Exploring the Scope of Economics

Economics studies how societies allocate scarce resources. It examines the production, distribution, and consumption of goods and services. Understanding the difference between financial and economic systems is crucial. Key concepts include scarcity, implying limited resources relative to unlimited wants, and opportunity cost, representing the value of the next best alternative forgone when making a choice. Market forces, such as supply and demand, determine prices and resource allocation. Economics provides a framework for analyzing how these forces interact to shape economic outcomes. The difference between financial and economic perspectives is often subtle but significant. Economic models often analyze large-scale trends, providing a broad understanding of the overall system. This macro perspective helps understand how government policies, technological change, and global events influence economic activity. The study of economics helps reveal the complexities of resource allocation in a world of finite resources. It is essential to understand the difference between financial and economic factors in decision-making, since one influences the other significantly.

A core aspect of economics is the study of market mechanisms. These mechanisms determine prices, quantities produced, and the distribution of goods and services. Competition among firms, consumer preferences, and technological innovation all influence market outcomes. Economic analysis often uses models to simplify complex realities. These models help economists understand cause-and-effect relationships. Analyzing economic data is critical for evaluating the effectiveness of policies or predicting future trends. The study of the difference between financial and economic systems helps individuals and policymakers make informed decisions about resource allocation. Understanding the fundamental principles of economics, such as supply and demand, enables a clearer grasp of the dynamics of markets and economies. This knowledge is critical for analyzing both microeconomic and macroeconomic phenomena.

Microeconomics focuses on individual economic agents, such as households and firms. It analyzes how they make decisions and interact in markets. This contrasts with macroeconomics, which studies the economy as a whole. Macroeconomics examines aggregate variables like national income, inflation, and unemployment. Understanding the difference between financial and economic analysis is vital for interpreting economic data and formulating effective policies. For example, microeconomic principles explain how individual consumer choices influence market demand. Conversely, macroeconomic analysis focuses on the overall performance of the economy and the impact of factors such as monetary policy and fiscal policy. The interplay between microeconomic and macroeconomic forces shapes economic outcomes. Analyzing this relationship is crucial for understanding the complexities of modern economies.

Delving into the World of Finance

Finance focuses on the management of money and investments. It encompasses individual, corporate, and governmental financial decisions. These decisions include budgeting, investing, fundraising, and risk management. Personal finance involves managing personal income and expenses. Corporate finance includes decisions about capital structure, investment projects, and dividend payouts. Governmental finance deals with fiscal policy, taxation, and public debt management. Understanding the difference between financial and economic factors is crucial for effective financial decision-making. The core principles of finance seek to maximize returns while minimizing risk. This involves careful analysis of various investment options and strategies, all within the context of the overall economic climate. The field considers various financial instruments, from stocks and bonds to derivatives and other complex investment vehicles. Effective financial management is essential for both individual prosperity and economic stability.

A key aspect of finance is the allocation of capital. Businesses use financial tools to determine which projects to fund and how to raise capital. Investors use financial analysis to assess the risk and return of different investment opportunities. Governments utilize fiscal and monetary policies to manage the economy. Finance uses various tools to analyze and manage risks associated with financial decisions. This is critical given the potential for loss or fluctuation in market value. Risk assessment techniques are employed to mitigate potential downsides. Understanding the difference between financial and economic factors is crucial to informed decision-making. This includes considerations of inflation, interest rates, and economic growth.

Finance and economics are closely intertwined. Economic conditions heavily influence financial markets. For example, a recession can lead to decreased investment and reduced consumer spending. Conversely, financial decisions can impact the overall economy. For instance, increased investment in infrastructure can stimulate economic growth. The interplay between finance and economics is complex and dynamic. It is vital to understand this relationship to make sound decisions in both personal and professional contexts. Understanding the difference between financial and economic indicators helps to navigate the complexities of the market. The relationship is symbiotic, with each field informing and impacting the other.

The Interplay: Where Economics and Finance Meet

Economics and finance are deeply intertwined. Economic conditions significantly influence financial markets and decision-making. For example, high inflation erodes the purchasing power of money, impacting investment returns and corporate profitability. Recessions lead to decreased consumer spending and investment, affecting financial institutions’ lending and profitability. Similarly, interest rate changes, a key macroeconomic indicator, directly affect borrowing costs for businesses and consumers, influencing investment decisions and overall economic activity. Understanding this crucial relationship is vital to grasping the difference between financial and economic analysis. The interplay reveals a complex relationship where macroeconomic trends shape financial outcomes.

Conversely, financial decisions impact the broader economy. Investment in infrastructure projects, driven by financial decisions, stimulates economic growth and job creation. Consumer spending, fueled by access to credit and investment returns, drives aggregate demand. Government fiscal policy, involving taxation and government spending, directly influences economic growth and stability. Financial markets channel savings into productive investments, which are essential drivers of economic expansion. This illustrates how financial choices impact the overall economic landscape, highlighting the intricate relationship between financial and economic forces. The difference between financial and economic analysis becomes clearer when considering their reciprocal effects. Financial instability can trigger economic downturns, while sound economic policies can support financial market stability.

Analyzing the difference between financial and economic factors requires a nuanced approach. Macroeconomic conditions, such as inflation and interest rates, directly affect asset prices and investment strategies. Microeconomic factors, like consumer preferences and technological advancements, also influence financial markets. For instance, a shift in consumer preference towards sustainable products impacts investment in related sectors. Therefore, a comprehensive understanding of both macroeconomic and microeconomic principles is crucial for effective financial analysis. This integrated perspective is key to navigating the complexities of the modern economy and understanding the dynamic interplay between economic and financial variables. The difference between financial and economic analysis is best understood by recognizing their mutual influence and interdependence.

How to Identify the Key Differences Between Economics and Finance

Understanding the difference between financial and economic analysis requires recognizing their distinct scopes and methodologies. Economics, broadly, studies how societies allocate scarce resources. This includes analyzing production, distribution, and consumption across various systems. Finance, conversely, centers on the management of money and capital. It focuses on individual, corporate, and governmental decisions regarding investment, budgeting, and risk. The core difference between financial and economic perspectives lies in their scale and focus: economics examines the overall system, while finance deals with specific financial entities and transactions. The difference between financial and economic analysis is crucial for effective decision-making.

A helpful way to understand the difference between financial and economic concepts is to consider their respective questions. Economics seeks to answer questions about resource allocation, market efficiency, and economic growth. For example, economists might investigate the impact of government spending on inflation or analyze the factors driving global trade imbalances. Finance, on the other hand, addresses questions concerning investment returns, risk management, and capital structure. Financial analysts might evaluate the profitability of a specific investment, assess the creditworthiness of a borrower, or develop a portfolio strategy to optimize returns while managing risk. This distinction in the questions each field addresses further clarifies the difference between financial and economic perspectives. The difference between financial and economic models stems from these differing objectives.

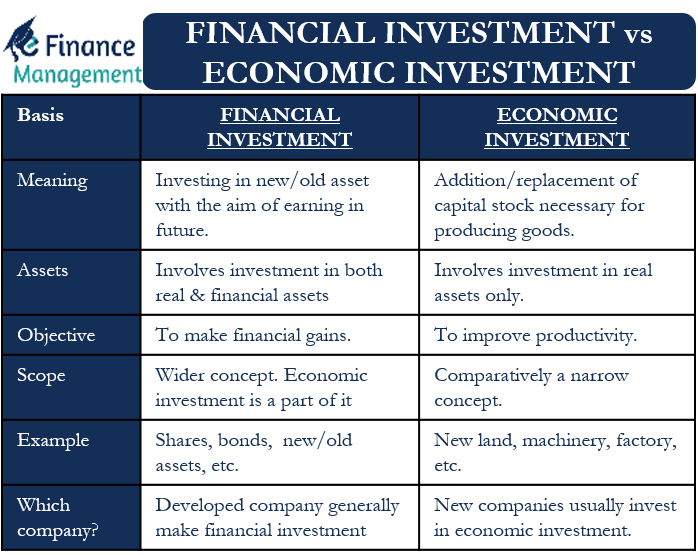

The table below summarizes the key distinctions. Note that while distinct, economics and finance are deeply intertwined. Economic conditions heavily influence financial markets, and financial decisions have significant economic consequences. Understanding this interplay is essential for informed decision-making in both fields. The difference between financial and economic forecasting, for example, lies in their focus: macroeconomic conditions versus specific asset prices. Recognizing this difference helps avoid misinterpretations and facilitates more accurate predictions. This nuanced understanding of the difference between financial and economic approaches is crucial for success in today’s complex world.

| Feature | Economics | Finance |

|---|---|---|

| Scale of Analysis | Macro and Micro | Micro (primarily) |

| Primary Focus | Resource allocation, market efficiency | Money management, investment, risk |

| Methodology | Models, statistical analysis | Financial modeling, valuation techniques |

| Typical Questions | What drives economic growth? How do markets allocate resources? | What is the optimal investment strategy? How can risk be mitigated? |

Microeconomics: A Deeper Dive into Individual Behavior

Understanding the difference between financial and economic principles at a micro level is crucial for informed decision-making. Microeconomics examines individual economic agents, such as consumers and firms, and their interactions within markets. In the context of finance, this translates to analyzing how individual choices impact asset prices and market trends. For example, consumer demand for a particular product drives its price. Similarly, individual investment decisions, informed by microeconomic principles of risk and return, collectively shape the performance of financial markets. The interplay of supply and demand for financial assets, like stocks and bonds, directly reflects microeconomic principles. Understanding consumer behavior and its impact on market dynamics is vital for investors and financial professionals. This understanding illuminates the difference between financial and economic factors influencing market activity. Analyzing individual behavior allows for a more precise understanding of market fluctuations.

Supply and demand principles are fundamental to understanding asset pricing. The scarcity of a particular asset, combined with high demand, will typically drive its price upward. Conversely, an oversupply relative to demand will depress prices. Microeconomic analysis provides tools to predict these price movements, informing investment strategies. This connection between microeconomic theory and financial decision-making highlights the critical difference between financial and economic analysis. The former focuses on individual choices and their consequences on markets, while the latter analyses the broader economic system.

Furthermore, microeconomic concepts such as marginal utility and opportunity cost are directly applicable to financial decisions. Marginal utility explains how the satisfaction derived from consuming an additional unit of a good or service diminishes. This principle can inform investment choices by helping to assess the potential returns against the risk. Opportunity cost, the value of the next best alternative forgone, is essential in evaluating investment opportunities. By carefully considering the trade-offs involved, investors can make more informed decisions. This demonstrates the importance of a thorough understanding of the difference between financial and economic theories in developing robust investment strategies. A clear grasp of microeconomic principles enhances financial literacy and aids in navigating complex markets.

Macroeconomics: Understanding the Big Picture

Macroeconomics provides a crucial framework for understanding the broader economic forces that significantly influence financial markets and investment strategies. Key macroeconomic concepts, such as inflation, interest rates, and economic growth, directly impact the performance of financial assets and the overall health of the economy. Inflation, for example, erodes the purchasing power of money, affecting the value of investments and influencing central bank monetary policies. Interest rates, determined by factors like government policy and market conditions, directly impact borrowing costs for individuals and businesses, affecting investment decisions and the cost of capital. Economic growth, measured by indicators like GDP, influences investor confidence and the overall availability of funds for investment. The difference between financial and economic factors becomes clear when considering the impact of macroeconomic shifts on asset prices. A period of rapid inflation might lead to a decrease in bond prices, while an economic recession can cause stock prices to decline.

Government policies play a vital role in shaping macroeconomic conditions and, consequently, influencing financial markets. Fiscal policy, which involves government spending and taxation, can stimulate or dampen economic activity. For instance, increased government spending on infrastructure projects can boost economic growth and positively affect investor sentiment. Monetary policy, controlled by central banks, manages interest rates and money supply to influence inflation and employment. Understanding the difference between financial and economic impacts of these policies is critical for informed financial decision-making. For example, a contractionary monetary policy aimed at curbing inflation might lead to higher interest rates, impacting the attractiveness of various investment options. The interplay between government policy and market forces shapes the macroeconomic landscape, creating both opportunities and challenges for financial actors. Analyzing these interactions is fundamental to understanding the broader economic context within which financial decisions are made.

Understanding the macroeconomic environment is essential for effective financial planning and investment. Macroeconomic indicators offer valuable insights into future economic trends and their potential impact on financial markets. By carefully analyzing macroeconomic data and forecasting future trends, investors can make more informed decisions, mitigating potential risks and capitalizing on emerging opportunities. The difference between financial and economic forecasting is crucial here; financial forecasting focuses on specific asset prices or market movements, while macroeconomic forecasting looks at broader economic trends that ultimately shape those specific movements. A well-informed understanding of both perspectives is crucial for navigating the complex world of finance.

Illustrative Case Studies: Putting Theory into Practice

The 2008 global financial crisis starkly reveals the difference between financial and economic considerations. The crisis originated in the US housing market, fueled by complex financial instruments and lax lending practices. These purely financial decisions, driven by profit-seeking, ultimately triggered a massive economic downturn. The difference between financial and economic impact became evident as businesses failed, unemployment soared, and governments intervened with massive economic stimulus packages. Understanding the difference between financial and economic fragility was crucial in designing effective responses. Economic policies aimed to stimulate aggregate demand while financial regulations sought to prevent future crises. The interplay between these two aspects highlighted the crucial need to address both financial instability and its broader economic consequences. The difference between financial and economic approaches became a central focus of policy debates.

Consider the contrasting responses of two companies facing a recession. One focused on cost-cutting measures, layoffs, and asset sales—a primarily financial strategy aimed at short-term survival. The other invested in research and development, aiming to create new products and services for the post-recession market. This represented an economic strategy focused on long-term growth and market share. The difference between financial and economic strategies became apparent in their post-recession performance. The company prioritizing long-term economic growth often recovered faster and stronger. The difference between financial and economic perspectives dictated their recovery strategies.

Another example lies in government infrastructure investment. Building a new highway system, for instance, involves significant financial outlays. However, the economic impact is far-reaching. Increased transportation efficiency leads to lower production costs, improved trade, and job creation. Understanding this difference between financial investment and economic output allows governments to make informed decisions about public spending. A purely financial perspective might deem the initial costs too high, neglecting the long-term economic benefits. Recognizing the difference between financial and economic returns is vital for effective public policy. Proper analysis of this difference allows for a balanced approach to strategic investment.

Conclusion: A Synthesized Perspective

In summary, the core difference between financial and economic analysis lies in their scope and focus. Economics examines the broader system of resource allocation, encompassing production, distribution, and consumption. It explores how societies use scarce resources to satisfy unlimited wants, considering factors like market forces, scarcity, and opportunity cost. Understanding this difference between financial and economic principles is crucial for informed decision-making.

Finance, conversely, centers on the management of money and investments at individual, corporate, and governmental levels. It tackles practical issues like budgeting, investing, fundraising, and risk management. While distinct, these disciplines are deeply intertwined. Economic conditions significantly influence financial markets and decisions. For instance, inflation impacts investment returns, and recessions affect corporate profitability. Conversely, financial decisions – such as increased consumer spending or infrastructure investment – can shape the overall economic landscape. Recognizing this interplay is key to understanding the complexities of both fields. The difference between financial and economic perspectives often determines the success of a business, the stability of a market, or the efficacy of a government policy.

Ultimately, a comprehensive understanding of both economics and finance is invaluable. This knowledge equips individuals and organizations to navigate complex economic situations, make informed financial choices, and contribute effectively to a thriving economy. The difference between financial and economic thinking allows for a more nuanced approach to problem-solving and strategic planning. Mastering both perspectives provides a significant competitive advantage in a world increasingly reliant on sound economic and financial principles. A holistic grasp of this difference between financial and economic concepts is crucial for success in various aspects of life, from personal financial planning to navigating global economic trends.