What Drives Market Movement: Uncovering the Role of Volume and Open Interest

In the fast-paced world of trading, understanding market indicators is crucial to making informed investment decisions. Among these indicators, volume and open interest play a vital role in grasping market dynamics. The difference between volume and open interest is often overlooked, leading to misguided trading decisions. However, by recognizing the significance of these indicators, traders can gain a deeper insight into market movement and sentiment. Volume and open interest provide a unique perspective on market activity, allowing traders to identify trends, gauge market sentiment, and make informed trading decisions. In this article, we will explore the importance of understanding volume and open interest, and how they can be used to drive trading decisions.

How to Analyze Market Sentiment with Volume and Open Interest

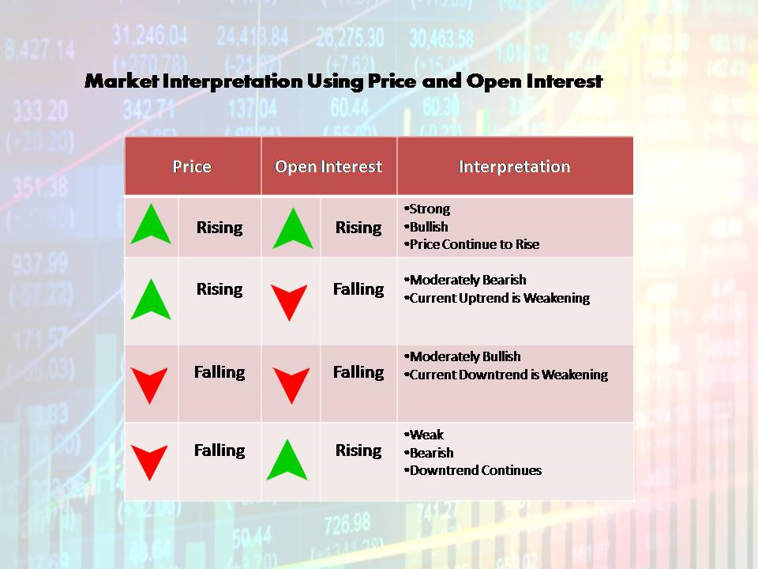

Market sentiment, a crucial aspect of trading, refers to the overall attitude of investors towards a particular market or asset. Understanding market sentiment is essential to making informed trading decisions, as it can help traders identify potential trends and opportunities. Volume and open interest are two key indicators that can be used to gauge market sentiment, providing valuable insights into market dynamics. By analyzing volume and open interest, traders can determine whether a market is bullish or bearish, and make informed decisions accordingly. For instance, a increase in volume accompanied by a rise in open interest may indicate a strong bullish sentiment, while a decrease in volume accompanied by a fall in open interest may suggest a bearish sentiment. By combining these indicators, traders can gain a more comprehensive understanding of market sentiment, ultimately leading to more effective trading strategies.

The Volume-Open Interest Conundrum: What’s the Difference?

One of the most common misconceptions in market analysis is the conflation of volume and open interest. While both indicators are crucial in understanding market dynamics, they serve distinct purposes and provide unique insights. The difference between volume and open interest lies in their calculation, interpretation, and applications in technical analysis. Volume represents the total amount of trading activity in a given period, providing a measure of market activity and liquidity. On the other hand, open interest refers to the total number of outstanding contracts in a particular market, indicating market commitment and sentiment. Understanding the difference between volume and open interest is essential to avoid misinterpreting market signals and making informed trading decisions. By recognizing the distinct roles of these indicators, traders can gain a more comprehensive understanding of market dynamics, ultimately leading to more effective trading strategies.

Volume: The Measure of Market Activity

Volume, a fundamental indicator in technical analysis, measures the total amount of trading activity in a given period. It is calculated by adding up the number of shares, contracts, or lots traded during a specific time frame, such as a day, week, or month. Volume provides valuable insights into market activity, helping traders identify trends, patterns, and potential reversals. A high volume indicates a high level of market participation, which can be a sign of strong market sentiment. Conversely, low volume may indicate a lack of interest or conviction in the market. By analyzing volume, traders can gain a better understanding of market dynamics, including the difference between volume and open interest, and make more informed trading decisions. For instance, a sudden increase in volume accompanied by a price increase may indicate a strong bullish trend, while a decrease in volume accompanied by a price decrease may suggest a weakening trend.

Open Interest: The Pulse of Market Commitment

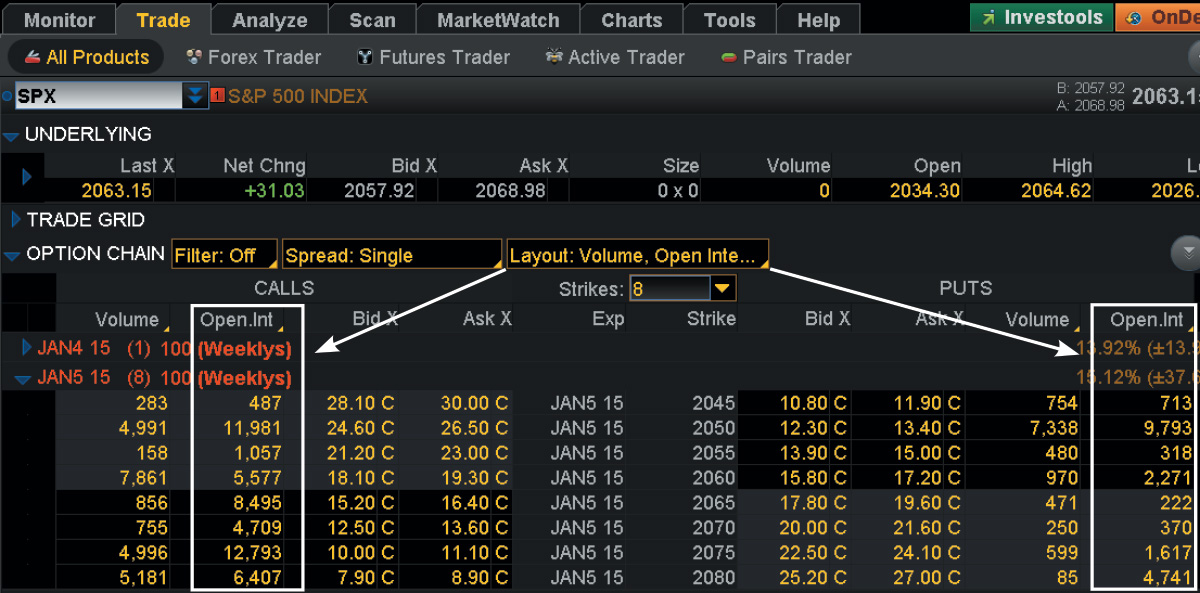

Open interest, a crucial indicator in futures and options markets, represents the total number of outstanding contracts in a particular market. It is calculated by adding up the number of long and short positions held by traders at the end of each trading day. Open interest provides valuable insights into market sentiment, commitment, and potential trend reversals. A rising open interest indicates an increase in market participation, which can be a sign of a strong trend. Conversely, a declining open interest may suggest a weakening trend or a lack of conviction in the market. By analyzing open interest, traders can gain a better understanding of market dynamics, including the difference between volume and open interest, and make more informed trading decisions. For instance, a rising open interest accompanied by a price increase may indicate a strong bullish trend, while a declining open interest accompanied by a price decrease may suggest a weakening trend. Furthermore, open interest can be used to identify potential trend reversals, as a sudden increase in open interest may indicate a shift in market sentiment.

Putting it All Together: How Volume and Open Interest Inform Trading Decisions

When used in conjunction, volume and open interest provide a powerful combination for informing trading decisions. By analyzing both indicators, traders can gain a more comprehensive understanding of market dynamics and sentiment. For instance, a rising volume accompanied by an increase in open interest may indicate a strong bullish trend, while a declining volume accompanied by a decrease in open interest may suggest a weakening trend. Additionally, traders can use volume and open interest to identify potential trend reversals, as a divergence between the two indicators may signal a change in market sentiment. By combining volume and open interest with other forms of analysis, such as technical indicators and chart patterns, traders can develop a more robust trading strategy. Furthermore, understanding the difference between volume and open interest is crucial in avoiding misconceptions and ensuring accurate analysis. By recognizing the distinct roles of volume and open interest, traders can make more informed trading decisions and improve their overall performance. For example, a trader may use volume to identify a strong trend and then use open interest to confirm the commitment of market participants, providing a more confident trading decision.

Common Pitfalls: Avoiding Misconceptions about Volume and Open Interest

When it comes to interpreting volume and open interest, traders often fall prey to common misconceptions that can lead to inaccurate analysis and poor trading decisions. One of the most significant pitfalls is failing to understand the difference between volume and open interest, leading to a conflation of the two indicators. This can result in traders misinterpreting market sentiment and trend strength. For instance, a trader may mistakenly assume that a high volume always indicates a strong trend, neglecting the importance of open interest in confirming market commitment. Another common mistake is relying too heavily on volume or open interest in isolation, without considering the broader market context and other forms of analysis. By recognizing these common pitfalls and taking steps to avoid them, traders can ensure more accurate analysis and improve their overall trading performance. Additionally, understanding the distinct roles of volume and open interest can help traders to identify potential trading opportunities and avoid costly mistakes. By being aware of these common misconceptions, traders can develop a more nuanced understanding of market dynamics and make more informed trading decisions.

Mastering Market Analysis: The Key to Successful Trading

In the world of trading, mastering market analysis is crucial for achieving success. By understanding the difference between volume and open interest, traders can gain a deeper insight into market dynamics and sentiment. This knowledge can be used to inform trading decisions, identify potential trading opportunities, and avoid costly mistakes. By combining volume and open interest with other forms of analysis, traders can develop a more comprehensive understanding of the market and make more informed investment decisions. Furthermore, recognizing the distinct roles of volume and open interest can help traders to avoid common pitfalls and misconceptions, ensuring more accurate analysis and improved trading performance. In today’s fast-paced and ever-changing market environment, having a solid grasp of volume and open interest is essential for traders who want to stay ahead of the curve. By incorporating these indicators into their analysis, traders can unlock new insights and opportunities, and ultimately achieve greater success in their trading endeavors.