Understanding the CAPM Model

The Capital Asset Pricing Model (CAPM) is a widely used financial model for estimating the expected rate of return on an asset, particularly stocks. It provides a framework for understanding the relationship between risk and return, allowing investors to assess the potential profitability of different investment options. Understanding the expected return is crucial for making informed investment decisions.

At its core, CAPM posits that the expected rate of return of an asset is influenced by its systematic risk. The model considers the risk-free rate, a proxy for the return on a risk-less investment, and the market risk premium, representing the additional return investors expect for bearing market risk. A stock’s beta, a measure of its volatility relative to the overall market, also plays a vital role in determining its expected return. The CAPM model allows investors to estimate the expected rate of return based on these core components, aiding in portfolio optimization and strategic decision-making.

The model’s significance lies in its ability to quantify the relationship between risk and return. By analyzing these factors, investors can determine the appropriate return for a given level of risk, fostering a deeper understanding of market dynamics. This aids investors in making more informed choices regarding their portfolios and investments in diverse market segments. A thorough comprehension of these elements is crucial for effective investment strategies and maximizing potential returns in different financial markets.

Defining the Risk-Free Rate

The risk-free rate, a cornerstone of the Capital Asset Pricing Model (CAPM) expected rate of return calculations, represents the theoretical return on an investment with zero risk. Such investments are considered virtually risk-free, meaning their return is nearly guaranteed. Understanding this baseline return is crucial for comparing it to potential returns from riskier assets.

Government bonds, particularly U.S. Treasury bills and bonds, are often cited as examples of risk-free investments. These securities are backed by the full faith and credit of the U.S. government, minimizing the risk of default. However, even these instruments carry a degree of inflation risk. Investors seek reliable data sources for accurate risk-free rate figures. Reliable sources include government websites and reputable financial data providers, offering up-to-date information for effective calculations of the CAPM expected rate of return.

The risk-free rate serves as a crucial benchmark in CAPM calculations. It’s the return an investor could expect from an equally risky asset, and the model compares it to other return expectations for stocks. Understanding the risk-free rate is essential for determining whether a particular stock’s return is sufficient compared to its risk profile. The risk-free rate forms a vital component in the calculation, impacting the estimated return and is often utilized in the determination of the market risk premium in the CAPM expected rate of return.

Estimating the Market Risk Premium

Calculating the market risk premium is a crucial step in applying the Capital Asset Pricing Model (CAPM) for estimating the expected rate of return. This premium represents the extra return investors expect to receive for holding a market portfolio, above the risk-free rate. A well-chosen market index, such as the S&P 500, provides a benchmark for measuring market returns. Determining the historical risk premium involves analyzing the difference between the market index’s historical returns and the risk-free rate.

A key component of this calculation is selecting an appropriate market index. The S&P 500, for instance, often serves as a proxy for the overall market, reflecting the performance of a large number of publicly traded companies. The historical data used to calculate the market risk premium typically span several years. Carefully choosing this historical period is essential because market conditions, and thus returns, can change dramatically over time. This period should be long enough to capture the broader trends in market returns. The expected rate of return using CAPM depends on this selection.

The market risk premium is directly linked to the risk inherent in the market. A higher market risk premium suggests investors anticipate greater fluctuations in the market’s performance. Conversely, a lower market risk premium implies a perception of lower market volatility. This directly relates to the risk-free rate, as the market risk premium is the difference between the expected market return and the risk-free rate. Understanding this relationship is vital for accurately estimating expected returns via CAPM.

Determining Stock Beta

Beta, a crucial component in the CAPM expected rate of return calculation, measures a stock’s volatility relative to the overall market. A stock’s beta reflects its systematic risk, quantifying how sensitive its price is to fluctuations in the market. A beta greater than 1 signifies higher market risk than the market itself; a beta less than 1 indicates lower market risk.

Determining beta involves analyzing historical price data for a stock and a relevant market index (like the S&P 500). Statistical methods, often incorporated into financial software or available on financial websites, calculate beta. These methods assess the correlation between the stock’s returns and the market’s returns over a specific time period. Reliable data sources for beta include reputable financial websites and databases. Thorough research ensures accurate beta values for accurate CAPM calculations.

Different stocks exhibit diverse betas. High-growth technology stocks, for instance, might have higher betas compared to more established, stable sectors. This reflects the varying degrees of sensitivity to market movements. Understanding these differences is vital for investors seeking to gauge the CAPM expected rate of return and tailor investment strategies accordingly. This crucial factor differentiates the CAPM expected rate of return for various investments.

Calculating the Expected Return

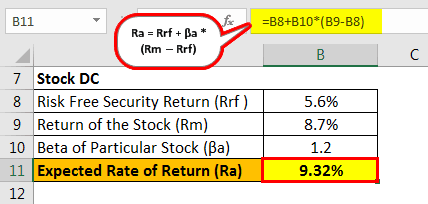

The Capital Asset Pricing Model (CAPM) provides a framework for calculating the expected rate of return on a stock. This section details the formula and demonstrates its application with a practical example. The CAPM expected rate of return is a crucial element for investors making informed decisions. Understanding this calculation is essential for portfolio construction and asset allocation.

The fundamental formula for calculating expected return using CAPM is: Expected Return = Risk-Free Rate + Beta × (Market Risk Premium). This formula allows investors to estimate the potential return of a stock given its risk profile. The risk-free rate represents the return on a theoretical investment with zero risk. Beta measures the volatility of a stock compared to the overall market. The market risk premium represents the additional return investors expect to compensate for the risk associated with the overall market. Using the CAPM, the expected return is a critical input in investment decisions, aiding in comparing returns across different assets and constructing portfolios aligned with risk tolerance and financial objectives.

Let’s illustrate with an example: Assume a risk-free rate of 3%, a beta of 1.2, and a market risk premium of 8%. Using the formula: Expected Return = 3% + 1.2 × 8% = 12.6%. This calculation suggests that the expected rate of return for the stock is 12.6%. Investors can compare this expected rate of return against the expected returns of other investments. This will guide them in making sound investment decisions. The calculated expected return is a critical factor in determining the desirability of a particular investment and comparing it with other potential options.

Factors Affecting CAPM Expected Rate of Return

Various external factors can influence the CAPM expected rate of return. Macroeconomic conditions play a significant role. Periods of economic expansion generally lead to higher market returns, boosting the market risk premium and thus influencing the CAPM expected rate of return. Conversely, recessions tend to depress market returns, impacting the risk premium and the overall CAPM expected rate of return.

Industry trends also exert influence. Emerging sectors with high growth potential frequently exhibit higher betas than established industries. This characteristic impacts the CAPM expected rate of return, as companies within these rapidly growing industries may see a higher return relative to their risk profile. Likewise, declines in a specific industry due to changes or external factors can lower the returns for companies in that sector, further impacting the CAPM expected rate of return.

Company-specific news and developments, such as earnings reports or major strategic announcements, can directly affect a stock’s price and its volatility relative to the market. Regulatory changes can also create uncertainty in markets, and this can impact the market risk premium, which, in turn, directly affects the CAPM expected rate of return. Investors should recognize that the CAPM expected rate of return is a model-based prediction, not a guarantee. Understanding the potential impact of these factors is essential for making informed investment decisions based on the CAPM model, even if the calculations themselves do not perfectly reflect the future.

Interpreting the Calculated CAPM Expected Rate of Return

Interpreting the calculated expected return using the Capital Asset Pricing Model (CAPM) requires careful consideration of the results within the context of alternative investment opportunities. A higher CAPM expected rate of return suggests a potentially more lucrative investment compared to options with lower returns. The CAPM expected rate of return, however, isn’t a guarantee of future performance.

Compare the calculated CAPM expected rate of return with returns from comparable investment options like bonds, mutual funds, or other stocks. Factor in potential risks and rewards associated with each alternative. Consider the time horizon of the investment. A short-term investment might necessitate a higher return to compensate for the reduced time available to recoup potential losses. Long-term investments may allow for the acceptance of a lower return if the potential for growth over time is considerable. The CAPM expected rate of return aids in forming informed investment choices. Account for individual risk tolerance when evaluating investment decisions. An investor with a higher risk tolerance might be more willing to accept a higher CAPM expected rate of return compared to a more risk-averse investor.

Consider how this CAPM expected rate of return aligns with your long-term financial goals. Does the expected return fulfill the required rate of return for the investment? Does it align with your overall financial plan? If the CAPM expected rate of return doesn’t meet these benchmarks, an alternative investment strategy might be more suitable. Remember that market conditions, economic factors, and other outside factors can influence the actual rate of return, impacting the real-world implications of the CAPM expected rate of return. The CAPM is a valuable tool for assessing potential returns, but it’s essential to approach the outcome with realistic expectations and a thorough understanding of market conditions and economic forecasts.

Incorporating CAPM into Investment Strategies

The CAPM expected rate of return provides a valuable framework for investment decisions. This section outlines a practical approach to incorporating the CAPM model into investment strategies, enabling investors to make informed choices. The model helps compare calculated returns against alternative investment options and consider its limitations.

A crucial step involves comparing the calculated CAPM expected rate of return with returns offered by alternative investment opportunities. Consider stocks with lower betas in relation to the overall market. Examine bond yields, real estate investment trusts (REITs), or other asset classes for comparison. Assess the potential risk-return trade-off for each option. Diversification remains a key strategy. Construct a diversified portfolio that includes assets with varying betas. By combining investments with different levels of market risk, investors can potentially smooth out returns and mitigate potential losses.

Acknowledging the limitations of CAPM is vital. The model relies on historical data and assumptions about market behavior. External factors, including economic shifts, regulatory changes, and company-specific news, can influence actual returns. The CAPM expected rate of return should be considered a benchmark, not a definitive prediction. Employing robust sensitivity analysis for different scenarios (e.g., varying market risk premiums or beta values) is crucial. Evaluate potential deviations from the expected CAPM rate of return and adapt investment strategies based on these analyses. Continuous monitoring of the market and company performance is essential.