What is the Sharpe Ratio and Why Does it Matter?

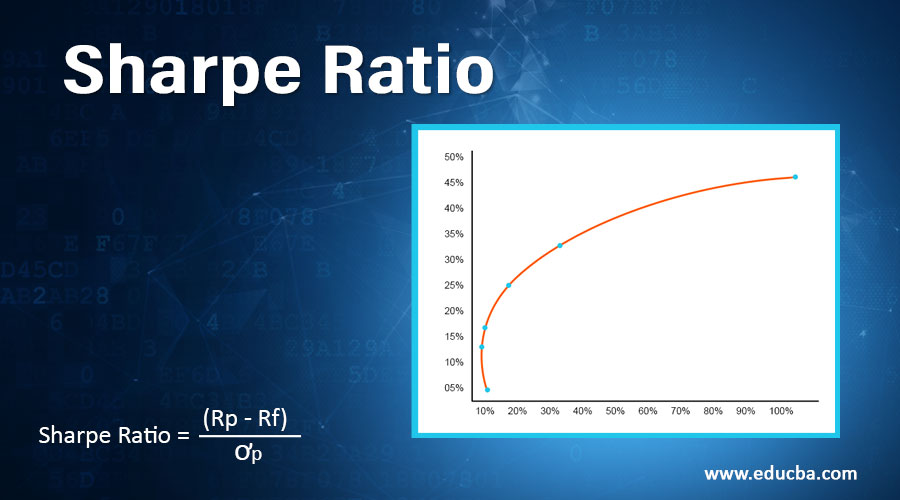

The Sharpe ratio is a widely used metric in finance that helps investors and portfolio managers evaluate the risk-adjusted return of an investment. It is a powerful tool that provides a standardized way to compare the performance of different investments, allowing investors to make informed decisions about their portfolios. The Sharpe ratio is calculated by subtracting the risk-free rate from the expected return of an investment and dividing the result by the standard deviation of the investment’s returns. This formula provides a clear picture of an investment’s risk-reward profile, enabling investors to determine whether the potential returns justify the level of risk involved. As investors navigate the complex landscape of financial markets, understanding the Sharpe ratio is crucial for making informed investment decisions and achieving long-term success. In fact, understanding whether can Sharpe ratio be negative is essential in evaluating the performance of an investment.

The Possibility of a Negative Sharpe Ratio

A negative Sharpe ratio is a scenario where an investment’s return is lower than the risk-free rate, and the standard deviation of the investment’s returns is high. This means that the investment is not generating enough returns to compensate for the level of risk taken. The possibility of a negative Sharpe ratio is a crucial aspect of investment analysis, as it can have significant implications for investors. For instance, a negative Sharpe ratio can indicate that an investment is not suitable for a particular portfolio or that the investment strategy needs to be revised. In some cases, a negative Sharpe ratio can even suggest that an investment is riskier than initially thought, which can lead to significant losses if not addressed promptly. It is essential to understand that can Sharpe ratio be negative and what it means for investors, as it can help them make more informed decisions about their investments.

How to Interpret a Negative Sharpe Ratio

When confronted with a negative Sharpe ratio, it is essential to understand the implications and potential risks associated with such an investment. A negative Sharpe ratio indicates that an investment is not generating sufficient returns to compensate for the level of risk taken. This can be a warning sign for investors, as it may suggest that the investment is not suitable for their portfolio or that the investment strategy needs to be revised. It is crucial to recognize that can Sharpe ratio be negative and what it means for investors, as it can help them make more informed decisions about their investments. In such cases, investors should consider other metrics, such as the Sortino ratio or Calmar ratio, to gain a more comprehensive understanding of the investment’s risk-reward profile. Additionally, investors should assess the underlying causes of the negative Sharpe ratio, such as high volatility or poor asset selection, and adjust their investment strategy accordingly. By taking a nuanced approach to risk management and portfolio optimization, investors can mitigate potential losses and achieve their long-term investment goals.

Causes of a Negative Sharpe Ratio

A negative Sharpe ratio can occur due to various reasons, including high volatility, poor asset selection, or inadequate risk management. High volatility can lead to a negative Sharpe ratio if the investment’s returns are highly unpredictable, making it challenging to generate consistent returns. Poor asset selection can also result in a negative Sharpe ratio if the investment does not align with the investor’s risk tolerance or investment goals. Inadequate risk management can further exacerbate the issue, as it may lead to a mismatch between the investment’s risk profile and the investor’s risk appetite. For instance, an investor who is risk-averse may invest in a high-risk asset, resulting in a negative Sharpe ratio. It is essential to recognize that can Sharpe ratio be negative and understand the underlying causes to make informed investment decisions. By identifying the root causes of a negative Sharpe ratio, investors can take corrective action to adjust their investment strategy and mitigate potential losses.

Managing Risk with a Negative Sharpe Ratio

When dealing with a negative Sharpe ratio, it is essential to adopt effective risk management strategies to mitigate potential losses. One approach is diversification, which involves spreading investments across different asset classes to reduce exposure to any one particular asset. This can help to minimize the impact of a negative Sharpe ratio on the overall portfolio. Another strategy is hedging, which involves taking positions in assets that are negatively correlated with the asset exhibiting a negative Sharpe ratio. This can help to offset potential losses and reduce overall portfolio risk. Asset allocation is also a crucial aspect of managing risk with a negative Sharpe ratio. By allocating a smaller proportion of the portfolio to assets with negative Sharpe ratios, investors can reduce their exposure to these assets and minimize potential losses. It is also important to recognize that can Sharpe ratio be negative and understand the implications of investing in assets with negative Sharpe ratios. By adopting a proactive approach to risk management, investors can navigate the complexities of a negative Sharpe ratio and achieve their long-term investment goals.

Real-World Examples of Negative Sharpe Ratios

Several real-world examples illustrate the occurrence of negative Sharpe ratios. For instance, during the 2008 global financial crisis, many stocks and funds exhibited negative Sharpe ratios due to their high volatility and poor performance. The S&P 500 Index, a benchmark for the US stock market, had a negative Sharpe ratio during this period, indicating that investors would have been better off investing in risk-free assets. Similarly, hedge funds that invested heavily in subprime mortgages also experienced negative Sharpe ratios, leading to significant losses for their investors. In another example, the cryptocurrency market has been known to exhibit high volatility, leading to negative Sharpe ratios for many digital assets. It is essential to recognize that can Sharpe ratio be negative and understand the underlying causes of these negative ratios. By analyzing these real-world examples, investors can gain valuable insights into the importance of risk management and portfolio optimization. Furthermore, investors can learn to identify potential warning signs of a negative Sharpe ratio and take proactive steps to mitigate potential losses.

Alternative Metrics to the Sharpe Ratio

In addition to the Sharpe ratio, investors can use alternative metrics to evaluate the risk-adjusted performance of their investments. The Sortino ratio, for instance, is a variation of the Sharpe ratio that uses downside deviation instead of standard deviation, providing a more nuanced view of risk. The Treynor ratio, on the other hand, measures the excess return generated by an investment relative to the risk-free rate, divided by the beta of the investment. The Calmar ratio, another alternative metric, calculates the return of an investment relative to its maximum drawdown, providing a measure of risk-adjusted performance over a specific time period. While these metrics have their strengths, it is essential to recognize that can Sharpe ratio be negative and understand the limitations of each metric. By using a combination of these metrics, investors can gain a more comprehensive understanding of their investments and make more informed decisions. Furthermore, investors should be aware that no single metric can fully capture the complexities of investment risk, and a nuanced approach to risk management and portfolio optimization is essential.

Conclusion: Navigating the Complexities of the Sharpe Ratio

In conclusion, the Sharpe ratio is a powerful tool for investors seeking to optimize their portfolios and manage risk. However, it is essential to recognize that can Sharpe ratio be negative, and understanding the implications of a negative Sharpe ratio is crucial for making informed investment decisions. By considering alternative metrics, such as the Sortino ratio, Treynor ratio, or Calmar ratio, investors can gain a more comprehensive understanding of their investments and make more informed decisions. Moreover, investors should be aware of the common causes of a negative Sharpe ratio, including high volatility, poor asset selection, or inadequate risk management, and take proactive steps to mitigate potential losses. Ultimately, a nuanced approach to risk management and portfolio optimization is essential for achieving long-term investment success. By adopting a thoughtful and informed approach to investing, investors can navigate the complexities of the Sharpe ratio and make more informed decisions that align with their investment goals.