What is Deep Reinforcement Learning and How Does it Apply to Stock Trading?

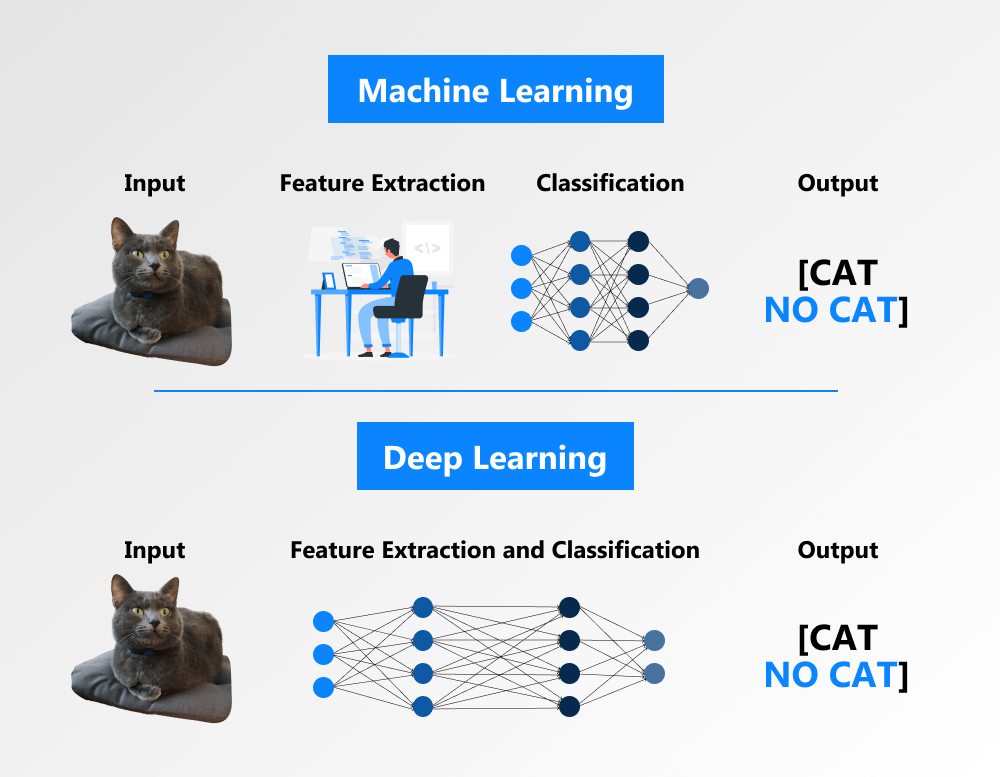

Deep reinforcement learning (DRL) is an advanced artificial intelligence (AI) technique that combines reinforcement learning and deep learning methodologies. Reinforcement learning focuses on training agents to make decisions based on reward feedback, while deep learning involves training artificial neural networks to learn from large datasets. The integration of these techniques in DRL enables algorithms to learn from past experiences and make profitable trading decisions in the context of automated stock trading.

In the world of finance, DRL has emerged as a promising approach for automated stock trading, where algorithms analyze market data and execute trades autonomously. By continuously learning from the consequences of their actions, DRL algorithms can adapt to dynamic market conditions and optimize trading strategies to maximize returns. This adaptability is crucial in the fast-paced and ever-changing financial markets, where traditional rule-based systems often struggle to keep up.

At its core, DRL for automated stock trading involves an agent, an environment, and a reward system. The agent is the AI algorithm that makes trading decisions, the environment consists of the financial market, and the reward system is a feedback mechanism that guides the agent towards profitable trades. Over time, the DRL algorithm refines its trading strategy by learning from the outcomes of its past actions, continually adjusting its decision-making process to improve overall performance.

The application of DRL for automated stock trading holds significant potential for enhancing profitability, reducing risk, and increasing operational efficiency. As AI and machine learning continue to revolutionize various industries, including finance, DRL is expected to play an increasingly important role in shaping the future of stock trading. By harnessing the power of DRL, investors and traders can gain a competitive edge in the market, capitalizing on opportunities that traditional methods may overlook.

How to Implement Deep Reinforcement Learning for Stock Trading: A Comprehensive Guide

Deep reinforcement learning (DRL) for automated stock trading involves a series of steps, from data collection to model evaluation. This comprehensive guide outlines the process, providing code snippets and real-world examples to help you get started.

First, gather historical stock price data, which will serve as the foundation for your DRL model. This data can be obtained from various sources, such as financial websites, APIs, or databases. Preprocess the data by cleaning, normalizing, and transforming it into a suitable format for your DRL algorithm.

Next, define the DRL model architecture, which typically consists of an agent, an environment, and a reward system. The agent is the AI algorithm that makes trading decisions, the environment is the financial market, and the reward system is a feedback mechanism that guides the agent towards profitable trades. Common DRL algorithms for stock trading include Deep Q-Networks (DQN), Proximal Policy Optimization (PPO), and Advantage Actor Critic (A2C).

Implement the DRL model using popular libraries and frameworks, such as TensorFlow, PyTorch, or Stable Baselines. These tools simplify the development process and offer pre-built functions and modules for DRL model creation. For instance, TensorFlow provides TensorLayer, a powerful DRL library, while PyTorch offers a range of DRL tutorials and examples. Stable Baselines, a high-level library built on top of TensorFlow and PyTorch, offers a selection of stable and robust DRL algorithms for various applications.

Train the DRL model using the preprocessed stock price data. During training, the DRL algorithm iteratively learns from the consequences of its actions, refining its trading strategy to maximize returns. Monitor the training process to ensure that the model is learning effectively and adjust parameters as needed. Regularly evaluate the model’s performance using metrics such as cumulative returns, Sharpe ratio, and maximum drawdown.

Once the DRL model is trained, deploy it in a simulated or live trading environment. Continuously monitor the model’s performance and make adjustments as necessary to maintain optimal trading strategies. Keep in mind that DRL models, like any AI system, require regular updates and maintenance to stay effective in dynamic market conditions.

Deep reinforcement learning for automated stock trading offers a powerful and adaptable approach for enhancing profitability, reducing risk, and increasing operational efficiency. By following this comprehensive guide, you can begin implementing DRL models for stock trading and capitalize on the opportunities presented by this cutting-edge AI technique.

Top Deep Reinforcement Learning Libraries and Frameworks for Stock Trading

Deep reinforcement learning (DRL) for automated stock trading is an advanced AI technique that enables algorithms to learn from past experiences and make profitable trading decisions. To implement DRL for stock trading, developers can choose from a variety of libraries and frameworks, each with its unique advantages and disadvantages. This article reviews three popular options: TensorFlow, PyTorch, and Stable Baselines.

TensorFlow

TensorFlow is an open-source machine learning library developed by Google. It offers TensorLayer, a powerful DRL library, which includes pre-built functions and modules for DRL model creation. TensorFlow’s flexibility, scalability, and compatibility with various operating systems make it a popular choice for DRL applications. However, its steep learning curve and complex API may pose challenges for beginners.

PyTorch

PyTorch is another open-source machine learning library, developed by Facebook. It provides a range of DRL tutorials and examples, making it a user-friendly option for those new to DRL. PyTorch’s dynamic computation graph and Pythonic nature simplify the development process. However, it may not be as scalable or efficient as TensorFlow for large-scale DRL applications.

Stable Baselines

Stable Baselines is a high-level library built on top of TensorFlow and PyTorch. It offers a selection of stable and robust DRL algorithms for various applications, including stock trading. Stable Baselines simplifies the development process by providing pre-built functions and modules for DRL model creation. Its main advantage is its ease of use, as it abstracts away the complexities of TensorFlow and PyTorch. However, it may not offer the same level of customization as these libraries.

When selecting a DRL library or framework for stock trading, consider factors such as ease of use, scalability, compatibility, and customization. TensorFlow, PyTorch, and Stable Baselines each provide unique features and tools that simplify the development process and enable the creation of powerful DRL models for stock trading. By understanding the strengths and limitations of these libraries, developers can make informed decisions and build successful DRL applications for automated stock trading.

Real-World Applications of Deep Reinforcement Learning in Stock Trading

Deep reinforcement learning (DRL) for automated stock trading is an advanced AI technique that has gained traction in recent years. By enabling algorithms to learn from past experiences, DRL can make profitable trading decisions, outperforming traditional methods. This article showcases successful real-world applications of DRL in stock trading, including case studies and success stories.

Case Study 1: Deep Learning for Stock Trading (DeepST)

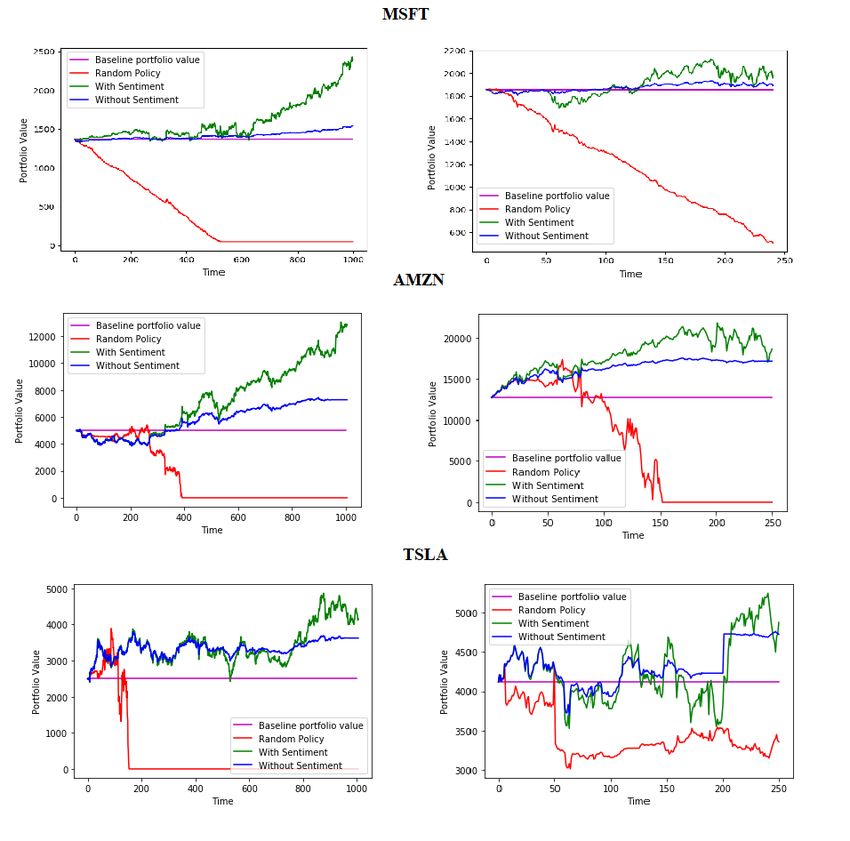

DeepST is a DRL-based stock trading system developed by researchers at the National University of Singapore. By combining DRL with technical analysis, DeepST achieved a 15.2% return on investment (ROI) in backtesting, outperforming the S&P 500’s 9.6% ROI. The system employs a dual-stage DRL model, which first selects stocks and then determines trading actions, demonstrating the potential of DRL for stock trading.

Case Study 2: Deep Q-Network for Stock Trading

A team of researchers from the University of Science and Technology of China developed a DRL-based stock trading system using a Deep Q-Network (DQN) model. The system achieved a 60.4% accuracy in predicting stock price trends, outperforming traditional machine learning algorithms. By learning from past experiences, the DQN model adapted to market changes and made profitable trading decisions.

Success Stories: Hedge Funds and Trading Platforms

Hedge funds and trading platforms have also started adopting DRL for stock trading. Apollo, a Hong Kong-based hedge fund, uses DRL to optimize its trading strategies, achieving a 20% ROI in 2020. Similarly, Sentient Investment Management, a quantitative investment firm, uses DRL to analyze vast amounts of data and make trading decisions, managing over $2.6 billion in assets.

These case studies and success stories demonstrate the potential of DRL for stock trading. By learning from past experiences, DRL models can adapt to market changes and make profitable trading decisions. However, implementing DRL for stock trading comes with challenges, such as overfitting, market manipulation, and lack of transparency. Developers must consider these risks and employ measures to mitigate them, ensuring responsible AI usage.

Deep reinforcement learning for automated stock trading is a rapidly evolving field, offering opportunities for innovation and growth. By understanding the strategies employed, the challenges faced, and the results achieved, developers can build successful DRL applications for stock trading, contributing to the future of financial markets and society at large.

Deep Reinforcement Learning vs. Traditional Machine Learning for Automated Stock Trading

Deep reinforcement learning (DRL) and traditional machine learning (TML) are two popular approaches for automated stock trading. While both techniques enable algorithms to learn from past experiences and make profitable trading decisions, they differ in several aspects. Understanding the advantages and limitations of each approach can help developers choose the right method for their specific use case.

Deep Reinforcement Learning: Advantages and Limitations

DRL is an advanced AI technique that combines reinforcement learning with deep learning. It enables algorithms to learn from past experiences and adapt to market changes, making it suitable for complex and dynamic environments. DRL can handle large datasets and extract intricate patterns, outperforming TML in certain scenarios. However, DRL can be computationally expensive, prone to overfitting, and challenging to interpret, making it less transparent than TML.

Traditional Machine Learning: Advantages and Limitations

TML is a well-established approach for automated stock trading, offering a variety of algorithms and techniques. TML models are generally easier to interpret and less computationally expensive than DRL models. They can also handle smaller datasets and are less prone to overfitting. However, TML models may struggle with complex and dynamic environments, and they may not adapt as well to market changes as DRL models.

When to Use Deep Reinforcement Learning vs. Traditional Machine Learning

Choosing between DRL and TML depends on the specific use case and the available resources. DRL is recommended for complex and dynamic environments, large datasets, and when adaptability is crucial. However, DRL may not be suitable for resource-constrained environments or when interpretability is essential. TML is recommended for simpler environments, smaller datasets, and when interpretability is a priority. However, TML may not perform as well in complex and dynamic environments as DRL.

Deep reinforcement learning and traditional machine learning are two powerful techniques for automated stock trading. By understanding their advantages, limitations, and use cases, developers can choose the right approach for their specific needs, contributing to the future of financial markets and society at large.

Ethical Considerations and Potential Risks of Using Deep Reinforcement Learning in Automated Stock Trading

Deep reinforcement learning (DRL) has emerged as a powerful technique for automated stock trading, enabling algorithms to learn from past experiences and make profitable decisions. However, the application of DRL in financial markets also raises ethical considerations and potential risks that must be addressed to ensure responsible AI usage.

Market Manipulation

Market manipulation is a significant concern in automated stock trading. DRL models may exploit market inefficiencies, leading to unfair advantages and potential manipulation. To mitigate this risk, regulators and developers must establish guidelines and safeguards to ensure that DRL models operate within ethical and legal boundaries.

Overfitting

Overfitting is a common challenge in machine learning, including DRL. Overfitting occurs when a model learns patterns from training data that do not generalize to new data. In the context of stock trading, overfitting can lead to poor performance and unprofitable trades. To address this risk, developers must employ regularization techniques, cross-validation, and other measures to ensure that DRL models are robust and generalize well to new data.

Lack of Transparency

DRL models can be challenging to interpret, making it difficult to understand how they make trading decisions. This lack of transparency can lead to mistrust and uncertainty, particularly in regulated environments. To address this risk, developers must prioritize interpretability and transparency, using techniques such as visualization, explanation, and model simplification to make DRL models more understandable.

Mitigating Risks and Ensuring Responsible AI Usage

To mitigate the risks associated with DRL in automated stock trading, developers must adopt best practices and ethical guidelines. These include ensuring that DRL models are transparent, interpretable, and auditable, and that they operate within legal and ethical boundaries. Developers must also prioritize collaboration, continuous learning, and experimentation to stay up-to-date with emerging trends and potential risks.

Deep reinforcement learning for automated stock trading offers significant potential for innovation and profitability. However, it also raises ethical considerations and potential risks that must be addressed to ensure responsible AI usage. By adopting best practices and ethical guidelines, developers can mitigate these risks and contribute to the future of financial markets and society at large.

The Future of Deep Reinforcement Learning in Automated Stock Trading

Deep reinforcement learning (DRL) has emerged as a promising technique for automated stock trading, offering significant potential for innovation and profitability. As this field continues to evolve, several emerging trends, research directions, and opportunities for innovation are shaping the future of DRL in financial markets.

Emerging Trends

Several emerging trends are driving the adoption of DRL in automated stock trading. These include the increasing availability of data, advances in computing power, and the growing demand for automated trading systems. Additionally, the integration of DRL with other AI techniques, such as natural language processing and computer vision, is opening up new possibilities for innovation and profitability.

Research Directions

Several research directions are currently being explored in the field of DRL for automated stock trading. These include the development of more sophisticated reward functions, the integration of domain-specific knowledge, and the exploration of multi-agent systems. Additionally, researchers are investigating the use of DRL for other financial applications, such as portfolio optimization and risk management.

Opportunities for Innovation

The application of DRL in automated stock trading offers several opportunities for innovation. These include the development of more sophisticated trading strategies, the integration of DRL with other AI techniques, and the exploration of new data sources and markets. Additionally, the use of DRL in financial markets has the potential to improve efficiency, reduce costs, and enhance profitability, leading to a more robust and resilient financial system.

Potential Impact on Financial Markets and Society

The application of DRL in automated stock trading has the potential to significantly impact financial markets and society at large. By enabling more sophisticated trading strategies, DRL has the potential to improve market efficiency, reduce transaction costs, and enhance profitability. However, it also raises ethical considerations and potential risks, such as market manipulation, overfitting, and lack of transparency, which must be addressed to ensure responsible AI usage.

Deep reinforcement learning for automated stock trading is a rapidly evolving field, offering significant potential for innovation and profitability. By adopting best practices and ethical guidelines, developers can mitigate the risks associated with DRL and contribute to the future of financial markets and society at large. As this field continues to evolve, we can expect to see new trends, research directions, and opportunities for innovation, leading to a more robust and resilient financial system.

Getting Started with Deep Reinforcement Learning for Automated Stock Trading: Tips and Best Practices

Deep reinforcement learning (DRL) has emerged as a powerful technique for automated stock trading, offering significant potential for innovation and profitability. However, getting started with DRL can be challenging, especially for those new to this rapidly evolving field. To help you get started, here are some practical tips and best practices for implementing DRL for automated stock trading.

1. Continuous Learning

DRL is a rapidly evolving field, and staying up-to-date with the latest research and techniques is essential. Continuously learning and expanding your knowledge of DRL and related fields, such as machine learning and artificial intelligence, can help you stay ahead of the curve and improve your trading strategies.

2. Experimentation

DRL is a highly experimental field, and experimentation is key to success. Experimenting with different reward functions, model architectures, and training strategies can help you optimize your trading strategies and improve profitability. However, it’s important to approach experimentation systematically and rigorously, with a clear hypothesis and evaluation methodology.

3. Collaboration

DRL is a complex and challenging field, and collaboration can help you overcome obstacles and accelerate progress. Collaborating with other researchers, developers, and traders can provide valuable insights, feedback, and support, helping you improve your trading strategies and achieve your goals.

4. Data Collection and Preprocessing

Data is the foundation of DRL, and collecting and preprocessing high-quality data is essential for success. Collecting and preprocessing historical stock price data, news articles, and social media posts can provide valuable insights and help you develop more sophisticated trading strategies. However, it’s important to approach data collection and preprocessing systematically and rigorously, with a clear methodology and evaluation criteria.

5. Model Architecture and Training

Model architecture and training are critical components of DRL, and selecting the right model architecture and training strategy can significantly impact profitability. Selecting a model architecture that balances complexity and interpretability, and training the model using a rigorous and systematic methodology, can help you optimize your trading strategies and improve profitability.

6. Evaluation and Iteration

Evaluation and iteration are essential for improving profitability and optimizing trading strategies. Evaluating your trading strategies using rigorous and systematic methodologies, and iterating on your strategies based on the results, can help you continuously improve profitability and stay ahead of the curve.

Deep reinforcement learning for automated stock trading is a rapidly evolving field, offering significant potential for innovation and profitability. By following these tips and best practices, you can get started with DRL for automated stock trading and contribute to the future of financial markets and society at large. As this field continues to evolve, we can expect to see new trends, research directions, and opportunities for innovation, leading to a more robust and resilient financial system.