Understanding the Language of Commercial Real Estate

In the world of commercial real estate, understanding key terms is crucial for making informed investment decisions. Two essential rates that often confuse investors are the capitalization rate and discount rate. These rates are vital in evaluating the potential return on investment of a commercial property, yet many investors struggle to grasp their meanings and applications. By grasping the fundamentals of capitalization rate vs discount rate, investors can navigate the complex landscape of investment opportunities, mitigate risks, and maximize returns. In this article, we will delve into the world of commercial real estate investing, exploring the significance of these rates and how they impact investment decisions.

What is a Capitalization Rate and How Does it Impact Your Investment?

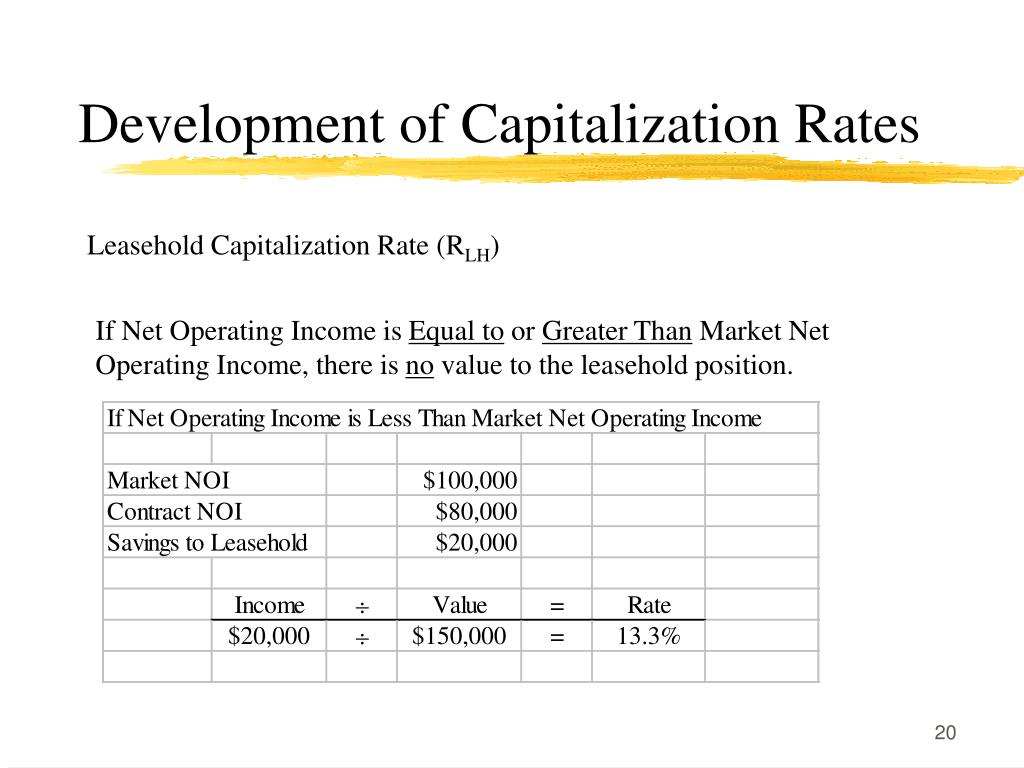

A capitalization rate, also known as a cap rate, is a crucial metric in commercial real estate investing that helps investors evaluate the potential return on investment of a property. It is calculated by dividing the net operating income (NOI) of a property by its current market value. The resulting percentage represents the rate of return an investor can expect to earn from the property’s income. For instance, if a property has an NOI of $100,000 and a market value of $1,000,000, the capitalization rate would be 10%. This rate serves as a benchmark for investors to compare the potential returns of different properties and make informed investment decisions. In the context of capitalization rate vs discount rate, understanding the cap rate is essential for determining the viability of an investment opportunity.

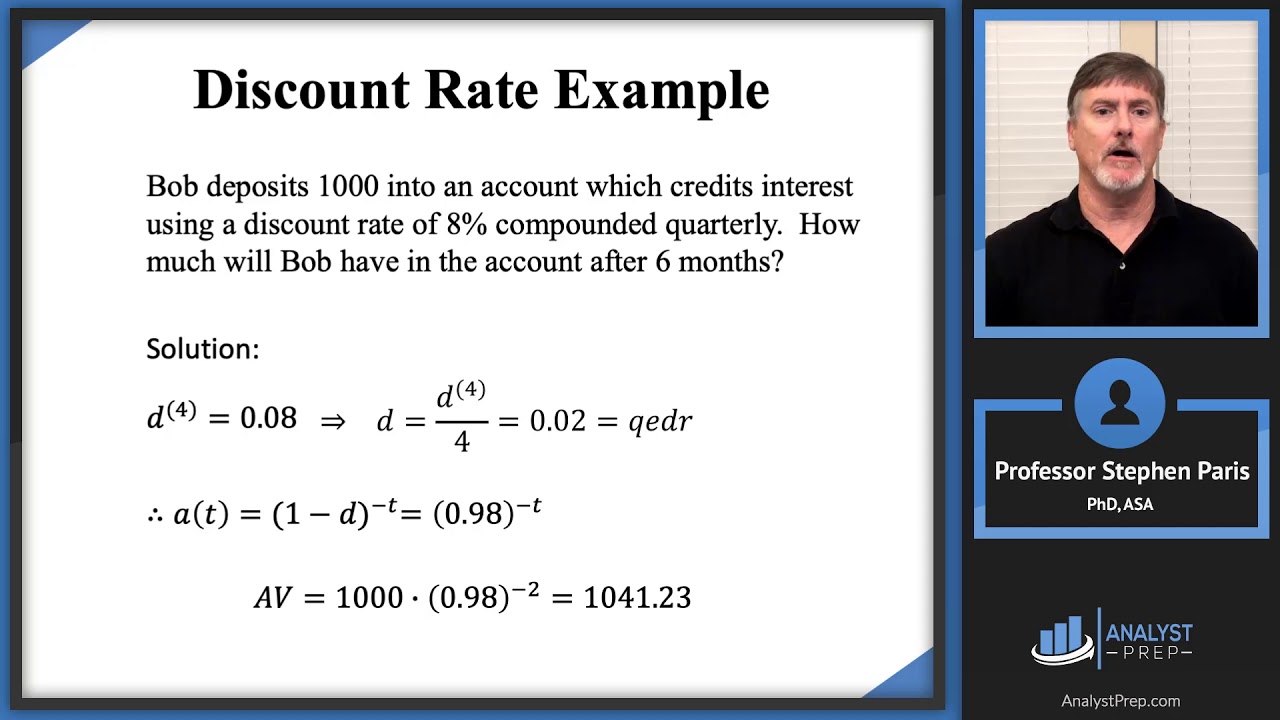

Demystifying the Discount Rate: A Crucial Component of Investment Analysis

The discount rate is a critical component of investment analysis in commercial real estate, and it is often misunderstood in relation to the capitalization rate. The discount rate represents the rate of return an investor requires to justify an investment in a property, considering factors such as risk, opportunity cost, and time value of money. It is used to discount future cash flows to their present value, allowing investors to evaluate the viability of an investment opportunity. In the context of capitalization rate vs discount rate, the discount rate is a more subjective measure, as it is influenced by an investor’s individual preferences and risk tolerance. A higher discount rate indicates a higher required rate of return, which can result in a lower present value of future cash flows. Understanding the discount rate is essential for investors to accurately assess the potential returns of a commercial property and make informed investment decisions.

How to Choose the Right Rate for Your Investment Strategy

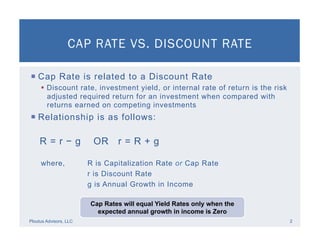

When it comes to evaluating commercial real estate investments, understanding the differences between the capitalization rate and discount rate is crucial. While both rates are essential in investment analysis, they serve distinct purposes and are used in different contexts. To make informed investment decisions, it’s essential to know when to use the capitalization rate versus the discount rate. The capitalization rate is typically used to evaluate the potential return on investment of a property based on its current market value and net operating income. On the other hand, the discount rate is used to determine the present value of future cash flows, considering factors such as risk, opportunity cost, and time value of money. In the context of capitalization rate vs discount rate, investors should use the capitalization rate when evaluating the potential return on investment of a property, and the discount rate when assessing the viability of an investment opportunity based on future cash flows. By selecting the appropriate rate based on the investment goals and risk tolerance, investors can make more accurate assessments and informed decisions.

The Interplay Between Capitalization Rate and Discount Rate: A Real-World Example

To illustrate the interplay between the capitalization rate and discount rate, let’s consider a hypothetical example. Suppose an investor is evaluating a commercial property with a net operating income of $100,000 and a market value of $1,000,000. The capitalization rate for this property is 10%, indicating a potential return on investment of 10% based on its current market value and net operating income. However, the investor requires a higher return on investment, say 12%, to justify the investment. In this case, the discount rate would be 12%, which would be used to discount the future cash flows to their present value. If the investor were to use the capitalization rate vs discount rate, they would arrive at different present values for the future cash flows. For instance, if the property is expected to generate $120,000 in net operating income in year 5, the present value of this cash flow using a 10% capitalization rate would be $83,333. However, using a 12% discount rate, the present value would be $74,074. This example demonstrates how changes in the capitalization rate and discount rate can affect the investment analysis, and highlights the importance of understanding the interplay between these two rates.

Common Mistakes to Avoid When Working with Capitalization and Discount Rates

When working with capitalization rates and discount rates, investors often make mistakes that can lead to inaccurate investment decisions. One common error is confusing the two rates, using the capitalization rate when a discount rate is required, or vice versa. This can result in mispriced investments and poor returns. Another mistake is failing to consider the underlying assumptions of each rate, such as the risk-free rate, market rate, and investment horizon. Investors must also avoid using a single rate for all investment opportunities, as each property and investment strategy requires a tailored approach. Furthermore, neglecting to update the rates in response to changes in market conditions or investment goals can lead to suboptimal investment decisions. By understanding the differences between the capitalization rate vs discount rate and avoiding these common mistakes, investors can make more informed decisions and maximize their returns. It is essential to recognize that the capitalization rate and discount rate are not interchangeable and should be used in their respective contexts to ensure accurate investment analysis.

Expert Insights: How Top Investors Use Capitalization and Discount Rates to Their Advantage

Experienced investors and industry experts understand the importance of accurately using capitalization rates and discount rates to inform their investment decisions. According to a seasoned real estate investor, “The capitalization rate vs discount rate is a crucial distinction that can make or break an investment. By understanding the nuances of each rate, investors can make more informed decisions and maximize their returns.” Another expert notes, “The discount rate is often overlooked, but it’s essential for determining the present value of future cash flows. By using the correct rate, investors can avoid overpaying for a property and ensure a higher return on investment.” A commercial real estate expert emphasizes, “It’s not just about using the right rate, but also about understanding the underlying assumptions and adjusting them according to market conditions and investment goals.” By following the guidance of these experts, investors can avoid common mistakes and make more informed decisions when working with capitalization rates and discount rates.

Maximizing Your Returns: Putting Capitalization and Discount Rates into Practice

To effectively incorporate capitalization rates and discount rates into investment analysis and decision-making, investors should follow a few key strategies. First, it’s essential to understand the investment goals and risk tolerance to select the appropriate rate. For example, a conservative investor may prefer a higher capitalization rate to ensure a lower purchase price, while a more aggressive investor may opt for a lower capitalization rate to maximize returns. Additionally, investors should regularly update their rates to reflect changes in market conditions and investment goals. This may involve adjusting the discount rate to account for shifts in interest rates or inflation. By doing so, investors can ensure that their investment decisions are informed by accurate and relevant data. Furthermore, investors should consider using sensitivity analysis to test how changes in the capitalization rate vs discount rate affect the investment’s potential returns. This can help identify potential risks and opportunities, allowing investors to make more informed decisions. By following these strategies, investors can unlock the full potential of capitalization rates and discount rates, making more informed investment decisions and maximizing their returns.