Understanding the Concept of Free Cash Flow

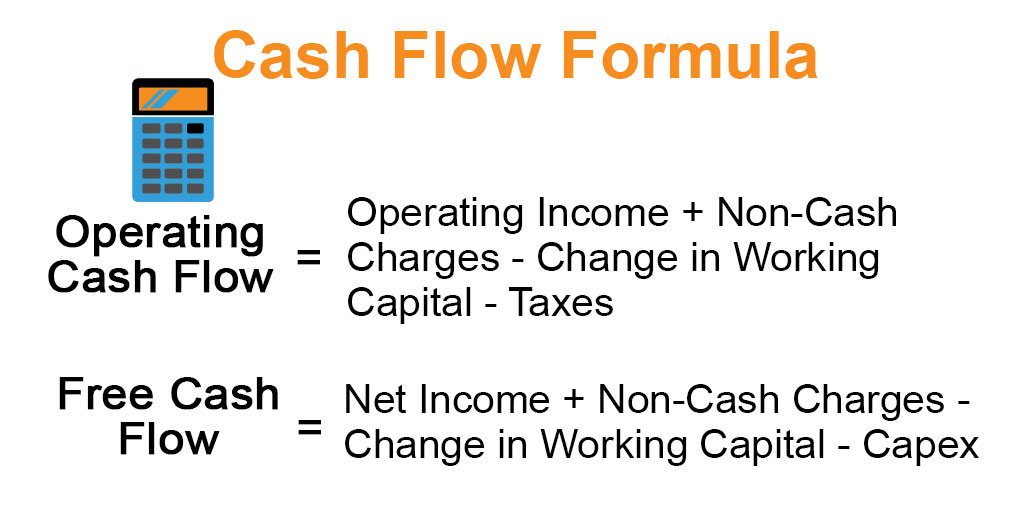

Free cash flow is a vital metric in evaluating a company’s financial performance and health. It represents the amount of cash available to a company for investment, debt repayment, or distribution to shareholders. Unlike net income, which is an accounting measure of profitability, free cash flow provides a more accurate picture of a company’s ability to generate cash. This distinction is essential, as a company can be profitable on paper but still struggle to meet its financial obligations due to poor cash flow management. Free cash flow is calculated by subtracting capital expenditures from operating cash flow, providing a clear picture of a company’s ability to generate cash from its core operations. By understanding free cash flow, businesses can make informed decisions about investments, funding, and strategic growth initiatives.

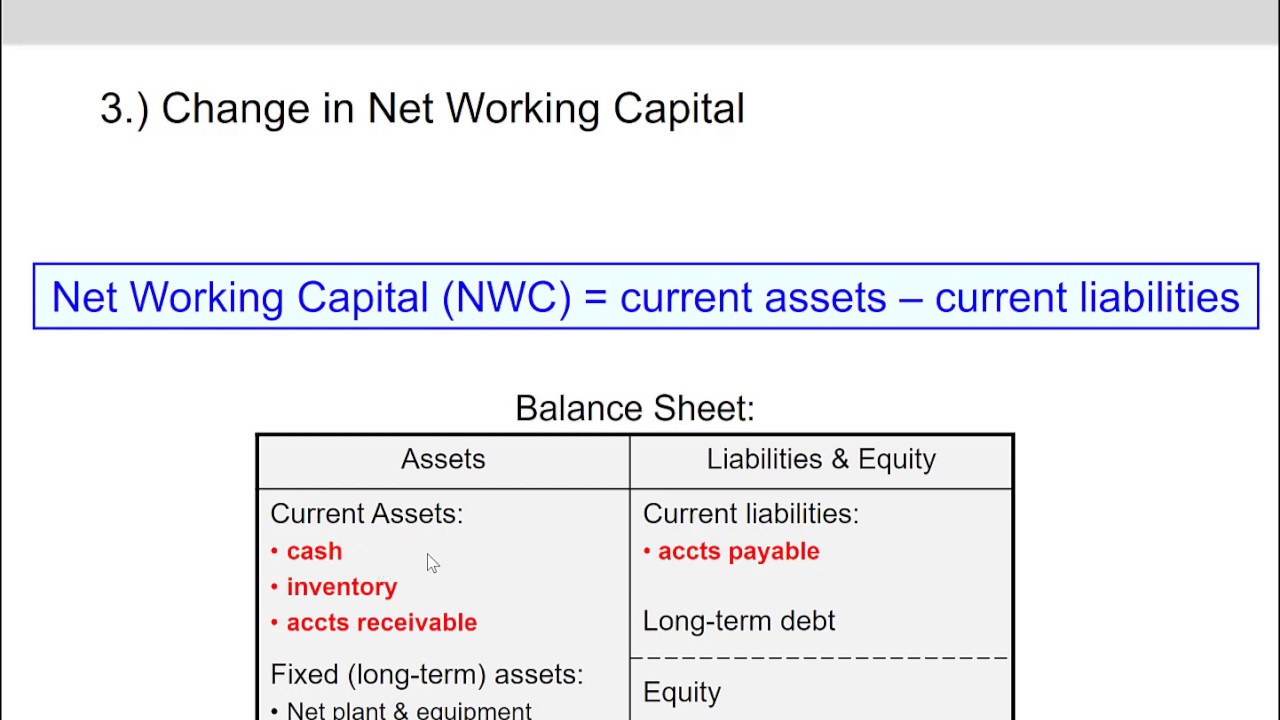

The Role of Working Capital in Free Cash Flow

Working capital plays a crucial role in a company’s ability to generate free cash flow. Working capital refers to the difference between a company’s current assets and current liabilities. It represents the amount of money required to finance a company’s day-to-day operations. Changes in working capital can significantly impact a company’s free cash flow, as it directly affects the amount of cash available for investment, debt repayment, or distribution to shareholders. For instance, an increase in accounts receivable or inventory levels can tie up cash, reducing a company’s free cash flow. On the other hand, a decrease in accounts payable or inventory levels can free up cash, increasing a company’s free cash flow. Understanding the relationship between working capital and free cash flow is essential for businesses to make informed decisions about managing their working capital to optimize their free cash flow.

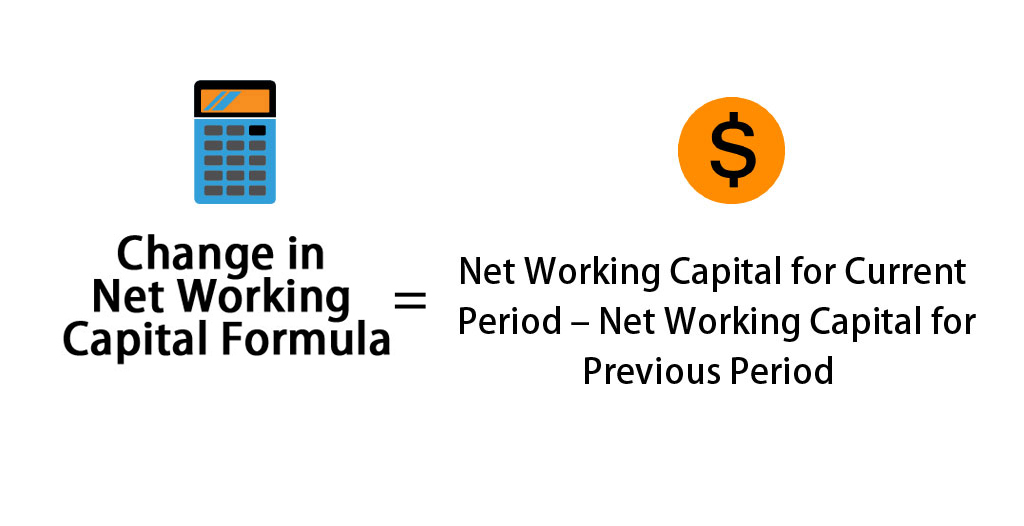

How to Calculate Change in Working Capital Free Cash Flow

To calculate the change in working capital free cash flow, businesses need to follow a step-by-step approach. The formula to calculate change in working capital free cash flow is: Change in Working Capital Free Cash Flow = (Change in Accounts Receivable + Change in Inventory + Change in Accounts Payable + Change in Accrued Expenses) – Capital Expenditures. This formula takes into account the changes in working capital components, such as accounts receivable, inventory, accounts payable, and accrued expenses, and subtracts capital expenditures to arrive at the change in working capital free cash flow. For example, if a company’s accounts receivable increased by $100,000, inventory decreased by $50,000, accounts payable increased by $20,000, and accrued expenses decreased by $30,000, and capital expenditures were $150,000, the change in working capital free cash flow would be ($100,000 + (-$50,000) + $20,000 + (-$30,000)) – $150,000 = -$110,000. This indicates that the company’s working capital changes have resulted in a decrease in free cash flow of $110,000.

Interpreting the Results: What Does a Change in Working Capital Free Cash Flow Mean?

Once the change in working capital free cash flow is calculated, it’s essential to interpret the results to understand their implications on a company’s financial health. A positive change in working capital free cash flow indicates that a company has generated more cash from its working capital components, such as accounts receivable, inventory, and accounts payable. This can be a sign of effective working capital management, which can lead to increased financial flexibility, reduced debt, and improved profitability. On the other hand, a negative change in working capital free cash flow suggests that a company is experiencing cash flow constraints, which can lead to liquidity problems, reduced investment in growth opportunities, and decreased competitiveness. A negative change in working capital free cash flow may also indicate inefficient working capital management, such as slow collection of accounts receivable, excessive inventory levels, or delayed payment of accounts payable. By understanding the change in working capital free cash flow, businesses can identify areas for improvement and implement strategies to optimize their working capital management and improve their financial performance.

Common Causes of Changes in Working Capital Free Cash Flow

Changes in working capital free cash flow can be attributed to various factors that affect a company’s ability to generate cash from its working capital components. One common cause is a change in accounts receivable, which can occur when customers delay payments or when a company offers more lenient credit terms. An increase in accounts receivable can lead to a decrease in working capital free cash flow, while a decrease in accounts receivable can result in an increase in working capital free cash flow. Another factor is a change in accounts payable, which can occur when a company negotiates better payment terms with its suppliers or when it delays payments to conserve cash. An increase in accounts payable can lead to an increase in working capital free cash flow, while a decrease in accounts payable can result in a decrease in working capital free cash flow. Inventory levels can also impact working capital free cash flow, as an increase in inventory can tie up cash and lead to a decrease in working capital free cash flow, while a decrease in inventory can free up cash and result in an increase in working capital free cash flow. Additionally, changes in accrued expenses, such as wages and taxes, can also affect working capital free cash flow. By understanding these common causes of changes in working capital free cash flow, businesses can identify areas for improvement and implement strategies to optimize their working capital management and improve their financial performance.

Strategies for Managing Working Capital to Improve Free Cash Flow

Effective management of working capital is crucial to improving free cash flow. By implementing the following strategies, businesses can optimize their working capital and generate more cash from their operations. One strategy is to optimize accounts receivable by implementing efficient invoicing and collection processes, offering discounts for early payment, and regularly reviewing and adjusting credit terms. Another strategy is to optimize accounts payable by negotiating better payment terms with suppliers, taking advantage of early payment discounts, and implementing a just-in-time inventory system. Implementing efficient inventory management systems can also help to reduce inventory levels, freeing up cash and improving working capital free cash flow. Additionally, businesses can consider implementing a cash flow forecasting system to identify potential cash flow gaps and take proactive measures to address them. By implementing these strategies, businesses can improve their working capital management, increase their free cash flow, and enhance their financial performance. For instance, a company can reduce its accounts receivable days by 10 days, which can lead to a significant increase in its change in working capital free cash flow. Similarly, a company can negotiate better payment terms with its suppliers, leading to an increase in its accounts payable days and a subsequent increase in its change in working capital free cash flow. By understanding the importance of managing working capital and implementing these strategies, businesses can unlock the power of free cash flow and achieve long-term financial success.

Real-World Examples of Companies That Have Successfully Managed Working Capital to Improve Free Cash Flow

Several companies have successfully implemented strategies to manage working capital and improve free cash flow. For instance, Dell Inc. implemented a just-in-time inventory system, which reduced its inventory levels and improved its change in working capital free cash flow. As a result, Dell was able to generate more cash from its operations and invest in growth initiatives. Another example is Walmart, which optimized its accounts payable by negotiating better payment terms with its suppliers. This led to an increase in its accounts payable days, resulting in a significant improvement in its change in working capital free cash flow. Additionally, Procter & Gamble implemented a cash flow forecasting system, which enabled the company to identify potential cash flow gaps and take proactive measures to address them. By doing so, Procter & Gamble was able to improve its change in working capital free cash flow and enhance its financial performance. These examples demonstrate the importance of effective working capital management in improving free cash flow and achieving long-term financial success. By implementing similar strategies, businesses can unlock the power of free cash flow and achieve their financial goals. For example, a company can reduce its inventory levels by 20%, leading to a significant increase in its change in working capital free cash flow. Similarly, a company can negotiate better payment terms with its suppliers, resulting in an increase in its accounts payable days and a subsequent improvement in its change in working capital free cash flow. By understanding the importance of managing working capital and implementing these strategies, businesses can improve their financial performance and achieve long-term success.

Conclusion: The Importance of Monitoring and Managing Change in Working Capital Free Cash Flow

In conclusion, monitoring and managing changes in working capital free cash flow is crucial for a company’s long-term financial health and success. By understanding the concept of free cash flow and its relationship with working capital, businesses can identify areas for improvement and implement strategies to optimize their working capital management. Effective management of working capital can lead to significant improvements in free cash flow, enabling companies to invest in growth initiatives, reduce debt, and enhance their financial performance. It is essential for businesses to regularly calculate and analyze their change in working capital free cash flow to identify potential cash flow gaps and take proactive measures to address them. By doing so, companies can unlock the power of free cash flow and achieve their financial goals. Remember, a positive change in working capital free cash flow indicates a company’s ability to generate cash from its operations, while a negative change may indicate cash flow gaps that need to be addressed. By prioritizing the management of working capital and monitoring changes in working capital free cash flow, businesses can ensure long-term financial success and sustainability.

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)