Understanding the Russell 2000 Index

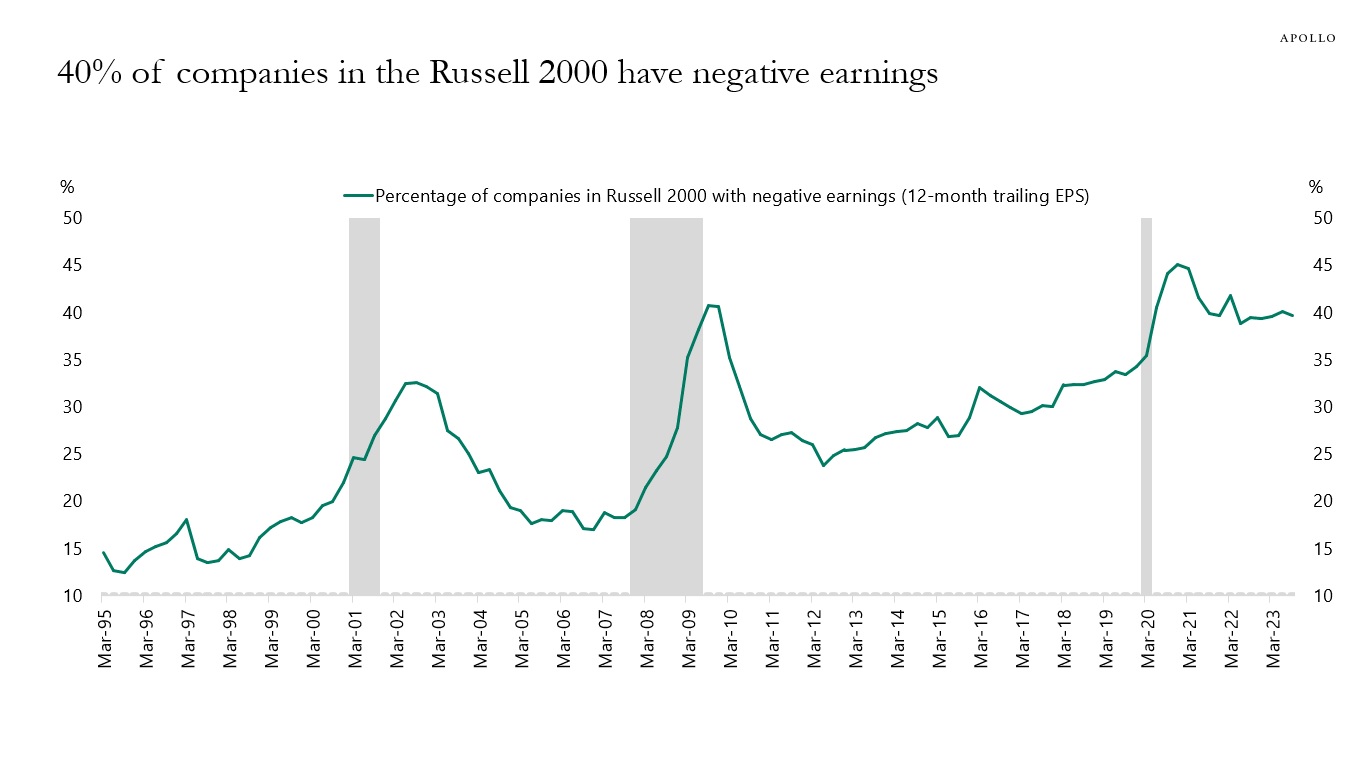

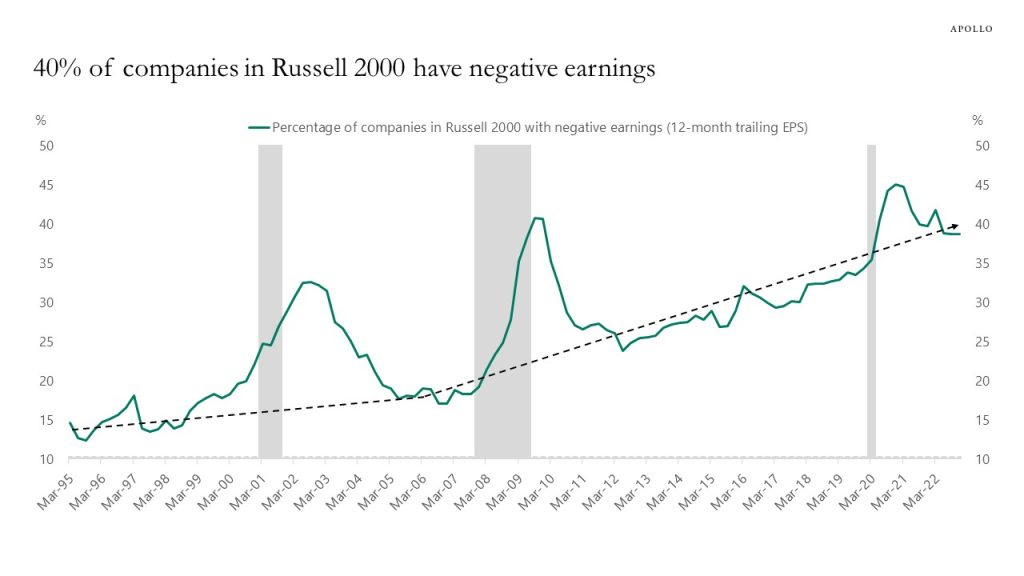

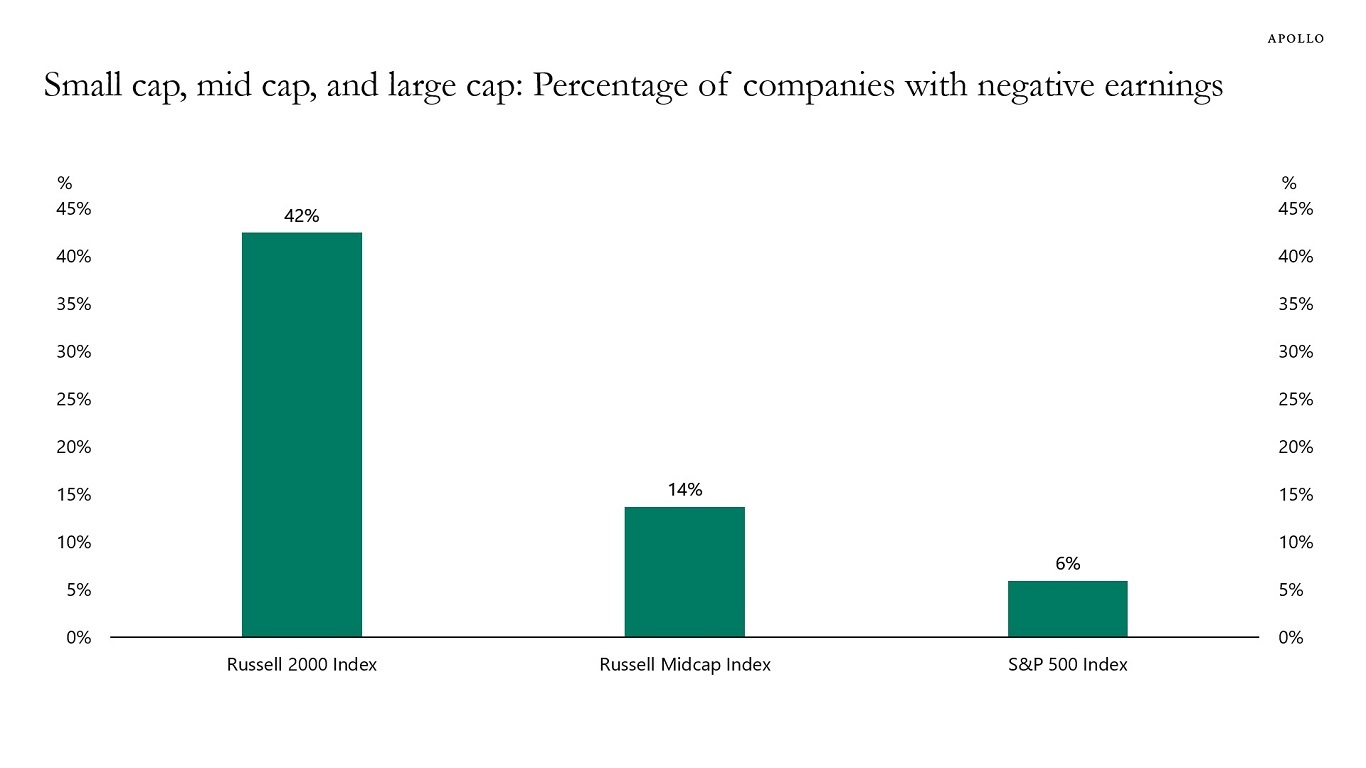

The Russell 2000 Index tracks the performance of the smallest 2000 companies in the US equity market. It serves as a crucial benchmark for small-cap investing, providing a broad representation of this dynamic segment. Unlike the S&P 500, which focuses on large-cap companies, the Russell 2000 offers exposure to companies with smaller market capitalizations, often exhibiting higher growth potential but also increased volatility. Investors are drawn to companies in the Russell 2000 because of the potential for significant returns, although these returns often come with higher risk. Understanding the nuances of this index is vital for any investor considering exposure to companies in the Russell 2000. The index’s composition is regularly rebalanced, ensuring it accurately reflects the current landscape of small-cap companies in the US. This dynamism makes it a challenging but potentially rewarding market for skilled investors. The Russell 2000 offers a distinct alternative to large-cap investing, appealing to those seeking higher growth opportunities. Many investors believe that companies in the Russell 2000 represent a significant portion of the overall market’s growth potential. The inclusion of smaller, faster-growing companies provides a different investment profile compared to larger, more established firms.

Analyzing the Russell 2000 requires a deep understanding of small-cap investing strategies. Identifying promising companies in the Russell 2000 necessitates a robust approach to fundamental analysis. This includes carefully examining financial statements, industry trends, and competitive dynamics. Investors often use screening tools to identify companies that meet their specific criteria, focusing on factors such as revenue growth, profitability, and debt levels. Successful investing in companies in the Russell 2000 often involves identifying companies poised for significant future growth. This requires not only evaluating current performance but also forecasting future potential. The market capitalization of companies in the Russell 2000 is a key factor to consider, as it can indicate both opportunity and risk. Smaller market caps often mean higher volatility but also the potential for greater price appreciation. Understanding these factors is essential for navigating this unique market segment. The right approach to analyzing companies in the Russell 2000 can lead to attractive returns over time.

The Russell 2000 index offers a unique investment landscape compared to large-cap indices like the S&P 500. While the S&P 500 focuses on established, large companies, the Russell 2000 provides access to a diverse range of smaller, growth-oriented companies. This difference in company size and maturity translates to distinct risk and return profiles. Companies in the Russell 2000 are generally characterized by higher growth potential and volatility. This is why many investors allocate a portion of their portfolio to this segment, seeking diversification and higher growth possibilities, though accepting higher risk. Thorough research and a well-defined investment strategy are crucial for successfully navigating the intricacies of the Russell 2000 and identifying promising companies within it. The inherent volatility requires a long-term perspective and a well-diversified portfolio to mitigate potential losses. Careful selection of companies in the Russell 2000 is paramount for maximizing returns while effectively managing risk. The index provides a rich pool of opportunities for investors who understand and embrace the challenges associated with small-cap investing.

Identifying Promising Small-Cap Stocks

Investors seeking opportunities in companies in the Russell 2000 often prioritize several key characteristics. Growth potential is paramount. One looks for companies demonstrating strong historical revenue growth and exhibiting a clear path to continued expansion. Market capitalization, while inherently smaller than large-cap counterparts, should still be substantial enough to offer liquidity and mitigate excessive risk. Profitability, or the clear potential for profitability in the near future, is crucial. Companies showing consistent improvement in margins are often favored. High levels of debt can be a significant red flag; a healthy balance sheet is desirable in companies in the Russell 2000. Finally, understanding prevailing industry trends is vital. Investing in companies positioned to benefit from positive industry shifts offers increased chances of success. Fundamental analysis, using financial statements and industry reports, plays a crucial role in this evaluation process. This thorough approach helps identify the most promising companies in the Russell 2000.

Screening tools and resources are readily available to aid in identifying potentially successful companies in the Russell 2000. Many financial data providers offer robust screening capabilities, allowing investors to filter companies based on specific criteria such as revenue growth, profit margins, debt levels, and market capitalization. These tools allow investors to narrow their focus to companies that meet their predefined investment parameters. Furthermore, analyzing financial statements—income statements, balance sheets, and cash flow statements—provides crucial insights into a company’s financial health and performance. Investors also assess management quality; a strong, experienced management team is often a key factor in a company’s success. Analyzing industry reports and competitive landscapes further helps determine a company’s long-term prospects. The combination of efficient screening and in-depth analysis allows for more effective identification of promising companies in the Russell 2000.

Beyond the quantitative aspects, qualitative factors also influence the selection of companies in the Russell 2000. The overall business model needs to be assessed for its scalability and long-term viability. The competitive landscape and the company’s position within that landscape warrant careful scrutiny. Intellectual property, patents, or brand recognition can significantly impact a company’s competitive advantage. Access to capital and management’s ability to execute its strategy are also crucial. A combination of quantitative screening and qualitative assessment helps identify well-positioned companies in the Russell 2000, improving the likelihood of investment success. Understanding these diverse factors contributes to a more thorough and informed investment strategy. This meticulous approach enhances the probability of identifying high-potential companies in the Russell 2000 for long-term growth.

How to Research Russell 2000 Companies Effectively

Thorough research is crucial when considering companies in the Russell 2000. Begin by examining a company’s financial statements. These include the income statement, which reveals revenue, costs, and profitability; the balance sheet, showcasing assets, liabilities, and equity; and the cash flow statement, detailing cash inflows and outflows. Analyzing these statements provides insights into a company’s financial health and performance. Publicly available data sources like the SEC’s EDGAR database and company investor relations websites offer this information. Investors should also review industry reports from reputable firms to understand market trends and competitive landscapes impacting companies in the Russell 2000. This contextual understanding is critical for informed investment decisions.

Next, assess the management team’s quality. A strong and experienced leadership team often contributes significantly to a company’s success. Look for information about their backgrounds, experience, and track record. News articles, company press releases, and analyst reports can provide valuable information. Consider the company’s competitive landscape. Analyze its market share, competitive advantages, and strategies for maintaining or expanding its market position. Examine factors such as brand recognition, pricing power, and technological innovation. Understanding a company’s competitive advantages is key to evaluating its long-term prospects, especially within the dynamic environment of companies in the Russell 2000.

Finally, integrate all gathered information. Consider how the financial statements reflect the company’s position within its industry. Does the management team’s experience align with the company’s strategy? Is the company well-positioned to compete effectively? By systematically evaluating these aspects, investors can build a comprehensive understanding of companies in the Russell 2000, leading to more informed investment choices. Remember to regularly revisit your research, as market conditions and company performance can change quickly. Continuous monitoring is essential for successful small-cap investing.

Analyzing Financial Performance: Key Metrics for Companies in the Russell 2000

Analyzing the financial health of companies in the Russell 2000 requires a deep dive into key financial metrics. Investors use these ratios to compare companies, assess their performance relative to their industry, and predict future growth. Understanding these metrics is crucial for making informed investment decisions in this dynamic segment of the market. Key ratios include Price-to-Earnings (P/E), Price-to-Sales (P/S), Return on Equity (ROE), and Debt-to-Equity. The P/E ratio shows how much investors are willing to pay for each dollar of a company’s earnings. A high P/E ratio might indicate high growth expectations, but it could also signal overvaluation. Conversely, a low P/E ratio might suggest undervaluation or potential problems with the company’s profitability. Companies in the Russell 2000 often exhibit varying P/E ratios reflecting their stage of growth and industry.

The Price-to-Sales (P/S) ratio provides another perspective on valuation, comparing a company’s market capitalization to its revenue. This ratio is particularly useful for evaluating companies with negative earnings, as it offers a valuation benchmark regardless of profitability. A low P/S ratio can suggest undervaluation, while a high P/S ratio might indicate overvaluation or high growth potential. For companies in the Russell 2000, careful analysis of P/S ratios within their respective sectors is vital. Return on Equity (ROE) measures how effectively a company uses shareholder investments to generate profits. A high ROE signifies efficient use of capital and strong profitability. Investors use ROE to compare the profitability of companies in the Russell 2000 against their peers and industry benchmarks. A declining ROE may signal deteriorating efficiency or management issues.

Finally, the Debt-to-Equity ratio assesses a company’s financial leverage by comparing its total debt to its shareholder equity. A high Debt-to-Equity ratio suggests higher financial risk, as the company relies heavily on debt financing. This is especially important for companies in the Russell 2000, which often have less established track records than larger companies. A low Debt-to-Equity ratio indicates a more conservative financial strategy. Careful consideration of these key financial metrics, alongside qualitative factors such as management quality and industry trends, provides a robust assessment of companies in the Russell 2000. Remember that no single ratio tells the whole story; a comprehensive analysis is essential for successful investing. Analyzing these ratios in conjunction with other qualitative factors such as management quality, competitive landscape, and industry trends enables a more holistic understanding of the companies in the Russell 2000. This combination provides a strong basis for informed investment decisions.

Assessing Growth Potential and Risk in Companies in the Russell 2000

Investing in companies in the Russell 2000 requires a careful assessment of both growth potential and inherent risk. Growth potential stems from various factors. New product launches can significantly boost revenue. Successful market expansion into new geographical areas or demographics fuels expansion. Strategic acquisitions of complementary businesses enhance market share and capabilities. Technological innovation allows companies to offer superior products or services, driving demand. Analyzing a company’s competitive advantages, such as strong brand recognition or proprietary technology, helps predict future growth. Investors should examine financial projections, market research, and industry trends to gauge a company’s realistic growth prospects. Companies in the Russell 2000 often exhibit higher growth potential than established large-cap firms, but this potential is accompanied by greater risk.

Risk assessment for companies in the Russell 2000 is crucial. Market volatility significantly impacts smaller companies more than larger, more established ones. Smaller market capitalization means price swings can be more dramatic. Company-specific risks, such as management changes, operational challenges, or financial difficulties, also pose a threat. Debt levels are another key factor to analyze. High debt can increase vulnerability during economic downturns. Regulatory changes within the industry can also negatively impact a company’s performance. A thorough understanding of the company’s business model, its competitive landscape, and macroeconomic factors is necessary to assess the risk profile. Investors should consider diversifying their investments across various sectors and companies to mitigate risk. A robust due diligence process, including a thorough review of financial statements and industry reports, is essential before investing in any company in the Russell 2000.

Understanding both the growth potential and the associated risks is paramount for successful investing in companies in the Russell 2000. Investors should develop a well-defined investment strategy that aligns with their risk tolerance and financial goals. This strategy should encompass a diversified portfolio of companies across different sectors and a careful assessment of each company’s unique circumstances. Regular monitoring of investment performance and adjustments to the portfolio as needed are vital aspects of managing risk and maximizing returns in this dynamic market segment. Remember, thorough research and a long-term perspective are critical to navigating the opportunities and challenges presented by companies in the Russell 2000.

Diversification Strategies within the Russell 2000

Diversification is crucial when investing in the Russell 2000, mitigating the inherent risks associated with small-cap companies. Companies in the Russell 2000, while offering high growth potential, are also more volatile than larger, established firms. A diversified portfolio reduces the impact of any single company’s underperformance. One effective approach involves sector diversification. Investors can spread their investments across various sectors represented within the Russell 2000, such as technology, healthcare, or consumer staples. This strategy reduces reliance on any single industry’s performance. Another layer of diversification involves considering different market capitalizations within the Russell 2000 itself. While all companies are considered small-cap, there’s a range within that classification. Investing across this range can provide a more balanced exposure to various growth stages and risk profiles among companies in the Russell 2000. This approach adds another level of risk mitigation. Remember, thorough research is vital for all diversification approaches.

Exchange-traded funds (ETFs) and mutual funds offer a convenient path to diversification within the Russell 2000. These funds hold a basket of companies in the Russell 2000, instantly providing broad exposure. Some ETFs and mutual funds target specific sectors or market cap segments within the index. This allows investors to create a diversified portfolio aligned with their investment goals and risk tolerance. For example, an investor seeking exposure to the technology sector within the small-cap space might select a technology-focused Russell 2000 ETF. By using these vehicles, investors benefit from professional management and the immediate diversification of their investments among companies in the Russell 2000. This approach simplifies the investment process, making it suitable for various investor experience levels. It also offers access to a broader range of companies than an investor could reasonably manage individually.

Ultimately, the best diversification strategy depends on an investor’s individual goals and risk tolerance. However, the importance of diversification when investing in companies in the Russell 2000 cannot be overstated. It’s a fundamental strategy for managing risk and potentially enhancing long-term returns. Whether investors choose a sector-specific approach, a market-cap-based strategy, or leverage ETFs and mutual funds, diversification remains a cornerstone of successful small-cap investing. Carefully considering these options and conducting thorough due diligence on any selected fund or individual companies in the Russell 2000 is key to a robust and well-managed portfolio. Remember that past performance does not guarantee future results. Diversification is not a guarantee against loss, but a vital tool in mitigating risk.

Examples of Successful Russell 2000 Companies

Many companies in the Russell 2000 have demonstrated remarkable growth and success. These companies often exhibit strong innovation, efficient operations, and a keen understanding of market trends. Their journeys highlight the potential for significant returns when investing in smaller-cap companies. Analyzing their strategies offers valuable insights for future investments in companies in the Russell 2000.

Consider, for example, a hypothetical company that initially focused on a niche market within the technology sector. By consistently delivering high-quality products and services, this company achieved strong revenue growth. Strategic acquisitions and expansion into related markets further fueled their success. This demonstrates the power of focused execution and calculated expansion for companies in the Russell 2000. Another successful example might be a company that leveraged technological advancements to disrupt a traditional industry. This innovative approach attracted investors and propelled significant growth. The company’s ability to adapt to changing consumer preferences and effectively manage operational efficiency is a key factor in its success. Studying such examples provides a deeper understanding of what contributes to the success of companies in the Russell 2000.

In addition to the above examples, many companies in the Russell 2000 have seen substantial growth by focusing on sustainable practices. Environmental, social, and governance (ESG) factors are increasingly important to investors. Companies demonstrating a strong commitment to ESG principles often attract significant investment, showcasing a trend within companies in the Russell 2000. This reflects a broader shift in investor preferences and a recognition of the long-term value of sustainable business practices. These case studies illustrate the diverse paths to success within the Russell 2000 and the importance of considering various factors when selecting investment opportunities. Understanding the diverse strategies employed by successful companies in the Russell 2000 allows investors to identify companies with high growth potential.

Investing in the Russell 2000: Practical Tips

Investing in companies in the Russell 2000 requires a strategic approach. Begin by defining clear investment goals. Are you aiming for long-term growth, capital preservation, or a blend of both? Understanding your objectives helps shape your investment strategy. Next, assess your risk tolerance. Small-cap stocks, including companies in the Russell 2000, inherently carry more risk than large-cap investments. A higher risk tolerance allows for a more aggressive approach, while a lower tolerance suggests a more conservative strategy involving diversification. Determining your risk profile guides portfolio allocation decisions.

Several investment vehicles provide access to companies in the Russell 2000. Exchange-Traded Funds (ETFs) offer diversified exposure to the index as a whole. Mutual funds provide similar diversification but with active management. Individual stock selection allows for targeted investments in specific companies, but demands in-depth research and carries higher risk. Choose the vehicle aligning with your investment goals, risk tolerance, and resources. Regularly monitor your investments. Track performance, adjust the portfolio as needed based on market trends and company performance. Rebalancing is crucial to maintain the desired asset allocation. Remember that successful investing in companies in the Russell 2000 often requires a long-term perspective. Short-term market fluctuations are normal; focus on the long-term growth potential.

Successful investing in companies in the Russell 2000 hinges on thorough due diligence. Research individual companies’ financials, competitive landscapes, and management teams before investing. Utilize reputable financial data sources to inform your decisions. Remember that diversification within the Russell 2000 itself is key to mitigating risk. Don’t put all your eggs in one basket. Spread investments across various sectors and consider different market caps within the index for a more robust portfolio. Consistent monitoring and a long-term outlook are paramount for navigating the volatility inherent in the small-cap market. These factors, when combined with a well-defined strategy, enhance the chances of success when investing in these dynamic companies in the Russell 2000.