What Influences the Cost of a Zero-Coupon Bond?

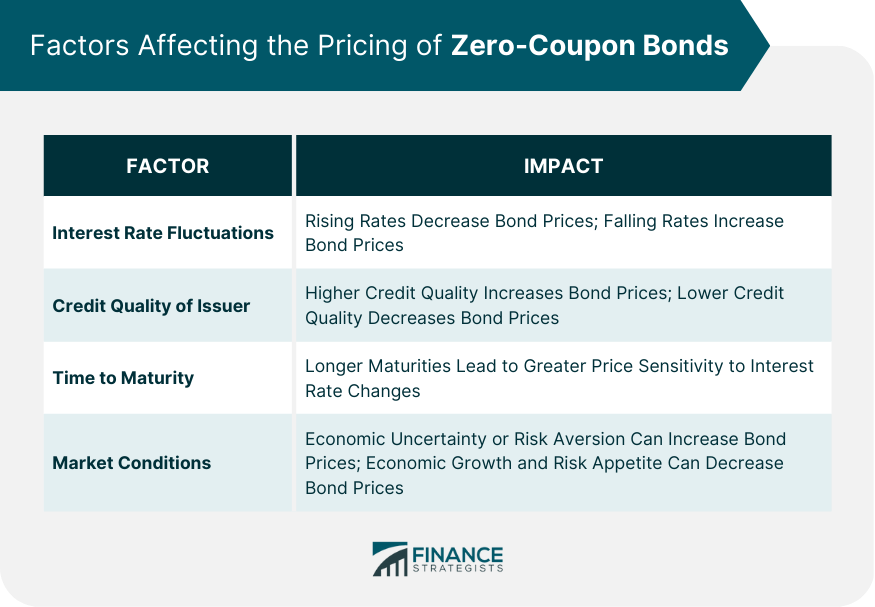

Zero-coupon bonds are a straightforward investment. They don’t pay interest periodically. Instead, investors buy them at a discount. The return comes from the difference between the purchase price and the face value received at maturity. Several factors influence the cost of zero coupon bonds. Market interest rates play a crucial role. Generally, higher interest rates lead to lower bond prices, and vice versa. This inverse relationship is fundamental to understanding the cost of zero coupon bond. The time until the bond matures also affects its price. Longer maturities typically result in a larger discount. This is because your money is invested for a longer period. Creditworthiness is another key factor. Bonds from less creditworthy issuers command higher discounts to reflect the increased risk of default. Finally, broader market conditions, such as economic growth and investor sentiment, influence the cost of zero coupon bonds. Understanding these factors is essential for making informed investment decisions. The cost of zero coupon bond reflects a complex interplay of these variables.

Analyzing the cost of zero coupon bond requires a nuanced understanding of yield to maturity (YTM). YTM represents the total return an investor anticipates if the bond is held until maturity. It accounts for the discount, the time to maturity, and the face value. Changes in market interest rates directly impact YTM. For example, if market rates rise after you purchase a zero-coupon bond, its market price will fall. This is because newly issued bonds offer higher returns, making your existing bond less attractive. Conversely, if market rates fall, your bond becomes more attractive, and its price increases. The present value calculation helps determine the bond’s price. This calculation discounts the future face value back to today’s value, using the prevailing market interest rate as the discount rate. While the precise formula can be complex, the core concept is straightforward: higher discount rates (interest rates) lead to lower present values (bond prices). The cost of zero coupon bond, therefore, is directly tied to market interest rates and time value of money concepts.

Investors should consider the cost of zero coupon bond in relation to other factors. Credit rating agencies like Moody’s, S&P, and Fitch assess the creditworthiness of bond issuers. Higher-rated bonds carry lower risk and, therefore, typically sell at lower discounts. Lower-rated bonds, reflecting higher default risk, sell at significantly higher discounts. Understanding credit ratings is crucial when evaluating the cost of zero coupon bond. The cost of zero coupon bond, ultimately, is a function of risk, time, and prevailing market conditions. It’s essential to carefully weigh these factors before investing in zero-coupon bonds. A thorough understanding of the cost of zero coupon bonds enables investors to make more informed and potentially profitable choices.

The Role of Interest Rates in Determining Bond Value

Understanding the cost of zero coupon bond hinges significantly on prevailing interest rates. These rates represent the return investors expect for lending their money. Yield to maturity (YTM) is a crucial concept here. It reflects the total return an investor anticipates receiving if they hold the zero-coupon bond until its maturity date. This return accounts for the difference between the purchase price and the face value, effectively incorporating the discount into the overall yield.

A fundamental inverse relationship exists between interest rates and zero-coupon bond prices. When market interest rates rise, newly issued bonds offer higher yields. This makes existing zero-coupon bonds, with their fixed YTM, less attractive. Consequently, the cost of zero coupon bond decreases to make them competitive. Conversely, when interest rates fall, the YTM of existing zero-coupon bonds becomes more appealing. This increased demand drives up their prices. Imagine a $1,000 face value zero-coupon bond. If market interest rates increase from 3% to 5%, the cost of zero coupon bond will fall, because a new bond offers a better return. The present value calculation, a core principle in bond pricing, helps determine this cost. It essentially discounts the future face value back to its current worth, considering the prevailing interest rate and time to maturity. A simplified way to visualize this is to consider the interest rate as the discount rate applied to the future cash flow (the face value).

The cost of zero coupon bond is therefore dynamically linked to interest rates. Investors constantly assess the relationship between current yields on new bonds and the YTM of existing zero-coupon bonds. This dynamic interplay ensures that bond prices continually adjust to reflect market interest rate fluctuations. Understanding this dynamic is critical for anyone interested in investing in or analyzing the cost of zero coupon bond. Changes in the overall market environment, expectations of future interest rate movements, and the perceived creditworthiness of the issuer are all influencing factors further adding complexity to pricing.

Time to Maturity and Its Impact on the Cost of a Zero-Coupon Bond

The time until a zero-coupon bond matures significantly impacts its price. Longer maturities generally result in a higher discount. This is because your money is invested for a longer period, and there’s increased uncertainty. Investors demand a larger return to compensate for this extended time horizon. For example, a $1,000 zero-coupon bond maturing in 10 years will sell at a deeper discount than an identical bond maturing in 5 years. This is true even if prevailing interest rates remain constant. The longer the maturity, the greater the impact of fluctuating interest rates on the cost of zero coupon bond.

Understanding this relationship is crucial for evaluating the cost of zero coupon bond. Consider two zero-coupon bonds with the same face value and issued by the same entity. If one bond matures in 2 years and the other in 10 years, the 10-year bond will have a substantially lower current price (a greater discount). This reflects the greater risk associated with tying up capital for a longer duration. The longer maturity increases the uncertainty surrounding future interest rates, and hence, the investor’s final return. Therefore, the longer the time to maturity, the lower the current market price to compensate for this added risk. Investors are compensated with a deeper discount for this increased uncertainty about the future value of the investment. This increased discount directly impacts the cost of zero coupon bond, making it lower for longer-term bonds.

Investors should carefully consider the time to maturity when assessing the cost of zero coupon bond. A longer maturity offers the potential for higher returns but also carries greater risk. Conversely, shorter-term bonds offer lower returns but are less susceptible to interest rate fluctuations, minimizing the impact on the cost of zero coupon bond. The optimal time to maturity will depend on each investor’s individual risk tolerance and investment goals. This dynamic relationship between time to maturity and the cost of zero coupon bond is a fundamental aspect of bond valuation that every investor should understand.

Assessing Credit Risk and its Effect on Pricing

The creditworthiness of the issuer significantly impacts the cost of zero coupon bonds. Bonds issued by entities with a higher credit risk, reflected in lower credit ratings from agencies like Moody’s, S&P, and Fitch, will generally command a lower price than those from highly creditworthy issuers. This is because investors demand a higher return to compensate for the increased risk of default. A lower price translates to a higher yield to maturity for the investor, making it an attractive option for those willing to accept greater risk for potentially higher returns. The cost of zero coupon bond is directly influenced by this perceived risk. Understanding credit ratings is crucial for assessing the potential for loss of principal in the event the bond issuer fails to make payments at maturity. Investors should carefully review these ratings before investing.

Credit rating agencies use various financial metrics and qualitative assessments to determine an issuer’s creditworthiness. Factors considered include the issuer’s financial strength, debt levels, and overall economic outlook. Bonds receive letter ratings (e.g., AAA, AA, A, BBB, etc.) reflecting varying levels of credit risk. Higher ratings (AAA being the highest) indicate lower risk and typically correlate with lower yields and higher prices. Lower ratings, on the other hand, suggest higher risk and usually result in higher yields and lower prices to compensate investors for the added risk of default. The cost of zero coupon bond reflects this risk-reward tradeoff. For instance, a bond rated BBB might sell at a substantially lower price than a similar bond with an AA rating, illustrating the impact of credit risk on the bond’s cost. This difference in price represents the risk premium demanded by investors.

Investors should carefully consider the credit rating of a zero-coupon bond before purchasing. Bonds with lower ratings might offer higher yields to compensate for the higher default risk. However, investors must carefully weigh the potential for higher returns against the increased likelihood of losing their principal if the issuer defaults. A thorough understanding of credit risk and its effect on the cost of zero coupon bonds is essential for making informed investment decisions. Comparing bonds with different credit ratings and assessing the potential risks associated with each is crucial to managing investment portfolio risk effectively. Diversification across various credit ratings can help mitigate the impact of defaults on overall portfolio performance. Investors should always carefully research and understand the issuer’s financial health and overall market conditions before investing in zero-coupon bonds.

How to Calculate the Approximate Cost of a Zero-Coupon Bond

Understanding the cost of zero coupon bond is crucial for potential investors. A simplified approach helps determine the approximate purchase price. This calculation considers the bond’s face value, the yield to maturity (YTM), and the time to maturity. The YTM represents the total return an investor will receive if the bond is held until maturity. It takes into account the discount at which the bond is purchased.

Let’s consider a hypothetical example to illustrate the process. Suppose a $1,000 face value zero-coupon bond matures in 5 years, and current market interest rates suggest a 4% YTM. To calculate the approximate cost of this zero-coupon bond, we need to determine the present value of the $1,000 face value. A simple way to approximate this is to discount the face value by the YTM for each year. For the first year, you would divide $1000 by 1.04. For the second year, you would divide the result by 1.04 again, and so on, for all five years. The final result will show the approximate cost of the zero-coupon bond today, reflecting its discounted value due to the time until maturity and the YTM.

This method provides a reasonable estimate of the cost of zero coupon bond. Remember, this calculation simplifies the process. More precise calculations might involve more complex formulas considering compounding interest more frequently than annually. However, this approach offers a clear and easily understood method for determining a bond’s approximate cost. The accuracy of this approximation increases as the YTM is smaller, or the time to maturity is shorter. The cost of zero coupon bond is inversely related to prevailing interest rates. Higher interest rates result in a lower present value, meaning the bond will cost less, and vice versa. Understanding this relationship is key to making informed investment decisions.

Market Conditions and Their Influence on Bond Prices

Broader market conditions significantly impact the cost of zero coupon bonds. Economic growth, for instance, often influences interest rates. Strong economic growth may lead to higher interest rates. Higher interest rates, in turn, decrease the price of existing zero-coupon bonds. This is because newly issued bonds will offer higher yields, making older bonds less attractive. Conversely, during economic slowdowns or recessions, interest rates tend to fall. Lower interest rates increase the cost of zero coupon bonds, as investors seek safer investments with relatively higher returns. Inflation expectations also play a crucial role. High inflation erodes the purchasing power of future payments, affecting the cost of zero coupon bond. Investors demand higher yields to compensate for inflation, leading to lower bond prices. Therefore, understanding inflation’s impact is vital when assessing the cost of zero coupon bond.

Investor sentiment also contributes to the price fluctuations of zero-coupon bonds. During periods of uncertainty or risk aversion, investors may flock to safer assets like government bonds. This increased demand can push up the cost of zero coupon bond, even if interest rates remain unchanged. Conversely, periods of high risk tolerance may lead to lower demand and decreased prices. The interplay between these factors—economic growth, inflation expectations, and investor sentiment—creates a dynamic environment for zero-coupon bond pricing. Careful consideration of these elements is crucial for understanding the cost of zero coupon bond and making informed investment decisions. The cost of zero coupon bond is not solely determined by the bond’s intrinsic characteristics; market forces play a substantial role.

Geopolitical events and regulatory changes can also influence the cost of zero coupon bond. Unexpected international incidents or shifts in government policies can create market volatility. This volatility impacts investor confidence and consequently influences the demand for, and therefore the price of, zero-coupon bonds. Analyzing these external factors is important for a complete understanding of what drives the cost of zero coupon bond. Investors should monitor these market conditions to make well-informed decisions about their investments in zero-coupon bonds. The cost of zero coupon bond is a complex function of several interacting elements. A thorough understanding of these aspects is essential for successful investing.

Comparing Zero-Coupon Bonds to Other Investments

Zero-coupon bonds offer a straightforward investment approach, differing significantly from other options. Unlike regular coupon bonds that pay periodic interest, zero-coupon bonds provide a return solely through the difference between the purchase price and the face value at maturity. This means understanding the cost of zero coupon bond upfront is crucial. Compared to certificates of deposit (CDs), zero-coupon bonds often offer greater flexibility in terms of maturity dates, although CDs might provide more predictable returns. High-yield savings accounts, while liquid and accessible, typically yield lower returns than zero-coupon bonds, especially over longer time horizons. The cost of zero coupon bond is a key factor when comparing them to these alternatives.

A significant advantage of zero-coupon bonds is their potential for tax advantages in some jurisdictions, depending on how they are structured. However, the lack of periodic interest payments can be a drawback for investors needing regular income. The cost of zero coupon bond should be carefully weighed against the need for consistent cash flow. Investors should consider their individual circumstances when evaluating the appropriateness of zero-coupon bonds compared to other investment vehicles. The cost of a zero coupon bond is, therefore, only one part of the investment decision, to be considered against all the alternatives.

Another key difference lies in the risk profile. Zero-coupon bonds, like all bonds, carry interest rate risk – meaning their value fluctuates with changes in market interest rates. The cost of zero coupon bond is sensitive to interest rate changes. However, the risk is often lower than with higher-yielding alternatives such as stocks or certain high-yield bonds. Understanding the potential impact of inflation on the bond’s ultimate real return is also vital. This is another factor affecting the perceived cost of zero coupon bond. Careful consideration of these factors helps determine if zero-coupon bonds align with an investor’s risk tolerance and overall financial goals.

Investing in Zero-Coupon Bonds: Risks and Considerations

Investing in zero-coupon bonds, like any investment, carries inherent risks. Understanding these risks is crucial before committing capital. One key risk is reinvestment risk. Since zero-coupon bonds don’t provide periodic interest payments, the investor must consider the challenge of reinvesting the eventual proceeds at a comparable rate of return. If interest rates fall after the purchase, reinvesting the proceeds may yield less than initially anticipated, impacting the overall return on the cost of zero coupon bond. Interest rate risk is another significant factor. Rising interest rates cause the cost of zero coupon bond to decline, potentially leading to capital losses if the bond is sold before maturity. Conversely, falling rates may increase the bond’s value, but this benefit is not guaranteed.

Inflation risk also presents a challenge. The purchasing power of the bond’s face value at maturity might be less than anticipated if inflation significantly erodes its value. This is especially true for bonds with longer maturities. The cost of zero coupon bond, while seemingly fixed at purchase, is indirectly impacted by inflation’s effect on future value. Therefore, it’s essential to consider inflation projections when assessing the potential return of a zero-coupon bond. Diversification is a key strategy to mitigate these risks. By spreading investments across different asset classes, investors can reduce their exposure to the fluctuations inherent in any single investment type, including the variability in the cost of zero coupon bond. The overall return on investment is not solely dependent on the individual performance of zero-coupon bonds but on the portfolio’s performance as a whole.

Before investing in zero-coupon bonds, investors should carefully consider their individual financial goals and risk tolerance. Zero-coupon bonds are generally considered a lower-risk investment compared to stocks, but they are not without risk. A thorough understanding of the potential rewards and the associated cost of zero coupon bond, coupled with a well-diversified portfolio, helps ensure a more balanced and potentially profitable investment strategy. Individuals should consult with a financial advisor to determine if zero-coupon bonds align with their specific financial circumstances and risk profile. The cost of zero coupon bond, while seemingly straightforward, needs to be evaluated within a broader financial context.