Understanding the Fundamentals of Portfolio Management

Portfolio management is a crucial aspect of investment strategy, as it enables investors to achieve their financial goals by optimizing returns and minimizing risk. Effective portfolio management involves the careful selection and allocation of assets, taking into account the investor’s risk tolerance, investment horizon, and return expectations. By diversifying their portfolio, investors can reduce their exposure to market volatility and increase the potential for long-term growth. Risk management is another critical component of portfolio management, as it helps investors identify and mitigate potential risks that could negatively impact their investment portfolio. A well-structured portfolio can provide a sense of security and confidence in an ever-changing market landscape, making it an essential tool for investors seeking to maximize their returns. As investors navigate the complexities of portfolio management, understanding the role of the capital allocation line vs capital market line can be a key differentiator in achieving optimal portfolio performance.

Capital Allocation Line vs Capital Market Line: What’s the Difference?

In the realm of portfolio optimization, two critical concepts stand out: the Capital Allocation Line (CAL) and the Capital Market Line (CML). While both are essential tools for investors seeking to maximize returns, they serve distinct purposes and possess unique characteristics. The CAL is a graphical representation of the optimal portfolio, illustrating the trade-off between risk and return. It helps investors identify the most efficient portfolio by combining different assets in a way that minimizes risk while maximizing expected returns. On the other hand, the CML is a risk-return framework that illustrates the trade-off between risk and return for a given portfolio. It provides investors with a visual representation of the expected returns for a given level of risk, enabling them to make informed decisions about their investment portfolios. Understanding the differences between the CAL and CML is crucial for investors seeking to optimize their portfolios and achieve their investment goals. By grasping the distinct characteristics and purposes of these two concepts, investors can make more informed decisions about their investment strategies, ultimately leading to better portfolio performance and higher returns. The capital allocation line vs capital market line debate is a critical aspect of portfolio management, and understanding the nuances of each can be a key differentiator in achieving success.

How to Construct an Efficient Portfolio with the Capital Allocation Line

Constructing an efficient portfolio using the Capital Allocation Line (CAL) involves a step-by-step approach that helps investors identify the optimal portfolio and calculate expected returns. The CAL is a graphical representation of the optimal portfolio, illustrating the trade-off between risk and return. To construct an efficient portfolio with the CAL, investors should follow these steps:

Step 1: Identify the investment universe, including the available assets and their respective expected returns and risks.

Step 2: Determine the investor’s risk tolerance and investment goals, which will influence the optimal portfolio construction.

Step 3: Calculate the expected returns and risks for each asset, using historical data or financial models.

Step 4: Plot the assets on a risk-return graph, creating the CAL.

Step 5: Identify the optimal portfolio by finding the point on the CAL that maximizes expected returns for a given level of risk.

Step 6: Calculate the expected returns and risks for the optimal portfolio, using the CAL.

By following these steps, investors can construct an efficient portfolio using the CAL, which helps to minimize risk and maximize expected returns. The capital allocation line vs capital market line debate is an important aspect of portfolio management, and understanding how to construct an efficient portfolio with the CAL is crucial for achieving optimal portfolio performance. By applying the CAL in portfolio construction, investors can make more informed decisions about their investment strategies, ultimately leading to better portfolio performance and higher returns.

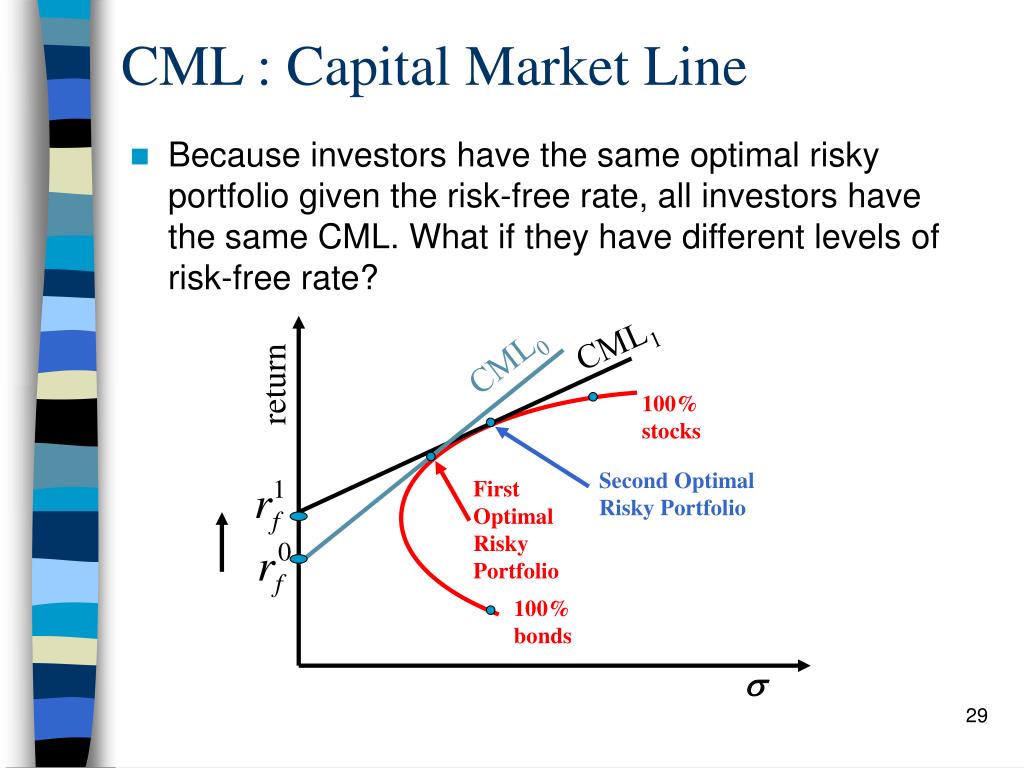

The Capital Market Line: A Risk-Return Framework for Investors

The Capital Market Line (CML) is a fundamental concept in portfolio management, providing a risk-return framework for investors to make informed decisions about their investment portfolios. The CML is a graphical representation of the trade-off between risk and return, illustrating the expected returns for a given level of risk. This framework is essential for investors seeking to optimize their portfolios, as it helps to identify the most efficient portfolios and make informed investment decisions.

The CML is constructed by plotting the expected returns of different portfolios against their respective risks, measured by the standard deviation of returns. The resulting line represents the optimal risk-return trade-off, with higher expected returns associated with higher levels of risk. By using the CML, investors can identify the optimal portfolio for their desired level of risk, maximizing expected returns while minimizing risk.

The CML is particularly useful for investors seeking to diversify their portfolios, as it provides a framework for evaluating the risk-return profiles of different assets and portfolios. By comparing the risk-return profiles of different portfolios, investors can identify the most efficient portfolios and make informed decisions about their investment strategies. The capital allocation line vs capital market line debate is an important aspect of portfolio management, and understanding the CML’s role in illustrating the trade-off between risk and return is crucial for achieving optimal portfolio performance.

In addition to its role in portfolio optimization, the CML also provides a framework for evaluating the performance of different investment strategies. By comparing the risk-return profiles of different portfolios, investors can identify the most effective investment strategies and make informed decisions about their investment portfolios. Overall, the CML is a powerful tool for investors seeking to optimize their portfolios and achieve their investment goals.

Key Similarities and Differences between CAL and CML

When it comes to portfolio optimization, the Capital Allocation Line (CAL) and Capital Market Line (CML) are two essential concepts that investors should understand. While both lines are used in portfolio management, they serve distinct purposes and have different characteristics. In this section, we will explore the similarities and differences between CAL and CML, highlighting their roles in portfolio construction and investment strategies.

Similarities between CAL and CML:

Both CAL and CML are graphical representations of the risk-return trade-off, illustrating the expected returns for a given level of risk. They are both used to identify the optimal portfolio, maximizing expected returns while minimizing risk. Additionally, both lines are constructed by plotting the expected returns of different portfolios against their respective risks, measured by the standard deviation of returns.

Differences between CAL and CML:

The main difference between CAL and CML lies in their purposes and constructions. The CAL is a graphical representation of the optimal portfolio, illustrating the trade-off between risk and return for a specific investor. It is constructed by plotting the expected returns of different portfolios against their respective risks, taking into account the investor’s risk tolerance and investment goals. On the other hand, the CML is a risk-return framework that illustrates the trade-off between risk and return for the entire market, rather than a specific investor.

In terms of portfolio construction, the CAL is used to identify the optimal portfolio for a specific investor, while the CML is used to evaluate the risk-return profiles of different portfolios and identify the most efficient ones. The capital allocation line vs capital market line debate is an important aspect of portfolio management, and understanding the similarities and differences between these two concepts is crucial for achieving optimal portfolio performance.

By understanding the similarities and differences between CAL and CML, investors can make more informed decisions about their investment portfolios, ultimately leading to better portfolio performance and higher returns. In the next section, we will explore the real-world applications of CAL and CML in portfolio management, including case studies and examples of successful investment strategies.

Real-World Applications of CAL and CML in Portfolio Management

In the real world, the Capital Allocation Line (CAL) and Capital Market Line (CML) are widely used in portfolio management to optimize investment portfolios and maximize returns. Many investment firms and financial institutions rely on these concepts to construct efficient portfolios and make informed investment decisions.

For example, a pension fund may use the CAL to construct a portfolio that meets its specific investment goals and risk tolerance. By identifying the optimal portfolio, the pension fund can maximize its expected returns while minimizing risk. On the other hand, a hedge fund may use the CML to evaluate the risk-return profiles of different portfolios and identify the most efficient ones.

In addition, many investment strategies, such as the Black-Litterman model, rely on the CAL and CML to optimize portfolio construction. This model uses the CAL to identify the optimal portfolio and the CML to evaluate the risk-return profiles of different assets. By combining these two concepts, investors can create a diversified portfolio that maximizes expected returns while minimizing risk.

Another example is the use of CAL and CML in asset allocation. By using the CAL to identify the optimal portfolio, investors can allocate their assets effectively across different asset classes, such as stocks, bonds, and real estate. The CML can then be used to evaluate the risk-return profiles of different asset classes and identify the most efficient ones.

The capital allocation line vs capital market line debate is an important aspect of portfolio management, and understanding the real-world applications of these concepts is crucial for achieving optimal portfolio performance. By using CAL and CML in portfolio management, investors can make more informed decisions, maximize returns, and minimize risk.

In the next section, we will discuss the common challenges and limitations of implementing CAL and CML in portfolio management, including data quality issues, model risk, and behavioral biases.

Overcoming Common Challenges in Implementing CAL and CML

While the Capital Allocation Line (CAL) and Capital Market Line (CML) are powerful tools in portfolio management, their implementation can be challenging. Investors and portfolio managers may face several obstacles when using these concepts to optimize their investment portfolios.

One common challenge is data quality issues. The accuracy of the CAL and CML relies heavily on the quality of the data used to construct them. If the data is incomplete, inaccurate, or outdated, the resulting portfolios may not be optimal. To overcome this challenge, investors must ensure that they have access to high-quality data and use robust data cleaning and processing techniques.

Another challenge is model risk. The CAL and CML are based on mathematical models that assume certain conditions and relationships between variables. However, these models may not always reflect real-world market conditions, leading to model risk. To mitigate this risk, investors must regularly review and update their models to ensure they remain relevant and accurate.

Behavioral biases are also a common challenge in implementing CAL and CML. Investors and portfolio managers may be influenced by cognitive biases, such as overconfidence or anchoring, which can lead to suboptimal portfolio decisions. To overcome this challenge, investors must be aware of their biases and use techniques such as diversification and regularization to minimize their impact.

In addition, the capital allocation line vs capital market line debate can be complex, and investors may struggle to choose the right approach for their specific investment goals and risk tolerance. To overcome this challenge, investors must have a deep understanding of both concepts and their applications in portfolio management.

By understanding these common challenges and limitations, investors and portfolio managers can take steps to overcome them and effectively implement the CAL and CML in their portfolio management strategies. This can lead to more efficient portfolio construction, better risk management, and ultimately, higher returns.

Conclusion: Maximizing Returns with Effective Portfolio Optimization

In conclusion, the capital allocation line vs capital market line debate is a crucial aspect of portfolio management. By understanding the distinct characteristics and purposes of the Capital Allocation Line (CAL) and Capital Market Line (CML), investors can make informed decisions about their investment portfolios and achieve optimal portfolio performance.

The CAL and CML are powerful tools that can help investors construct efficient portfolios, manage risk, and maximize returns. By applying these concepts in real-world portfolio management, investors can create diversified portfolios that meet their specific investment goals and risk tolerance.

However, it is essential to overcome common challenges and limitations of implementing CAL and CML, such as data quality issues, model risk, and behavioral biases. By being aware of these challenges, investors can take steps to mitigate them and ensure that their portfolios remain optimal.

In today’s complex investment landscape, understanding the capital allocation line vs capital market line debate is more important than ever. By grasping the key similarities and differences between CAL and CML, investors can make more informed decisions about their investment portfolios and achieve their long-term financial goals.

Ultimately, the key to maximizing returns is to adopt a disciplined and systematic approach to portfolio management, leveraging the power of CAL and CML to construct efficient portfolios that meet specific investment goals and risk tolerance. By doing so, investors can navigate the complexities of the investment landscape with confidence and achieve optimal portfolio performance.

:max_bytes(150000):strip_icc()/DDM_INV_CML-Final-a50f290fb65849cdab26156c236777a5.jpg)