Understanding the Role of CME in Predicting Rate Hikes

The Chicago Mercantile Exchange (CME) is a leading indicator of interest rate changes, providing investors with a valuable tool to gauge the likelihood of a rate hike. The CME probability of rate hike, in particular, has become a widely followed metric, offering insights into the market’s expectations of future interest rate changes. By analyzing CME probability data, investors can better understand the market’s sentiment and make more informed investment decisions. The CME probability of rate hike is calculated based on the prices of Eurodollar futures contracts and options, which reflect the market’s expectations of future interest rate changes. As a result, CME probability has become a key metric for investors seeking to stay ahead of the curve and make informed decisions about their investments.

How to Interpret CME Probability Data for Informed Investment Decisions

Interpreting CME probability data is crucial for investors seeking to make informed decisions about their investments. To effectively use CME probability data, investors must understand the different probability ranges and their implications. A CME probability of rate hike above 50% indicates a higher likelihood of a rate hike, while a probability below 50% suggests a lower likelihood. Investors can use this information to adjust their investment portfolios accordingly. For instance, if the CME probability of rate hike is above 70%, investors may consider reducing their exposure to interest-rate sensitive assets. On the other hand, if the probability is below 30%, investors may consider increasing their exposure to these assets. By understanding the different probability ranges and their implications, investors can make more informed decisions and optimize their investment portfolios.

The Impact of Economic Indicators on CME Probability of Rate Hike

The CME probability of rate hike is influenced by a range of economic indicators, which provide valuable insights into the likelihood of a rate hike. Key economic indicators that impact CME probability include GDP growth, inflation rates, and employment numbers. A strong GDP growth rate, for instance, may increase the likelihood of a rate hike, as it suggests a robust economy that can withstand higher interest rates. On the other hand, low inflation rates may decrease the likelihood of a rate hike, as they suggest that the economy is not overheating and does not require higher interest rates to cool it down. Employment numbers also play a crucial role, with low unemployment rates increasing the likelihood of a rate hike. By analyzing these economic indicators, investors can gain a better understanding of the factors that influence CME probability and make more informed investment decisions. For example, if GDP growth is strong and inflation rates are rising, investors may expect a higher CME probability of rate hike, and adjust their portfolios accordingly. By staying up-to-date with these economic indicators, investors can stay ahead of the curve and make informed decisions about their investments.

What Do CME Probability Charts Reveal About Market Sentiment?

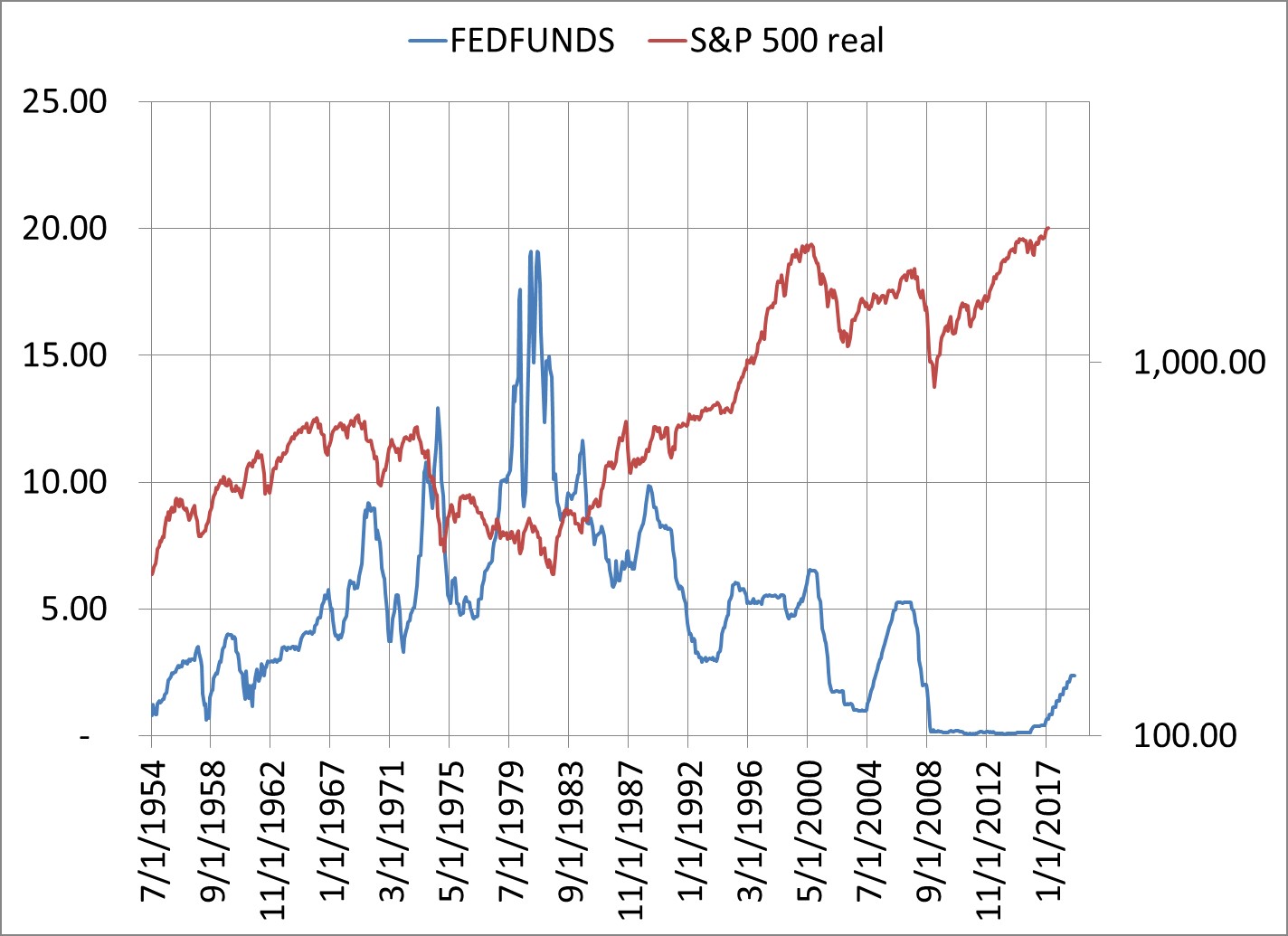

CME probability charts provide valuable insights into market sentiment, allowing investors to gauge the likelihood of a rate hike and make informed investment decisions. By analyzing CME probability charts, investors can identify trends and patterns that reveal market expectations about future interest rate changes. For instance, a rising CME probability of rate hike may indicate that the market is pricing in a higher likelihood of a rate hike, suggesting that investors are becoming more bullish on interest rates. Conversely, a declining CME probability of rate hike may indicate that the market is pricing in a lower likelihood of a rate hike, suggesting that investors are becoming more bearish on interest rates. By understanding these trends and patterns, investors can adjust their investment portfolios accordingly, positioning themselves for potential changes in interest rates. Additionally, CME probability charts can also reveal market sentiment around specific economic indicators, such as GDP growth or inflation rates, providing investors with a more comprehensive view of the market’s expectations.

The Relationship Between CME Probability and Federal Reserve Policy

The CME probability of rate hike is closely tied to Federal Reserve policy, with the two influencing each other in complex ways. The Federal Reserve, as the central bank of the United States, has the power to set interest rates and shape the country’s monetary policy. The CME probability of rate hike, on the other hand, reflects market expectations of future interest rate changes. When the Federal Reserve signals a potential rate hike, the CME probability of rate hike tends to increase, reflecting the market’s expectation of a higher likelihood of a rate hike. Conversely, when the Federal Reserve signals a dovish stance, the CME probability of rate hike tends to decrease, reflecting the market’s expectation of a lower likelihood of a rate hike. This interplay between the Federal Reserve and CME probability is crucial for investors, as it provides valuable insights into the direction of interest rates and the overall economy. By understanding the relationship between CME probability and Federal Reserve policy, investors can make more informed investment decisions and position themselves for potential changes in interest rates.

Using CME Probability to Time Your Investments: A Strategic Approach

Timing investments based on CME probability of rate hike can be a strategic approach to maximizing returns and minimizing losses. By understanding the different probability ranges and their implications, investors can adjust their investment portfolios accordingly. For instance, when the CME probability of rate hike is high, investors may want to consider reducing their exposure to interest-rate sensitive assets, such as bonds, and increasing their exposure to assets that tend to perform well in a rising interest rate environment, such as stocks. Conversely, when the CME probability of rate hike is low, investors may want to consider increasing their exposure to interest-rate sensitive assets and reducing their exposure to assets that tend to perform poorly in a low interest rate environment. Additionally, investors can use CME probability to identify potential trading opportunities, such as buying or selling options on interest-rate sensitive assets based on the probability of a rate hike. By incorporating CME probability into their investment strategy, investors can make more informed decisions and potentially improve their returns.

A key aspect of using CME probability to time investments is understanding the different probability ranges and their implications. For example, a CME probability of rate hike above 70% may indicate a high likelihood of a rate hike, while a CME probability below 30% may indicate a low likelihood of a rate hike. By understanding these probability ranges, investors can adjust their investment portfolios accordingly and make more informed decisions. Furthermore, investors can use CME probability to identify potential trends and patterns in interest rates, allowing them to make more strategic investment decisions.

Common Misconceptions About CME Probability of Rate Hike Debunked

Despite its widespread use, CME probability of rate hike is often misunderstood, leading to misconceptions about its accuracy and reliability. One common myth is that CME probability is only useful for short-term predictions, when in fact, it can provide valuable insights into long-term interest rate trends. Another misconception is that CME probability is only influenced by Federal Reserve policy, when in reality, it is affected by a range of economic indicators, including GDP growth, inflation rates, and employment numbers.

Some investors believe that CME probability is not reliable because it is based on market expectations, which can be volatile and prone to sudden changes. However, this ignores the fact that CME probability is based on a large and diverse pool of market participants, making it a robust and reliable indicator of interest rate expectations. Furthermore, CME probability has been shown to be a strong predictor of future interest rate changes, with studies demonstrating a high degree of accuracy in predicting rate hikes and cuts.

Another common misconception is that CME probability is only useful for fixed-income investors, when in fact, it can provide valuable insights for investors across a range of asset classes. By understanding the likelihood of a rate hike, investors can adjust their portfolios to minimize risk and maximize returns, regardless of their investment strategy. For example, equity investors can use CME probability to identify potential opportunities in interest-rate sensitive sectors, such as banking and finance.

By debunking these common misconceptions, investors can gain a better understanding of the CME probability of rate hike and how it can be used to inform their investment decisions. By incorporating CME probability into their investment strategy, investors can make more informed decisions and potentially improve their returns.

Staying Ahead of the Curve: How to Monitor CME Probability for Rate Hike Insights

To stay ahead of the curve and make informed investment decisions, it’s essential to monitor CME probability of rate hike regularly. One way to do this is to set up alerts on financial news websites or apps, such as Bloomberg or CNBC, to notify you of changes in CME probability. This allows you to respond quickly to shifts in market sentiment and adjust your investment portfolio accordingly.

Another approach is to track CME probability charts, which provide a visual representation of the likelihood of a rate hike over time. By analyzing these charts, investors can identify trends and patterns in CME probability, such as increases or decreases in the likelihood of a rate hike, and adjust their investment strategy accordingly. For example, if CME probability is trending upwards, investors may want to consider reducing their exposure to interest-rate sensitive assets, such as bonds, and increasing their exposure to assets that tend to perform well in a rising interest rate environment, such as stocks.

In addition to tracking CME probability charts, investors can also use financial data providers, such as Thomson Reuters or Refinitiv, to access real-time CME probability data. These providers offer a range of tools and resources, including data feeds and analytics platforms, that allow investors to monitor CME probability and make informed investment decisions.

Furthermore, investors can use social media and online forums to stay up-to-date with market sentiment and CME probability. By following financial experts and market analysts on social media, investors can gain insights into market trends and sentiment, and adjust their investment strategy accordingly. Online forums, such as Reddit’s r/investing, also provide a platform for investors to discuss market trends and share insights on CME probability.

By monitoring CME probability of rate hike regularly, investors can stay ahead of the curve and make informed investment decisions. Whether through setting up alerts, tracking charts, or using financial data providers, investors can use CME probability to gain valuable insights into market sentiment and interest rate expectations.