What is a Coupon Bond and How Does it Work?

Coupon bonds are a type of fixed-income investment that offers regular income and relatively low risk. They differ from other types of bonds, such as zero-coupon bonds, which do not make regular interest payments. Instead, coupon bonds provide investors with a steady stream of income, making them an attractive option for those seeking predictable returns.

The benefits of investing in coupon bonds are numerous. They offer a relatively low-risk profile, making them an ideal choice for conservative investors. Additionally, the regular income stream provided by coupon bonds can help investors manage their cash flow and achieve their long-term financial goals. However, to fully understand the potential of coupon bonds, it’s essential to grasp the concept of coupon bond yield to maturity, which plays a critical role in determining the bond’s overall return.

Understanding Yield to Maturity: The Key to Unlocking Bond Potential

Yield to maturity (YTM) is a critical concept in bond investing, as it represents the total return an investor can expect to earn from a bond if it is held until maturity. It takes into account the coupon rate, face value, and market price of the bond, providing a comprehensive picture of the bond’s potential return. Calculating YTM is essential for investors, as it helps them make informed decisions about their bond investments and compare different bond options.

The significance of YTM lies in its ability to provide a clear understanding of a bond’s overall return. It encompasses not only the regular interest payments but also any capital gains or losses that may occur when the bond is redeemed at maturity. By considering the YTM, investors can determine whether a bond is a good investment opportunity, given their individual financial goals and risk tolerance. Furthermore, YTM serves as a benchmark for evaluating the performance of a bond portfolio, allowing investors to adjust their strategy accordingly.

In the context of coupon bonds, YTM plays a vital role in determining the bond’s attractiveness to investors. A higher YTM generally indicates a more attractive investment opportunity, as it suggests a higher potential return. Conversely, a lower YTM may indicate a less attractive investment, unless the investor is willing to accept a lower return in exchange for a lower level of risk. By understanding the concept of YTM, investors can make more informed decisions about their coupon bond investments and maximize their returns.

How to Calculate Coupon Bond Yield to Maturity: A Step-by-Step Guide

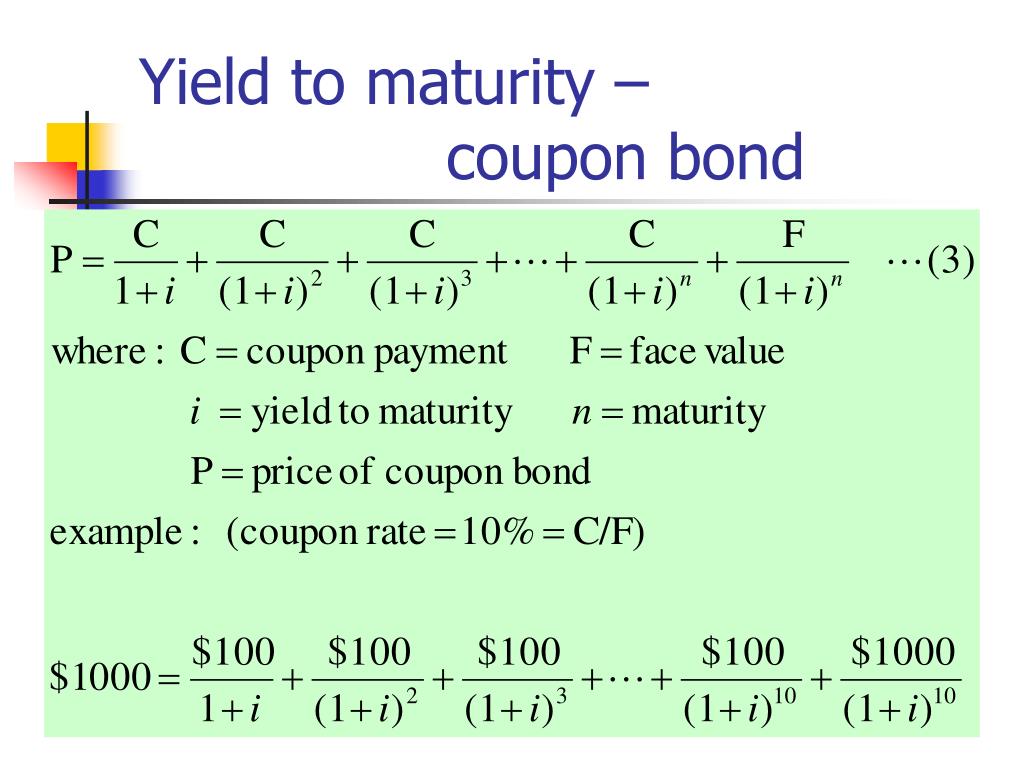

Calculating coupon bond yield to maturity (YTM) is a crucial step in evaluating the potential return of a coupon bond investment. The YTM represents the total return an investor can expect to earn from a bond if it is held until maturity, taking into account the coupon rate, face value, and market price of the bond. In this section, we will provide a step-by-step guide on how to calculate coupon bond YTM, including the formula and examples to illustrate the process.

The formula to calculate coupon bond YTM is as follows:

YTM = (Coupon Payment + ((Face Value – Market Price) / Years to Maturity)) / ((Face Value + Market Price) / 2)

Where:

- Coupon Payment is the annual interest payment made by the bond issuer

- Face Value is the bond’s par value or principal amount

- Market Price is the current market price of the bond

- Years to Maturity is the number of years until the bond matures

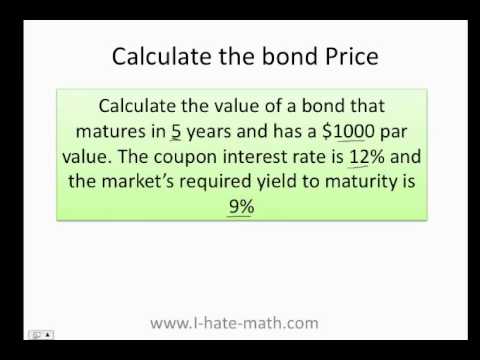

Let’s consider an example to illustrate the calculation of coupon bond YTM. Suppose we have a 10-year coupon bond with a face value of $1,000, a coupon rate of 5%, and a market price of $900. To calculate the YTM, we would plug in the following values:

YTM = ($50 + (($1,000 – $900) / 10)) / (($1,000 + $900) / 2)

YTM = 6.45%

In this example, the coupon bond YTM is 6.45%, indicating that an investor can expect to earn a total return of 6.45% if the bond is held until maturity. By understanding how to calculate coupon bond YTM, investors can make more informed decisions about their bond investments and maximize their returns.

The Impact of Interest Rates on Coupon Bond Yield to Maturity

Interest rates play a crucial role in determining the coupon bond yield to maturity (YTM). Changes in interest rates can significantly affect the bond’s yield and overall return, making it essential for investors to understand the relationship between the two. In this section, we will explore how interest rates impact coupon bond YTM and what it means for investors.

When interest rates rise, the coupon bond YTM also increases. This is because investors can earn a higher return from newly issued bonds with higher coupon rates, making existing bonds with lower coupon rates less attractive. As a result, the market price of the existing bond decreases, causing the YTM to increase. Conversely, when interest rates fall, the coupon bond YTM decreases, making existing bonds more attractive and causing their market price to increase.

The impact of interest rates on coupon bond YTM can be significant. For example, suppose we have a 10-year coupon bond with a face value of $1,000, a coupon rate of 5%, and a market price of $900. If interest rates rise by 1%, the YTM may increase to 7%, making the bond less attractive to investors. On the other hand, if interest rates fall by 1%, the YTM may decrease to 4%, making the bond more attractive.

Understanding the relationship between interest rates and coupon bond YTM is essential for investors to make informed decisions about their bond investments. By recognizing how changes in interest rates affect the bond’s yield and overall return, investors can adjust their strategy to maximize their returns. For instance, investors may choose to invest in shorter-term bonds or bonds with floating coupon rates to take advantage of rising interest rates. Alternatively, they may opt for longer-term bonds or bonds with fixed coupon rates to benefit from falling interest rates.

In conclusion, the impact of interest rates on coupon bond YTM is a critical factor that investors must consider when investing in coupon bonds. By understanding this relationship, investors can make more informed decisions and maximize their returns in a changing interest rate environment.

Factors Affecting Coupon Bond Yield to Maturity: A Comprehensive Analysis

When it comes to investing in coupon bonds, understanding the factors that influence coupon bond yield to maturity (YTM) is crucial for making informed decisions. In this section, we will examine the various factors that affect coupon bond YTM, including credit rating, bond duration, and market conditions, and how they impact the bond’s overall return.

Credit rating is one of the most significant factors affecting coupon bond YTM. Bonds issued by companies or governments with high credit ratings tend to have lower yields, as they are considered to be less risky. On the other hand, bonds with lower credit ratings have higher yields to compensate investors for taking on greater credit risk. For example, a 10-year coupon bond with a high credit rating may have a YTM of 4%, while a similar bond with a lower credit rating may have a YTM of 6%.

Bond duration is another critical factor that affects coupon bond YTM. Bond duration measures the sensitivity of a bond’s price to changes in interest rates. Bonds with longer durations are more sensitive to interest rate changes, which can result in higher yields. For instance, a 10-year coupon bond with a duration of 7 years may have a YTM of 5%, while a similar bond with a duration of 3 years may have a YTM of 3%.

Market conditions, such as supply and demand, also play a significant role in determining coupon bond YTM. When demand for bonds is high, prices tend to rise, and yields decrease. Conversely, when demand is low, prices fall, and yields increase. Additionally, market conditions such as inflation, economic growth, and monetary policy can also impact coupon bond YTM.

Other factors that can influence coupon bond YTM include the bond’s liquidity, callability, and convertibility. Bonds with higher liquidity tend to have lower yields, as investors are more willing to buy and sell them. Callable bonds, which can be redeemed by the issuer before maturity, may have higher yields to compensate investors for the added risk. Convertible bonds, which can be converted into stocks, may have lower yields due to the potential for capital appreciation.

In conclusion, understanding the various factors that affect coupon bond YTM is essential for investors to make informed decisions and maximize their returns. By recognizing the impact of credit rating, bond duration, market conditions, and other factors on coupon bond YTM, investors can adjust their strategy to optimize their investment portfolio.

Maximizing Returns: Strategies for Investing in Coupon Bonds

Investing in coupon bonds can be a lucrative strategy for income-seeking investors, but it requires a thoughtful approach to maximize returns. In this section, we will explore practical strategies for investors looking to optimize their coupon bond investments, including diversification, laddering, and active management.

Diversification is a crucial strategy for coupon bond investors. By spreading investments across different issuers, sectors, and maturities, investors can reduce risk and increase potential returns. For example, a diversified portfolio might include a mix of government and corporate bonds, as well as bonds with different credit ratings and durations. This approach can help investors mitigate the impact of any single bond’s performance on their overall portfolio.

Laddering is another effective strategy for coupon bond investors. This involves investing in bonds with staggered maturities, which can help to reduce interest rate risk and provide a steady stream of income. For instance, an investor might invest in a series of bonds with maturities ranging from 2 to 10 years, which can help to smooth out returns and reduce the impact of interest rate fluctuations.

Active management is also a key strategy for maximizing returns from coupon bonds. This involves regularly monitoring and adjusting the bond portfolio to take advantage of changes in market conditions and interest rates. For example, an investor might adjust their portfolio to take advantage of falling interest rates by investing in longer-term bonds, or to reduce exposure to rising interest rates by investing in shorter-term bonds.

In addition to these strategies, investors can also consider other approaches to maximize returns from coupon bonds. For example, investing in bonds with higher coupon rates or yields can provide a higher return, but may also come with higher credit risk. Similarly, investing in bonds with longer durations can provide a higher return, but may also increase interest rate risk.

Ultimately, the key to maximizing returns from coupon bonds is to develop a thoughtful and disciplined investment approach. By diversifying, laddering, and actively managing their bond portfolio, investors can optimize their returns and achieve their investment goals. By understanding the factors that affect coupon bond yield to maturity, investors can make informed decisions and unlock the full potential of these investments.

Common Mistakes to Avoid When Investing in Coupon Bonds

When investing in coupon bonds, it’s essential to avoid common mistakes that can negatively impact returns. In this section, we will identify common pitfalls to watch out for, including ignoring credit risk, failing to diversify, and misunderstanding the impact of interest rates on coupon bond yield to maturity.

One of the most significant mistakes investors make is ignoring credit risk. Credit risk refers to the likelihood that the bond issuer will default on their debt obligations. Investing in bonds with low credit ratings can result in higher yields, but it also increases the risk of default. To avoid this mistake, investors should carefully evaluate the creditworthiness of the issuer and consider investing in bonds with high credit ratings.

Failing to diversify is another common mistake investors make. Diversification is critical when investing in coupon bonds, as it helps to reduce risk and increase potential returns. Investors should aim to create a diversified portfolio by investing in bonds with different issuers, sectors, and maturities. This approach can help to mitigate the impact of any single bond’s performance on the overall portfolio.

Misunderstanding the impact of interest rates on coupon bond yield to maturity is also a common mistake. Changes in interest rates can significantly affect the bond’s yield and overall return. Investors should understand how interest rates affect coupon bond yield to maturity and adjust their investment strategy accordingly. For example, when interest rates rise, investors may want to consider investing in shorter-term bonds or bonds with lower durations to reduce interest rate risk.

Other common mistakes to avoid when investing in coupon bonds include failing to monitor and adjust the portfolio, ignoring the impact of market conditions, and not considering the tax implications of bond investments. By being aware of these common mistakes, investors can take steps to avoid them and maximize their returns from coupon bonds.

By understanding the factors that affect coupon bond yield to maturity and avoiding common mistakes, investors can make informed decisions and unlock the full potential of these investments. In the next section, we will summarize the key takeaways from this article and provide a final thought on how investors can maximize their returns from coupon bonds.

Conclusion: Unlocking the Full Potential of Coupon Bonds

In conclusion, understanding coupon bond yield to maturity is crucial for investors seeking to maximize their returns from these investments. By grasping the concept of yield to maturity, investors can make informed decisions about their bond investments and avoid common mistakes that can negatively impact their returns.

Throughout this article, we have explored the world of coupon bonds, from the basics of how they work to the intricacies of calculating yield to maturity. We have also examined the factors that affect coupon bond yield to maturity, including credit rating, bond duration, and market conditions, and discussed strategies for maximizing returns, such as diversification, laddering, and active management.

By applying the knowledge and insights gained from this article, investors can unlock the full potential of coupon bonds and achieve their investment goals. Remember, understanding coupon bond yield to maturity is key to making informed investment decisions and maximizing returns. By avoiding common mistakes and employing effective strategies, investors can harness the power of coupon bonds to build a successful investment portfolio.

In the world of bond investing, knowledge is power. By staying informed and up-to-date on the latest developments and trends, investors can stay ahead of the curve and make the most of their investments. Whether you’re a seasoned investor or just starting out, understanding coupon bond yield to maturity is essential for achieving success in the bond market.