What is Money Supply and Why Does it Matter?

In the realm of economics, few concepts are as crucial as money supply. It is the backbone of a nation’s economy, influencing inflation, employment, and economic growth. The money supply refers to the total amount of money circulating in an economy, encompassing various forms of currency, deposits, and other liquid assets. Understanding the concept of money supply is vital for investors, policymakers, and individuals alike, as it has a profound impact on the overall performance of an economy. In fact, grasping the difference between M1 and M2 money supply can provide valuable insights into the intricacies of monetary policy and its effects on the economy.

Understanding the Two Tiers of Money Supply: M1 and M2

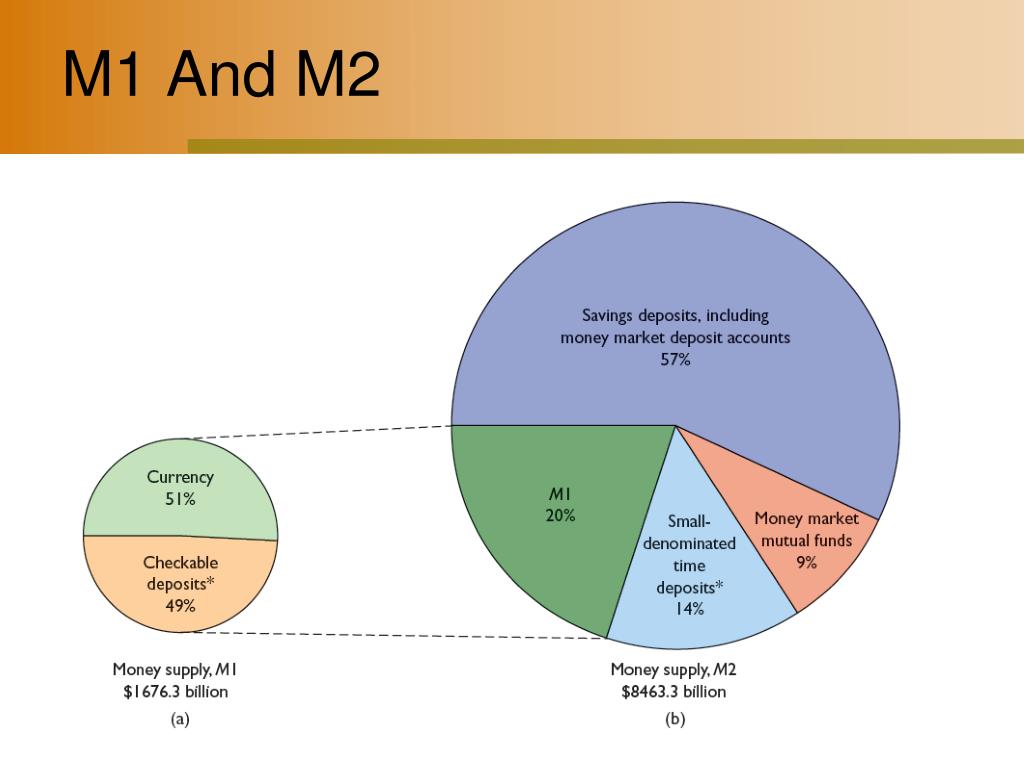

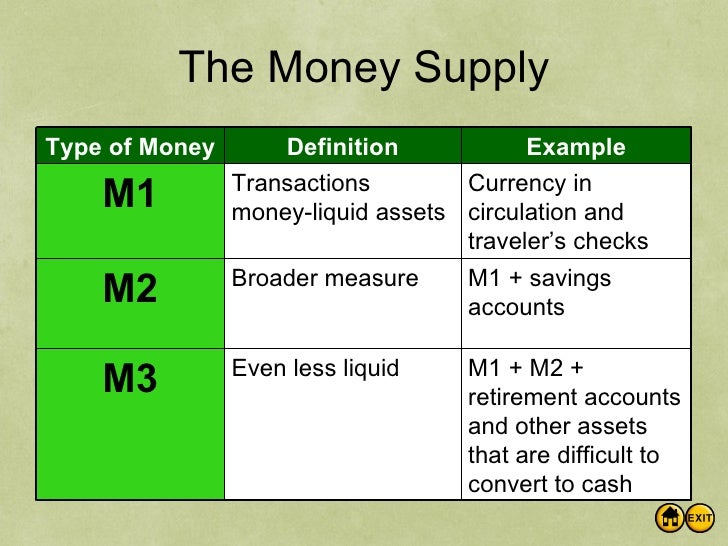

The money supply is categorized into two main tiers: M1 and M2. Understanding the difference between M1 and M2 money supply is crucial for grasping the intricacies of monetary policy and its effects on the economy. M1, also known as narrow money, refers to the most liquid forms of money, including cash, coins, and checking accounts. These are the funds that are readily available for transactions and are often used for daily expenses. On the other hand, M2, or broad money, encompasses a broader range of liquid assets, including savings accounts, time deposits, and money market funds. M2 is a more comprehensive measure of the money supply, as it includes funds that are less liquid but still readily convertible into cash.

How to Distinguish Between M1 and M2: A Breakdown of the Components

To fully grasp the difference between M1 and M2 money supply, it’s essential to delve deeper into their components. M1, the narrow money supply, consists of the most liquid forms of money, including:

- Cash: physical currency in circulation

- Coins: metal currency in circulation

- Checking accounts: demand deposits that can be withdrawn at any time

On the other hand, M2, the broad money supply, encompasses a broader range of liquid assets, including:

- Savings accounts: time deposits with limited liquidity

- Time deposits: certificates of deposit (CDs) and other time deposits with fixed maturity dates

- Money market funds: liquid investments that can be easily converted into cash

The key difference between M1 and M2 lies in their liquidity and accessibility. M1 is more liquid and readily available for transactions, whereas M2 is less liquid but still convertible into cash. Understanding the components of M1 and M2 is crucial for recognizing the difference between m1 and m2 money supply and its implications for the economy.

The Role of Central Banks in Regulating Money Supply

Central banks play a crucial role in regulating the money supply, using various tools and strategies to manage M1 and M2. The primary objective of central banks is to maintain price stability, promote economic growth, and ensure financial stability. To achieve this, they employ monetary policy decisions that influence the money supply.

One of the key tools used by central banks is open market operations, which involve buying or selling government securities to increase or decrease the money supply. For instance, when a central bank buys government securities, it injects liquidity into the economy, increasing the money supply. Conversely, selling securities reduces the money supply.

Central banks also use reserve requirements to regulate the money supply. By setting a minimum reserve requirement, central banks can influence the amount of credit that commercial banks can extend, thereby affecting the money supply. Additionally, central banks can use interest rates to regulate the money supply. By increasing or decreasing interest rates, central banks can influence borrowing and spending habits, which in turn affect the money supply.

The difference between M1 and M2 money supply is critical in understanding the impact of monetary policy decisions. M1, being the most liquid form of money, is more sensitive to changes in interest rates and reserve requirements. M2, on the other hand, is less liquid and more influenced by changes in long-term interest rates and economic growth. By understanding the difference between M1 and M2, central banks can tailor their monetary policy decisions to achieve specific economic objectives.

In conclusion, central banks play a vital role in regulating the money supply, using a range of tools and strategies to manage M1 and M2. By understanding the difference between M1 and M2 money supply, central banks can make informed monetary policy decisions that promote economic growth, stability, and prosperity.

The Impact of M1 and M2 on Economic Indicators

The money supply, comprising M1 and M2, has a profound impact on various economic indicators, including GDP, inflation rate, and unemployment rate. Understanding the effects of M1 and M2 on these indicators is crucial for policymakers, investors, and individuals alike.

Changes in M1, the most liquid form of money, can significantly influence the GDP. An increase in M1 can boost consumer spending, leading to an increase in GDP. Conversely, a decrease in M1 can lead to a decline in GDP. For instance, during the 2008 financial crisis, the US Federal Reserve increased the money supply by injecting liquidity into the economy, which helped stimulate economic growth.

The difference between M1 and M2 money supply also affects the inflation rate. M1, being the most liquid form of money, is more susceptible to inflationary pressures. An increase in M1 can lead to higher inflation, as excess liquidity chases a limited number of goods and services. On the other hand, M2, which includes less liquid assets, is less prone to inflationary pressures. Central banks often monitor M1 and M2 to gauge inflationary pressures and adjust monetary policy accordingly.

The unemployment rate is also influenced by the money supply. An increase in M1 and M2 can lead to an increase in borrowing and spending, which can create jobs and reduce unemployment. Conversely, a decrease in the money supply can lead to higher unemployment. For example, during the 1930s Great Depression, the US Federal Reserve’s failure to increase the money supply exacerbated the unemployment crisis.

In conclusion, the impact of M1 and M2 on economic indicators such as GDP, inflation rate, and unemployment rate cannot be overstated. Understanding the difference between M1 and M2 money supply is essential for policymakers, investors, and individuals to make informed decisions and navigate the complexities of the economy.

Real-World Examples of M1 and M2 in Action

Understanding the difference between M1 and M2 money supply is crucial for grasping the complexities of the economy. To illustrate the significance of M1 and M2, let’s examine some real-world examples of how changes in money supply have affected economies in the past.

One notable example is the hyperinflation in Zimbabwe in the 2000s. The country’s central bank, the Reserve Bank of Zimbabwe, printed excessive amounts of money to finance government spending, leading to a surge in M1 and M2. As a result, the inflation rate skyrocketed, rendering the Zimbabwean dollar worthless. This example highlights the importance of central banks’ role in regulating M1 and M2 to prevent economic instability.

In contrast, the economic boom in the United States during the 1990s was fueled by a increase in M2, driven by low interest rates and technological advancements. The growth in M2 led to an increase in borrowing and spending, resulting in a period of rapid economic growth and low unemployment. This example demonstrates how a well-managed M2 can stimulate economic growth.

The 2008 global financial crisis provides another example of the impact of M1 and M2 on the economy. The crisis was triggered by a sharp decline in M1, as banks reduced lending and households hoarded cash. Central banks responded by injecting liquidity into the economy, increasing M1 and M2. This helped stabilize the financial system and prevent a complete collapse of the economy.

These real-world examples illustrate the significance of understanding the difference between M1 and M2 money supply. By recognizing the distinct roles of M1 and M2, policymakers and investors can make informed decisions to promote economic stability and growth.

Conclusion: The Importance of Understanding M1 and M2 Money Supply

In conclusion, understanding the difference between M1 and M2 money supply is crucial for grasping the complexities of the economy. The distinction between these two tiers of money supply has significant implications for economic indicators such as GDP, inflation rate, and unemployment rate. By recognizing the unique characteristics of M1 and M2, policymakers, investors, and individuals can make informed decisions to promote economic stability and growth.

The difference between M1 and M2 money supply is not just an academic concept, but a vital tool for navigating the economy. Central banks, in particular, must carefully manage M1 and M2 to prevent economic instability and promote sustainable growth. Investors and individuals can also benefit from understanding the difference between M1 and M2, as it can inform their investment decisions and help them navigate economic uncertainty.

In today’s complex and interconnected economy, understanding the difference between M1 and M2 money supply is more important than ever. By grasping the nuances of these two tiers of money supply, individuals can gain a deeper understanding of the economy and make more informed decisions. Whether you’re a policymaker, investor, or individual, understanding the difference between M1 and M2 money supply is essential for navigating the complexities of the economy and achieving long-term success.

Final Thoughts: How to Apply Your Knowledge of M1 and M2

Now that you have a comprehensive understanding of the difference between M1 and M2 money supply, it’s essential to apply this knowledge in your personal and professional life. By recognizing the distinct characteristics of M1 and M2, you can make informed investment decisions, navigate economic uncertainty, and optimize your financial strategy.

For investors, understanding the difference between M1 and M2 money supply can help you identify opportunities and mitigate risks. For instance, if you anticipate an increase in M2, you may consider investing in assets that are sensitive to changes in money supply, such as stocks or bonds. Conversely, if you expect a decrease in M1, you may want to adjust your portfolio to minimize exposure to cash and other liquid assets.

For policymakers, grasping the difference between M1 and M2 money supply is crucial for developing effective monetary policies. By understanding the impact of M1 and M2 on economic indicators, policymakers can create targeted policies that promote economic growth, stability, and low inflation.

For individuals, understanding the difference between M1 and M2 money supply can help you make informed decisions about your personal finances. For example, if you’re considering a large purchase, such as a house or car, understanding the current state of M1 and M2 can help you determine whether it’s a good time to make the investment.

In conclusion, understanding the difference between M1 and M2 money supply is a valuable tool for anyone looking to navigate the complexities of the economy. By applying this knowledge in your personal and professional life, you can make more informed decisions, optimize your financial strategy, and achieve long-term success.