Unveiling Expected Shortfall: A Deeper Dive into Risk Assessment

Conditional Value at Risk (CVaR), also known as Expected Shortfall (ES), is a crucial risk measure that extends beyond the limitations of Value at Risk (VaR). While VaR identifies a threshold for potential losses, CVaR quantifies the expected magnitude of losses exceeding that threshold. This makes it an invaluable tool in risk management, especially when dealing with fat-tailed distributions or the potential for extreme events. The conditional value at risk formula is essential for understanding potential losses.

The importance of CVaR lies in its ability to provide a more comprehensive understanding of tail risk. Traditional VaR only indicates the maximum loss expected within a given confidence level but offers no insight into the severity of losses beyond that point. CVaR, on the other hand, directly addresses this concern by calculating the average loss that occurs in the worst-case scenarios. This is particularly relevant for institutions managing portfolios with potentially catastrophic downsides. The conditional value at risk formula helps to properly asses downside risk.

Expected Shortfall, the synonym often used interchangeably with CVaR, has gained significant traction in the financial industry. Its sensitivity to the shape of the tail distribution makes it a more reliable measure of risk than VaR, especially when dealing with non-normal distributions. Furthermore, CVaR possesses the property of subadditivity, meaning that the CVaR of a portfolio is always less than or equal to the sum of the CVaRs of its individual components. This coherence property makes CVaR a more theoretically sound and practically useful risk measure for portfolio optimization and risk aggregation. The practical application of the conditional value at risk formula is vital for regulatory compliance and informed risk management. The conditional value at risk formula offers a more robust evaluation compared to other methods. The conditional value at risk formula gives decision makers better insights of tail risk.

How to Calculate Expected Shortfall: A Step-by-Step Guide

Calculating CVaR, also known as Expected Shortfall, involves several methodologies. These range from simpler historical simulations to more complex Monte Carlo simulations and parametric approaches. Each method offers a unique way to estimate the potential losses exceeding the VaR threshold. Understanding these methods is crucial for effective risk management. The choice of method depends on data availability, computational resources, and the desired level of accuracy.

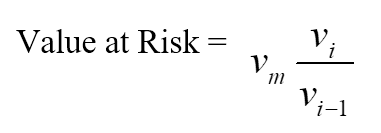

The historical simulation method is a straightforward approach. It uses past data to simulate potential future losses. First, arrange historical returns in ascending order. Then, identify the VaR threshold at the chosen confidence level (alpha). CVaR is then calculated as the average of the losses that exceed the VaR. This method is easy to implement, but its accuracy depends heavily on the availability of sufficient and representative historical data. A key limitation is that it assumes the future will resemble the past. The conditional value at risk formula in this case is an average of actual historical losses.

Monte Carlo simulation provides a flexible alternative. It involves generating numerous random scenarios based on assumed distributions for the underlying risk factors. For each scenario, calculate the portfolio loss. Then, similar to the historical simulation method, identify the VaR threshold and calculate CVaR as the average loss exceeding that threshold. Monte Carlo simulation can accommodate complex dependencies and non-normal distributions. However, it requires careful model calibration and significant computational resources. The conditional value at risk formula application here relies on the accuracy of the simulated scenarios. Parametric methods, on the other hand, assume a specific distribution for asset returns. For example, one might assume a normal or t-distribution. Once the distribution is specified, the CVaR can be calculated directly from the distribution parameters. This method is computationally efficient, but its accuracy hinges on the validity of the distributional assumption. If the true distribution deviates significantly from the assumed distribution, the CVaR estimate may be unreliable. Ultimately, selecting the appropriate method for conditional value at risk formula calculation requires careful consideration of the trade-offs between simplicity, accuracy, and computational cost.

Deconstructing the Expected Shortfall Calculation

The Conditional Value at Risk (CVaR), also known as Expected Shortfall (ES), is a risk measure that quantifies the expected loss when losses exceed the Value at Risk (VaR) threshold at a given confidence level. Understanding the components of the conditional value at risk formula is crucial for interpreting and applying this risk measure effectively. The conditional value at risk formula relies on three key elements: the confidence level (alpha), the VaR threshold, and the conditional expectation of losses exceeding VaR. Alpha represents the probability that losses will exceed the VaR threshold. Commonly used confidence levels include 95% and 99%, reflecting a desire to capture extreme tail events.

The VaR threshold is the maximum loss expected to occur with a probability of (1 – alpha). For example, if the VaR at a 95% confidence level is $1 million, it means there is a 5% chance of losing more than $1 million. The conditional expectation of losses exceeding VaR is the average loss, given that the loss exceeds the VaR threshold. This is where CVaR distinguishes itself from VaR. While VaR only indicates the threshold beyond which losses may occur, CVaR quantifies the magnitude of those losses. The conditional value at risk formula, therefore, provides a more complete picture of tail risk.

To illustrate, consider a portfolio with a VaR of $1 million at a 95% confidence level. Suppose that, on average, when losses exceed $1 million, the expected loss is $1.5 million. In this case, the CVaR would be $1.5 million. This indicates that if losses do exceed the VaR threshold, the average expected loss is $1.5 million. This additional information is invaluable for risk management. It allows for a more informed assessment of potential losses and better capital allocation decisions. Understanding the interplay between alpha, VaR, and the conditional expectation is essential for effectively utilizing the conditional value at risk formula in risk management practices. Different methods exist for calculating CVaR, each with its own assumptions and limitations, further influencing the final result.

Exploring Different Approaches to Estimate CVaR

Estimating Conditional Value at Risk (CVaR), also known as Expected Shortfall, involves several methodologies, each with its own strengths and weaknesses. Understanding these approaches is crucial for effective risk management. The choice of method depends on the availability of data, computational resources, and the desired level of accuracy. One common approach is historical simulation.

Historical simulation is straightforward to implement. It relies on past data to simulate future losses. The conditional value at risk formula is applied to the tail of the historical loss distribution. While simple, this method has limitations. It assumes that the future will resemble the past. This assumption may not hold true, especially during periods of significant market change. Another method is Monte Carlo simulation. This approach uses random sampling to generate numerous possible scenarios. These scenarios are based on assumed statistical distributions for relevant risk factors. The conditional value at risk formula is then applied to the simulated loss distribution. Monte Carlo simulation offers flexibility. It can incorporate complex dependencies and non-normal distributions. However, it is computationally intensive. It also requires careful model calibration. The accuracy of the results depends heavily on the validity of the assumptions.

Parametric methods offer an alternative. These methods assume that the loss distribution follows a specific mathematical form, such as the normal or t-distribution. The conditional value at risk formula can then be derived analytically or numerically. Parametric methods are computationally efficient. They require fewer data points compared to simulation methods. However, their accuracy depends on the validity of the distributional assumption. In many cases, financial returns exhibit fat tails and skewness. These characteristics are not well captured by simple parametric distributions. For example, if a normal distribution is assumed when the real distribution has a heavier tail, the conditional value at risk formula will underestimate the true risk. Each approach to estimating Conditional Value at Risk has benefits and drawbacks. Historical simulation is easy but relies on the past. Monte Carlo is flexible but intensive. Parametric methods are efficient but require distributional assumptions. The best approach depends on the specific context and the trade-off between accuracy and computational cost. Considering the specific characteristics of the portfolio and market conditions is important. The conditional value at risk formula provides a valuable tool. Combining it with sound judgment allows for robust risk management.

Applications of CVaR in Financial Risk Management

Conditional Value at Risk (CVaR) plays a vital role in financial risk management, offering a more comprehensive view of potential losses than traditional measures like Value at Risk (VaR). Its applications span various areas, providing decision-makers with the insights needed to navigate complex financial landscapes. One crucial application lies in portfolio optimization. CVaR can be used to construct portfolios that minimize expected losses in the worst-case scenarios, leading to more robust and resilient investment strategies. The conditional value at risk formula helps investors to balance risk and return, creating portfolios aligned with their specific risk tolerance. Risk budgeting is another area where CVaR proves invaluable. By allocating capital based on CVaR, financial institutions can ensure that risk exposure is appropriately distributed across different business units or asset classes. This approach allows for a more efficient allocation of resources, maximizing returns while staying within acceptable risk limits. The conditional value at risk formula is employed to determine the optimal capital allocation for each unit.

Regulatory capital requirements increasingly rely on CVaR, also known as Expected Shortfall, as a key metric for assessing financial stability. Regulators recognize CVaR’s ability to capture tail risk, making it a more prudent measure than VaR. Banks and other financial institutions are required to hold sufficient capital to cover potential losses as measured by CVaR. Stress testing is a further area where CVaR is extensively used. By simulating extreme market conditions, institutions can estimate potential losses and assess the adequacy of their capital buffers. CVaR provides a more accurate picture of potential losses under stress scenarios. The conditional value at risk formula allows for a better understanding of the potential impact of adverse events. The practical application of the conditional value at risk formula empowers financial institutions to make informed decisions about risk exposure and capital allocation.

Certain financial regulations explicitly favor CVaR (or Expected Shortfall) over VaR due to CVaR’s superior properties in capturing tail risk. This is because the conditional value at risk formula considers the losses exceeding the VaR threshold, providing a more complete picture of the potential downside. For instance, in the context of insurance risk management, CVaR can help insurers better understand the potential losses from catastrophic events, allowing them to set premiums and manage their reserves more effectively. The adoption of CVaR reflects a growing recognition of the importance of managing tail risk in an increasingly complex and interconnected global financial system.

CVaR vs. VaR: Understanding the Key Differences

Conditional Value at Risk (CVaR) and Value at Risk (VaR) are both risk measures used extensively in finance, but they differ significantly in their approach and the information they provide. VaR estimates the maximum loss expected over a specific time horizon at a given confidence level. For instance, a 95% VaR of $1 million suggests there is a 5% chance of losing more than $1 million. However, VaR doesn’t quantify the magnitude of losses exceeding this threshold.

CVaR, also known as Expected Shortfall, addresses this limitation by calculating the expected loss, given that the loss exceeds the VaR level. In other words, it quantifies the average loss in the worst-case scenarios beyond the VaR threshold. This makes CVaR a more sensitive measure of tail risk, particularly relevant when dealing with fat-tailed distributions where extreme events are more likely. A key advantage of CVaR is its coherence, meaning it satisfies the properties of subadditivity, monotonicity, homogeneity, and translation invariance, making it a more reliable measure for portfolio optimization and risk aggregation. The subadditivity property, in particular, ensures that the CVaR of a portfolio is never greater than the sum of the CVaRs of its individual components, a desirable characteristic for risk management. The conditional value at risk formula helps capture the expected loss when the VaR threshold is breached, making it more comprehensive.

While CVaR offers a more complete picture of tail risk and boasts superior mathematical properties, VaR remains widely used due to its simplicity and ease of calculation. The conditional value at risk formula is more complex than the VaR calculation. VaR can be more appropriate when the focus is solely on estimating the probability of exceeding a specific loss threshold, without needing to quantify the expected magnitude of losses beyond that point. However, when assessing risk exposure in situations involving potentially large and devastating losses, CVaR provides a more prudent and informative measure. Furthermore, certain regulatory frameworks now explicitly favor CVaR (or Expected Shortfall) over VaR, recognizing its greater sensitivity to tail risk and its ability to incentivize more conservative risk management practices. Despite the advantages of CVaR, it is also important to acknowledge that both measures rely on assumptions about the distribution of returns and can be sensitive to input parameters. The choice between VaR and CVaR depends on the specific application, the level of risk aversion, and the regulatory context, but in many situations, the conditional value at risk formula provides a better gauge of true risk exposure.

Tools and Software for CVaR Calculation

Calculating Conditional Value at Risk (CVaR) often requires specialized tools due to the complexity of the conditional value at risk formula and the data involved. Fortunately, various software packages and libraries are available to streamline this process. These tools cater to different needs, ranging from academic research to professional risk management.

For users comfortable with statistical programming, R offers several powerful packages. The “PerformanceAnalytics” package is a popular choice, providing functions for calculating various risk measures, including CVaR (also known as Expected Shortfall). Similarly, “quantmod” facilitates the acquisition and analysis of financial data, complementing the risk analysis capabilities of “PerformanceAnalytics.” Python is another excellent option, with libraries like SciPy and NumPy offering the numerical computation capabilities needed for CVaR calculations. These libraries allow users to implement the conditional value at risk formula from scratch or utilize pre-built functions for common statistical tasks.

Beyond open-source solutions, numerous commercial risk management software packages incorporate CVaR calculation capabilities. These platforms often provide a user-friendly interface and a comprehensive suite of tools for risk analysis, portfolio optimization, and regulatory reporting. Examples include Moody’s Analytics, RiskMetrics, and Bloomberg PORT. When selecting a tool, consider factors such as the size and complexity of your data, the desired level of customization, and your budget. Evaluate whether a programming-based approach or a commercial software package best aligns with your needs and resources. The proper application of the conditional value at risk formula is essential, and these tools can significantly aid in its accurate and efficient calculation.

Addressing the Limitations of CVaR

While Conditional Value at Risk (CVaR) offers significant advantages over other risk measures like VaR, it is crucial to acknowledge its limitations. The conditional value at risk formula relies on specific input parameters, making it sensitive to their accuracy. Small changes in these parameters can lead to substantial variations in the calculated CVaR value. This sensitivity highlights the importance of careful data selection and validation. The conditional value at risk formula also depends on model assumptions about the distribution of losses. If these assumptions are not valid, the CVaR estimate may be inaccurate. For example, assuming a normal distribution when losses exhibit fat tails can lead to an underestimation of tail risk. The conditional value at risk formula is not a perfect predictor.

Another limitation of CVaR is its potential for underestimating extreme losses, particularly in situations with highly non-normal loss distributions or when dealing with systemic risk. While CVaR captures the expected loss beyond the VaR threshold, it does not necessarily capture the worst-case scenario. This is because the conditional value at risk formula focuses on the average loss within the tail, rather than the maximum possible loss. Furthermore, CVaR can be computationally intensive to calculate, especially when using Monte Carlo simulation techniques. This can be a barrier to its adoption in situations where real-time risk assessment is required. Addressing these limitations requires a multifaceted approach.

Several methods can be employed to mitigate the limitations of CVaR. Robust estimation techniques can be used to reduce the sensitivity of the conditional value at risk formula to input parameters. Stress testing can be incorporated to assess the potential impact of extreme events that are not adequately captured by the historical data. Combining CVaR with other risk measures, such as VaR and stress testing, can provide a more holistic view of risk exposure. It is also important to regularly review and validate the models used to estimate CVaR, and to update them as new data becomes available. The conditional value at risk formula should be seen as one tool among many in a comprehensive risk management framework. No single risk measure is perfect, and a holistic approach is essential for effective risk management. Understanding the limitations of the conditional value at risk formula is just as important as understanding its strengths.