Understanding the Purpose of Financial Statements

Financial statements are a critical component of a company’s financial reporting, providing stakeholders with a comprehensive view of its financial performance and position. The primary purpose of financial statements is to present a transparent and accurate picture of a company’s financial situation, enabling investors, creditors, and other stakeholders to make informed decisions. The three main financial statements – income statements, balance sheets, and cash flow statements – work together to provide a complete understanding of a company’s financial health. The income statement, in particular, is a crucial component of financial reporting, as it showcases a company’s revenues, expenses, and net income over a specific period. One of the key expenses reported on the income statement is depreciation expense, which has a significant impact on a company’s financial performance and position. In fact, the question of whether depreciation expense goes on the income statement is a common query among stakeholders. By understanding the role of financial statements, stakeholders can better appreciate the significance of depreciation expense and its impact on a company’s financial performance.

What is Depreciation Expense and Why is it Important?

Depreciation expense is a critical component of a company’s financial reporting, representing the decrease in value of assets over time. It is a non-cash item that affects a company’s financial performance and position, making it essential to understand its causes and significance. Depreciation expense is caused by the wear and tear of assets, such as property, plant, and equipment, as well as intangible assets like patents and copyrights. The significance of depreciation expense lies in its impact on a company’s net income, profitability, and cash flow. It is a crucial aspect of financial reporting, as it helps stakeholders understand a company’s ability to generate earnings and sustain its operations over time. In fact, the question of whether depreciation expense goes on the income statement is a common query among stakeholders, highlighting the importance of accurate reporting. By understanding depreciation expense, stakeholders can gain valuable insights into a company’s financial health and make informed decisions.

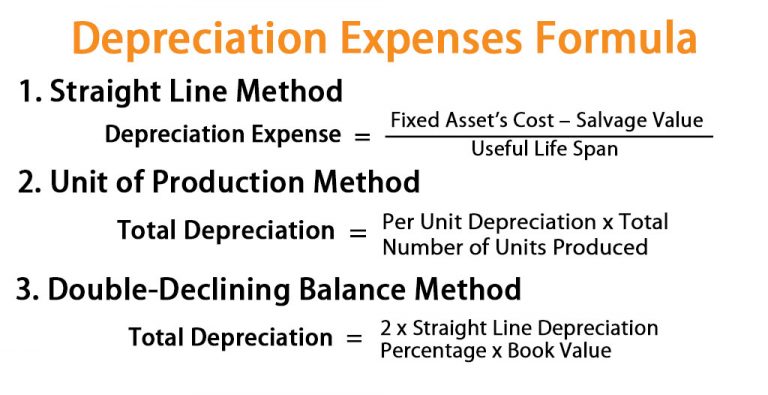

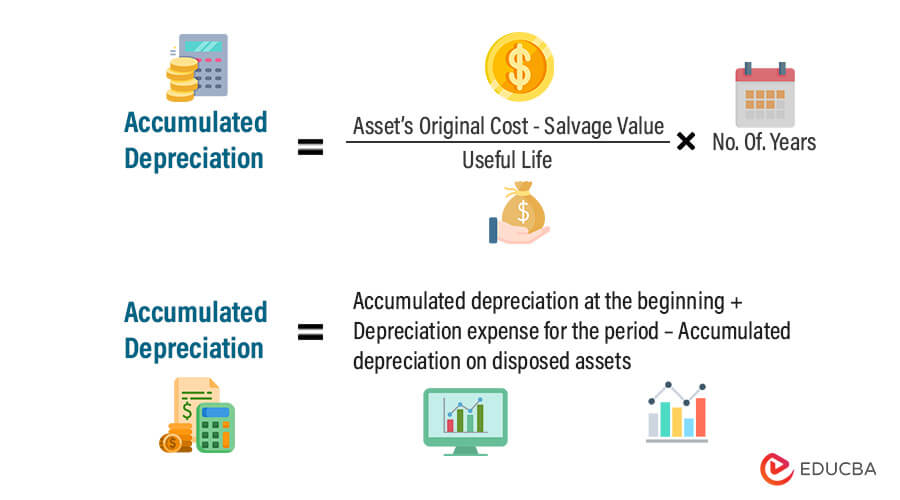

How to Account for Depreciation Expense: A Step-by-Step Guide

To accurately report depreciation expense on the income statement, it is essential to follow a step-by-step guide on how to account for it. The first step is to calculate depreciation expense using the straight-line method, declining balance method, or units-of-production method. The next step is to record the depreciation expense in the journal entries, debiting the depreciation expense account and crediting the accumulated depreciation account. The ledger accounts should then be updated to reflect the depreciation expense, ensuring that the financial statements accurately reflect the company’s financial performance and position. It is crucial to note that depreciation expense does go on the income statement, as it is a non-cash item that affects a company’s net income and profitability. By following these steps, companies can ensure accurate depreciation expense reporting, providing stakeholders with a comprehensive view of their financial performance and position.

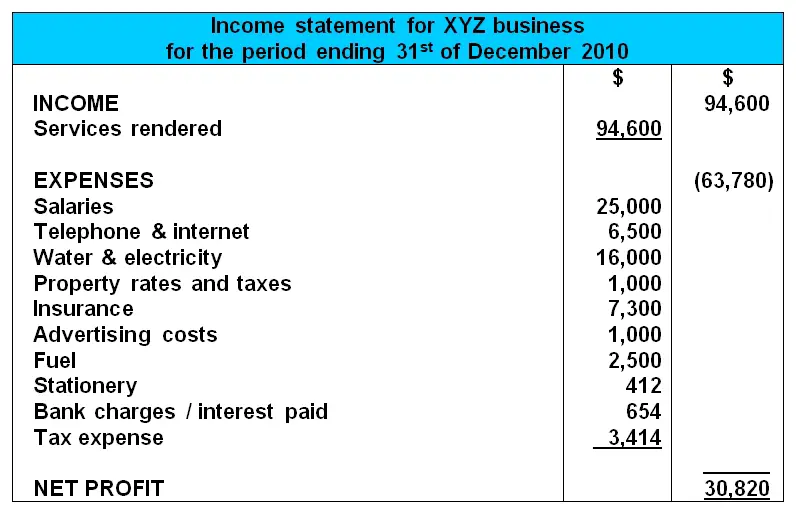

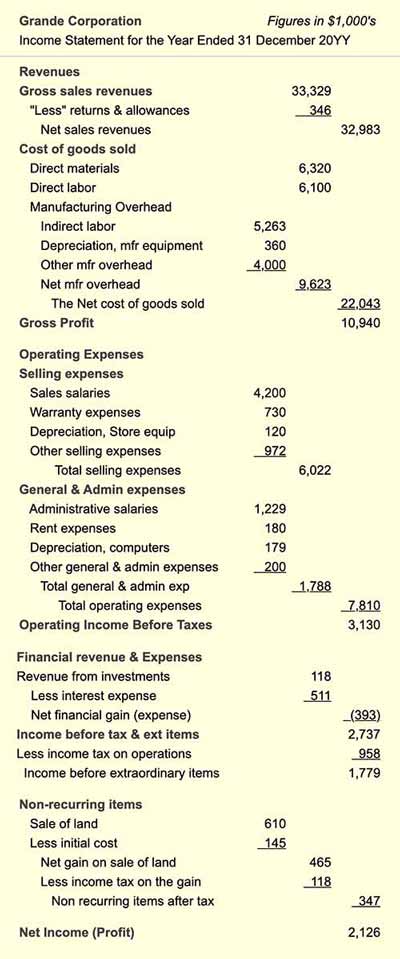

The Income Statement: Where Depreciation Expense Takes Center Stage

The income statement, also known as the profit and loss statement, is a critical component of financial reporting that provides stakeholders with a comprehensive view of a company’s financial performance over a specific period. The income statement is structured to present revenues, expenses, and net income, with depreciation expense playing a significant role as a non-cash item. Depreciation expense is a crucial component of the income statement, as it represents the decrease in value of assets over time. The question of does depreciation expense go on the income statement is a common query among stakeholders, and the answer is yes, it does. Depreciation expense is typically reported on the income statement as an operating expense, affecting net income and profitability. A company’s ability to accurately report depreciation expense on the income statement is essential, as it provides stakeholders with a clear understanding of its financial performance and position. By understanding the structure and components of the income statement, stakeholders can gain valuable insights into a company’s financial health and make informed decisions.

Why Depreciation Expense is a Crucial Component of the Income Statement

Depreciation expense plays a vital role on the income statement, as it significantly impacts a company’s profitability, cash flow, and financial ratios. As a non-cash item, depreciation expense does not affect a company’s cash inflows or outflows, but it does reduce net income, which in turn affects profitability. The question of does depreciation expense go on the income statement is a crucial one, and the answer is yes, it does. Depreciation expense is a critical component of the income statement, as it provides stakeholders with a comprehensive view of a company’s financial performance and position. By accurately reporting depreciation expense, companies can ensure that their financial statements accurately reflect their financial health. Furthermore, depreciation expense affects financial ratios, such as the debt-to-equity ratio and return on equity, which are essential metrics for stakeholders to evaluate a company’s financial performance. Inaccurate reporting of depreciation expense can lead to misrepresentation of a company’s financial position, which can have significant consequences for stakeholders. Therefore, it is essential for companies to accurately report depreciation expense on the income statement to provide stakeholders with a clear understanding of their financial performance and position.

Common Misconceptions about Depreciation Expense and the Income Statement

Despite its importance, depreciation expense is often misunderstood, leading to common misconceptions about its relationship with the income statement. One common misconception is that depreciation expense is a cash item, which is not the case. Depreciation expense is a non-cash item that represents the decrease in value of assets over time. Another misconception is that depreciation expense does not affect net income, which is incorrect. Depreciation expense directly affects net income, as it is subtracted from revenue to calculate net income. Additionally, some stakeholders believe that depreciation expense is only relevant for companies with tangible assets, such as property, plant, and equipment. However, depreciation expense can also be applicable to intangible assets, such as patents and copyrights. Furthermore, some stakeholders may think that depreciation expense is not important for financial analysis, which is a misconception. Depreciation expense provides valuable insights into a company’s financial performance and position, and its accurate reporting is crucial for stakeholders to make informed decisions. By understanding these common misconceptions, stakeholders can gain a clearer understanding of depreciation expense and its significance on the income statement. The question of does depreciation expense go on the income statement is a crucial one, and understanding the answer can help stakeholders avoid these common misconceptions.

Real-World Examples of Depreciation Expense on the Income Statement

To illustrate the significance of depreciation expense on the income statement, let’s examine real-world examples of companies that have reported depreciation expense on their income statements. For instance, Amazon, the e-commerce giant, reported depreciation and amortization expense of $4.4 billion in 2020, which accounted for approximately 2% of its total revenue. This significant expense highlights the importance of accurately reporting depreciation expense on the income statement, as it directly affects net income and profitability. Another example is General Electric, which reported depreciation and amortization expense of $3.3 billion in 2020, representing around 3% of its total revenue. These examples demonstrate how depreciation expense can have a substantial impact on a company’s financial performance and position. By accurately reporting depreciation expense on the income statement, companies like Amazon and General Electric provide stakeholders with a clear understanding of their financial health. The question of does depreciation expense go on the income statement is answered clearly in these examples, as it is a crucial component of the income statement that provides valuable insights into a company’s financial performance and position. These real-world examples underscore the importance of accurate depreciation expense reporting on the income statement, as it enables stakeholders to make informed decisions about a company’s financial health.

Conclusion: The Importance of Accurate Depreciation Expense Reporting

In conclusion, accurate depreciation expense reporting on the income statement is crucial for providing stakeholders with a comprehensive view of a company’s financial performance and position. The question of does depreciation expense go on the income statement is answered clearly, as it is a vital component of the income statement that affects net income, profitability, and cash flow. By understanding the significance of depreciation expense and its impact on the income statement, stakeholders can make informed decisions about a company’s financial health. Moreover, accurate depreciation expense reporting enables companies to comply with accounting standards and regulations, maintain transparency, and build trust with stakeholders. In today’s competitive business landscape, accurate financial reporting is essential for companies to thrive and succeed. Therefore, it is essential for companies to prioritize accurate depreciation expense reporting on the income statement, as it provides a clear understanding of a company’s financial performance and position. By doing so, companies can ensure that stakeholders have a comprehensive view of their financial health, enabling them to make informed decisions and drive business growth.