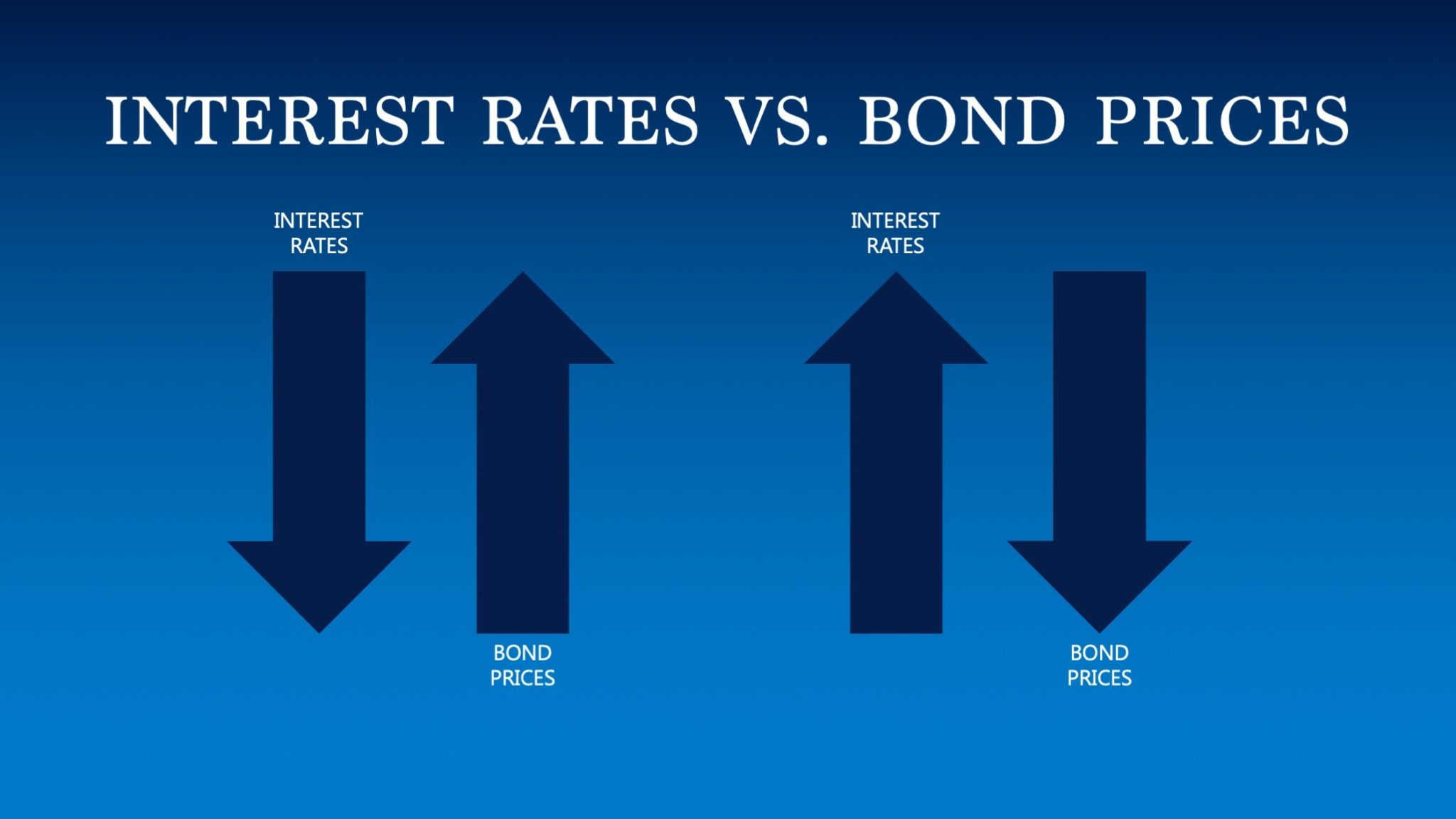

What is Bond Pricing and Why Does it Matter?

In the world of finance, bond pricing plays a vital role in shaping investment decisions. It is the process of determining the value of a bond, which is influenced by various factors such as interest rates, credit ratings, and market conditions. Bond pricing is crucial because it directly affects the returns on investment, and a thorough understanding of it can help investors make informed decisions. At the heart of bond pricing lies the concept of dirty price vs clean price, two distinct types of bond prices that are often misunderstood. The dirty price represents the total value of a bond, including accrued interest, whereas the clean price excludes accrued interest. Understanding the difference between dirty price and clean price is essential for investors, as it can significantly impact their investment decisions and overall portfolio performance.

Dirty Price vs Clean Price: Understanding the Difference

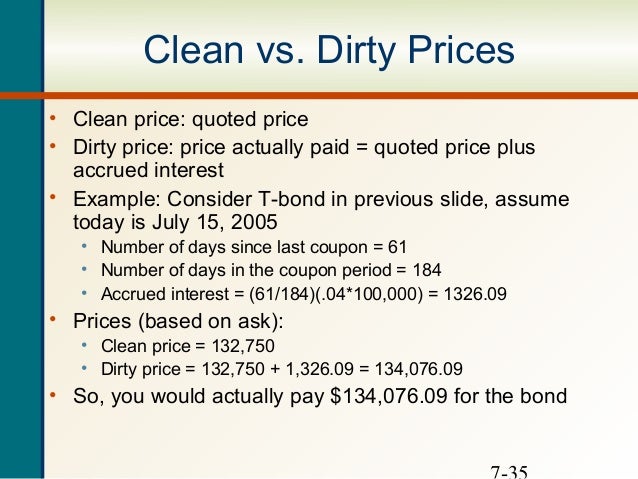

When it comes to bond pricing, understanding the difference between dirty price and clean price is crucial. The dirty price, also known as the full price or invoice price, represents the total value of a bond, including accrued interest. On the other hand, the clean price, also referred to as the flat price or quoted price, excludes accrued interest. The key distinction between the two lies in the treatment of accrued interest, which can significantly impact the bond’s value. To illustrate the difference, consider a bond with a face value of $1,000 and an accrued interest of $50. The dirty price would be $1,050, while the clean price would be $1,000. Understanding the nuances of dirty price vs clean price is essential for investors, as it can affect their investment decisions and overall portfolio performance.

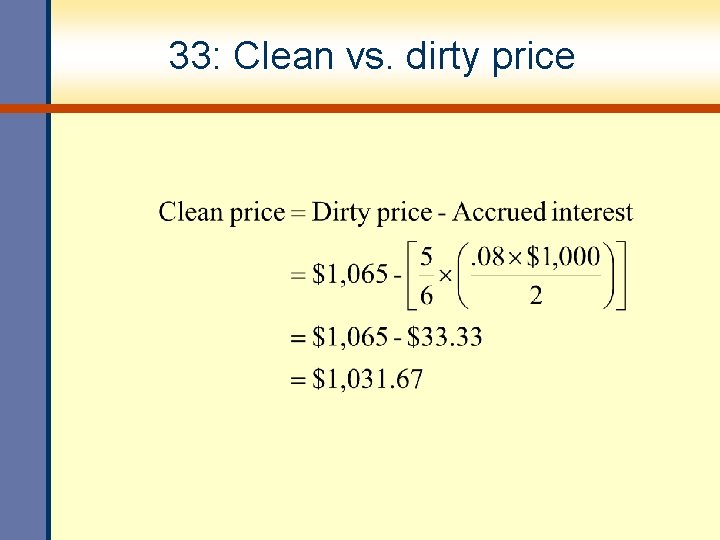

How to Calculate Dirty Price and Clean Price: A Step-by-Step Guide

Calculating dirty price and clean price is a crucial step in bond pricing. To accurately determine the value of a bond, investors must understand the formulas and variables involved. The dirty price can be calculated using the following formula: Dirty Price = Clean Price + Accrued Interest. The clean price, on the other hand, can be calculated using the following formula: Clean Price = Face Value / (1 + (Yield / Frequency)). In these formulas, Face Value represents the bond’s par value, Yield represents the bond’s yield to maturity, and Frequency represents the number of times interest is compounded per year. For example, consider a bond with a face value of $1,000, a yield to maturity of 5%, and semi-annual compounding. The clean price would be $980.39, and the accrued interest would be $24.51, resulting in a dirty price of $1,004.90. By understanding these formulas and variables, investors can accurately calculate dirty price vs clean price and make informed investment decisions.

The Impact of Accrued Interest on Bond Pricing

Accrued interest plays a crucial role in bond pricing, particularly when it comes to calculating the dirty price. Accrued interest represents the interest that has accumulated on a bond since its last coupon payment. When a bond is traded, the buyer must pay the seller the accrued interest, which is then added to the clean price to arrive at the dirty price. The impact of accrued interest on bond pricing cannot be overstated, as it can significantly affect the bond’s value. For instance, a bond with a high accrued interest can result in a higher dirty price, making it more expensive for investors. On the other hand, a bond with a low accrued interest can result in a lower dirty price, making it more attractive to investors. Understanding the role of accrued interest in bond pricing is essential for investors, as it can help them make informed decisions when buying or selling bonds. In the context of dirty price vs clean price, accrued interest is a critical component that can affect the overall value of a bond.

Real-World Scenarios: When to Use Dirty Price and When to Use Clean Price

In the world of bond investing, understanding when to use dirty price and when to use clean price is crucial. In real-world scenarios, the choice between dirty price and clean price depends on the specific investment goals and strategies. For instance, when buying a bond, investors typically use the dirty price, which includes the accrued interest, to determine the total cost of the investment. On the other hand, when selling a bond, investors may use the clean price, which excludes the accrued interest, to calculate the proceeds from the sale. In another scenario, investors may use the clean price to compare the yields of different bonds, while using the dirty price to calculate the total return on investment. By understanding the differences between dirty price and clean price, investors can make informed decisions and optimize their bond portfolios. For example, an investor looking to invest in a high-yield bond may use the dirty price to calculate the total return, while an investor looking to diversify their portfolio may use the clean price to compare the yields of different bonds. In the context of dirty price vs clean price, understanding the real-world applications of each can help investors make more informed decisions and achieve their investment goals.

Common Mistakes to Avoid When Working with Dirty and Clean Prices

When working with dirty and clean prices, investors often make mistakes that can lead to inaccurate calculations and poor investment decisions. One common mistake is failing to account for accrued interest when calculating the dirty price. This can result in an incorrect total cost of the investment. Another mistake is using the clean price when buying a bond, which can lead to an underestimation of the total return on investment. Additionally, investors may confuse the dirty price with the clean price, or vice versa, which can lead to incorrect calculations and decisions. To avoid these mistakes, investors should ensure they understand the differences between dirty price and clean price, and use the correct formulae and variables when calculating each. Furthermore, investors should always consider the context in which they are using the dirty price vs clean price, and adjust their calculations accordingly. By being aware of these common mistakes, investors can avoid costly errors and make more informed investment decisions. In the context of dirty price vs clean price, understanding the potential pitfalls can help investors navigate the complexities of bond pricing and achieve their investment goals.

The Role of Bond Pricing in Investment Decisions

Bond pricing, including dirty price and clean price, plays a crucial role in investment decisions. Accurate bond pricing enables investors to make informed decisions about buying, selling, or holding bonds. When evaluating bond investments, investors must consider the dirty price vs clean price to determine the total return on investment. The dirty price, which includes accrued interest, provides a more accurate picture of the bond’s total cost, while the clean price, which excludes accrued interest, is useful for comparing yields between different bonds. By understanding the differences between dirty price and clean price, investors can optimize their bond portfolios and achieve their investment goals. For instance, investors seeking high-yield bonds may use the dirty price to calculate the total return, while investors looking to diversify their portfolios may use the clean price to compare yields. Furthermore, bond pricing influences investment decisions by affecting the bond’s yield, duration, and credit risk. By considering these factors, investors can make more informed decisions and minimize potential losses. In the context of dirty price vs clean price, understanding the role of bond pricing in investment decisions is essential for achieving success in the bond market.

Conclusion: Mastering the Art of Bond Pricing

In conclusion, understanding the intricacies of bond pricing, particularly the distinction between dirty price and clean price, is crucial for investors seeking to navigate the complex world of bond investments. By grasping the concepts of dirty price vs clean price, investors can make informed decisions about buying, selling, or holding bonds, and optimize their portfolios to achieve their investment goals. Throughout this comprehensive guide, we have explored the importance of bond pricing, the differences between dirty price and clean price, and how to calculate each. We have also discussed the impact of accrued interest, real-world scenarios, and common mistakes to avoid. By mastering the art of bond pricing, investors can unlock the full potential of their bond investments and achieve long-term success in the financial market. Remember, a deep understanding of dirty price vs clean price is essential for making informed investment decisions and minimizing potential losses. With this knowledge, investors can confidently navigate the world of bond pricing and achieve their financial objectives.