Understanding the Basics of Monetary Policy

In the realm of economics, monetary policy plays a vital role in shaping the overall direction of an economy. At its core, monetary policy refers to the actions of a central bank that determine the money supply and interest rates in an economy. The primary objective of monetary policy is to promote economic growth, stability, and low inflation. Central banks, such as the Federal Reserve in the United States, use various tools to regulate the money supply, including setting interest rates, buying or selling government securities, and adjusting reserve requirements. A deep understanding of monetary policy is essential to grasping the difference between M1 and M2 economics, as it provides the foundation for comprehending the role of money supply in an economy. By understanding the intricacies of monetary policy, economists and policymakers can better navigate the complexities of the economy, ultimately leading to more informed decision-making.

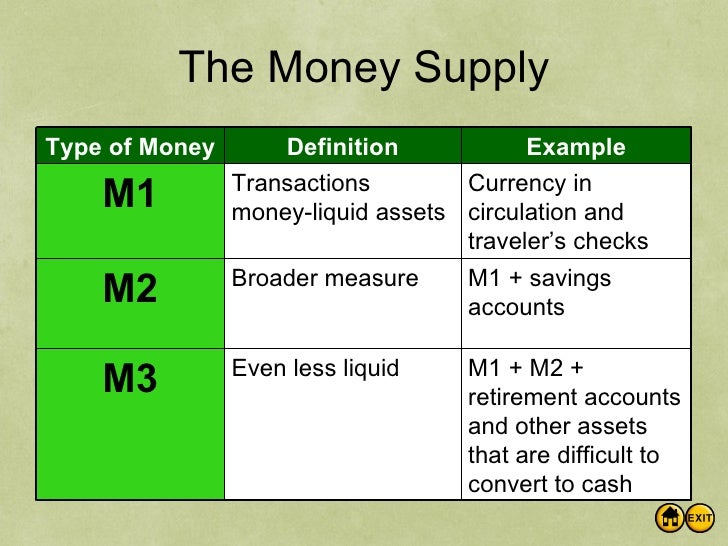

What is M1 Money Supply?

M1 money supply, also known as narrow money, is a monetary aggregate that comprises the most liquid assets in an economy. It is a crucial component of the money supply, as it represents the funds that are readily available for spending and investment. The M1 money supply consists of physical currency, checking accounts, and other liquid assets that can be easily converted into cash. This includes coins, banknotes, and demand deposits, such as checking accounts and other transactional accounts. The significance of M1 lies in its ability to measure the money supply that is immediately available for economic activity, providing valuable insights into the overall health of an economy. Understanding the composition and importance of M1 money supply is essential for grasping the difference between M1 and M2 economics, as it lays the foundation for comprehending the broader money supply and its implications for economic policy-making.

Unpacking the M2 Money Supply: A Broader Perspective

M2 money supply, also known as broad money, is a monetary aggregate that provides a more comprehensive picture of the money supply in an economy. It builds upon the M1 money supply by including additional assets that are less liquid, but still readily convertible into cash. The M2 money supply consists of M1 components, such as physical currency, checking accounts, and other liquid assets, as well as savings deposits, money market funds, and other less liquid assets. This broader definition of money supply provides a more accurate representation of the overall money supply, as it captures a larger portion of the funds available for economic activity. Understanding the differences between M1 and M2 money supply is crucial in grasping the implications of monetary policy decisions, as it highlights the varying levels of liquidity and availability of funds in an economy. The distinction between M1 and M2 is essential in understanding the difference between m1 and m2 economics, as it influences the effectiveness of monetary policy tools in achieving economic goals.

How to Distinguish Between M1 and M2: A Step-by-Step Guide

To fully comprehend the difference between M1 and M2 economics, it is essential to understand how to differentiate between the two monetary aggregates. Here is a step-by-step guide to help you distinguish between M1 and M2 money supply:

Step 1: Identify the components of M1 money supply, including physical currency, checking accounts, and other liquid assets.

Step 2: Recognize the additional components of M2 money supply, such as savings deposits, money market funds, and other less liquid assets.

Step 3: Understand the liquidity levels of each component, with M1 being more liquid and M2 being less liquid.

Step 4: Analyze the economic activity and policy implications of each monetary aggregate, with M1 influencing short-term economic activity and M2 affecting long-term economic growth.

By following these steps, you can effectively distinguish between M1 and M2 money supply, grasping the significance of the difference between m1 and m2 economics in understanding the overall money supply and its implications for economic policy-making.

The Implications of M1 and M2 on Economic Activity

The distinction between M1 and M2 money supply has significant implications for economic activity, influencing key macroeconomic variables such as inflation, interest rates, and economic growth. Understanding the difference between M1 and M2 economics is crucial in grasping the effects of monetary policy decisions on the economy.

M1 money supply, being more liquid, has a direct impact on short-term economic activity, influencing consumption and production decisions. An increase in M1 money supply can lead to higher demand for goods and services, potentially fueling inflation. On the other hand, a decrease in M1 money supply can lead to reduced economic activity, potentially resulting in recession.

In contrast, M2 money supply, being less liquid, has a more profound impact on long-term economic growth, influencing investment decisions and the overall direction of the economy. An increase in M2 money supply can lead to increased investment in productive activities, promoting economic growth and development. Conversely, a decrease in M2 money supply can lead to reduced investment, potentially hindering economic growth.

The difference between M1 and M2 economics also has implications for interest rates, with M1 influencing short-term interest rates and M2 influencing long-term interest rates. Understanding the distinction between the two monetary aggregates is essential in grasping the effects of monetary policy decisions on interest rates and, subsequently, on economic activity.

In conclusion, the implications of M1 and M2 on economic activity are far-reaching, highlighting the significance of understanding the difference between M1 and M2 economics in economic policy-making. By recognizing the distinct effects of each monetary aggregate, policymakers can make informed decisions, promoting economic growth, stability, and prosperity.

A Comparative Analysis of M1 and M2: Strengths and Weaknesses

A thorough understanding of the strengths and weaknesses of M1 and M2 money supply is essential in grasping the difference between M1 and M2 economics and its implications for economic policy-making. This comparative analysis highlights the advantages and limitations of each monetary aggregate, providing a comprehensive understanding of their roles in measuring the money supply.

M1 money supply, being more liquid, has the strength of accurately capturing the short-term money supply, making it an effective tool for monetary policy decisions. However, its narrow composition and exclusion of less liquid assets are significant weaknesses, limiting its ability to provide a comprehensive picture of the money supply.

On the other hand, M2 money supply, being broader in scope, has the strength of capturing a wider range of assets, providing a more comprehensive picture of the money supply. However, its inclusion of less liquid assets can make it less accurate in capturing short-term money supply fluctuations, which is a significant weakness.

The difference between M1 and M2 economics is also evident in their measurement limitations. M1 is limited in its ability to capture the money supply in economies with a high proportion of savings deposits, while M2 is limited in its ability to capture the short-term money supply fluctuations. Understanding these limitations is crucial in selecting the appropriate monetary aggregate for economic policy-making.

In conclusion, a thorough understanding of the strengths and weaknesses of M1 and M2 money supply is essential in grasping the difference between M1 and M2 economics and its implications for economic policy-making. By recognizing the advantages and limitations of each monetary aggregate, policymakers can make informed decisions, promoting economic growth, stability, and prosperity.

Real-World Applications of M1 and M2: Case Studies and Examples

The difference between M1 and M2 economics has significant implications for economic policy-making, and understanding these differences is crucial in applying monetary aggregates in real-world scenarios. This section provides case studies and examples illustrating the application of M1 and M2 in economic policy-making, highlighting the significance of understanding the differences between the two.

Case Study 1: Monetary Policy in the United States

The Federal Reserve, the central bank of the United States, uses M2 money supply as a key indicator of monetary policy. During the 2008 financial crisis, the Federal Reserve implemented expansionary monetary policies, increasing M2 money supply to stimulate economic growth. This decision was based on the understanding that M2 captures a broader range of assets, providing a more comprehensive picture of the money supply.

Case Study 2: Inflation Targeting in the European Union

The European Central Bank (ECB) uses M1 money supply as a key indicator of inflation targeting. During the 2010s, the ECB implemented contractionary monetary policies, reducing M1 money supply to combat high inflation rates. This decision was based on the understanding that M1 captures short-term money supply fluctuations, making it an effective tool for inflation targeting.

Example: The Impact of M1 and M2 on Interest Rates

A country’s central bank may use M1 money supply to set short-term interest rates, while using M2 money supply to set long-term interest rates. Understanding the difference between M1 and M2 economics is crucial in making informed decisions about interest rates, as it can have significant implications for economic activity.

In conclusion, understanding the difference between M1 and M2 economics is essential in applying monetary aggregates in real-world scenarios. By recognizing the strengths and weaknesses of each monetary aggregate, policymakers can make informed decisions, promoting economic growth, stability, and prosperity.

Conclusion: The Importance of Understanding M1 and M2 in Economics

In conclusion, understanding the difference between M1 and M2 economics is crucial in grasping the complexities of monetary aggregates and their implications for economic policy-making. The significance of M1 and M2 money supply lies in their ability to provide a comprehensive picture of the money supply, enabling policymakers to make informed decisions about monetary policy, interest rates, and economic growth.

The difference between M1 and M2 economics has far-reaching implications for economic activity, influencing inflation, interest rates, and economic growth. By recognizing the strengths and weaknesses of each monetary aggregate, policymakers can tailor their policies to specific economic conditions, promoting economic stability and prosperity.

As demonstrated through the case studies and examples, understanding the difference between M1 and M2 economics is essential in applying monetary aggregates in real-world scenarios. By grasping the nuances of M1 and M2, policymakers can develop effective monetary policies, mitigating the risks of economic downturns and promoting sustainable economic growth.

In summary, the difference between M1 and M2 economics is a critical concept in understanding the complexities of monetary aggregates and their implications for economic policy-making. By recognizing the significance of M1 and M2 money supply, policymakers can make informed decisions, promoting economic growth, stability, and prosperity.