Demystifying Equity Derivatives: Warrants Versus Options

The purpose of this article is to clarify the difference between an option and a warrant. Both are equity derivatives. However, they have key differences. Understanding these differences is crucial for investors. This article will explore these distinctions. It aims to provide clarity for making informed investment decisions. It will help navigate the complexities of these financial instruments. It is essential to grasp how each derivative operates. This ensures you understand their respective impacts on your portfolio.

Decoding Options Contracts: Rights, Not Obligations

An option contract grants the holder a right. It is not an obligation. It allows the holder to buy or sell an underlying asset. This happens at a specific price. The price is set on or before a certain date. A call option gives the right to buy. A put option gives the right to sell. The holder *can* choose to exercise their right. They are not obligated to do so. Options provide flexibility. They allow investors to speculate on price movements. They can also be used to hedge existing positions. Knowing the difference between an option and a warrant is the first step. It will help you to use these financial instruments correctly.

Understanding Warrants: A Company’s Promise of Future Equity

Warrants are issued directly by the company. This usually happens with a bond or stock offering. They give the holder the right to purchase company stock. The purchase happens at a predetermined price. This is within a specific timeframe. When a warrant is exercised, new shares are created. This dilutes existing shareholders. Warrants represent a company’s promise of future equity. They are often used to make debt or equity offerings more attractive. Understanding the difference between an option and a warrant is very important. It helps investors assess the potential impact on share value.

How to Distinguish Between Options and Warrants: A Step-by-Step Guide

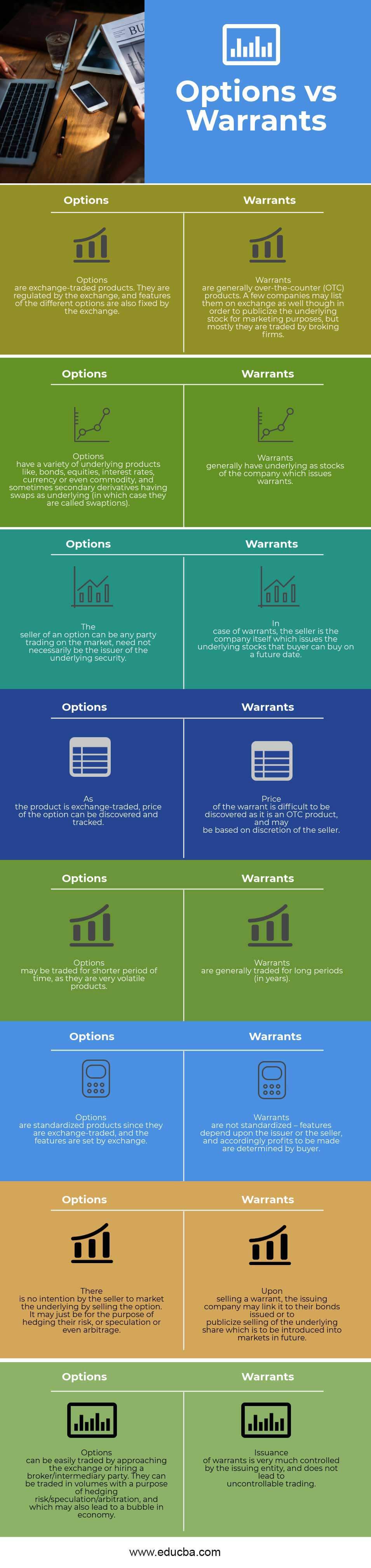

Here’s a guide highlighting the key distinctions between options and warrants:

- Issuer: Options are created by exchanges or individuals. Warrants are issued by the company itself.

- Dilution: Exercising options usually doesn’t dilute shareholders. Exercising warrants *always* dilutes shareholders.

- Maturity: Warrants often have longer expiration dates than options. These can be years versus months.

- Supply: Option supply is market-driven and fluctuates. Warrant supply is fixed by the issuing company.

- Proceeds: Option exercise proceeds go to the option writer. Warrant exercise proceeds go to the company.

Examining the Underlying Asset: Company Stock vs. Something Else

The underlying asset is crucial for both options and warrants. An option is written on company stock or another asset. The value of the option is derived from the price of this underlying asset. Understanding the underlying asset is key. It drives informed trading decisions. Warrants are specifically linked to the company’s stock. This stock represents a direct claim on company equity. Options are more versatile. They can be linked to various assets. These include stocks, indices, commodities, or currencies.

Analyzing the Impact of Exercise: A Look at Market Dynamics

Warrant exercises increase shares outstanding. This can lead to downward pressure on the stock price. Option exercises generally do not affect the company’s float. The difference between an option and a warrant lies in their creation. Warrants create new shares. Options transfer existing shares. Investors need to be aware of the market impact. Dilution from warrants is a key consideration. It will affect share value. Options offer leverage. They allow investors to control a large number of shares. This is with a smaller capital outlay.

Weighing the Risks and Rewards: Investor Considerations

Investing in options and warrants involves risks and rewards. Both are speculative. They offer high leverage. This can result in high gains or losses. Understand the underlying company and its prospects. The specific risks related to dilution are important with warrants. Options can be used for hedging. Warrants are typically a speculative bet on the company’s future. Investors should carefully assess their risk tolerance. They should also consider their investment goals. Before investing in either. The difference between an option and a warrant impacts risk profile.

Navigating Equity Derivatives: A Summary of Key Differences

Options are created on exchanges and gives the holder the right to buy or sell an asset. Warrants are issued by the company and can dilute shares. Both are valuable tools for investors. A thorough understanding of their specific characteristics and risks is vital. The difference between an option and a warrant is a fundamental element. Conduct thorough research before investing in either. Understand the terms and conditions of each instrument. This ensures informed decisions. Navigate the complexities of equity derivatives with confidence.

Decoding Options Contracts: Rights, Not Obligations

An option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. Understanding this fundamental characteristic is crucial when exploring the difference between an option and a warrant. There are two primary types of options: call options and put options. A call option gives the holder the right to *buy* the underlying asset at the specified price (the strike price). Conversely, a put option gives the holder the right to *sell* the underlying asset at the strike price. The holder of an option will only exercise their right if it is financially advantageous to do so.

For instance, if you hold a call option with a strike price of $50 on a stock, and the stock price rises to $60 before the expiration date, you can exercise your option to buy the stock at $50 and immediately sell it in the market for $60, making a profit (minus the initial premium paid for the option). However, if the stock price remains below $50, you would simply let the option expire, losing only the premium paid. Similarly, a put option holder profits when the price of the underlying asset falls below the strike price. It’s important to remember that the option buyer pays a premium to the option seller (also known as the writer) for this right. This premium represents the maximum potential loss for the option buyer and the maximum potential gain for the option seller. The difference between an option and a warrant lies, in part, in who receives the proceeds when the contract is exercised.

The flexibility inherent in options contracts makes them versatile tools for various investment strategies. Investors can use options to speculate on the future direction of an asset’s price, hedge existing positions, or generate income. However, this flexibility also comes with inherent risks. Options are leveraged instruments, meaning that a small change in the price of the underlying asset can result in a significant gain or loss for the option holder. Therefore, a thorough understanding of options pricing, risk management, and the underlying asset is essential before trading options. Understanding the difference between an option and a warrant begins with grasping the nature of the option contract itself: a right, not an obligation, with potential for both substantial rewards and significant losses. The difference between an option and a warrant also involves understanding the source of the option and where the money goes upon excercise.

Understanding Warrants: A Company’s Promise of Future Equity

Warrants are financial instruments issued directly by a company, often alongside bond or stock offerings. The key difference between an option and a warrant lies in its origin and impact on the issuing company. A warrant grants the holder the right, but not the obligation, to purchase the company’s stock at a predetermined price, known as the exercise price, within a specified timeframe. This timeframe can be significantly longer than that of a typical option, sometimes spanning several years.

When a warrant is exercised, the holder pays the exercise price to the company in exchange for new shares of stock. This is a crucial difference between an option and a warrant. The issuance of new shares increases the total number of shares outstanding, a process known as dilution. Dilution reduces the ownership percentage of existing shareholders and can potentially decrease the earnings per share. Companies issue warrants as a way to incentivize investors or to make a debt offering more attractive. The potential for future equity participation through warrants can sweeten the deal for investors, making them more willing to invest in the company’s bonds or stock. The difference between an option and a warrant is also evident in where the funds go upon exercise; with warrants, the company receives the capital.

The exercise of warrants has a direct impact on the company’s capital structure. Because new shares are created, the company’s equity base expands. This infusion of capital can be used to fund growth initiatives, reduce debt, or for other corporate purposes. However, it’s important to remember that the dilution effect can be a concern for existing shareholders. Investors considering warrants should carefully evaluate the company’s plans for the capital raised through warrant exercises and assess the potential impact on the stock’s value. Understanding the difference between an option and a warrant, particularly regarding dilution, is vital for making informed investment decisions.

How to Distinguish Between Options and Warrants: A Step-by-Step Guide

Understanding the difference between an option and a warrant is crucial for investors seeking to navigate the complexities of equity derivatives. This section provides a step-by-step guide to help differentiate these two financial instruments.

Firstly, consider the issuer. Options are typically created by exchanges or individuals, acting as market participants. Warrants, on the other hand, are issued directly by the company itself. This is a fundamental difference between an option and a warrant. Secondly, examine the impact on share dilution. Exercising options generally does not dilute existing shareholders, except in the case of employee stock options. However, exercising warrants always dilutes existing shareholders, as new shares are created and issued. This difference between an option and a warrant significantly impacts the company’s capital structure. Thirdly, assess the maturity dates. Warrants often have much longer expiration dates than options, typically spanning several years compared to the months-long lifespan of most options contracts. Another key difference between an option and a warrant lies in their supply. The supply of options is market-driven and can fluctuate significantly based on demand and trading activity. The supply of warrants is usually fixed by the issuing company at the time of issuance.

Finally, trace where the proceeds go. When an option is exercised, the proceeds go to the option writer, the party who sold the option contract. Conversely, when a warrant is exercised, the proceeds go directly to the company that issued the warrant, providing them with additional capital. Recognizing the difference between an option and a warrant regarding the flow of funds is essential. In summary, the issuer, dilution effect, maturity, supply dynamics, and destination of proceeds are key factors that highlight the difference between an option and a warrant. Understanding these distinctions is paramount for making informed investment decisions within the equity derivatives market.

Examining the Underlying Asset: Company Stock vs. Something Else

When exploring the difference between an option and a warrant, a crucial aspect lies in understanding the underlying asset upon which these derivatives are based. An option contract derives its value from an underlying asset. This is typically company stock. However, it could also be an index, commodity, or another financial instrument. The option gives the holder the *right*, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) that underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date).

Therefore, the value of an option fluctuates based on the price movements of this underlying asset. For instance, a call option on a particular company’s stock will generally increase in value as the stock price rises. Conversely, a put option on the same stock will generally increase in value as the stock price falls. The key takeaway is that the option’s value is directly linked to the performance of the underlying asset. Recognizing this relationship is fundamental to grasping the difference between an option and a warrant, and to understanding how options are utilized in investment strategies.

Warrants, on the other hand, are specifically linked to the issuing company’s stock. The warrant grants the holder the right to purchase shares of that company’s stock at a predetermined price within a specific timeframe. So, while options can be based on a variety of assets, warrants are exclusively tied to the stock of the company that issued them. This distinction is significant because the exercise of a warrant directly impacts the company’s capital structure by creating new shares, an important difference between an option and a warrant. Understanding the underlying asset is paramount when evaluating these financial instruments and their potential impact on an investment portfolio.

Analyzing the Impact of Exercise: A Look at Market Dynamics

The exercise of options and warrants has distinct effects on the market and the underlying company. Understanding these dynamics is crucial for investors considering these equity derivatives. A key difference between an option and a warrant lies in how their exercise impacts the company’s stock. Option exercises generally do not directly affect the company’s float. The shares traded when an option is exercised typically come from another investor who wrote the option contract. This transaction occurs within the existing market supply of shares. Therefore, standard option exercises don’t create new shares or dilute the ownership of existing shareholders.

In contrast, the exercise of warrants always leads to the creation of new shares. When a warrant holder exercises their right to purchase company stock, the company issues new shares to fulfill this obligation. This increase in the number of shares outstanding is known as dilution. Dilution can potentially lead to downward pressure on the stock price, as the ownership stake of existing shareholders is reduced. The extent of this downward pressure depends on several factors, including the number of warrants exercised, the overall market sentiment, and the company’s financial health. Because of this dilutive effect, investors closely monitor the outstanding warrant positions of a company. This is another major difference between an option and a warrant.

It’s important to consider the potential impact of warrant exercises on a company’s earnings per share (EPS). With more shares outstanding, the company’s earnings are divided among a larger shareholder base, potentially leading to a decrease in EPS. Investors should carefully evaluate the terms of the warrants and their potential impact on the company’s financial performance. Assessing potential dilution is a critical step in understanding the difference between an option and a warrant and their respective implications for investment decisions. By understanding these market dynamics, investors can better assess the risks and rewards associated with options and warrants and make more informed investment decisions.

Weighing the Risks and Rewards: Investor Considerations

Investing in both options and warrants involves inherent risks and potential rewards, demanding careful consideration. Both instruments are inherently speculative, offering the potential for leveraged gains, but also exposing investors to substantial losses. Understanding the difference between an option and a warrant is crucial before investing.

Options, with their shorter time horizons, demand a keen awareness of market timing and the underlying asset’s price movements. The potential for rapid gains is counterbalanced by the risk of swift and complete loss if the option expires out-of-the-money. Conversely, warrants, with their extended expiration dates, offer a longer timeframe for the underlying stock to appreciate. However, this extended duration also exposes investors to prolonged market volatility and the risk that the company’s prospects may diminish over time. Dilution is a specific risk associated with warrants. The exercise of warrants increases the number of outstanding shares, potentially leading to a decrease in the stock price. This dilution effect can negatively impact existing shareholders, making it crucial to assess the potential for warrant exercises and their likely impact on the company’s stock valuation. Understanding the difference between an option and a warrant in regards to stock dilution is key.

Before venturing into options or warrants, a thorough understanding of the underlying company is paramount. Analyzing its financial health, competitive landscape, and growth potential is essential for making informed investment decisions. Investors should also carefully evaluate their risk tolerance and investment objectives. The high leverage associated with both options and warrants makes them unsuitable for risk-averse investors. The difference between an option and a warrant can impact an investor’s decision, based on their risk profile and investment goals. Warrants often trade at a premium, reflecting their longer lifespan and the potential for future growth. Investors must assess whether the potential upside justifies this premium, considering the dilution risk and the company’s prospects. Options trading strategies can be complex, requiring a solid understanding of implied volatility, time decay, and various option Greeks. The difference between an option and a warrant also lies in their trading dynamics. Investors should seek education and guidance before implementing advanced option strategies. Remember that both warrants and options, while potentially lucrative, carry significant risks. A comprehensive understanding of these risks, coupled with thorough research and due diligence, is crucial for navigating the world of equity derivatives successfully. The difference between an option and a warrant should be clear to any investor considering these financial instruments.

Navigating Equity Derivatives: A Summary of Key Differences

This section summarizes the key differences between options and warrants. Both are equity derivatives, offering unique investment opportunities, yet understanding their distinct characteristics is crucial. The primary difference between an option and a warrant lies in their issuer and impact on the company. Options are contracts, often exchange-traded, granting the right, but not the obligation, to buy (call) or sell (put) an underlying asset. Warrants, conversely, are issued directly by the company, providing the holder the right to purchase the company’s stock at a specified price.

A significant difference between an option and a warrant is the effect of exercise. Option exercises generally don’t dilute existing shareholders, with exceptions like employee stock options. However, warrant exercises always create new shares, leading to dilution. Another difference between an option and a warrant involves maturity dates. Warrants typically have longer lifespans, often spanning several years, while options usually expire within months. Furthermore, the source of proceeds differs. Option exercise proceeds go to the option writer, whereas warrant exercise proceeds go directly to the issuing company.

In conclusion, both options and warrants are powerful tools for investors seeking leverage and exposure to equity markets. Recognizing the difference between an option and a warrant, particularly regarding dilution and issuer, is essential for informed decision-making. Investors must conduct thorough research and understand the risks associated with each instrument before investing. A clear grasp of these equity derivatives helps investors to navigate the complexities of the market and make strategic choices aligned with their financial goals.