Investing is an essential activity for building wealth and securing financial futures, yet it inherently involves navigating uncertainty. All investments, from stocks and bonds to real estate and alternative assets, carry some degree of risk. This risk, while often perceived as a negative aspect, is actually a fundamental part of the investment process and it should be carefully considered before making any financial decision. The degree of risk can vary significantly among different investments, and understanding these differences is crucial for investors of all experience levels. The primary objective for an investor, after understanding his/her own risk tolerance, should be to manage and mitigate those risks effectively. Rather than fearing risk, the focus should be on understanding its nature and employing strategies to make well-informed investment choices. A key to effectively managing risk is recognizing that all risks can be broadly classified into two main categories which are: diversifiable risk and nondiversifiable risk. This distinction is a fundamental concept in investment management and a key tool for building a solid and resilient portfolio.

These risk categories are essential because they demand different risk management strategies. The first category, diversifiable risk, also commonly known as unsystematic risk, encompasses factors that affect individual companies or specific industries, allowing for risk reduction. For example, a product failure from one specific company will hardly affect other companies in other sectors. Conversely, nondiversifiable risk, also called systematic risk, includes broader macroeconomic and market-related factors impacting all or a large segment of investments, this means that risk reduction is much more complex. Changes in interest rates, inflation, or global economic slowdowns are examples that affect most assets. In the upcoming sections, this distinction between diversifiable risk and nondiversifiable risk will be examined further to provide a comprehensive understanding of how each type of risk can impact investments. By grasping these concepts, an investor can make more strategic decisions and achieve a higher level of financial success.

Unsystematic Risk Explained: How to Minimize Company-Specific Threats

Unsystematic risk, also known as diversifiable risk, refers to the risk that is specific to an individual company, industry, or sector. This type of risk is unique and does not affect the market as a whole. Unlike nondiversifiable risk, which influences the entire market, unsystematic risk arises from factors within a specific entity. Examples of unsystematic risk include a company facing a product recall due to safety issues, a major scandal involving its executives, or a significant shift in its management team. These events can substantially affect the company’s stock price, performance, and reputation, but usually do not impact other companies or industries. Additionally, changes in technology that make products obsolete, labor strikes that shut down operations, or even a lawsuit against a firm are considered unsystematic risks. These specific risks make individual companies vulnerable and directly influence their performance while having limited to no effect on broader market conditions. Understanding that diversifiable risk can be minimized is essential for any investor who wishes to safeguard their investments.

The key strategy to mitigate unsystematic risk is diversification. By investing in a variety of companies across different sectors, industries and even geographical locations, investors can substantially reduce the potential impact of any single company’s specific problems. A diversified portfolio is designed to ensure that if one investment performs poorly, other investments in the portfolio may compensate for the loss and stabilize your returns. For example, if one company in the technology sector experiences a major setback, a diversified investor who also holds stocks in the healthcare, consumer goods, and financial sectors is less likely to be significantly affected. Diversification can also be applied within an industry; an investor may decide to not invest all their capital in one technology company but in multiple companies. Therefore, choosing different stocks in the same sector, or across different sectors or assets can reduce the overall vulnerability of the portfolio. When building a well-diversified portfolio, investors can minimize the impact of diversifiable risk while creating a more robust investment strategy. However, it is very important to understand that this strategy does not completely remove the investment risks, as non-diversifiable risk may still affect the entire portfolio simultaneously. Diversification is a way of reducing exposure to specific company risk, while systematic risk cannot be addressed with this strategy.

Systematic Risk Demystified: Understanding the Impact of Market-Wide Forces

Systematic risk, also known as non-diversifiable risk, refers to the risk inherent to the entire market or a significant segment of it. This type of risk is not specific to individual companies or industries; instead, it stems from broad economic, political, or social factors that can affect all investments. Unlike unsystematic risk, which can be mitigated through diversification, systematic risk cannot be eliminated by simply diversifying a portfolio. Examples of systematic risks include fluctuations in interest rates. When interest rates rise, borrowing costs increase for businesses, which can lead to reduced profitability and therefore affect stock prices negatively. Inflation is another significant factor. When the general price level rises, the purchasing power of money decreases, and this can erode the real returns of investments. Recessions, which are periods of economic contraction, can also lead to widespread declines in asset values, making systematic risk a critical consideration for investors. These factors are beyond the control of any single investor or company and affect the market as a whole. Political instability and shifts in government policies, such as changes in taxation or international trade agreements, can introduce further systematic risks, impacting investment across various sectors and regions. It’s crucial to recognize that while a diversified portfolio can reduce diversifiable risk, it cannot shield investors from the pervasive influence of systematic risks. Understanding the nature and potential impact of these market-wide forces is fundamental for effective risk management in any investment strategy. The implications of systematic risk are particularly important when analyzing long-term investment goals because these risks present the largest challenges. Furthermore, the management of systematic risk involves strategic asset allocation, hedging strategies, and maintaining a long-term investment horizon.

The interconnectedness of global markets means systematic risk can manifest in unexpected ways, quickly affecting multiple asset classes and geographies. Consider, for instance, how a major financial crisis in one country can swiftly spread to other nations through the interconnectedness of global financial systems. This ripple effect underscores the nature of non-diversifiable risk and shows that it’s essential to incorporate into every portfolio assessment. Investors must remain cognizant of the broader macroeconomic trends and potential disruptive events that can trigger volatility across markets. Furthermore, shifts in governmental policies, like regulatory changes in key industries, can have a widespread impact affecting multiple companies. To make sound investment decisions, investors should diligently follow macroeconomic indicators, such as GDP growth, unemployment rates, and inflation. In doing so they can better gauge the current and potential future direction of the market and therefore can better understand the impacts of systematic risk in their portfolios. Thus, strategies for navigating market-wide uncertainty, which include hedging and long term planning are often essential for preserving capital in the face of systematic threats. Ignoring the non-diversifiable risk factor within portfolios can lead to losses that cannot be avoided simply through diversification.

How to Protect Your Portfolio Against Unavoidable Market Risks

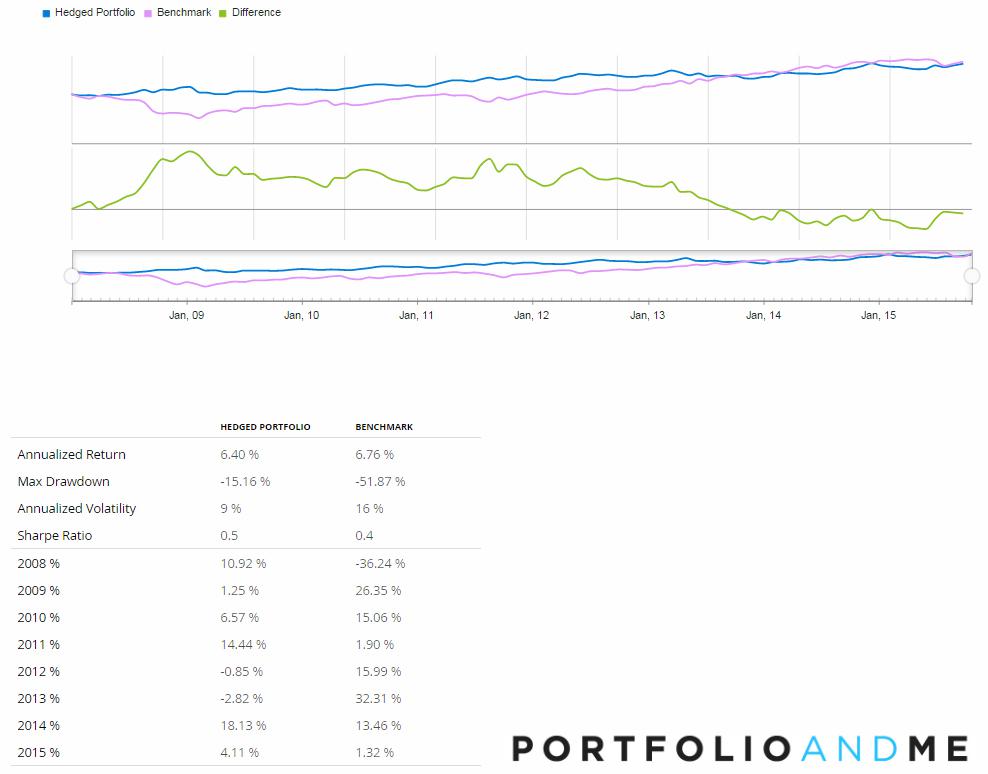

While diversifiable risk, which is specific to individual companies or industries, can be mitigated through strategic portfolio diversification, nondiversifiable risk, also known as systematic risk, is inherent in the investment landscape. These systematic risks are market-wide forces that affect a broad spectrum of investments and cannot be eliminated through diversification alone. Strategies to manage these unavoidable market risks revolve around carefully structuring your investment approach. One of the primary methods involves asset allocation, which entails distributing investments across different asset classes, such as stocks, bonds, and real estate, to balance risk and return. Different asset classes respond differently to market events, helping to reduce the portfolio’s overall volatility. Furthermore, hedging techniques, including the use of derivatives like options or futures, can provide a shield against adverse price movements, albeit with their own inherent complexities and risks. These methods aim to counterbalance losses in some parts of the portfolio with gains in others when the market encounters a downturn. However, the most effective way to deal with nondiversifiable risk is adopting a long-term investment horizon. Market fluctuations are natural over time, and attempting to time the market based on short-term movements often leads to suboptimal results.

Beyond asset allocation and hedging, understanding the influence of external factors on your portfolio is vital. Political risks, such as policy changes or international tensions, and economic risks, including inflation or recessions, can significantly affect investment performance. These events introduce systematic risks that cannot be diversified away. For example, changes in interest rates can alter the valuation of fixed-income securities and affect borrowing costs for businesses, while a recession can trigger a market-wide downturn. As a result, investors must be aware of macroeconomic trends and consider how they might affect their investment strategy. It is important to conduct thorough due diligence when deciding about investment funds and companies. Looking into their historical performance and how they behaved during different market conditions helps to determine their risk profile. A key aspect is to align the investment strategy with individual financial goals and risk tolerance. The willingness to bear short-term losses must be balanced with the potential for long-term gains, especially when dealing with risks inherent to investing. An awareness of diversifiable risk and nondiversifiable risk is key to making sound investment decisions.

Diversification Strategies: Building a Robust Portfolio to Reduce Specific Risks

Diversification stands as a cornerstone strategy in investment management, designed to mitigate the impact of diversifiable risk, also known as unsystematic risk. This approach involves strategically spreading investments across a variety of assets, aiming to reduce the potential for significant losses should any single investment perform poorly. The primary goal is to construct a resilient portfolio that can withstand market fluctuations and minimize exposure to risks specific to individual companies or sectors. Effective diversification extends beyond merely owning multiple stocks; it encompasses a broader scope of asset classes, including stocks, bonds, and real estate, and should also consider geographical diversity. When selecting assets for a diversified portfolio, understanding the concept of correlation is essential. Correlation measures the degree to which two assets move in relation to each other. Ideally, a portfolio should include assets with low or negative correlations, meaning that if one asset declines, another may remain stable or even increase in value, further reducing the portfolio’s overall diversifiable risk. A well-diversified portfolio is more robust, less volatile, and offers greater potential for consistent returns over time. By allocating capital across different asset types and sectors, investors can achieve a balance that reduces the reliance on any single investment’s success.

Within each asset class, diversification should be further considered. For example, within the stock market, it is crucial to diversify across various sectors and industries, such as technology, healthcare, and consumer goods, reducing exposure to the nondiversifiable risk that might impact a specific sector. This intra-asset diversification helps to mitigate risks associated with particular industries or company-specific events. Similarly, bonds can be diversified by maturity dates and issuers. However, it’s important to be aware that over-diversification can dilute potential returns and make portfolio management unnecessarily complex. The key is to strike a balance that provides sufficient risk reduction without compromising the portfolio’s performance potential. Choosing assets that have a low or negative correlation is also important. In general, a portfolio must include assets that might perform inversely during specific market conditions. Therefore, when constructing a diversified portfolio, attention must be paid not only to the number of assets but also to their quality, including careful consideration of how they perform in different economic climates and their individual and combined exposures to nondiversifiable risk.

Analyzing Your Investment Portfolio: Identifying and Assessing Potential Threats

Analyzing an investment portfolio to understand potential risks is a crucial step towards achieving financial goals. A thorough analysis involves several key actions. Firstly, identify the different asset classes within the portfolio, such as stocks, bonds, and real estate. Evaluate the diversification within each asset class; for example, within stocks, note the distribution across sectors (technology, healthcare, finance) and industries. Examine the concentration of investments, paying particular attention to over-reliance on any single sector or company. Secondly, assess the historical performance of each asset, both in isolation and in relation to broader market benchmarks. Look at risk metrics such as beta, which indicates an asset’s volatility compared to the market, to understand the market or systematic risk your portfolio may be exposed to. The presence of higher beta stocks contributes more to nondiversifiable risk, as they are more susceptible to overall market fluctuations. Thirdly, evaluate the correlation between different assets in the portfolio. Positively correlated assets tend to move in the same direction, which reduces the overall benefit of diversification. Ideally, a portfolio should include assets with low or negative correlations to help mitigate the impact of both diversifiable risk and nondiversifiable risk when one asset performs poorly. By understanding the correlation between each of your assets you can better balance your portfolio and control your risk exposure. You will be able to mitigate company-specific risks and balance the exposure to market risk. Be aware of the sectors in which you are invested since some sectors are more prone to certain risks than others, for example, technology can be sensitive to innovation risks, whereas utilities may be more subject to regulatory risk.

Regular review and rebalancing of an investment portfolio are equally critical. The initial asset allocation strategy may become unbalanced due to market movements and varying asset performance. Therefore, periodic reviews, typically at least annually, allow for adjustments to maintain the desired level of risk exposure. This process involves comparing the current portfolio allocation to the initial target and rebalancing by selling some assets that have overperformed and buying others that have underperformed. For example, if an investor’s target allocation was 60% stocks and 40% bonds and now the portfolio is weighted 70% stocks and 30% bonds, the investor should sell some stocks and buy more bonds. Additionally, remember to consider other factors such as life events or shifts in financial goals that may require changes in the investment strategy. It is vital to understand the risks in different sectors and their sensitivity to different market or company factors. An investor should also assess the credit risk of bonds in the portfolio, especially when investing in corporate bonds. By continuously monitoring and adjusting the investment portfolio, investors can control diversifiable risk and nondiversifiable risk to a great extent, and better adapt to changing market conditions and their own personal circumstances, thereby improving the chances of reaching financial objectives. Also, analyze the portfolio to be sure you do not have too much overlap and be aware of the different factors that may affect the investment.

The Interplay of Systematic and Unsystematic Risk: A Holistic View

Understanding the relationship between diversifiable risk and nondiversifiable risk is crucial for effective portfolio management. These two types of investment risks do not operate in isolation; rather, they interact to shape the overall risk profile of an investment portfolio. Unsystematic risk, also known as diversifiable risk, stems from factors specific to a company or industry. For example, a company might face a lawsuit, experience a product recall, or encounter changes in its management structure. These events can significantly impact the company’s performance and, consequently, the value of its stock. However, because these are company-specific issues, they can be mitigated through diversification. A well-diversified portfolio will not be unduly affected by a single company’s problems, as the negative impact on one investment can be offset by positive performance in others. This ability to reduce unsystematic risk through diversification highlights its nature as “diversifiable”. Nondiversifiable risk, on the other hand, also referred to as systematic risk, is inherent in the overall market and cannot be avoided through diversification alone. These are risks stemming from macroeconomic conditions like changes in interest rates, inflation rates, geopolitical events, or recessionary pressures. These market-wide factors can impact all companies, regardless of their individual strengths or weaknesses. Therefore, while diversification helps in reducing the impact of company-specific events, it is unable to eliminate the exposure to these broad market risks. A balanced portfolio, therefore, needs to consider both aspects.

A holistic approach to risk management involves recognizing the interconnected nature of diversifiable risk and nondiversifiable risk. It’s not sufficient to focus solely on reducing unsystematic risk through diversification while ignoring the pervasive influence of systematic risk. A responsible investor must address both aspects in order to create a resilient investment strategy. To achieve this, investors must perform thorough due diligence by analyzing investment funds and individual companies to understand their risk profiles. Checking investment funds’ track records, management styles, and the asset allocation that the fund follows, are crucial factors to evaluate if that investment is suitable with their risk appetite. Similarly, before investing in a company is crucial to understand its historical risk profile by checking its financial health, and competitive advantages and also to understand in which sector the company participates. Evaluating these aspects of the investment, allows the investor to know what kind of risks are involved. For example, a company in the technology sector could have more unsystematic risk depending on the company’s competitiveness. On the other hand, the energy sector is usually linked with economic and political factors, increasing the systematic risk. Understanding the sector’s exposure is key to diversify accordingly. By assessing and managing both types of risks, investors can build portfolios that are not only diversified but also positioned to withstand broader market fluctuations. Such portfolios are more likely to achieve their long-term financial goals without succumbing to the unpredictable nature of investment markets. Therefore, both diversifiable risk and nondiversifiable risk should be considered to have a complete view of the investment risk profile.

Navigating Investment Uncertainty: A Long-Term Approach

Risk is an inherent component of the investment landscape; no investment is entirely devoid of it. Successfully navigating the complexities of investing necessitates a thorough understanding and diligent management of these risks. While complete elimination of risk is unattainable, a strategic approach, informed by knowledge of its diverse forms, can substantially enhance investment outcomes. This understanding involves recognizing the fundamental distinction between diversifiable risk and nondiversifiable risk. Diversifiable risk, also known as unsystematic risk, pertains to specific companies or industries and can be mitigated through diversification. Conversely, nondiversifiable risk, or systematic risk, affects the broader market and cannot be eliminated through diversification alone. Effective risk management is not merely about avoiding losses; it’s about strategically positioning investments to achieve long-term financial objectives while acknowledging the inherent uncertainty of the market. A long-term perspective is paramount, as short-term market fluctuations are often a product of these unavoidable risks.

The challenge for investors lies in adopting strategies that acknowledge both diversifiable risk and nondiversifiable risk. Strategies such as asset allocation, hedging, and a well-thought-out diversification plan play crucial roles. Diversification, involving investments across various asset classes and sectors, helps in reducing the impact of diversifiable risk by ensuring that a negative performance in one area can be balanced by positive performance in another. Nondiversifiable risk, on the other hand, demands a broader approach, including thorough economic analysis and an awareness of global market trends. Political and economic uncertainties should also be considered as they may impact different investment sectors and industries differently. These risks, although unavoidable, can be prepared for by making sure to have a well-diversified and balanced portfolio. The due diligence process of funds and companies is an important step that can’t be skipped to have the best knowledge about the risk profiles of the investments. Risk management is therefore a continuous and adaptable process, rather than a one-time task.

Embracing a long-term view is an essential part of risk management. Market fluctuations, affected by both diversifiable risk and nondiversifiable risk, are inherent in any investment strategy, and a long-term perspective can help investors ride through volatility. By understanding that financial success depends on understanding and managing these risks, investors are more able to make rational decisions, avoiding impulsive reactions to market conditions. A balanced perspective on risk is the key to long-term financial well-being. Diversification remains a powerful tool, but it is imperative to understand its limitations, especially when dealing with systematic risks. The objective is not to eradicate risk but to manage it intelligently, allowing your portfolio to achieve its full potential over time. This involves accepting a certain level of market uncertainty and structuring investment portfolios in a way that makes the most of the opportunities presented, while not losing sight of the risks associated with such investments.