What is Default Probability and Why Does it Matter?

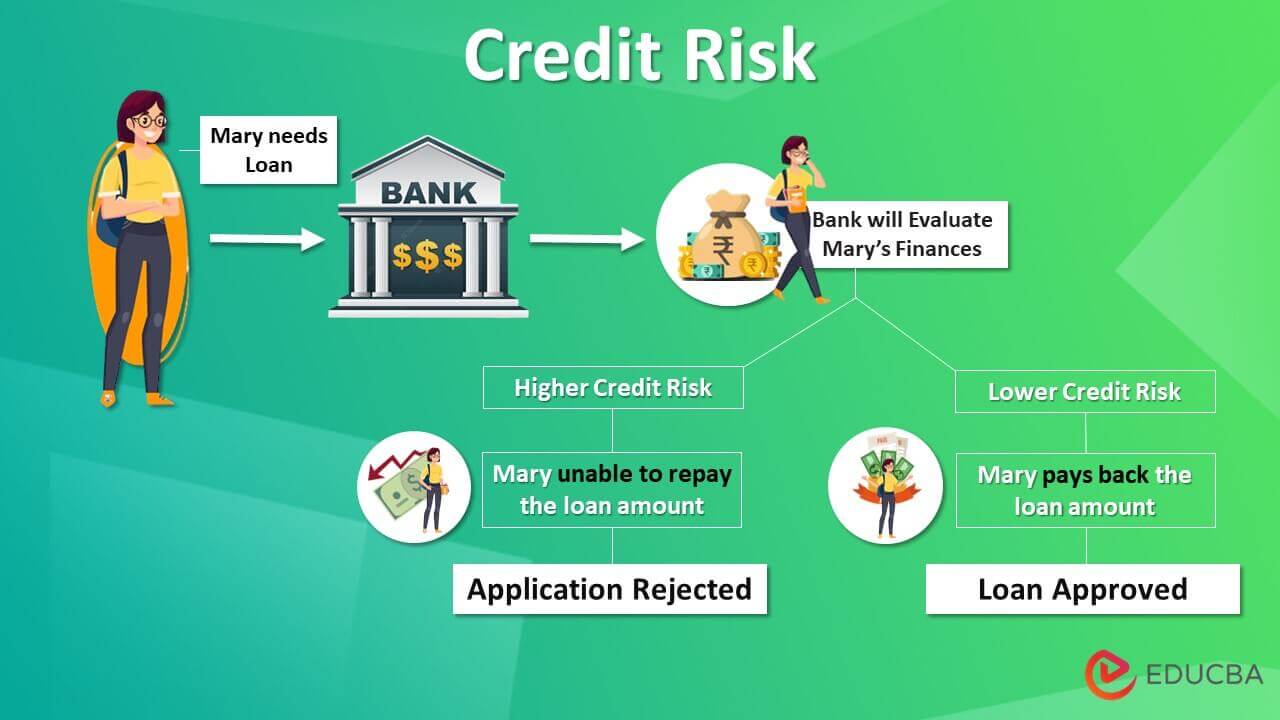

In the realm of credit risk assessment, default probability plays a crucial role in determining the likelihood of a borrower defaulting on their debt obligations. It is a statistical measure that estimates the probability of a borrower failing to meet their repayment commitments, thereby incurring a loss for the lender. Default probability is a critical component in credit risk assessment, as it directly affects lending decisions and has a significant impact on a lender’s portfolio performance.

Accurate default probability estimation is essential in minimizing credit losses and maximizing returns on investment. By understanding the default probability of a borrower, lenders can make informed decisions about loan approvals, interest rates, and credit limits. Moreover, default probability estimation enables lenders to identify high-risk borrowers and take proactive measures to mitigate potential losses.

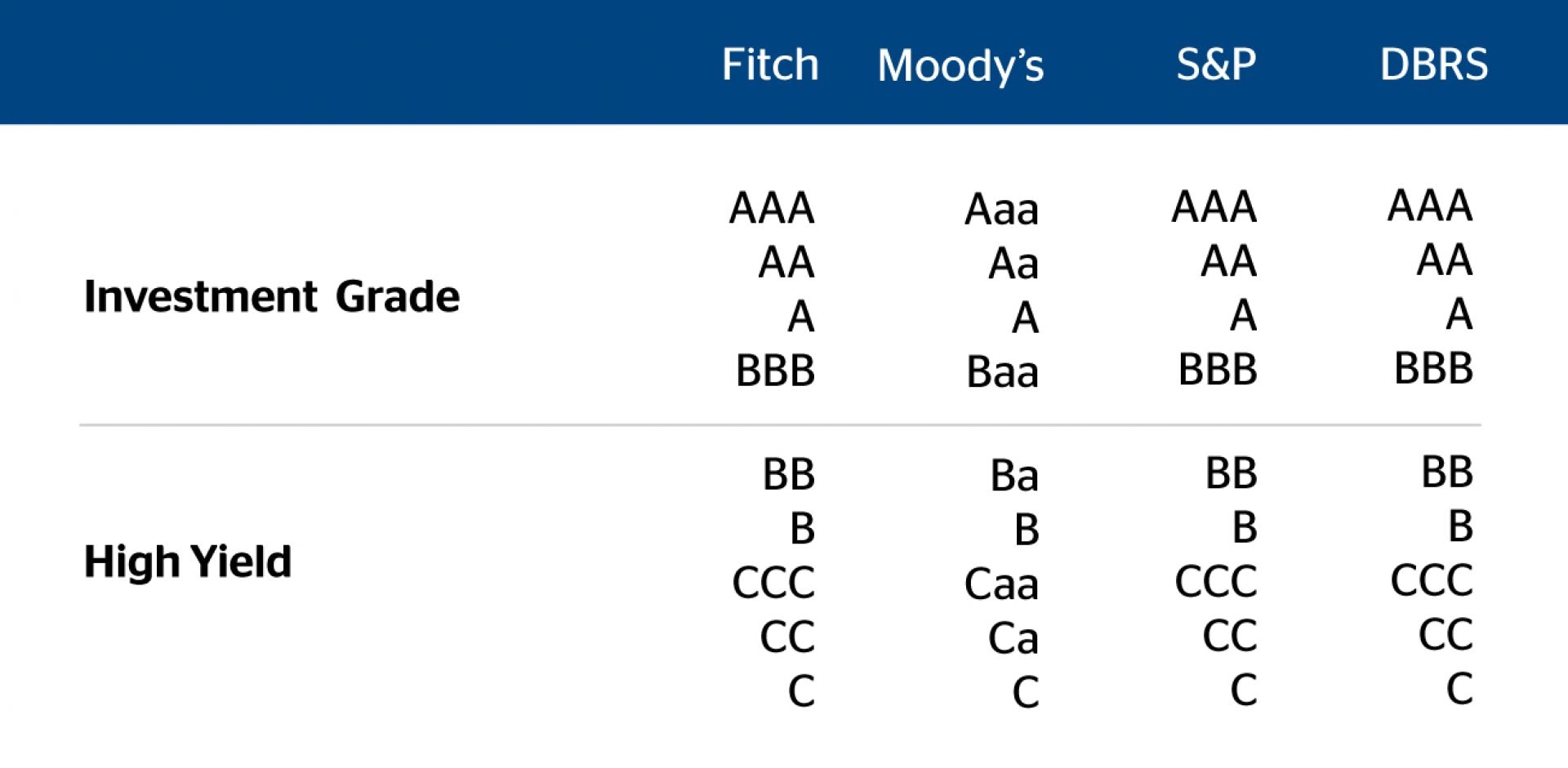

In the context of credit rating, default probability is a key factor in determining the creditworthiness of a borrower. Credit rating agencies, such as Moody’s, S&P, and Fitch, use default probability estimates to assign credit ratings to borrowers. These ratings, in turn, influence the interest rates and credit terms offered to borrowers. As such, default probability by credit rating is a critical concept in credit risk assessment, and its accurate estimation is vital for lenders, investors, and borrowers alike.

How to Determine Default Probability by Credit Rating

Credit ratings play a crucial role in determining default probability, as they provide a standardized measure of a borrower’s creditworthiness. The three major credit rating agencies, Moody’s, S&P, and Fitch, use different credit rating scales to assess the credit risk of borrowers. Moody’s uses a scale ranging from Aaa (highest credit quality) to C (lowest credit quality), while S&P uses a scale ranging from AAA to D. Fitch, on the other hand, uses a scale ranging from AAA to D.

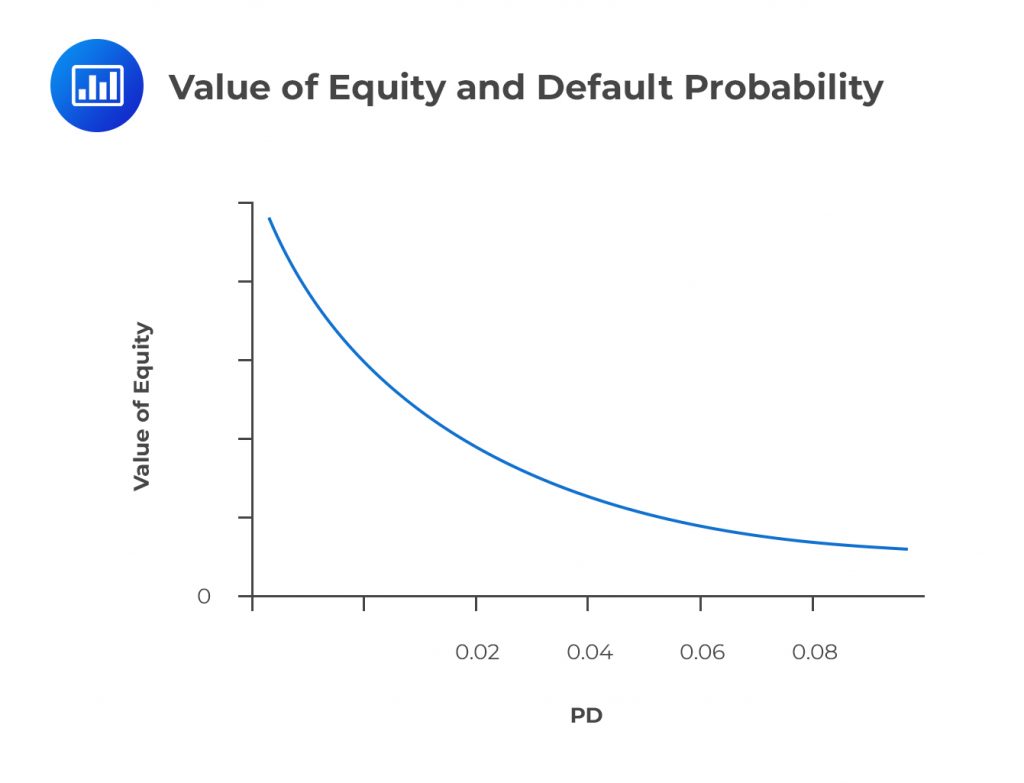

The relationship between credit ratings and default probabilities is complex, but generally, lower credit ratings are associated with higher default probabilities. For instance, a borrower with a low credit rating, such as CCC or lower, is considered to be at a higher risk of default compared to a borrower with a high credit rating, such as AAA or A. This is because lower credit ratings indicate a higher likelihood of default, which in turn affects the lender’s risk assessment and lending decisions.

Default probability by credit rating is a critical concept in credit risk assessment, as it enables lenders to make informed decisions about loan approvals, interest rates, and credit limits. By understanding the default probability associated with a particular credit rating, lenders can adjust their lending strategies to minimize credit losses and maximize returns on investment. In the next section, we will present a comparative analysis of default probabilities across different credit ratings, highlighting the differences in default rates between investment-grade and high-yield bonds.

Default Probability by Credit Rating: A Comparative Analysis

A comparative analysis of default probabilities across different credit ratings reveals significant differences in default rates between investment-grade and high-yield bonds. According to a study by Moody’s, the default probability for investment-grade bonds (Aaa to Baa) ranges from 0.01% to 0.15% over a one-year horizon. In contrast, high-yield bonds (Ba to C) have a default probability ranging from 1.15% to 10.15% over the same horizon.

Data from S&P Global Ratings shows that the default rate for investment-grade bonds is significantly lower than that of high-yield bonds. For instance, the default rate for AAA-rated bonds is approximately 0.02%, while that of CCC-rated bonds is around 5.5%. This highlights the importance of credit rating in determining default probability, as lower credit ratings are associated with higher default probabilities.

Fitch Ratings’ data also supports this trend, with investment-grade bonds having a default probability of around 0.05% to 0.20% over a one-year horizon, compared to high-yield bonds with a default probability of 1.50% to 15.00%. These statistics demonstrate the significance of credit rating in determining default probability and the importance of accurate default probability estimation in credit risk assessment.

In the next section, we will discuss the key factors that influence default probability, including credit score, debt-to-equity ratio, interest coverage ratio, and industry-specific risks. We will also examine how these factors interact with credit ratings to determine default probability.

Understanding the Factors that Influence Default Probability

Default probability is influenced by a combination of factors, including credit score, debt-to-equity ratio, interest coverage ratio, and industry-specific risks. These factors interact with credit ratings to determine default probability, making it essential to understand their impact on credit risk assessment.

Credit score, a numerical representation of a borrower’s creditworthiness, is a significant factor in determining default probability. A higher credit score indicates a lower default probability, while a lower credit score suggests a higher default probability. Debt-to-equity ratio, which measures a borrower’s leverage, also affects default probability. A high debt-to-equity ratio can increase default probability, as it may indicate a borrower’s inability to meet debt obligations.

Interest coverage ratio, which measures a borrower’s ability to meet interest payments, is another critical factor in determining default probability. A low interest coverage ratio can increase default probability, as it may indicate a borrower’s inability to service debt. Industry-specific risks, such as regulatory changes or market fluctuations, can also impact default probability.

These factors interact with credit ratings to determine default probability. For instance, a borrower with a high credit score and low debt-to-equity ratio may have a lower default probability, even if they have a lower credit rating. Conversely, a borrower with a low credit score and high debt-to-equity ratio may have a higher default probability, even if they have a higher credit rating.

In the next section, we will examine the role of credit rating agencies in estimating default probabilities, including the methodologies used by these agencies and their limitations.

The Role of Credit Rating Agencies in Default Probability Estimation

Credit rating agencies, such as Moody’s, S&P, and Fitch, play a crucial role in estimating default probabilities. These agencies use a combination of statistical models and expert judgment to assign credit ratings to borrowers, which are then used to estimate default probabilities.

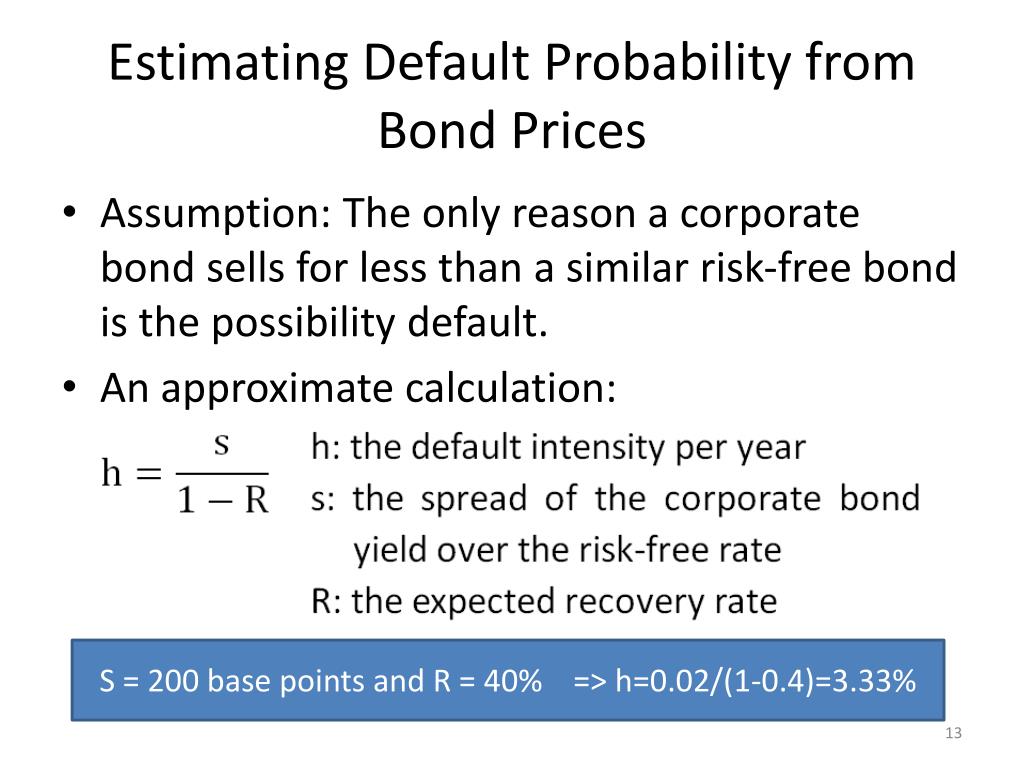

Moody’s, for instance, uses a probability of default (PD) model that takes into account a borrower’s credit score, financial statements, and industry-specific risks. S&P, on the other hand, uses a probability of default (PD) and loss given default (LGD) model that considers a borrower’s credit score, debt-to-equity ratio, and interest coverage ratio. Fitch uses a similar approach, incorporating credit score, financial leverage, and industry-specific risks into its default probability estimation model.

While credit rating agencies provide valuable insights into default probabilities, their methodologies are not without limitations. Statistical models can be sensitive to data quality issues, and expert judgment can be subjective. Furthermore, credit rating agencies may not always capture the nuances of a borrower’s credit profile, leading to potential errors in default probability estimation.

Despite these limitations, credit rating agencies remain a crucial component of the credit risk assessment process. Their default probability estimates provide lenders with a standardized framework for evaluating credit risk, enabling them to make informed lending decisions. In the next section, we will discuss the challenges and limitations of estimating default probabilities, including data quality issues, model risk, and the impact of economic downturns.

Challenges and Limitations of Default Probability Estimation

Estimating default probabilities is a complex task, and credit risk assessors face several challenges and limitations. One of the primary challenges is data quality issues, which can lead to inaccurate default probability estimates. Incomplete or inconsistent data can result in biased models, which can have significant consequences for credit risk assessment.

Model risk is another significant challenge in default probability estimation. Credit risk models are only as good as the data and assumptions used to develop them. If the models are flawed or do not capture the underlying dynamics of default risk, they can produce inaccurate default probability estimates. Furthermore, model risk can be exacerbated by the use of overly complex models that are difficult to interpret and validate.

The impact of economic downturns is another critical challenge in default probability estimation. Economic downturns can lead to increased default rates, which can be difficult to predict using traditional credit risk models. Credit risk assessors must be able to incorporate macroeconomic factors into their models to accurately estimate default probabilities during times of economic stress.

To address these challenges, credit risk assessors can employ robust modeling and stress testing techniques. Robust modeling involves using multiple models and approaches to estimate default probabilities, which can help to reduce model risk and improve the accuracy of default probability estimates. Stress testing involves analyzing the performance of credit risk models under different economic scenarios, which can help to identify potential vulnerabilities and improve the resilience of credit risk assessment frameworks.

In the next section, we will discuss best practices for credit risk management using default probability estimates, including the importance of regular portfolio monitoring, diversification, and risk-based pricing.

Best Practices for Credit Risk Management using Default Probability

Effective credit risk management is crucial for lenders to minimize credit losses and maximize returns. Default probability estimates play a vital role in this process, enabling lenders to make informed decisions about lending and risk management. Here are some best practices for credit risk management using default probability estimates:

Regular Portfolio Monitoring: Regularly review and update default probability estimates to ensure that the portfolio remains aligned with the lender’s risk appetite. This involves continuously monitoring the creditworthiness of borrowers and adjusting the portfolio accordingly.

Diversification: Diversify the portfolio by lending to borrowers with different credit ratings, industries, and geographic locations. This helps to reduce concentration risk and minimize the impact of defaults on the portfolio.

Risk-Based Pricing: Use default probability estimates to price loans according to the borrower’s credit risk. This ensures that lenders are adequately compensated for the risk they take on and helps to maintain a profitable portfolio.

Stress Testing: Conduct regular stress tests to assess the portfolio’s resilience to economic downturns and other adverse scenarios. This helps to identify potential vulnerabilities and take proactive measures to mitigate them.

Default Probability by Credit Rating: Use default probability estimates to develop a credit rating system that accurately reflects the credit risk of borrowers. This enables lenders to make informed decisions about lending and risk management.

By following these best practices, lenders can effectively manage credit risk and minimize credit losses. In the next section, we will summarize the key takeaways from this article and highlight the importance of accurate default probability estimation in credit risk assessment and management.

Conclusion: The Importance of Accurate Default Probability Estimation

In conclusion, default probability estimation is a critical component of credit risk assessment and management. Accurate default probability estimation enables lenders to make informed decisions about lending and risk management, minimizing credit losses and maximizing returns. The importance of default probability estimation cannot be overstated, as it has a direct impact on the profitability and sustainability of lending institutions.

This article has provided a comprehensive guide to understanding default probabilities, including the relationship between credit ratings and default probabilities, the factors that influence default probability, and the challenges and limitations of default probability estimation. We have also discussed best practices for credit risk management using default probability estimates, including regular portfolio monitoring, diversification, and risk-based pricing.

As the credit landscape continues to evolve, it is essential to stay abreast of the latest developments in default probability estimation. Ongoing research and development in this area are crucial to improving the accuracy and reliability of default probability estimates. By leveraging advanced analytics and machine learning techniques, lenders can develop more sophisticated credit risk models that better capture the complexities of default risk.

In the end, accurate default probability estimation is critical to the long-term success of lending institutions. By understanding the intricacies of default probability and implementing best practices for credit risk management, lenders can navigate the complexities of credit risk and achieve their business objectives.