Understanding Trading Activity in Financial Markets

Financial markets are dynamic environments driven by investor behavior and market forces. Understanding trading activity is crucial for technical analysis. Key metrics like trading volume and open interest provide insights into market sentiment, price movements, and investor participation. These concepts are intrinsically linked; changes in one often correlate with changes in others, impacting price action. Analyzing the difference between open interest and volume is essential to effectively interpret market signals.

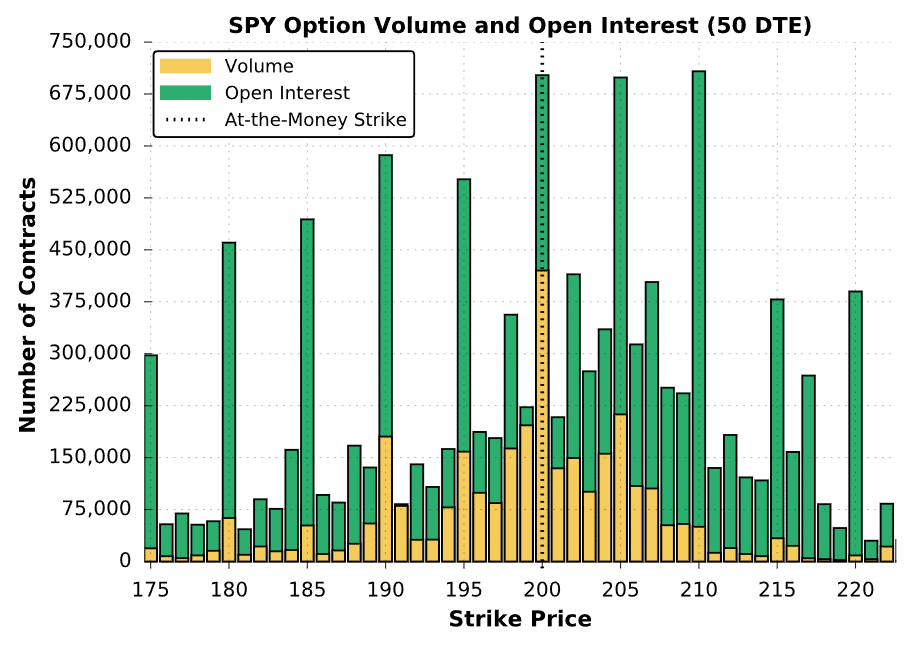

Market participants constantly buy and sell assets, influencing the price. This activity creates trends and patterns that technical analysts study. Volume and open interest are integral components of this analysis. Volume measures the total number of contracts traded during a given period, reflecting the overall market participation. Open interest represents the outstanding contracts that have not been settled, highlighting the commitment of market participants to a specific price. The relationship between these two critical metrics can significantly impact market behavior and potential price movements, highlighting their importance in technical analysis.

Understanding the nuances of trading activity is pivotal to grasping market dynamics and the difference between open interest and volume. Technical analysis helps assess market sentiment and anticipate price changes. Analyzing historical data helps forecast future movements, and the interplay of volume and open interest provides valuable insights for informed trading decisions. These insights can help gauge the strength of trends and investor conviction, and provide clues for potential price reversals.

Open Interest: A Deep Dive

Open interest represents the total number of unsettled contracts in a derivative market, such as futures or options. It’s a crucial metric for understanding the market’s overall commitment to a particular price or direction. Open interest measures the outstanding contracts that haven’t been closed by offsetting trades. A higher open interest indicates greater market participation and potential for price movement. Understanding this key metric aids in analyzing the underlying supply and demand of the market. This helps to grasp the difference between open interest and volume, as they reflect distinct facets of market activity.

A higher open interest often suggests heightened interest in a particular asset. This increased interest might translate into greater price volatility. Conversely, low open interest could indicate a lack of commitment from market participants. This lack of commitment typically signifies reduced potential for significant price swings. Open interest plays a vital role in the market. It is essential to recognize the difference between open interest and volume to fully understand the dynamics driving price movements. Analyzing open interest and volume together offers a clearer picture of the market’s underlying sentiment. Understanding the nuance of the difference between open interest and volume is key to comprehending market conditions.

The connection between open interest and market forces is undeniable. Higher open interest typically signifies a stronger potential for price changes, whether up or down, reflecting a more concentrated commitment to a given price direction by market participants. Conversely, a smaller open interest often signifies reduced commitment and potentially less price volatility. Open interest fundamentally measures the commitment from participants, offering vital information for evaluating the difference between open interest and volume in various market conditions. Analyzing open interest alongside other key metrics, such as volume, can lead to more informed trading decisions. Analyzing the difference between open interest and volume can provide a more thorough understanding of market conditions. The comparison highlights how open interest and volume differ in their application for understanding market activity.

Trading Volume: Unpacking the Metrics

Trading volume represents the total number of contracts traded during a specific period. It serves as a crucial metric for understanding market participation. High volume often suggests significant investor interest in a particular asset. A surge in trading volume can signal a potential shift in market sentiment or a significant price movement. Analyzing volume helps assess the degree of participation, providing insights into the overall market’s interest in a security.

Volume differs significantly from open interest in its interpretation. Volume indicates the immediate activity, providing insights into the level of participation, while open interest represents the outstanding contracts awaiting resolution. The difference between open interest and volume is fundamental to distinguishing the snapshot of immediate activity versus the overall contract commitments. Tracking volume over time can be useful for recognizing market trends. High volume can be a positive indicator for market direction. Understanding the nuances of volume helps traders interpret market activity effectively.

A high volume with a consistently stable open interest suggests strong conviction among market participants. Conversely, high volume accompanied by fluctuating open interest might indicate a potential market shift. The dynamics between volume and open interest highlight the varied ways investors approach the markets, providing valuable clues for trading strategies. A crucial aspect in trading analysis is to distinguish between these two metrics, which are used to look at the market in different ways. The difference between open interest and volume is a fundamental concept in technical analysis.

The Relationship Between Open Interest and Volume

Analyzing the interplay between open interest and volume provides crucial insights into market sentiment and potential price movements. High trading volume combined with stable open interest often suggests strong conviction among market participants. This indicates a substantial degree of interest in the underlying asset. Conversely, substantial trading volume coupled with rapidly fluctuating open interest might signal a market shift or a period of heightened uncertainty. This difference between open interest and volume can be a significant factor in determining trading strategies.

Consider a scenario where a futures contract sees high trading volume, yet the open interest remains relatively steady. This pattern might suggest strong conviction from existing positions, indicating little change in trader sentiment. Alternatively, if the volume is high, but open interest experiences dramatic fluctuations, it could imply uncertainty or a potential change in market sentiment. Such shifts could indicate a shift in investor sentiment or speculation. This is a crucial element of the difference between open interest and volume in understanding price dynamics. Understanding these nuanced distinctions is critical for successful trading strategies.

While both metrics can be indicators of price movement, they reveal different facets of market activity. High volume with stable open interest often signals strong conviction and continued interest in the underlying asset. Conversely, high volume accompanied by rapidly changing open interest suggests market uncertainty. This difference between open interest and volume helps traders interpret market signals effectively. Recognizing these differences in trading activity is pivotal for making well-informed decisions.

Interpreting the Signals: A Practical Guide

Understanding how to interpret the signals from open interest and trading volume is crucial for informed trading decisions. High open interest with low volume might suggest indecision among market participants. This scenario often indicates a lack of strong conviction in a particular direction, making it a less reliable signal. Conversely, a combination of high open interest and high volume can signal bullish or bearish sentiment. This combination usually points to a market with significant conviction from participants, enhancing the reliability of the signal.

Consider a scenario where a futures contract exhibits high open interest. If trading volume is low, this could signify a period of uncertainty. Investors might be waiting for further price movement or more definitive signals before committing to a particular direction. In contrast, high volume often accompanies significant price fluctuations. This pattern, combined with high open interest, suggests a strong directional bias from investors. A substantial increase in both indicators often coincides with strong price movements.

Traders must analyze these patterns in the context of other market factors. News events or major announcements can influence investor behavior, affecting open interest and trading volume. Understanding the difference between open interest and volume is vital. Volume reflects the quantity of contracts exchanged, while open interest measures the outstanding contracts still in play. Considering both provides a comprehensive perspective on market activity and can improve the accuracy of trading decisions. Technical indicators, in conjunction with these measures, offer a holistic view, improving the reliability of trading predictions, and providing a greater understanding of the current market sentiment. A comprehensive understanding of the difference between open interest and volume in the financial markets allows for more precise evaluation and enhances a trader’s ability to make informed decisions.

Distinguishing the Two: A Comparison Table

Understanding the difference between open interest and volume is vital for interpreting market activity. A clear comparison helps traders understand when each metric provides the most informative insights. This table highlights key distinctions, focusing on the strengths and weaknesses of each metric for technical analysis and to spot the difference between open interest and volume.

| Characteristic | Open Interest | Trading Volume |

|---|---|---|

| Definition | The total number of outstanding contracts that haven’t been settled. | The total number of contracts traded over a specific period. |

| Focus | Measures market commitment and speculation. | Measures market participation and activity. |

| Timeframe | Represents market commitment over a given time period, often days or weeks. | Focuses on recent trading activity, usually measured over a specific time frame like a day or an hour. |

| Interpretation | High open interest suggests increased speculative interest, while low open interest might imply diminished commitment. | High volume indicates greater market participation. Low volume suggests reduced activity. |

| Strength | Identifies underlying interest and anticipation for future price movements. | Indicates recent market activity and participation. |

| Weakness | Doesn’t directly show the current trading activity. | Doesn’t reflect the level of commitment to the trade. |

| Usage | Useful in predicting market sentiment and anticipating future price trends. | Helpful in judging the degree of market participation and identifying potential turning points. |

This table illustrates the difference between open interest and volume. Understanding these distinctions allows for a more comprehensive market analysis. Combining open interest and volume insights for trading decisions is recommended. The use of open interest and trading volume is valuable for a more detailed understanding of market characteristics, enabling traders to make better decisions when managing open interest and volume to achieve desired results.

How to Use Open Interest and Volume Together for Better Trading Decisions

Analyzing both open interest and trading volume can lead to more informed trading decisions. Integrating these metrics enhances the understanding of market dynamics. Combining these indicators provides a more holistic view, supplementing existing technical analysis. By evaluating the difference between open interest and volume, traders gain a more complete picture of market sentiment and potential price movements. Sophisticated traders utilize this crucial information to refine their strategies.

One key strategy is to consider the relationship between open interest and volume changes. If volume remains consistent while open interest increases, it suggests a growing interest in the asset. This can be a bullish sign. Conversely, if open interest is high but volume is low, this might signal indecision or a lack of conviction. This dynamic interplay between open interest and volume provides crucial clues about market sentiment and price action. Observing this difference between open interest and volume is pivotal in making profitable decisions. Simultaneously, understanding the connection between open interest and volume highlights opportunities.

Another strategy is to look at the recent changes in both metrics. For example, if volume surges alongside a simultaneous increase in open interest, it could signify a significant shift in market sentiment, either bullish or bearish. Recognizing this difference between open interest and volume helps in assessing the validity of the signals received and adapting trading strategies based on this information. It’s crucial to remember that these are only parts of the broader picture. Market conditions, economic factors, and technical indicators are other pieces that should be included in a comprehensive analysis. Using open interest and trading volume together can help mitigate risk while enhancing profitable trading strategies.

Beyond the Basics: Additional Considerations

While open interest and trading volume offer valuable insights into market activity, understanding their limitations is equally crucial. These metrics should not be the sole determinants of trading decisions.

Considering other factors, such as prevailing market trends, recent news events, and pertinent technical indicators, provides a more comprehensive perspective. A thorough market analysis that goes beyond simply observing the difference between open interest and volume is essential.

For instance, a sudden surge in open interest and volume might be influenced by a significant news announcement rather than inherent investor sentiment. Analyzing the difference between open interest and volume alone could lead to misleading interpretations. Therefore, it’s important to incorporate a wider range of information to form a more complete picture of the market’s health.

Moreover, risk management is paramount in any trading strategy. Relying solely on the metrics of open interest and volume can be detrimental. These indicators can’t account for unforeseen circumstances, market volatility, or unexpected changes in investor sentiment. A balanced approach that considers both market fundamentals and risk tolerance is crucial for successful trading.

Ultimately, understanding the difference between open interest and volume is a vital step. However, it’s only one piece of a much larger puzzle. Successful traders recognize the limitations of these metrics and incorporate a diversified set of information sources to make informed decisions.

By recognizing the nuances of open interest and volume, traders can approach market analysis more effectively, which significantly enhances their trading decisions.