income) and actual cash flow. This distinction is valuable for assessing a company’s liquidity, solvency, and overall financial health. Investors and creditors use cash flow statements to make informed decisions. Does depreciation go on the income statement? Yes, but its impact extends beyond the income statement, affecting how companies present their cash flow situation.

Analyzing Depreciation’s Impact on Financial Ratios

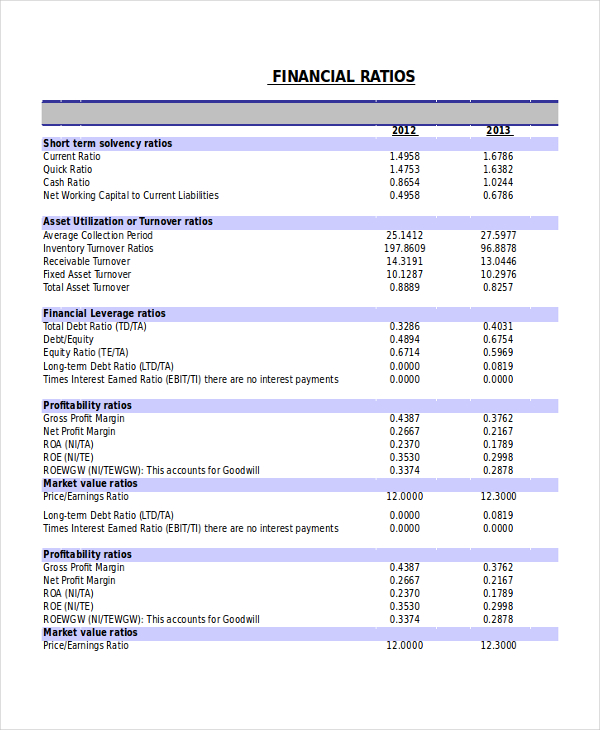

Depreciation expense significantly influences key financial ratios, offering insights into a company’s profitability and asset management efficiency. These ratios are essential tools for investors and analysts evaluating a company’s financial health and performance. Understanding how depreciation affects these ratios is crucial for accurate financial analysis. Depreciation affects ratios that analysts use to get an understanding of the business, including ratios that may indicate where does depreciation go on the income statement.

Profitability ratios, such as net profit margin (Net Income / Revenue), are directly impacted by depreciation. Because depreciation expense reduces net income, it consequently lowers the net profit margin. A higher depreciation expense leads to a lower net profit margin, potentially making a company appear less profitable. However, it’s important to consider that depreciation is a non-cash expense. Companies with substantial fixed assets and high depreciation may show lower profitability margins, but this doesn’t necessarily indicate poor performance. The choice of depreciation method (e.g., accelerated vs. straight-line) also influences these ratios. Accelerated methods recognize more depreciation expense earlier in an asset’s life, which can initially depress profitability ratios more than straight-line depreciation.

Asset turnover ratios, such as the fixed asset turnover ratio (Revenue / Average Net Fixed Assets), are also affected by depreciation. Accumulated depreciation reduces the book value of fixed assets. Higher accumulated depreciation leads to a lower net fixed asset value, which in turn increases the fixed asset turnover ratio. A higher ratio suggests that the company is efficiently using its fixed assets to generate revenue. Changes in depreciation methods or policies can significantly impact this ratio, making it important to understand a company’s accounting choices when comparing its performance to competitors. Also understanding where does depreciation go on the income statement helps with getting the complete picture. For example, a company that switches to a more aggressive depreciation method might see an increase in its asset turnover ratio, but this could simply be due to the faster reduction in the book value of its assets, not necessarily an improvement in operational efficiency and because depreciation expense does depreciation go on the income statement.

Real-World Examples: Examining Depreciation in Company Reports

To illustrate how depreciation is reported in practice, let’s examine examples from well-known companies. Public companies meticulously disclose depreciation expense within their financial statements, providing transparency to investors and stakeholders. The location where depreciation goes on the income statement can vary slightly depending on the industry and company presentation, but it consistently plays a crucial role in reflecting asset utilization.

Consider Apple Inc., a global technology leader. In Apple’s consolidated statements of operations, depreciation expense is typically embedded within the line items for “Cost of Sales” and “Operating Expenses.” Reviewing Apple’s 10-K filing with the Securities and Exchange Commission (SEC) will reveal these figures. Within the cost of sales, depreciation relates to the manufacturing equipment used to produce Apple’s products. As for operating expenses, depreciation pertains to assets used in research and development, as well as sales and administrative activities. Identifying where does depreciation go on the income statement in Apple’s report requires careful review of these sections.

Similarly, Microsoft Corporation, a dominant player in the software industry, reports depreciation expense in its financial statements. Similar to Apple, Microsoft includes depreciation within both its cost of revenue and operating expenses. Scrutinizing Microsoft’s annual report will show how depreciation expense reduces the company’s profitability metrics. These real-world examples emphasize the significance of where does depreciation go on the income statement. Furthermore, these instances highlight its importance in understanding a company’s financial performance and the true cost of its operations. By analyzing these reports, one can observe the practical application of accounting principles related to depreciation. The effective recording of where does depreciation go on the income statement helps in providing an accurate financial overview.

Strategies for Managing Depreciation

Companies have some flexibility in choosing depreciation methods, which can impact their financial statements and tax obligations. The choice of method – straight-line, declining balance, or units of production – can influence the amount of depreciation expense recognized in a given period. Does depreciation go on the income statement? Yes, it does, and the method chosen directly affects this expense.

A faster depreciation method, like the declining balance method, results in higher depreciation expense in the early years of an asset’s life. This can reduce taxable income and, consequently, income tax payments in those years. Conversely, the straight-line method spreads the expense evenly, leading to a more consistent impact on profitability. Companies might strategically select a method to minimize their tax burden in the short term or to present a smoother earnings trend to investors. Understanding where depreciation expense is reported is vital in assessing the impact of these strategies.

Furthermore, changes in depreciation estimates, such as the useful life or salvage value of an asset, can also affect depreciation expense. These changes are typically accounted for prospectively, meaning they only impact future depreciation calculations. It’s important to note that while companies have some discretion in choosing and managing depreciation methods and estimates, these choices must be justifiable and consistently applied within the boundaries of accounting standards. This ensures financial reporting remains transparent and reliable. Does depreciation go on the income statement? Absolutely, and its accurate reflection is crucial for fair financial representation.