Unlock Insights: The Power of Discounted Cash Flow Analysis

Discounted Cash Flow (DCF) analysis stands as a cornerstone of investment decision-making, offering a rigorous framework for determining the intrinsic value of an investment. This method revolves around projecting future cash flows an investment is expected to generate and then discounting them back to their present value. The underlying principle is that the value of an investment is the sum of all its future cash flows, adjusted for the time value of money. This means that money received today is worth more than the same amount received in the future, due to its potential earning capacity. Mastering the art of discounted cash flow in excel provides an incredible advantage.

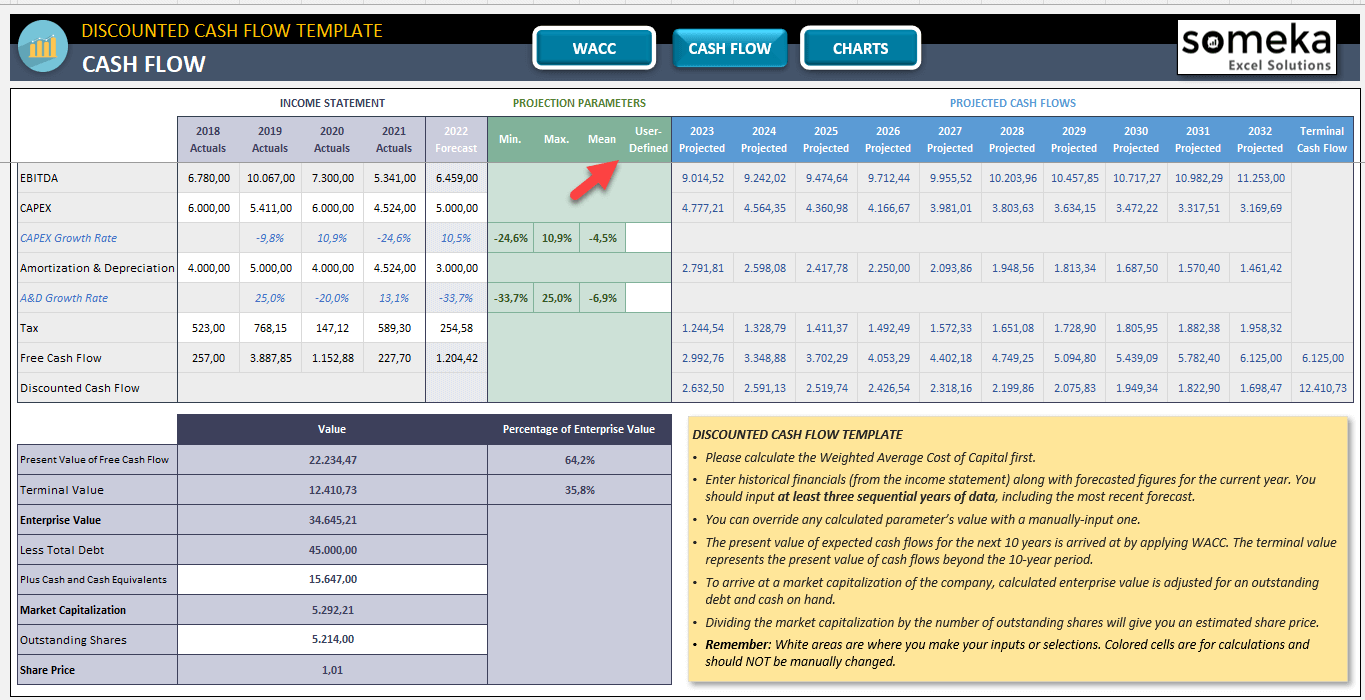

Key components of DCF analysis include accurately forecasting future cash flows, selecting an appropriate discount rate, and estimating the terminal value. Future cash flows represent the expected inflows and outflows of cash over the investment’s life. The discount rate, often represented by the Weighted Average Cost of Capital (WACC) or a required rate of return, reflects the risk associated with the investment. The terminal value captures the value of the investment beyond the explicit forecast period, assuming a stable growth rate. The importance of discounted cash flow in excel modeling is to create scenarios and adjust variables.

Excel provides a practical and accessible platform for conducting DCF analysis. Its intuitive interface, powerful calculation capabilities, and readily available functions make it an ideal tool for both novice and experienced analysts. By leveraging Excel, investors can build sophisticated financial models to evaluate investment opportunities, conduct sensitivity analyses, and ultimately make more informed decisions. Discounted cash flow in excel offers a flexible and transparent way to understand the drivers of value and assess the potential risks and rewards of an investment. The utilization of discounted cash flow in excel becomes increasingly crucial.

How to Calculate Present Value of Future Income Streams in Excel

This section outlines how to establish a basic discounted cash flow in excel (DCF) framework. Begin by opening Microsoft Excel and creating a new spreadsheet. The initial step involves organizing your data effectively. Designate columns for the year, projected cash flows, and present value calculations. In the ‘Year’ column, list the periods for which you are forecasting cash flows (e.g., Year 1, Year 2, up to Year 5 or beyond). Then, input the corresponding projected cash flows for each year in the ‘Projected Cash Flows’ column. These cash flows represent the expected income or revenue generated by the investment or project in each period. Accurate cash flow projections are critical for a reliable DCF analysis.

Next, a crucial component of the discounted cash flow in excel (DCF) model is determining the discount rate. This rate reflects the time value of money and the risk associated with the investment. The discount rate can be the Weighted Average Cost of Capital (WACC) or the required rate of return. Input the chosen discount rate as a decimal (e.g., 0.10 for 10%) into a designated cell. With the cash flows and discount rate in place, proceed to calculate the present value of each cash flow. Utilize Excel’s PV function for this purpose. The PV function requires three key arguments: the discount rate, the period (year), and the future value (cash flow for that year). The formula in Excel will look similar to this: =PV(discount_rate, year_number, -cash_flow). Note the negative sign before the cash flow, which is used because the PV function typically treats cash inflows as positive and cash outflows as negative. Applying this formula to each year’s cash flow yields its present value.

Finally, to arrive at the total present value of all future cash flows, sum the present values calculated for each year. This sum represents the estimated value of the investment based on the discounted cash flow in excel (DCF) analysis. The formula in Excel will be =SUM(range_of_present_values). This total present value provides a basis for informed investment decisions. By comparing the total present value to the initial investment cost, one can assess whether the investment is potentially profitable. If the total present value exceeds the investment cost, it suggests that the investment is likely to generate a positive return, considering the time value of money and the associated risks. This step-by-step process in Excel provides a clear and structured approach to calculating the present value of future income streams, a cornerstone of investment analysis.

Forecasting Future Earnings: Projecting Cash Flows Accurately

Forecasting future cash flows is a cornerstone of discounted cash flow (DCF) analysis, significantly impacting the valuation outcome. Accurate projections are vital when building a reliable discounted cash flow in excel model. This section explores methods for forecasting and integrating them effectively into your Excel spreadsheet. The integrity of a discounted cash flow in excel model depends on this projection.

Several forecasting methods exist, each with its strengths and weaknesses. Historical growth rates offer a simple approach, projecting past performance into the future. This method assumes that the business will continue to grow at a similar rate. Industry analysis provides a broader perspective, considering factors like market size, competition, and technological advancements. More sophisticated methods involve regression analysis or econometric models. These advanced tools require more data and expertise, but they can provide more accurate forecasts. Regardless of the method selected, ensure the assumptions are well-documented within the discounted cash flow in excel model to maintain transparency. Integrating these projections into an Excel model involves linking forecast drivers (e.g., revenue growth, cost margins) to the cash flow statements. Formulas calculate future revenues, expenses, and ultimately, free cash flows. Regularly review and update these forecasts to reflect the latest information. The usefulness of discounted cash flow in excel analysis improves with careful updates.

Forecasting over long periods presents unique challenges. The further into the future, the more uncertain the projections become. Consider using a multi-stage forecasting approach. In the initial years, use more detailed methods, gradually transitioning to a stable growth rate for the terminal value calculation. Sensitivity analysis becomes crucial when addressing forecasting uncertainty. By varying key assumptions, you can assess the potential range of outcomes and understand the model’s sensitivity to changes in these variables. Documenting assumptions and performing sensitivity analysis enhances the robustness and reliability of the discounted cash flow in excel model. Remember to stress-test the model with pessimistic and optimistic scenarios. These will help in understanding the potential impacts on the final valuation. Successfully forecasting cash flows requires a blend of analytical skills, industry knowledge, and sound judgment, all contributing to a more robust discounted cash flow in excel analysis.

Determining the Discount Rate: WACC and Its Components

The discount rate is a critical component of any discounted cash flow in excel (DCF) analysis. It represents the rate of return required by investors for undertaking the risk of investing in a particular project or company. A commonly used discount rate is the Weighted Average Cost of Capital (WACC). The WACC reflects the average rate of return a company expects to pay to finance its assets. It is a weighted average of the cost of each source of capital, including both debt and equity. A precise WACC is vital for accurate discounted cash flow in excel calculations.

Calculating WACC in Excel involves several steps. First, determine the market value of the company’s equity and debt. These values are used to calculate the weights for each component of the capital structure. Next, estimate the cost of equity, which represents the return required by equity investors. The Capital Asset Pricing Model (CAPM) is a common method for estimating the cost of equity. CAPM considers the risk-free rate, the market risk premium, and the company’s beta. Beta measures the company’s volatility relative to the overall market. The formula is: Cost of Equity = Risk-Free Rate + Beta * (Market Risk Premium). Then, calculate the cost of debt, which is the effective interest rate a company pays on its debt. This rate is typically adjusted for the tax deductibility of interest expense. The formula is: Cost of Debt = Interest Rate * (1 – Tax Rate). Input these values into your discounted cash flow in excel spreadsheet.

Once the cost of equity and cost of debt are calculated, the WACC can be determined using the following formula: WACC = (Weight of Equity * Cost of Equity) + (Weight of Debt * Cost of Debt). In Excel, you would create cells for each of these inputs and then use a formula to calculate the WACC. Estimating these values requires careful analysis and judgment. Publicly traded companies’ betas can be found on financial websites. It is crucial to use reliable data sources and to understand the assumptions underlying each calculation. An accurate WACC is paramount for effective discounted cash flow in excel modeling, as it directly impacts the present value of future cash flows. Sensitivity analysis, as discussed later, can help assess the impact of different WACC assumptions on the final valuation. Using the right discount rate in your discounted cash flow in excel analysis is key to a reliable valuation.

Calculating Terminal Value: Capturing Value Beyond the Forecast Period

The terminal value represents the value of a business beyond the explicit forecast period in a discounted cash flow in excel (DCF) analysis. Since it is impossible to accurately predict cash flows indefinitely, the terminal value captures all future cash flows into a single lump sum at the end of the forecast period. This component often constitutes a significant portion of the total present value, making its accurate calculation crucial for a reliable valuation. Ignoring terminal value would severely underestimate the true worth of a company, as it disregards the continuing value creation potential.

Two common methods exist for calculating terminal value: the Gordon Growth Model and the Exit Multiple method. The Gordon Growth Model, also known as the constant growth model, assumes that the company’s cash flows will grow at a constant rate forever. The formula is: Terminal Value = (Final Year Cash Flow * (1 + Growth Rate)) / (Discount Rate – Growth Rate). Implementing this in discounted cash flow in excel requires calculating the final year’s projected cash flow, estimating a sustainable long-term growth rate, and using the previously determined discount rate (WACC). A key consideration is that the growth rate must be lower than the discount rate for the formula to be valid. The Exit Multiple method estimates terminal value by applying a multiple to a financial metric, such as EBITDA or revenue, in the final forecast year. This multiple is typically based on comparable companies in the same industry. To implement this in discounted cash flow in excel, research industry-specific multiples, multiply the chosen multiple by the corresponding financial metric in the final forecast year.

Both methods have advantages and disadvantages. The Gordon Growth Model is relatively simple but relies heavily on the assumption of a constant growth rate, which may not be realistic. The Exit Multiple method is more market-driven but depends on the availability of reliable comparable company data and the selection of an appropriate multiple. When constructing a discounted cash flow in excel model, it’s beneficial to calculate terminal value using both methods and compare the results. This provides a range of potential values and helps to assess the sensitivity of the valuation to different assumptions. Ultimately, the choice of method and the assumptions used should be carefully considered and justified based on the specific characteristics of the company being valued. Sensitivity analysis, as discussed in the next section, is critical for understanding how changes in the terminal value assumptions impact the overall valuation conclusions of the discounted cash flow in excel model.

Conducting Sensitivity Analysis: Stress Testing Your Model

Sensitivity analysis is crucial for any discounted cash flow in excel model. It helps to understand how changes in key assumptions impact the valuation results. A discounted cash flow in excel model relies on forecasts and estimations, which inherently involve uncertainty. By conducting sensitivity analysis, you can identify the drivers that significantly affect the intrinsic value and assess the potential range of outcomes. This allows for more informed decision-making and risk management.

Excel provides several tools to perform sensitivity analysis efficiently. Data tables are a powerful feature that allows you to see how the net present value (NPV) changes when one or two variables are altered. For example, you can create a data table to analyze the impact of different discount rates and growth rates on the intrinsic value. Simply define the input cells (e.g., discount rate, growth rate) and the output cell (e.g., NPV), and Excel will automatically calculate the NPV for various combinations of the input values. This provides a clear visual representation of the model’s sensitivity to these key assumptions. Another useful tool is the Scenario Manager. It enables you to define different scenarios (e.g., optimistic, base case, pessimistic) by assigning specific values to multiple input variables. This allows for a more comprehensive assessment of the potential range of outcomes under different economic conditions or management strategies. With the Scenario Manager, you can quickly switch between scenarios and see how the valuation changes.

When conducting sensitivity analysis, it is essential to focus on the most critical assumptions that drive the discounted cash flow in excel model. These typically include the discount rate, growth rate, and terminal value assumptions. Consider a reasonable range of values for each assumption based on historical data, industry benchmarks, and expert opinions. It’s crucial to present the sensitivity analysis results in a clear and concise manner, using charts and tables to illustrate the impact of changes in key assumptions. This helps stakeholders understand the potential range of outcomes and the associated risks. Sensitivity analysis is not about finding the “right” answer but rather about understanding the potential range of outcomes and the factors that drive the valuation. By stress-testing the model with different scenarios, you can gain a better understanding of the investment’s risk profile and make more informed decisions. Remember that a robust discounted cash flow in excel model should not be overly sensitive to small changes in assumptions. If the valuation swings wildly with minor adjustments, it may indicate that the model is too reliant on specific assumptions or that the underlying business is inherently risky.

Valuing a Business with Microsoft Excel: An Example Scenario

Let’s illustrate the power of a discounted cash flow in excel model with a practical example. Imagine we’re evaluating “TechForward Inc.,” a software company. We’ll use a simplified DCF model in Excel to determine its intrinsic value and compare it to its current market price.

First, gather the necessary financial data. Assume TechForward Inc. has the following projected free cash flows (FCF) for the next five years (in millions): Year 1: $15, Year 2: $18, Year 3: $22, Year 4: $25, Year 5: $28. We also need to determine a suitable discount rate. Let’s assume the company’s Weighted Average Cost of Capital (WACC) is 10%. Next, we calculate the present value of each year’s FCF using the formula: PV = FCF / (1 + Discount Rate)^Year. In Excel, this translates to a simple formula using cell references. For instance, if Year 1’s FCF is in cell B2 and the discount rate is in cell B3, the present value for Year 1 would be “=B2/(1+B3)^1”. Repeat this calculation for each of the five years. Then, we need to calculate the Terminal Value, which represents the value of all future cash flows beyond the explicit forecast period. Using the Gordon Growth Model, let’s assume a perpetual growth rate of 3% and apply the formula: Terminal Value = (Year 5 FCF * (1 + Growth Rate)) / (Discount Rate – Growth Rate). In Excel, this could look like “=(B7*(1+B4))/(B3-B4)”, assuming Year 5’s FCF is in B7 and the growth rate is in B4. Discount this terminal value back to its present value using the same PV formula. Summing the present values of all individual cash flows and the present value of the terminal value gives us the enterprise value of TechForward Inc. Let’s say this calculation yields an enterprise value of $300 million. If TechForward Inc. has $50 million in debt and 10 million shares outstanding, we subtract the debt from the enterprise value ($300 million – $50 million = $250 million) and divide by the number of shares to arrive at the intrinsic value per share ($250 million / 10 million shares = $25 per share).

Finally, compare the calculated intrinsic value ($25) to the current market price of TechForward Inc.’s stock. If the market price is significantly lower than $25, the stock might be undervalued, suggesting a potential investment opportunity. Conversely, if the market price is much higher, the stock might be overvalued. This discounted cash flow in excel analysis provides a data-driven foundation for investment decisions. Remember, this is a simplified example, and a real-world DCF model often involves more complex assumptions and calculations. This example demonstrates how a discounted cash flow in excel model can be used to estimate the intrinsic value of a company. Using discounted cash flow in excel allows for dynamic adjustments to assumptions and immediate observation of their impact on the final valuation.

Beyond the Basics: Refinements and Enhancements to Your Excel Model

The foundation of a robust discounted cash flow in excel model lies in its ability to adapt and evolve. While a basic DCF model provides a valuable framework, several advanced techniques can significantly enhance its accuracy and relevance. Incorporating variable growth rates is a powerful refinement. Instead of assuming a constant growth rate for the entire forecast period, the model can be adjusted to reflect different growth phases. For example, a company might experience high growth in the initial years, followed by a gradual slowdown as it matures. This can be achieved in Excel by using different growth rate assumptions for different periods within the cash flow projections. These adjustments allow the discounted cash flow in excel model to be more sensitive to the specific characteristics of the business being valued.

Tax effects are another critical consideration. A comprehensive discounted cash flow in excel model should account for the impact of taxes on future cash flows. This involves projecting taxable income, calculating the applicable tax liability, and adjusting the cash flows accordingly. Furthermore, linking the model to external data sources can provide real-time updates and improve its responsiveness to market changes. Excel’s data connection capabilities allow for seamless integration with financial databases, ensuring that key inputs, such as interest rates and market multiples, are current and accurate. This dynamic updating enhances the reliability of the discounted cash flow in excel analysis and provides a more informed basis for investment decisions.

Despite its power, it’s important to acknowledge the limitations of discounted cash flow analysis. DCF models are inherently sensitive to assumptions, and even small changes in key inputs can significantly impact the valuation results. Therefore, reliance on other valuation methods, such as comparable company analysis and precedent transactions, is important to corroborate the findings. The discounted cash flow in excel model should be viewed as one tool among many in the investment analysis process. Combining it with other approaches and exercising sound judgment will lead to more informed and reliable investment decisions. Employing a discounted cash flow in excel provides a structured approach to valuation, it is essential to recognize its inherent assumptions and potential limitations within a broader investment strategy.

https://www.youtube.com/watch?v=gLULdxrS-CU