Decoding the Benchmark: What Drives Treasury Note Values?

The 10-year Treasury note is a debt security issued by the U.S. government with a maturity of ten years. It serves as a benchmark interest rate for the U.S. economy, reflecting market sentiment about the nation’s financial health. Investors and economists closely monitor its yield because it influences various other interest rates, including mortgage rates and corporate bond yields. The cnbc 10 year treasury rate is considered a bellwether of economic confidence. Its fluctuations often signal shifts in investor expectations regarding economic growth, inflation, and monetary policy. A rising 10-year Treasury yield typically suggests that investors anticipate stronger economic growth and potentially higher inflation. Conversely, a falling yield may indicate concerns about a slowing economy or deflationary pressures. Understanding the 10-year Treasury note is crucial for grasping the broader dynamics of the financial markets.

The value of the 10-year Treasury note is determined by supply and demand in the bond market. Several factors influence this supply and demand, impacting the cnbc 10 year treasury rate. These factors include the Federal Reserve’s monetary policy decisions, such as changes in the federal funds rate and quantitative easing programs. Economic data releases, like inflation reports, GDP growth figures, and employment numbers, also play a significant role. Strong economic data typically leads to higher yields as investors anticipate increased inflation and potential interest rate hikes by the Federal Reserve. Geopolitical events and global economic conditions can also impact the 10-year Treasury yield. During times of uncertainty, investors often seek the safety of U.S. Treasury bonds, driving up demand and lowering yields. The cnbc 10 year treasury rate is a key indicator of global economic stability.

Moreover, investor expectations about future inflation are a primary driver of the 10-year Treasury yield. Inflation erodes the purchasing power of future fixed income payments, so investors demand a higher yield to compensate for this risk. The difference between the 10-year Treasury yield and inflation expectations, known as the real yield, reflects the actual return investors are earning after accounting for inflation. Changes in inflation expectations can lead to significant swings in the 10-year Treasury yield, impacting the cnbc 10 year treasury rate. Analyzing these movements provides valuable insights into market perceptions of economic risk and future growth prospects. The cnbc 10 year treasury rate, therefore, acts as a vital barometer of the U.S. economy and the global financial landscape.

How to Track Treasury Yield Fluctuations: A Step-by-Step Approach

Tracking the 10-year Treasury yield is essential for investors and anyone interested in the financial markets. The 10-year Treasury note serves as a benchmark for many other interest rates, so monitoring its yield provides valuable insights into the economy. This guide offers a clear, step-by-step approach to finding and tracking this important rate. One reliable source is the official website of the U.S. Treasury. This site provides accurate and up-to-date information on all Treasury securities, including the 10-year note. You can easily find the current yield and historical data on this website. For more frequent updates, consider using reputable financial news websites. Many of these sites offer real-time quotes and charts of the 10-year Treasury yield. While it’s crucial to stay informed, always prioritize credible sources to ensure the accuracy of the data you’re using. Many brokerage platforms also provide tools for tracking Treasury yields. If you have an account with a brokerage, you can typically find the 10-year Treasury yield within their platform. These platforms often offer advanced charting tools and analysis features.

When tracking the 10-year Treasury yield, it’s important to understand what factors can influence its movement. Economic data releases, such as inflation reports and GDP figures, can have a significant impact. Federal Reserve policy decisions also play a key role. Keeping an eye on these factors will help you interpret the changes in the 10-year Treasury yield. Regularly checking the 10-year treasury rate is crucial for understanding market dynamics. The cnbc 10 year treasury rate is a commonly searched term, reflecting the public’s interest in this key indicator. Remember to consult various sources and compare data to get a well-rounded view. Don’t rely solely on one source, as this can lead to biased or inaccurate information. Diversifying your sources ensures you’re getting the most accurate and reliable data available. Whether you’re a seasoned investor or just starting to learn about finance, tracking the 10-year Treasury yield is a valuable skill.

To effectively track the 10-year Treasury yield, establish a routine for checking its value. Set aside specific times each day or week to monitor the yield and any related news. This will help you stay informed about market trends and potential investment opportunities. Also, consider setting up alerts or notifications to be informed of significant changes in the yield. Many financial websites and brokerage platforms offer this feature. This can be especially useful if you’re actively managing investments or closely following the economy. By consistently monitoring the 10-year Treasury yield, you can gain a deeper understanding of the financial markets and make more informed decisions. Monitoring the cnbc 10 year treasury rate and comparing it across platforms is good practice. The cnbc 10 year treasury rate provides a snapshot, but context is always important.

Economic Indicators Influencing Treasury Note Rates

Several key economic indicators significantly influence Treasury yields. Inflation, a general increase in prices, is a major factor. Higher inflation typically leads to higher yields as investors demand a greater return to compensate for the diminished purchasing power of their investment. The Federal Reserve (also known as the Fed), the central bank of the US, plays a crucial role. The Fed’s monetary policy decisions, particularly interest rate adjustments, directly impact Treasury yields. For example, raising interest rates generally increases Treasury yields, making them more attractive to investors seeking higher returns. Conversely, lowering interest rates can decrease yields. Tracking the cnbc 10 year treasury rate alongside Fed announcements offers valuable insights into market reactions. GDP growth, reflecting the overall economic output, also influences yields. Strong economic growth often translates to higher yields, reflecting increased investor confidence and demand for higher-yielding assets. Employment figures, such as the unemployment rate, provide another important signal. Low unemployment typically indicates a strong economy, potentially leading to higher yields. Conversely, high unemployment may suggest economic weakness, which could depress yields. Understanding these interrelationships helps investors and economists interpret shifts in the cnbc 10 year treasury rate more effectively.

Beyond these core indicators, other factors influence Treasury yields. Consumer confidence, investor sentiment, and geopolitical events all play a part. Unexpected events, like trade wars or global crises, can send ripples through the financial markets and directly affect Treasury yields. For instance, during periods of economic uncertainty, investors may rush to the perceived safety of US Treasury bonds. This surge in demand drives bond prices up and yields down. This safe-haven effect is clearly reflected in the cnbc 10 year treasury rate, often dropping during times of geopolitical turmoil. Changes in government spending and debt levels also exert influence. Increased government borrowing can lead to higher Treasury yields as the supply of bonds increases. The cnbc 10 year treasury rate serves as a benchmark, and its fluctuations reflect the combined impact of all these interwoven factors. Investors carefully monitor these indicators to anticipate shifts in the cnbc 10 year treasury rate and adjust their investment strategies accordingly. The interplay between these indicators is complex and dynamic, making it essential to consider a holistic view for accurate interpretation.

The relationship between these indicators and Treasury yields is not always straightforward. Sometimes, conflicting signals emerge, making precise prediction difficult. For example, strong economic growth might push inflation higher, leading to increased yields, but the same growth could also boost investor confidence and lower yields. The cnbc 10 year treasury rate therefore offers a dynamic snapshot reflecting this complex interplay. Analyzing the cnbc 10 year treasury rate in conjunction with these economic factors provides a more complete understanding of market dynamics. This nuanced understanding aids in informed decision-making, whether it is for investment strategies or macroeconomic policy analysis. Careful observation and interpretation of the cnbc 10 year treasury rate, alongside these indicators, is crucial for navigating the complexities of the bond market.

The Bond Market and its Inverse Relationship with Interest Rates

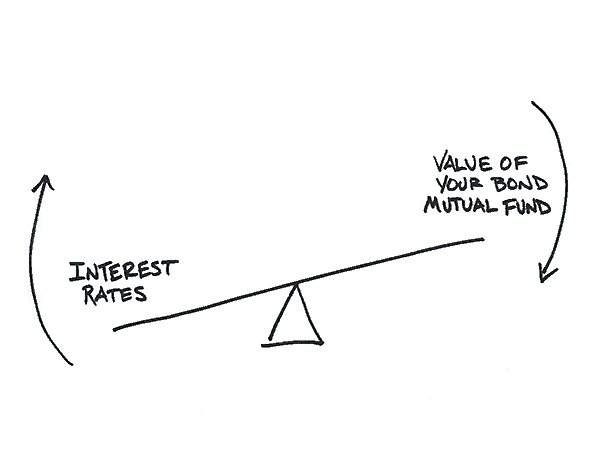

Understanding the relationship between bond prices and yields is crucial for navigating the bond market. This relationship is inverse: when bond prices rise, yields fall, and vice versa. Increased demand for Treasury bonds, like tracking the cnbc 10 year treasury rate, pushes prices upward. This higher price means a lower yield for new investors. Conversely, decreased demand lowers prices, resulting in higher yields. This dynamic reflects investor sentiment and the broader economic outlook. Investors often seek the safety of U.S. Treasuries during times of uncertainty, increasing demand and driving down yields. Conversely, a positive economic outlook might lead investors to seek higher returns elsewhere, decreasing demand for Treasuries and pushing yields up. Monitoring the cnbc 10 year treasury rate offers insights into this interplay.

Several factors contribute to shifts in demand for Treasury bonds. Economic growth prospects influence investor decisions. Strong growth may encourage investment in riskier assets, reducing demand for safer Treasury bonds. Conversely, slower growth or economic uncertainty increases the appeal of Treasuries, boosting demand and driving down yields. Inflation also plays a significant role. High inflation erodes the purchasing power of fixed-income investments like bonds. This can lead to increased demand for higher-yielding bonds, thereby pushing yields upward. The Federal Reserve’s monetary policy also influences yields. Interest rate hikes generally lead to higher Treasury yields, while rate cuts tend to lower them. Investors carefully consider these factors when assessing the cnbc 10 year treasury rate and making investment decisions. The interaction between these factors is complex and constantly evolving.

The interplay between bond prices and yields provides valuable information about market sentiment and economic conditions. Analyzing the cnbc 10 year treasury rate, for example, allows investors to gauge risk appetite. High demand and low yields suggest a flight to safety, indicating potential economic uncertainty. Conversely, low demand and high yields may signal confidence in the economy and a willingness to take on more risk. Understanding this dynamic helps investors make informed decisions and navigate the complexities of the bond market. By closely monitoring indicators like the cnbc 10 year treasury rate, investors can better anticipate market shifts and adjust their strategies accordingly. The inverse relationship between bond prices and yields is a fundamental concept in finance and understanding it is key to successful investment.

The Impact of Global Events on US Treasury Performance

Global events significantly influence the 10-year Treasury yield. Geopolitical instability, for example, often creates uncertainty in financial markets. Investors, seeking a safe haven for their assets, frequently turn to US Treasury bonds. This increased demand drives up bond prices, consequently lowering yields. The perceived safety of US Treasuries during turbulent times makes them a sought-after investment. Tracking the cnbc 10 year treasury rate during such periods can offer insights into the extent of this flight to safety. A sudden spike in global uncertainty, such as a major international conflict or a significant economic crisis, can cause a dramatic drop in yields. The cnbc 10 year treasury rate is often a key indicator of this phenomenon.

Trade wars also exert considerable pressure on the 10-year Treasury yield. Protectionist policies and escalating trade disputes introduce uncertainty into the global economic outlook. This uncertainty can lead to reduced investor confidence and a decreased appetite for riskier assets. As a result, investors may seek the relative safety of US Treasuries, boosting demand and lowering yields. Monitoring the cnbc 10 year treasury rate provides a valuable gauge of investor sentiment amidst trade tensions. Significant shifts in the cnbc 10 year treasury rate often mirror the escalation or de-escalation of trade conflicts, reflecting changing market perceptions of risk and future economic growth. Analysts closely watch this rate to understand the impact of trade policy on broader economic conditions.

Economic crises in other parts of the world can also impact the US Treasury market. When a major economic downturn occurs overseas, investors may seek the stability of US assets, including Treasury bonds. This increased demand pushes up bond prices and reduces yields. The cnbc 10 year treasury rate becomes a vital barometer of global economic health. A sharp decline in the cnbc 10 year treasury rate might suggest a global crisis is prompting investors to seek the perceived safety of US government debt. Analyzing the cnbc 10 year treasury rate in conjunction with other global economic indicators helps paint a more complete picture of the interconnectedness of global finance and the relative safety of US Treasuries during periods of uncertainty.

Treasury Yields and Their Influence on Mortgage Rates

The 10-year Treasury yield and mortgage rates share a close, direct correlation. This relationship plays a significant role in the housing market. Changes in the 10-year Treasury yield often translate into corresponding changes in mortgage rates. When the Treasury yield rises, mortgage rates typically follow suit. Conversely, a decrease in the Treasury yield often leads to lower mortgage rates. Understanding this connection is crucial for potential homebuyers and those involved in the real estate industry. The cnbc 10 year treasury rate is a key indicator.

The impact on home affordability is substantial. Even small fluctuations in mortgage rates can significantly affect the total cost of a home loan. A higher mortgage rate means higher monthly payments for borrowers. This can reduce the number of people who can afford to buy a home. Lower mortgage rates, on the other hand, can make homeownership more accessible. This stimulates demand in the housing market. The cnbc 10 year treasury rate is monitored closely. It influences these financial decisions. The cnbc 10 year treasury rate is a benchmark.

Several factors contribute to this relationship. Mortgage-backed securities (MBS), which are bundles of home loans, are often priced based on the 10-year Treasury yield. Lenders use the Treasury yield as a benchmark for setting mortgage rates. They add a premium to account for the risk associated with lending money for home purchases. This premium covers factors such as credit risk and prepayment risk. Changes in the economic outlook can also influence both Treasury yields and mortgage rates. For example, expectations of higher inflation can push both rates upward. The cnbc 10 year treasury rate is a reflection of these expectations. Therefore, tracking the cnbc 10 year treasury rate provides valuable insights. It helps in understanding potential shifts in the housing market and the overall economy.

How Experts Interpret Shifts in Treasury Note Values

Professional investors, economists, and financial analysts closely monitor the 10-year Treasury yield to assess the overall health of the economy and inform their investment strategies. The 10-year Treasury note serves as a key indicator, reflecting market expectations for economic growth, inflation, and monetary policy. Shifts in the yield can signal changing investor sentiment and potential shifts in the economic landscape. These experts often analyze the yield curve, which represents the difference between short-term and long-term Treasury yields, to gain deeper insights into future economic conditions. A steepening yield curve, where long-term yields rise faster than short-term yields, typically indicates expectations of stronger economic growth and potentially higher inflation. Conversely, a flattening or inverting yield curve, where short-term yields approach or exceed long-term yields, can signal concerns about a potential economic slowdown or recession.

The level of the cnbc 10 year treasury rate is also used to determine relative value across different asset classes. For example, analysts might compare the yield on the 10-year Treasury note to the dividend yield on the S&P 500 or the yields on corporate bonds to assess whether stocks or corporate debt are more attractive relative to the risk-free rate offered by US Treasuries. Furthermore, economists and policymakers pay close attention to how the cnbc 10 year treasury rate responds to economic data releases, such as inflation reports, GDP figures, and employment numbers. Unexpectedly high inflation, for instance, could lead to a spike in the 10-year Treasury yield as investors demand higher compensation for the erosion of purchasing power. Similarly, strong economic growth could push yields higher, reflecting increased demand for capital and expectations of higher future interest rates.

Changes in the cnbc 10 year treasury rate are also scrutinized for their impact on various sectors of the economy, including housing, corporate investment, and consumer spending. For example, rising Treasury yields can lead to higher mortgage rates, which can dampen demand in the housing market. Similarly, higher borrowing costs for corporations can reduce investment in new projects and expansion plans. Thus, understanding how experts interpret shifts in Treasury note values is crucial for investors, businesses, and policymakers alike. Monitoring reputable sources for cnbc 10 year treasury rate information is an important part of economic analysis. By analyzing the cnbc 10 year treasury rate, stakeholders can gain a better understanding of the current state of the economy and make more informed decisions.

Analyzing Long-Term Trends in Government Bond Rates

A historical perspective on 10-year Treasury yields reveals fluctuating rates influenced by prevailing economic conditions. Examining periods of high and low yields offers insights into the factors driving these shifts. Consider the early 1980s, a period marked by high inflation. During this time, the 10-year Treasury yield reached peaks, reflecting the Federal Reserve’s efforts to combat rising prices. Conversely, periods of economic recession or uncertainty often see yields decline as investors seek the safety of government bonds. Tracking cnbc 10 year treasury rate historical data shows an inverse relationship between economic downturns and treasury yields.

Long-term trends in government bond rates are shaped by several key factors. Demographic changes play a role, as aging populations may influence investment patterns and demand for fixed-income securities. Technological innovation can impact economic growth and productivity, potentially leading to shifts in interest rate expectations. Government debt levels are another significant consideration. High levels of government debt may put upward pressure on yields as investors demand higher compensation for the increased risk. Monitoring the cnbc 10 year treasury rate alongside these factors provides a more complete picture of the market dynamics.

Furthermore, understanding these long-term trends requires analyzing the interplay of global events and domestic policies. Major economic crises, such as the 2008 financial crisis, have triggered significant declines in Treasury yields as investors sought safe-haven assets. Changes in Federal Reserve policy, including quantitative easing programs, can also have a substantial impact on bond rates. Analyzing cnbc 10 year treasury rate fluctuations in the context of these events is crucial for informed decision-making. By examining these historical patterns, investors and analysts can better understand the forces shaping the US Treasury market and its implications for the broader economy.