Demystifying Risk: An Overview

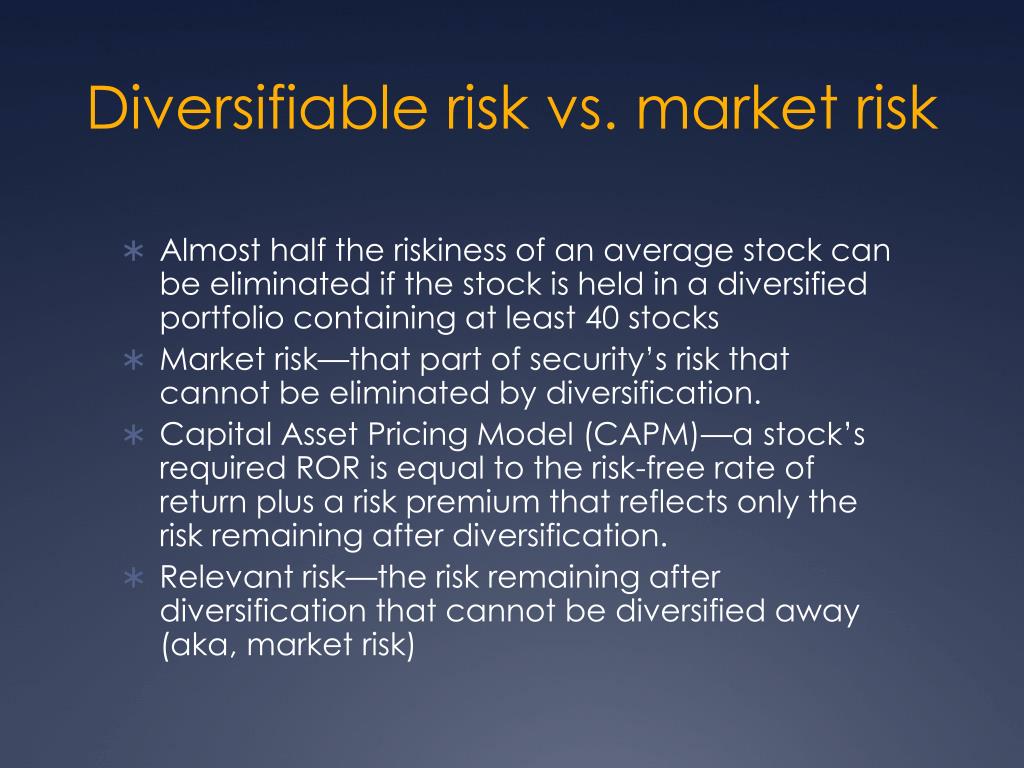

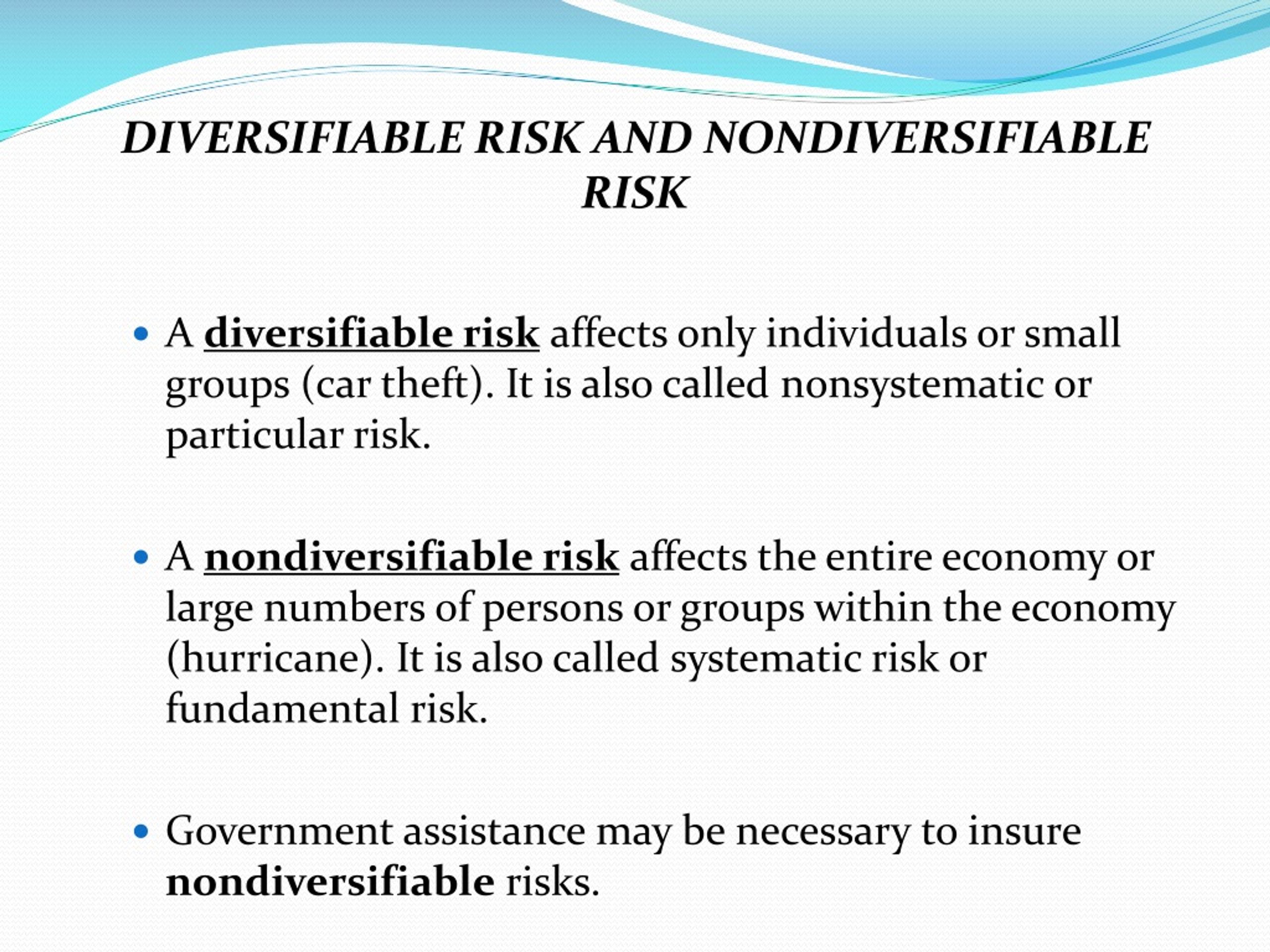

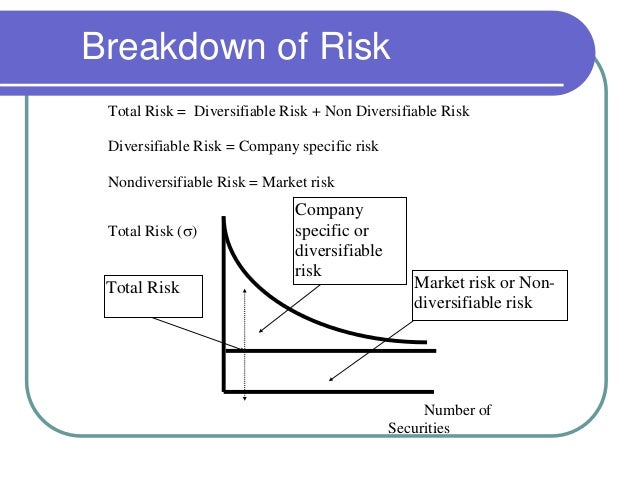

Risk, in the context of finance, refers to the potential for financial losses or negative impacts on investment returns. Understanding the different types of risk is crucial for investors to make informed decisions and build robust investment strategies. Two primary categories of risk are diversifiable risk and non-diversifiable risk. This comprehensive guide will delve into the details of these risks and provide insights on how investors can effectively manage them.

Diversifiable Risk: Defining and Managing Unique Exposures

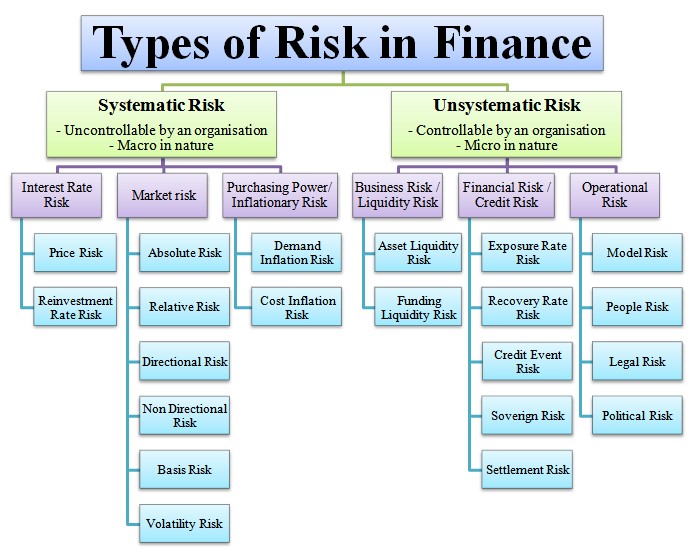

Diversifiable risk, also known as unsystematic risk, arises from specific factors related to individual investments or sectors. In contrast to non-diversifiable risk, diversifiable risk can be reduced or eliminated through effective diversification strategies. By spreading investments across various assets, sectors, and geographical regions, investors can minimize the impact of diversifiable risk on their overall portfolio performance.

Common sources of diversifiable risk include:

- Industry-specific risks: These risks are associated with factors that affect a particular industry, such as regulatory changes, technological disruptions, or shifts in consumer preferences.

- Company-specific risks: These risks are related to the performance and operations of individual companies, including management decisions, financial mismanagement, or product failures.

- Country-specific risks: These risks are associated with political, economic, or social factors unique to a particular country, such as currency fluctuations, political instability, or changes in tax laws.

To mitigate diversifiable risk, investors can employ various strategies, such as:

- Asset allocation: By distributing investments across different asset classes, such as stocks, bonds, and real estate, investors can reduce their exposure to diversifiable risk.

- Portfolio rebalancing: Regularly reviewing and rebalancing a portfolio helps maintain an optimal asset allocation and minimizes the impact of underperforming investments.

- Regular review of investments: Periodically assessing individual investments and making adjustments as needed can help investors stay ahead of potential diversifiable risks.

For example, an investor with a portfolio heavily concentrated in technology stocks may be exposed to significant diversifiable risk due to industry-specific risks, such as cybersecurity threats or regulatory changes. By diversifying their portfolio with investments in other sectors, such as healthcare, finance, or consumer goods, the investor can reduce their exposure to these risks and potentially improve their overall risk-adjusted returns.

Non-Diversifiable Risk: Systemic Factors and Their Impact

Non-diversifiable risk, also known as systematic risk, affects entire markets or market segments and cannot be eliminated through diversification. Systematic risk arises from factors that are generally beyond the control of individual investors or companies, such as macroeconomic conditions, interest rates, inflation, and geopolitical events. As a result, non-diversifiable risk impacts a broad range of investments, making it essential for investors to understand and manage this risk effectively.

Some primary sources of non-diversifiable risk include:

- Market risk: This risk is associated with fluctuations in the overall market or market segments, such as stocks, bonds, or real estate. Market risk, also known as systematic risk, affects most investments within a particular market segment.

- Interest rate risk: This risk is related to changes in interest rates, which can impact the value of fixed-income investments, such as bonds, and affect the cost of borrowing for businesses and consumers.

- Inflation risk: This risk arises from the declining purchasing power of money due to inflation. Investors may experience inflation risk if their investment returns do not keep pace with inflation, effectively eroding the real value of their investments.

- Geopolitical risk: This risk is associated with political instability, conflicts, or other geopolitical events that can impact global markets and economies.

While non-diversifiable risk cannot be eliminated through diversification, investors can employ various strategies to manage this risk, such as:

- Hedging: Investors can use financial instruments, such as futures, options, or swaps, to protect their portfolios from potential losses due to non-diversifiable risk factors.

- Diversification across asset classes: By investing in various asset classes, such as stocks, bonds, real estate, and commodities, investors can reduce their exposure to non-diversifiable risk and potentially improve their risk-adjusted returns.

For example, an investor concerned about market risk might consider allocating a portion of their portfolio to alternative investments, such as gold or other commodities, which may have a lower correlation with the stock market. This diversification strategy can help mitigate the impact of market risk on the investor’s overall portfolio performance.

Diversifiable vs. Non-Diversifiable Risk: Comparing Key Characteristics

Diversifiable and non-diversifiable risks are two primary categories of risk that investors face. Understanding the differences and similarities between these risks is crucial for building effective investment strategies. By recognizing the unique features of each risk type, investors can better manage their portfolios and minimize potential losses.

Similarities

Both diversifiable and non-diversifiable risks share some common characteristics:

- Potential for financial loss: Both risks can negatively impact investment returns, leading to potential financial losses for investors.

- Importance in investment decision-making: Recognizing and managing both risks is essential for investors to make informed decisions and build robust investment strategies.

Differences

Despite their similarities, diversifiable and non-diversifiable risks have several key differences:

- Diversifiability: Diversifiable risk, as the name suggests, can be reduced or eliminated through effective diversification strategies. Non-diversifiable risk, however, affects entire markets or market segments and cannot be eliminated through diversification.

- Sources: Diversifiable risk arises from specific factors related to individual investments or sectors, while non-diversifiable risk stems from macroeconomic conditions, interest rates, inflation, and geopolitical events that impact entire markets or market segments.

- Impact: Diversifiable risk typically has a more localized impact on individual investments or sectors, while non-diversifiable risk affects a broad range of investments within a particular market segment.

For example, an investor with a portfolio heavily concentrated in technology stocks may be exposed to significant diversifiable risk due to industry-specific risks, such as cybersecurity threats or regulatory changes. However, if the entire technology sector experiences a downturn due to a global economic crisis, the investor will also be exposed to non-diversifiable risk, which cannot be eliminated through diversification within the technology sector.

By understanding the differences and similarities between diversifiable and non-diversifiable risks, investors can better manage their portfolios and make informed decisions to minimize potential losses and optimize risk-adjusted returns.

Investment Strategies to Mitigate Diversifiable Risk

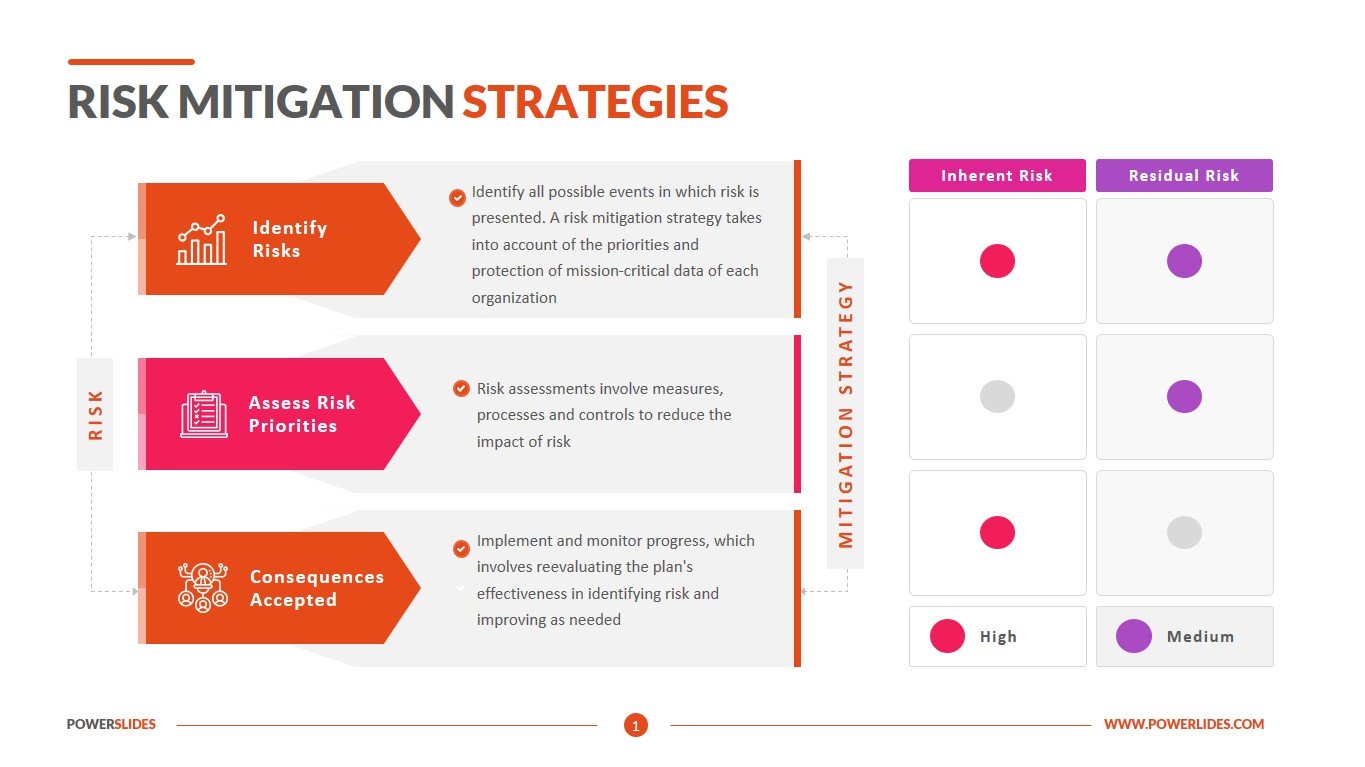

Diversifiable risk, also known as unsystematic risk, arises from specific factors related to individual investments or sectors. While it cannot be eliminated entirely, investors can employ various strategies to minimize diversifiable risk and protect their portfolios. Here are some effective investment strategies to consider:

Asset Allocation

Asset allocation involves distributing investments across various asset classes, such as stocks, bonds, real estate, and commodities. By allocating assets according to their risk levels, investment goals, and time horizons, investors can reduce their exposure to diversifiable risk and potentially improve their risk-adjusted returns.

Portfolio Rebalancing

Portfolio rebalancing is the process of periodically adjusting the weightings of different assets in a portfolio to maintain the desired asset allocation. Rebalancing helps ensure that a portfolio remains aligned with an investor’s risk tolerance and investment objectives, reducing the impact of underperforming investments and minimizing diversifiable risk.

Regular Review of Investments

Regularly reviewing individual investments and making adjustments as needed is another effective strategy for managing diversifiable risk. By staying informed about market conditions, economic trends, and individual company performance, investors can proactively address potential risks and capitalize on new opportunities.

Real-Life Examples

Consider an investor with a portfolio heavily concentrated in technology stocks. To mitigate diversifiable risk, the investor might allocate a portion of their portfolio to other sectors, such as healthcare, finance, or consumer goods. This diversification strategy can help reduce the impact of industry-specific risks, such as regulatory changes or cybersecurity threats, on the investor’s overall portfolio performance.

Another example involves an investor with a significant portion of their portfolio invested in a single company’s stock. To minimize diversifiable risk, the investor could diversify their portfolio by investing in a variety of companies across different sectors and geographical regions. This approach can help protect the investor from potential losses due to company-specific risks, such as management decisions, financial mismanagement, or product failures.

By employing these investment strategies, investors can effectively manage diversifiable risk and build robust, resilient portfolios that align with their risk tolerance and investment objectives.

Navigating Non-Diversifiable Risk: Hedging and Diversification Techniques

Non-diversifiable risk, also known as systematic risk, affects entire markets or market segments and cannot be eliminated through diversification. However, investors can employ various techniques to manage non-diversifiable risk and protect their portfolios from systemic risks. Here are some strategies to consider:

Hedging

Hedging involves using financial instruments, such as futures, options, or swaps, to protect a portfolio from potential losses due to non-diversifiable risk factors. For example, an investor concerned about interest rate risk might use interest rate swaps or futures to lock in a specific interest rate, reducing their exposure to potential interest rate fluctuations.

Diversification Across Asset Classes

While diversification cannot eliminate non-diversifiable risk, it can help mitigate its impact on a portfolio. By investing in various asset classes, such as stocks, bonds, real estate, and commodities, investors can reduce their exposure to specific risk factors and potentially improve their risk-adjusted returns.

Real-Life Examples

Consider an investor concerned about market risk due to a potential economic downturn. To manage this non-diversifiable risk, the investor might allocate a portion of their portfolio to bonds or other fixed-income investments, which may have a lower correlation with the stock market. This diversification strategy can help reduce the impact of market risk on the investor’s overall portfolio performance.

Another example involves an investor concerned about inflation risk. To manage this non-diversifiable risk, the investor might consider investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS) or real estate, which may offer some protection against inflation.

By employing these techniques, investors can effectively manage non-diversifiable risk and build robust, resilient portfolios that can withstand market fluctuations and systemic risks.

Assessing Your Risk Tolerance: A Crucial Step in Balancing Diversifiable and Non-Diversifiable Risk

Risk tolerance is an investor’s ability and willingness to withstand fluctuations in the value of their investments. Understanding one’s risk tolerance is crucial for determining the appropriate balance between diversifiable and non-diversifiable risks in an investment portfolio. Here’s how investors can assess their risk tolerance and adjust their investment strategies accordingly:

Identifying Risk Tolerance Levels

Investors should first determine their risk tolerance levels by considering factors such as their investment horizon, financial goals, and emotional comfort with market volatility. Generally, investors with a longer investment horizon, more aggressive financial goals, and a higher emotional comfort with market fluctuations can afford to take on more risk.

Risk Tolerance Questionnaires

Various online tools and questionnaires can help investors gauge their risk tolerance. These questionnaires typically ask a series of questions about an investor’s financial situation, investment goals, and risk preferences. Based on the responses, the tools provide an estimate of the investor’s risk tolerance, which can be used to inform investment decisions.

Risk Tolerance and Asset Allocation

Once an investor has determined their risk tolerance, they can adjust their asset allocation accordingly. Investors with a higher risk tolerance may opt for a more aggressive asset allocation, with a larger proportion of their portfolio invested in stocks or other high-risk, high-reward assets. Conversely, investors with a lower risk tolerance may prefer a more conservative asset allocation, with a larger proportion of their portfolio invested in bonds or other low-risk, low-reward assets.

Regularly Reviewing and Adjusting Risk Tolerance

Investors should regularly review and adjust their risk tolerance as their financial situation, investment goals, and emotional comfort with market volatility change over time. By staying informed and making proactive adjustments as needed, investors can maintain an optimal balance between diversifiable and non-diversifiable risks in their portfolios and achieve their long-term financial goals.

Monitoring and Adjusting Your Portfolio: Maintaining Balance Over Time

Regularly monitoring and adjusting an investment portfolio is essential for maintaining an optimal balance between diversifiable and non-diversifiable risks. By staying informed and making proactive adjustments as needed, investors can protect their portfolios from systemic risks and minimize the impact of unique exposures. Here are some tips for monitoring and adjusting your portfolio over time:

Set a Regular Review Schedule

Investors should set a regular review schedule, such as quarterly or semi-annually, to assess their portfolio’s performance and risk exposure. During these reviews, investors should consider factors such as their investment objectives, risk tolerance, and market conditions.

Rebalance Your Portfolio

Over time, the weightings of different assets in a portfolio may shift due to market fluctuations, potentially leading to an imbalance between diversifiable and non-diversifiable risks. Investors should regularly rebalance their portfolios to ensure that their asset allocation aligns with their investment objectives and risk tolerance.

Stay Informed About Market Conditions

Investors should stay informed about market conditions and economic trends that may impact their portfolio’s risk exposure. By monitoring news and analysis from reliable sources, investors can anticipate potential risks and adjust their portfolios accordingly.

Consider Professional Advice

Investors who lack the time, expertise, or confidence to manage their portfolios may consider seeking professional advice from a financial advisor or investment manager. These professionals can help investors develop and implement a customized investment strategy that balances diversifiable and non-diversifiable risks.

Be Prepared to Make Adjustments

Investors should be prepared to make adjustments to their portfolios as their financial situation, investment goals, and risk tolerance change over time. By staying flexible and proactive, investors can maintain an optimal balance between diversifiable and non-diversifiable risks and achieve their long-term financial objectives.