What Are Live Cattle Futures Contracts and How Do They Work?

Agreements to buy or sell live cattle at a predetermined future date represent a fundamental mechanism in the agricultural commodities market. These agreements, known as futures contracts, serve as a vital tool for various participants, including cattle producers who raise livestock, meat processors who purchase cattle for slaughter, and also speculators. These futures are actively traded, primarily on exchanges like the Chicago Mercantile Exchange. It’s important to understand that these contracts are not transactions of physical cattle occurring today; instead, they establish a legally binding obligation to either deliver or take delivery of a specified quantity of live cattle at a later point in time. This unique feature allows market participants to manage price risks associated with fluctuations in the cash market. The basic mechanics involve the continuous trading of these standardized contracts, with prices moving based on supply and demand dynamics, expectations of future conditions, and various economic factors. Unlike actual cash transactions for the physical commodity, these futures contracts offer an efficient way to manage and speculate on price movements within the live cattle market. When initiating a futures trade, it’s essential to have a good understanding of margin requirements, which are crucial for controlling leverage and potential losses. The standardized nature of these contracts makes it easier for individuals and businesses to participate in the market. While a single agreement might represent a large quantity of live cattle, it’s important to note that most futures positions are closed out, or offset, before the delivery date, with only a small percentage leading to an actual physical transfer of cattle.

The availability of futures contracts empowers cattle producers to lock in a selling price for their livestock ahead of the sale, thereby providing revenue certainty and mitigating the risk of a price drop before their cattle are ready for market. Similarly, processors are able to secure their raw material costs by purchasing contracts, which can then be used to secure margins regardless of how the live cattle market changes. Speculators, on the other hand, seek to profit from predicted price changes, buying contracts anticipating a price increase, or selling them in the anticipation that the price will go down. Understanding these roles and how they interact, it is easier to start understanding the market dynamics around these contracts. The value of a cme live cattle futures contract changes during the trading day, and traders and hedgers must keep updated and know the potential impacts on their position. The daily price changes of these contracts reflect how the market collectively assesses future supply and demand conditions and how that reflects on the potential future price of physical cattle. The price of a futures contract also takes into account the cost of carrying cattle and the time value of money, all of which influences the final price.

The Chicago Mercantile Exchange (CME) is the primary platform for trading such contracts, providing a centralized, regulated environment for price discovery. This regulated platform ensures transparency, making it easier for participants to analyze market trends, price discovery and manage their positions. The entire process, from the initial trade to settlement or offset, is designed to be efficient and transparent, which makes it a great tool for both, companies trying to manage their risk and individuals trying to participate in these markets. A thorough understanding of the purpose of a cme live cattle futures contract is a prerequisite for engaging in this market and having a higher probability of success. Understanding how each participant uses these instruments is paramount to understanding the full potential of this market.

Hedging with Live Cattle Contracts: A Risk Management Tool

Market participants, particularly cattle producers and processors, often utilize live cattle futures as a vital hedging mechanism to manage price risk. Imagine a cattle rancher concerned about a potential drop in prices before their cattle are ready for market; they might sell a cme live cattle futures contract. This action locks in a price, providing a safety net against adverse market movements. This is known as a short hedge. Conversely, a meat processor worried about increasing prices before they need to purchase cattle could buy a cme live cattle futures contract, establishing a long hedge. By doing this, they secure their input cost, protecting their business from the potentially damaging effects of rising prices. Hedging is not about making speculative profits, rather about mitigating risks, guaranteeing a more stable and predictable operational environment. These real-world scenarios highlight how the basic understanding of these agreements defined earlier transforms into a risk management tool, enabling businesses to operate with greater financial stability. The use of a cme live cattle futures contract allows both producers and processors to transfer price risk to those willing to accept it, mainly speculators, which ultimately stabilizes the market and promotes a healthy industry.

The mechanics of hedging involve taking a position in the futures market that is opposite to one’s position in the cash market. For example, a producer owning physical cattle (cash market position) would sell futures, creating a short hedge. If cash prices decline, the loss on the cash cattle would be offset by gains in the futures market. Conversely, a processor needing physical cattle would buy futures, creating a long hedge. Should cash prices increase, the loss on the cash cattle will be offset by the gains in the futures market. This method of counteracting price risks is fundamental in an industry with volatile price fluctuations. A careful strategy using a cme live cattle futures contract allows cattle producers and processors to protect their margins and create a more sustainable business model. Understanding how to hedge appropriately is a crucial part of risk management for all stakeholders, making it an important element of the live cattle market ecosystem.

Speculating on Live Cattle: Identifying Market Trends

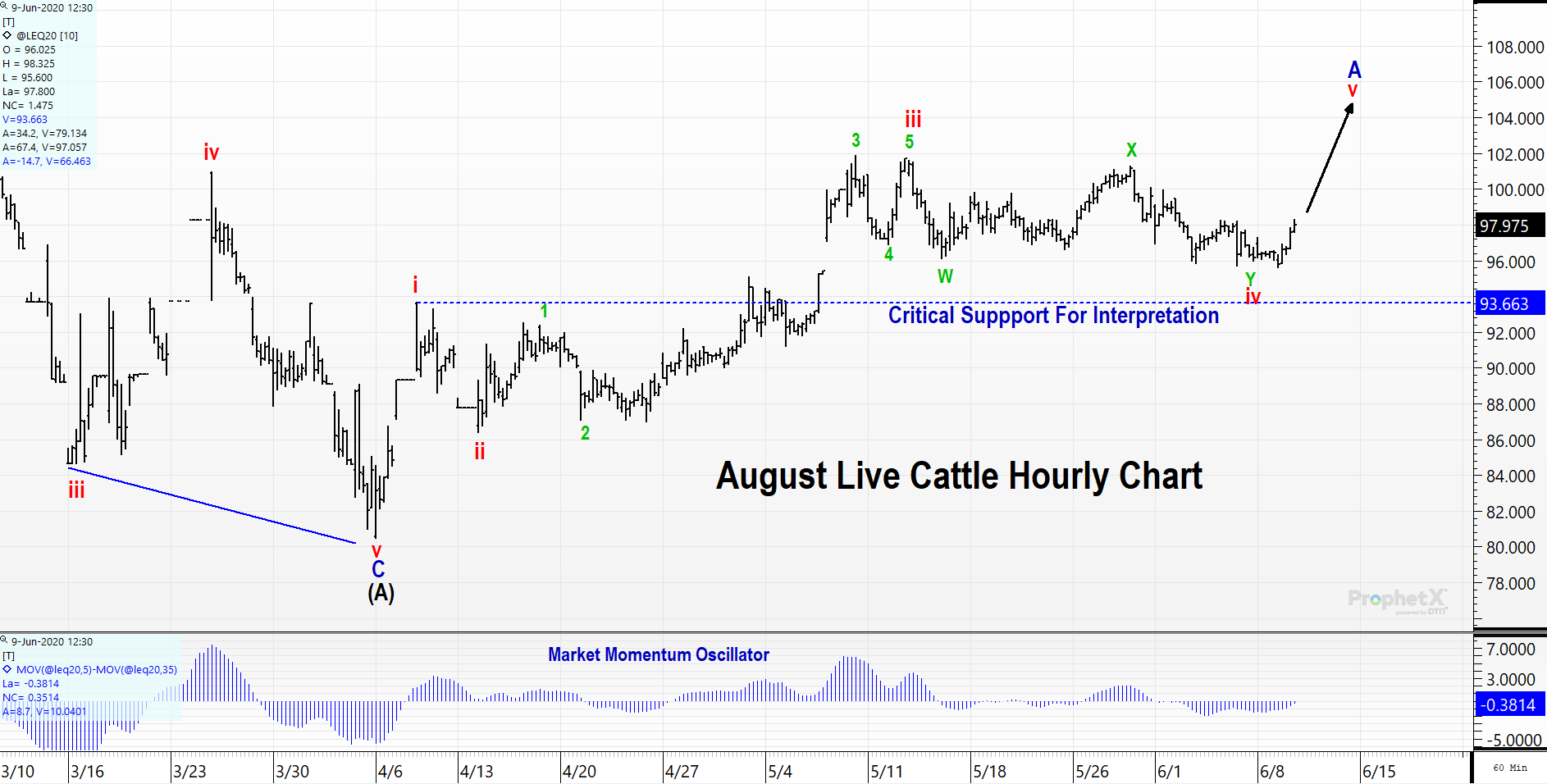

Speculation in live cattle futures involves traders aiming to profit from anticipated price movements, rather than using the contracts for hedging purposes. These market participants actively monitor various market indicators and economic conditions to forecast future price fluctuations. A crucial aspect of successful speculation within the livestock market revolves around understanding both technical and fundamental analyses. Technical analysis focuses on historical price and volume data, attempting to identify patterns and trends that might indicate future price direction. Charts, moving averages, and other technical tools help speculators recognize potentially advantageous entry and exit points. Fundamental analysis, conversely, examines factors like supply and demand dynamics, weather patterns, feed costs, and broader economic indicators such as consumer spending and export policies to make informed predictions. For example, an anticipated increase in demand for beef may signal a potential price rise in live cattle futures, prompting speculators to take a long position. Conversely, an outbreak of disease that affects cattle herds might lead to expectations of lower prices and short selling opportunities. The use of fundamental and technical analyses allows the speculator to strategically use a cme live cattle futures contract to their advantage, buying when the market price is expected to rise and selling when it’s expected to fall, thereby seeking to profit from these price movements.

The practice of speculation introduces a significant element of liquidity into the market, allowing hedgers to easily find counterparties for their trades. Successful speculation, however, demands a deep understanding of the agricultural and broader macroeconomic landscapes. It involves being able to not just predict price movements, but also the size and timing of those movements to maximize the potential gain and manage the inherent risk involved. Traders engaged in this activity might use sophisticated trading algorithms, employ risk management tools like stop-loss orders, and meticulously track market information to understand and respond to changing conditions. They do not take physical delivery of the cattle, and their trading activity revolves entirely around the potential price swings that the cme live cattle futures contract provides. This speculative activity is an essential part of market functionality, offering opportunities for profit but requiring a strong understanding of market dynamics, trends, and risk management.

Factors Influencing Live Cattle Futures Prices

The pricing of live cattle futures is a complex interplay of numerous factors spanning both supply and demand dynamics. On the supply side, feed costs play a pivotal role; higher prices for corn, soybeans, and other feed grains directly impact the cost of raising cattle, often leading to increased prices in the cme live cattle futures contract to reflect these higher production expenses. Weather conditions also wield considerable influence. Droughts can reduce pasture availability and increase feed costs, whereas severe weather events can disrupt transportation and processing, all of which can drive price fluctuations. Outbreaks of diseases affecting cattle populations can drastically reduce the available supply, leading to a sharp increase in futures prices. Furthermore, government regulations and international trade policies can introduce volatility in supply dynamics, especially when trade routes are disrupted or when new animal health protocols are introduced that impact the flow of livestock across borders. These elements highlight the intricate and interconnected nature of supply factors that impact cme live cattle futures contract prices.

Demand-side factors are equally significant in shaping live cattle futures prices. Consumer preferences for beef directly affect overall demand. Shifts towards healthier eating habits or changes in taste can increase or decrease the market’s demand for beef, influencing prices and the outlook for the cme live cattle futures contract. Export demand, another key aspect, is often influenced by global economic conditions and the trade policies of importing nations. Strong export demand from countries that are large beef consumers can drive up prices, whereas reduced export activity due to tariffs or trade barriers can lead to downward pressure. Broader macroeconomic factors also have a significant impact. Inflation rates and interest rates directly affect consumer spending and investment trends. Higher inflation may lead to increased costs across the supply chain, while rising interest rates can impact borrowing costs for producers and speculators, which can, in turn, ripple through the cme live cattle futures contract. Economic recession or slowdown can reduce consumer purchasing power and weaken demand for beef, and it has the potential to push prices lower.

Analyzing these influences requires a multifaceted approach that considers the interplay of all these factors. For instance, a drought in key cattle-producing regions coupled with robust export demand can create a powerful upward trend in futures prices. Conversely, a decline in consumer confidence accompanied by an increase in cattle herds can cause a bearish trend. The cme live cattle futures contract price is essentially a reflection of these expectations of future supply and demand conditions. A trader should look at the bigger picture to understand how the specific market dynamics relate to the different interconnected variables that drive the market.

How To Start Trading Live Cattle Futures

Embarking on the journey of trading live cattle futures requires a structured approach that prioritizes education and preparation. The initial step involves establishing a brokerage account with a firm that provides access to the Chicago Mercantile Exchange (CME), where these futures contracts are traded. It’s crucial to select a broker that offers a robust trading platform, research tools, and educational resources that can support your trading activities. Before placing your first trade, dedicate sufficient time to understanding the intricacies of the livestock market, including the factors influencing price movements and the specific characteristics of the cme live cattle futures contract you intend to trade. This preparation should involve both fundamental and technical analysis. Fundamental analysis focuses on understanding the supply and demand dynamics for live cattle, including feed costs, weather patterns, and consumer demand. Technical analysis involves interpreting price charts and other market data to identify trends and potential trading opportunities. Therefore, researching is paramount when dealing with a cme live cattle futures contract.

Once you have established your account and laid the groundwork through research, the next step is to familiarize yourself with the trading platform. Practice using the platform’s features, such as order entry, charting tools, and risk management functionalities. Before risking actual capital, consider paper trading which is a simulation of real-life trades. This will allow you to become comfortable with the mechanics of trading without financial risks. Understand the specific contract specifications of the cme live cattle futures contract you wish to trade, including contract size, tick value, and delivery months. This understanding is essential for making informed decisions. Develop a comprehensive trading plan that includes clearly defined entry and exit strategies, risk parameters, and position sizing guidelines. Such planning should reflect your risk tolerance and trading style. A well-defined plan prevents impulsive decisions and allows for better adaptation to changing market conditions. Remember that this initial planning stage is crucial for success, as is the consistent monitoring and updating of your strategy.

The transition into live trading should be gradual, starting with smaller positions to manage your risk exposure. Consistent monitoring of the market and your positions is vital, along with adapting your strategy as the market evolves. Regularly review your trading performance, identifying both successes and areas for improvement. The cme live cattle futures contract market is dynamic, which requires continuous learning and adjustment. Furthermore, engage in continuous education by staying abreast of market trends, new trading techniques, and the latest market news. Learning should be seen as a lifelong practice to enhance your ability to trade. Finally, remember that trading futures contracts carries risk, and it’s important to trade responsibly and within your comfort level.

Comparing Live Cattle Futures with Other Agricultural Futures

The agricultural futures market offers a diverse range of commodities, each with unique characteristics and risk profiles. While live cattle futures represent a significant portion of this market, understanding how they differ from other agricultural contracts is crucial for informed trading decisions. For instance, corn and soybean futures are heavily influenced by planting cycles, weather patterns in major growing regions, and global demand for feed and biofuels. These factors can lead to price movements that are distinct from those affecting the cattle market. Unlike grains, the live cattle market is significantly affected by disease outbreaks and domestic consumption habits, making its risk landscape more nuanced. Trading decisions in grains also require a deep understanding of government agricultural policies and storage capacities which affect their futures prices. The lean hog futures market, while related to livestock, presents a different dynamic due to variations in production cycles, feed conversion ratios, and consumer demand patterns, creating a different risk profile for investors. Understanding these nuances is key to comparing the risk and reward profiles of various commodities including live cattle, and specifically, the potential risks and rewards offered by the cme live cattle futures contract.

When comparing live cattle futures with other agricultural commodities like corn or soybeans, the underlying physical assets are fundamentally different. Corn and soybeans are harvested, stored, and transported in bulk, whereas live cattle require more complex logistics involving care, feeding, and transportation. This difference impacts the cost structure and the factors that influence their respective futures prices. The cme live cattle futures contract is subject to factors such as feedlot management decisions, weather impacts on grazing lands, and the overall health and condition of the herd, making analysis more about the biological process of growing livestock rather than the purely industrial process of crop production. This translates to very different speculative angles and risk management strategies. Lean hogs, while also livestock, differ from live cattle in terms of their breeding cycles, feed requirements, and the end products they supply, leading to a different type of exposure and risk profile for those trading their futures contracts.

The risk profile of a cme live cattle futures contract is also influenced by the time it takes to bring a calf to market compared to the time it takes to grow a crop. These differing timelines mean that events like disease outbreaks or changes in feed prices can have a more immediate and prolonged impact on the price of the cme live cattle futures contract than similar events might have on the prices of grain futures. Furthermore, live cattle futures are more susceptible to shifts in consumer meat consumption habits, while grains may be more directly influenced by global trade and export demand. Investors need to analyze these distinct factors when deciding to diversify their portfolios by including live cattle futures alongside other agricultural contracts. Each market requires a specific understanding of its fundamentals, the factors that influence its prices, and the risks associated with its unique characteristics, making a deeper understanding of the contract specifications crucial when considering trading, especially on a platform like the CME.

Understanding Contract Specifications for Live Cattle Futures

Trading live cattle futures requires a clear understanding of the specific details that define each contract. The size of a standard cme live cattle futures contract is 40,000 pounds of live cattle, a detail crucial for calculating potential profit or loss. Each price movement is measured in ticks, and the value of one tick movement is $10.00, with contracts quoted in cents per pound, so every tick corresponds to 0.025 cents per pound. For example, if the price moves from 150.00 cents per pound to 150.025 cents per pound, that’s a movement of one tick with a value of $10. Understanding these increments is essential for accurate trading and risk management. Delivery months are also important: contracts are available for specific months, such as February, April, June, August, October, and December. It’s imperative to note that not all months are necessarily liquid, and typically, trading volumes are higher in the nearby months. Traders must be aware of the precise delivery timeline and requirements, even if their intention is to close their position before the actual delivery date. The settlement procedure for these futures contracts involves either physical delivery, in which the actual cattle are exchanged or, more commonly, cash settlement, where the financial difference is calculated and paid between the final trade price and the closing price of the contract at expiry.

Another fundamental specification is that the live cattle must meet specific quality criteria for delivery, which is determined by the U.S. Department of Agriculture grading standards. Understanding these standards is very important if a trader takes actual delivery; usually, those who trade do not intend to receive the cattle and will close their position before delivery happens. The expiration date for a cme live cattle futures contract is typically the last business day of the contract month. Traders need to be mindful of this date to ensure they avoid unexpected delivery or settlement. The trading hours for these contracts align with the regular trading hours of the CME, and they are subject to any holiday closures that may occur. Further, the CME publishes contract specifications on its website. These can and do change over time, so it’s crucial that traders remain up to date with the most current information. Failure to know these details could lead to unexpected costs or liabilities, which can have a substantial impact on a trader’s strategies.

In practical terms, traders will use this information to gauge the potential risk and return of a position. For example, understanding the tick value will assist in assessing how sensitive the position is to price changes. Knowing delivery months will assist in planning entry and exit points, and awareness of settlement processes will determine how the trading position is closed. These details provide the fundamental operational structure of the market and allow market participants to accurately plan their trading, hedging, or speculative activities. Therefore, it’s not enough to understand the theory behind cme live cattle futures contract; a deep understanding of the contract specifications is needed for successful trading and risk management.

Monitoring and Managing Your Live Cattle Futures Positions

Actively managing positions in the volatile world of live cattle futures demands a disciplined and informed approach. It is crucial to recognize that trading in the market is not a static activity but rather a dynamic process requiring continuous monitoring and adjustment. Effective risk management should be at the forefront of any trading strategy involving a cme live cattle futures contract. This involves establishing clear risk parameters before initiating any trade. Traders should define the maximum amount of capital they are willing to risk on any single trade and implement stop-loss orders to automatically exit a position if the market moves against them beyond a specified threshold. Stop-loss orders are a critical component of risk management as they help protect capital from potentially catastrophic losses, and they prevent emotional responses to market fluctuations from dictating actions. Diversification across multiple delivery months or even other agricultural commodity markets can also help to reduce the risk associated with price volatility in a single market. This strategy ensures that a downturn in one area won’t severely impact the entire portfolio, thereby mitigating overall risk. Furthermore, regularly reviewing market conditions is necessary to adapt your strategies as new information becomes available. This could involve reassessing supply and demand dynamics, changes in feed prices, or unforeseen global economic events, as these factors can all affect the prices in the market.

Another fundamental aspect of successful futures trading, especially with a cme live cattle futures contract, involves understanding the importance of taking profits when targets are met. It’s often tempting to wait for further gains, but the market is subject to fluctuations that can quickly erode those profits. Setting clear profit targets and using limit orders to automatically close a position when the target is reached can be a powerful technique to maintain profitability and protect hard-earned gains. Regular evaluation of the overall trading strategy is also necessary. This means tracking performance metrics, analyzing what’s working and what isn’t, and adjusting tactics accordingly. Trading live cattle futures contracts is not about making one-time gains but more about building a consistent approach to the market. Understanding the impact of contract specifications on overall position risk is also very important. The size of a contract, the tick value, and delivery specifics should all be factored into the risk analysis and monitoring process. Effective monitoring is not just about observing market prices; it is about proactively managing risks, staying adaptable, and consistently applying risk management principles. By doing this, traders are better positioned to navigate the uncertainties of live cattle futures and increase the likelihood of achieving their financial objectives while protecting their capital.

The Role of Market Participants in the CME Live Cattle Futures Contract Market

The landscape of the live cattle futures market is populated by diverse participants, each with distinct objectives and strategies. Commercial entities, such as cattle producers and meat processors, are significant players who engage in these markets primarily for hedging purposes. Producers might use a short hedge by selling a cme live cattle futures contract to lock in a future selling price for their cattle, mitigating the risk of price declines before they are ready for market. This action allows producers to stabilize their income streams, making their businesses more predictable. On the other hand, processors, who need a consistent supply of cattle, might use a long hedge by purchasing these contracts to secure a future purchase price, protecting against potential increases in the cost of their raw materials. Beyond these commercial users, there exists a significant portion of the market that is made up of speculators. These individuals or firms don’t have any underlying positions in the physical cattle market. Instead, they are interested in the profit opportunities that arise from price movements within the cme live cattle futures contract market, adding liquidity and dynamism to trading.

Another critical participant category consists of institutional investors, including hedge funds and commodity trading advisors, that often employ sophisticated trading strategies based on macro trends and sophisticated analytical models. Their involvement increases the volume of trade and can lead to significant price movement based on their collective trading actions. The interplay among these various groups influences market trends, price discovery, and overall market efficiency. Each participant contributes to the formation of prices for the cme live cattle futures contract, making the market robust and reflective of supply and demand dynamics. For instance, fundamental factors, like feed costs, weather patterns, and disease prevalence, can heavily influence commercial hedging activity, which subsequently affects overall price levels. Speculators react to this activity, often accelerating short-term price changes. This diversity of interests creates a healthy, competitive environment that underpins the core functions of the cme live cattle futures contract. Understanding the specific motivations and tactics employed by each type of market participant is crucial for anyone seeking to navigate or trade effectively within this marketplace.

Therefore, the behavior of producers, processors, speculators, and institutional investors, directly affects not just prices but also the reliability and predictability of the market. Each contributes to a complex web that makes the market resilient and capable of fulfilling its role as a price discovery mechanism and risk management tool, making the cme live cattle futures contract a crucial instrument within the agricultural financial markets.