Understanding the 10-Year Treasury Note

A 10-year Treasury note is a debt security issued by the U.S. government. Investors lend money to the government for 10 years, receiving interest payments along the way. This simple concept makes them a cornerstone of the global financial system. The 10-year Treasury note serves as a benchmark for interest rates, influencing borrowing costs across the economy. Understanding this note is crucial for interpreting the cnbc 10 year treasury rate and its implications. The yield on this note reflects investor sentiment and expectations about future economic growth. It’s a key indicator watched closely by financial markets worldwide, and a significant component of the cnbc 10 year treasury rate coverage.

The U.S. government issues these notes to finance its spending. They’re considered one of the safest investments globally due to the backing of the full faith and credit of the U.S. government. This safety makes them attractive to investors seeking low-risk returns. The demand for these notes directly impacts their yield, which in turn influences other interest rates. The cnbc 10 year treasury rate analysis often highlights the relationship between Treasury yields and other interest rates. This provides a clear picture of how government borrowing costs ripple through the broader economy, affecting everything from mortgages to corporate loans. Consequently, the cnbc 10 year treasury rate becomes a valuable indicator of economic health.

Because the 10-year Treasury yield serves as a benchmark, it affects numerous aspects of the financial markets and the broader economy. Changes in the cnbc 10 year treasury rate are closely followed by investors, economists, and policymakers alike. It plays a crucial role in shaping investment strategies and influencing the overall economic climate. For example, a rising 10-year yield often signals growing confidence in the economy, while a falling yield might indicate concerns about future economic growth. The cnbc 10 year treasury rate reporting helps individuals understand this complex relationship.

Why the 10-Year Treasury Rate Matters

The 10-year Treasury yield holds significant weight in the financial world. It acts as a benchmark for interest rates across the economy. This rate influences borrowing costs for businesses and consumers alike. Lower yields encourage borrowing and investment, while higher yields can slow economic activity. Mortgage rates, for example, are often tied to the 10-year Treasury yield. A rise in this yield typically leads to higher mortgage rates, impacting the housing market. Similarly, corporate borrowing costs are also affected, influencing business investment decisions and overall economic growth. The CNBC 10 year treasury rate is frequently discussed because of its broad implications.

The 10-year Treasury yield is also considered a leading economic indicator. Changes in this rate can often foreshadow future economic trends. A rising yield might signal expectations of stronger economic growth or increased inflation. Conversely, a falling yield could suggest concerns about economic slowdown or deflation. Market participants and economists closely monitor this rate to gauge the overall health of the economy. CNBC’s coverage of the 10-year Treasury rate reflects its importance in understanding economic conditions and market sentiment. The cnbc 10 year treasury rate analysis provides valuable insights for investors and policymakers.

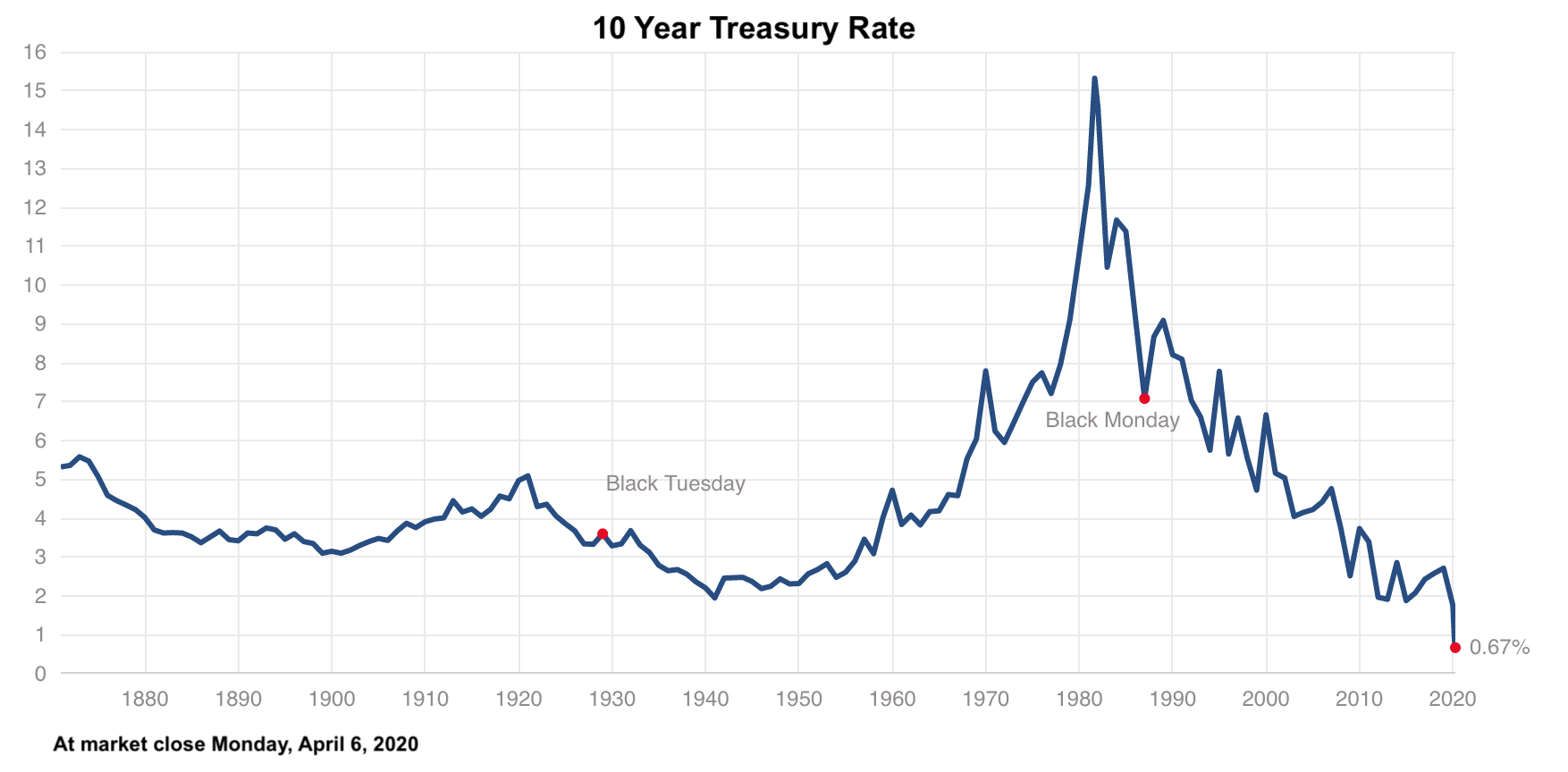

CNBC’s extensive coverage of the 10-year Treasury yield underscores its crucial role in financial markets. The network’s analysis goes beyond simply reporting the number; it delves into the underlying economic forces driving the rate’s movement. Experts regularly discuss the implications for various asset classes, including bonds, stocks, and real estate. This in-depth analysis, often coupled with charts and graphs, helps viewers understand the complexities of the financial markets and make informed investment decisions. Understanding the cnbc 10 year treasury rate reporting is critical for investors who want to stay abreast of market trends and opportunities. The cnbc 10 year treasury rate is a key component of their broader economic coverage. The network’s analysis helps investors navigate complex market dynamics, providing a clearer understanding of potential risks and rewards.

How CNBC Reports on the 10-Year Treasury Rate

CNBC, a leading financial news network, provides extensive coverage of the 10-year Treasury rate. The network integrates this crucial economic indicator into various segments across its programming. Viewers can expect to find analysis of the cnbc 10 year treasury rate during market updates, dedicated economic reports, and interviews with financial experts. CNBC utilizes various formats to present this information, including dynamic charts illustrating historical trends and projected movements, along with detailed graphs comparing the 10-year Treasury yield against other key economic metrics. The network often uses these visual aids to provide context and facilitate understanding of the cnbc 10 year treasury rate’s impact on the broader financial landscape.

Specific shows like “Squawk Box,” “Squawk on the Street,” and “Closing Bell” frequently feature discussions on the 10-year Treasury rate. The network’s analysts provide insights into the current rate, offering explanations for recent movements. They often discuss implications for the economy, forecasting future trends based on various economic models and assessing the potential impact on other asset classes. These segments commonly involve interviews with economists and portfolio managers. These experts offer diverse viewpoints on the implications of the cnbc 10 year treasury rate and its effect on investment strategies. The discussions often include perspectives on how shifts in the 10-year Treasury rate influence investor behavior and portfolio allocations.

CNBC’s reporting style for the cnbc 10 year treasury rate emphasizes clarity and accessibility. The network aims to provide concise explanations for even complex economic concepts. They use clear and simple language, supporting their analysis with readily understandable visuals. This approach facilitates comprehension for a broad audience, ranging from seasoned investors to individuals new to the financial markets. The network aims to present unbiased information. It acknowledges potential factors influencing the 10-year Treasury rate and encourages viewers to form their own informed opinions. By presenting data and expert perspectives, CNBC aims to equip viewers with the tools to analyze the cnbc 10 year treasury rate’s influence on their personal financial decisions. This comprehensive coverage positions CNBC as a significant source for insights into the cnbc 10 year treasury rate and its implications for the market.

Interpreting CNBC’s Analysis: What to Look For

Understanding how to interpret CNBC’s coverage of the cnbc 10 year treasury rate is crucial for investors. CNBC, like any news outlet, presents information through a particular lens. Analysts often highlight specific economic theories or perspectives. Their reporting may emphasize short-term market movements over long-term trends. Recognizing these potential biases allows for a more nuanced understanding of the cnbc 10 year treasury rate information presented. Investors should consider multiple viewpoints, consulting diverse sources to form a comprehensive picture.

To effectively utilize CNBC’s cnbc 10 year treasury rate reporting, focus on identifying key takeaways. Pay close attention to the underlying economic factors discussed. Note any correlation between the 10-year yield and other market indicators. Consider the implications for various asset classes, including bonds, stocks, and real estate. For example, a rising 10-year yield might signal increased borrowing costs for businesses, potentially impacting corporate earnings. Conversely, a falling yield could suggest investors are seeking safer assets, potentially indicating economic uncertainty. Always consider the broader economic context surrounding the cnbc 10 year treasury rate discussion.

Remember, the cnbc 10 year treasury rate is just one piece of a larger economic puzzle. CNBC’s analysis provides valuable insights, but it shouldn’t be the sole determinant of investment decisions. Investors should cross-reference CNBC’s reporting with data from other reputable sources. This approach ensures a more well-rounded perspective, reducing reliance on a single source’s potential biases. By critically evaluating the information presented and considering diverse viewpoints, investors can more effectively utilize the cnbc 10 year treasury rate data in their investment strategies. Remember, informed decision-making requires a comprehensive understanding of the market and multiple perspectives. The cnbc 10 year treasury rate is a key indicator, but not the only factor to consider.

Factors Influencing the 10-Year Treasury Yield

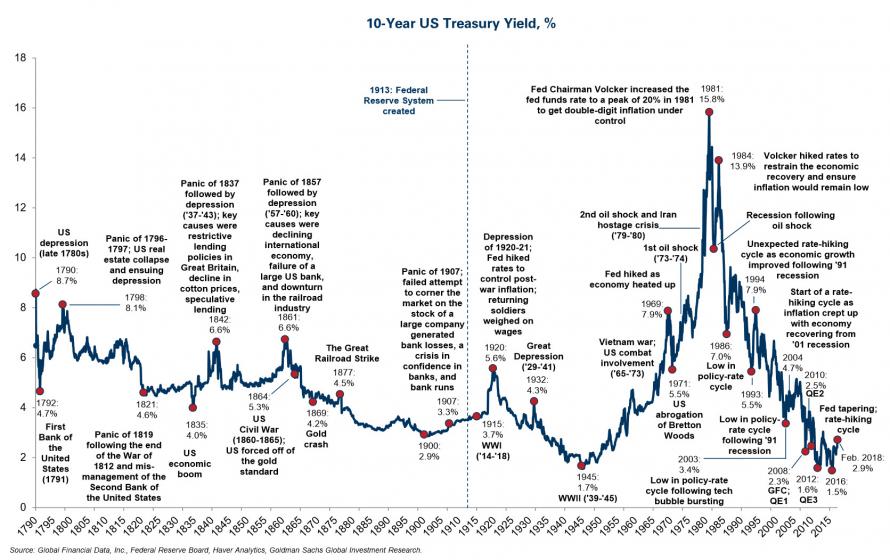

The 10-year Treasury yield, frequently covered by CNBC, is a dynamic figure influenced by a complex interplay of economic factors. Inflation plays a crucial role. Higher inflation expectations generally push yields upward, as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, lower inflation tends to suppress yields. The Federal Reserve’s monetary policy significantly impacts the cnbc 10 year treasury rate. Interest rate hikes increase yields by making Treasury bonds more attractive relative to other investments. Conversely, quantitative easing (QE), where the Fed buys Treasury bonds, typically lowers yields. Economic growth also influences the cnbc 10 year treasury rate. Strong economic growth often leads to higher yields as investors anticipate increased borrowing and higher inflation. Conversely, weak growth can suppress yields.

Global economic events exert considerable influence on the 10-year Treasury yield. Geopolitical instability, international trade disputes, or major economic shocks in other countries can cause significant shifts in investor sentiment, thereby affecting the demand for US Treasury bonds and influencing yields. For example, a global recession might lead investors to seek the safety of US Treasuries, driving down yields. Conversely, a period of strong global growth might increase yields as investors seek higher returns in other markets. The interplay between these factors creates a constantly evolving landscape for the 10-year Treasury yield, making it a key focus for CNBC’s economic analysis. Understanding these factors is crucial for interpreting CNBC’s reporting on the cnbc 10 year treasury rate and its implications for the broader economy. Analyzing how these factors interact provides a comprehensive perspective on yield movements.

The relationship between inflation and the cnbc 10 year treasury rate is particularly important. When inflation rises, the real return on a fixed-income investment like a Treasury bond declines. Investors, therefore, demand a higher yield to compensate for this inflation risk. This relationship is often highlighted in CNBC’s coverage, emphasizing the importance of inflation expectations in driving yield movements. The Federal Reserve’s actions directly influence the cnbc 10 year treasury rate. When the Fed raises interest rates, it becomes more expensive for the government to borrow money, which tends to push yields higher. Conversely, when the Fed lowers rates or engages in QE, it can drive yields lower. This dynamic is central to CNBC’s analysis of the cnbc 10 year treasury rate and its implications for the economy. Understanding these relationships allows investors to better understand the market forces driving the cnbc 10 year treasury rate and make more informed investment decisions.

How to Use the 10-Year Treasury Yield in Your Investment Strategy

The 10-year Treasury yield, frequently covered by CNBC, serves as a crucial benchmark for various investment strategies. Understanding its movements can significantly impact your portfolio’s performance. For bond investors, the yield directly influences returns. A rising yield suggests higher returns on newly issued bonds, while a falling yield indicates potentially higher prices for existing bonds. Investors should carefully consider their risk tolerance and investment horizon when making bond investment decisions based on the cnbc 10 year treasury rate.

The cnbc 10 year treasury rate also plays a role in stock market investing. A rising yield often reflects a strengthening economy, which can boost corporate earnings and stock prices. Conversely, a falling yield might signal economic slowdown or concerns about future growth, potentially leading to lower stock valuations. Investors should analyze the relationship between the 10-year yield and specific sectors to make informed equity investment choices. For example, sectors like utilities and consumer staples are typically seen as less risky and might perform better during times of lower yields, while growth stocks could be more sensitive to changes in the cnbc 10 year treasury rate.

Real estate investment is also influenced by the 10-year Treasury yield. Mortgage rates tend to track the 10-year yield, meaning a higher yield often results in higher mortgage rates, making borrowing more expensive. This affects both residential and commercial real estate investments. Investors should consider the implications of rising or falling yields when evaluating real estate opportunities and making financing decisions. They should also look at how the cnbc 10 year treasury rate impacts overall market sentiment, and how this could influence property values and rental income potential. Careful analysis of the prevailing yield and its projected trajectory is critical for maximizing returns in the real estate market.

The Relationship Between the 10-Year Treasury Yield and Other Market Indicators

The 10-year Treasury yield, a key focus of CNBC’s financial reporting, doesn’t exist in a vacuum. It shows a significant correlation with other major market indicators. Understanding these relationships is crucial for informed investment strategies. For example, the yield often inversely correlates with the S&P 500. When the 10-year Treasury yield rises, signaling potentially higher borrowing costs and a less favorable economic outlook, investors may shift away from riskier assets like stocks, leading to a decline in the S&P 500. Conversely, a falling yield can suggest a more favorable economic environment, potentially boosting investor confidence and driving up stock prices. The CNBC 10 year treasury rate coverage frequently highlights these dynamics.

Another important relationship exists between the 10-year Treasury yield and the dollar index. A rising yield can attract foreign investment into US Treasury bonds, increasing demand for the dollar and strengthening its value. This is because higher yields offer better returns compared to bonds in other countries. Conversely, a falling yield may weaken the dollar’s appeal, leading to a decrease in the dollar index. This interplay is frequently analyzed by CNBC’s financial experts. Their insights on the cnbc 10 year treasury rate and its effect on the dollar often provide valuable context for currency traders. Monitoring these movements allows investors to navigate the currency markets effectively.

Finally, the 10-year Treasury yield also shows some correlation with commodity prices. Rising yields can signal tighter monetary policy, potentially slowing economic growth and reducing demand for commodities. This can lead to lower commodity prices. Conversely, falling yields, indicating a more accommodative monetary policy, may stimulate economic activity and increase demand for commodities, thus raising their prices. CNBC’s analysis of the cnbc 10 year treasury rate often incorporates these factors, providing a comprehensive view of its impact across various asset classes. The network’s experts often discuss the implications of these relationships for investors, helping viewers make informed decisions. Understanding these interconnections is key to interpreting CNBC’s coverage of the 10-year Treasury yield and its implications for a diversified investment portfolio.

Staying Informed About the 10-Year Treasury Rate: Resources Beyond CNBC

While CNBC offers valuable coverage of the cnbc 10 year treasury rate, relying solely on one source can limit perspective. Investors should supplement their understanding by consulting diverse information providers. Government websites, such as the U.S. Treasury Department’s website, offer official data and analysis on Treasury yields. These provide a direct and unbiased source of information. They are crucial for confirming the accuracy of reports from other sources.

Numerous reputable financial news outlets provide in-depth analysis of the cnbc 10 year treasury rate. These sources often offer different perspectives and interpretations, enriching the overall understanding. They also frequently incorporate commentary from economists and market analysts. This adds another layer of valuable insight to the discussion. Remember to always critically evaluate the information presented.

Finally, accessing economic data providers can enhance your understanding. These sources offer comprehensive datasets and forecasting tools. They also present historical trends and relationships between the 10-year Treasury yield and other economic indicators. This helps form a more comprehensive picture of the financial landscape. Using multiple sources helps avoid potential biases and ensures a well-rounded perspective on the cnbc 10 year treasury rate and its implications. This multifaceted approach is essential for informed decision-making in the ever-evolving financial markets. Diversification of information sources minimizes reliance on a single narrative.