Understanding Yield to Maturity (YTM)

Yield to maturity (YTM) represents the total return an investor can expect to receive if they hold a bond until its maturity date. It accounts for the bond’s current market price, its face value, the coupon interest payments, and the time remaining until maturity. Calculating yield to maturity in Excel offers a significant advantage over manual calculation, providing a fast and accurate result. YTM serves as a crucial metric for comparing the relative attractiveness of different bonds and assessing their potential profitability. Investors use YTM to make informed decisions about which bonds to buy or sell, considering the inherent risks and potential returns. Mastering the calculation of yield to maturity in Excel is a valuable skill for any serious bond investor. This guide will provide a comprehensive understanding of this important metric and demonstrate how to easily calculate yield to maturity in Excel. This method simplifies the process of calculating yield to maturity in Excel significantly.

Understanding YTM is essential for effective bond investment. It reflects the total return, considering all cash flows. A higher YTM generally indicates a higher potential return, but also potentially higher risk. Conversely, a lower YTM suggests a lower potential return, but may imply lower risk. The process of calculating yield to maturity in Excel streamlines the calculation, removing the complexity of manual methods. By understanding how to calculate yield to maturity in Excel, investors can make more informed decisions, optimize their portfolios, and potentially increase their returns. The ability to efficiently calculate yield to maturity in Excel provides a significant advantage in the bond market.

This guide focuses on using Excel’s built-in functions to determine YTM. This approach offers significant accuracy and efficiency. Calculating yield to maturity in Excel allows investors to quickly evaluate numerous bonds. This efficient calculation provides a clear comparative analysis, enabling better investment choices. The step-by-step instructions provided will empower investors to confidently analyze bond opportunities and make data-driven decisions. Learning how to calculate yield to maturity in Excel is an investment in financial literacy, leading to improved investment outcomes. This method of calculating yield to maturity in Excel provides a valuable tool for informed decision-making in the bond market.

Essential Inputs for Calculating Yield to Maturity

To accurately calculate yield to maturity in Excel, several key inputs are required. These inputs define the characteristics of the bond and its current market conditions. First, the bond’s face value, also known as par value, represents the amount the issuer will repay at maturity. This information is typically found in the bond’s offering documents or on financial websites. Next, the coupon rate determines the annual interest payment relative to the face value. The coupon rate is usually stated as a percentage. This is also readily available in bond prospectuses and financial data providers. The current market price reflects the price at which the bond is currently trading in the secondary market. This price fluctuates based on factors like interest rates and credit ratings. Real-time market prices can be found on financial news websites and trading platforms. Calculating yield to maturity in Excel also requires the time to maturity, expressed in years. This represents the remaining time until the bond’s maturity date. Finally, you need to know the payment frequency, whether it’s annual or semi-annual. This detail is specified in the bond’s documentation.

Understanding where to find this information is crucial for calculating yield to maturity in Excel. Bond prospectuses, official offering documents, and financial data services like Bloomberg or Refinitiv provide comprehensive details. For publicly traded bonds, many financial websites display real-time market prices, coupon rates, and maturity dates. Investors can also consult their brokerage accounts for details on the bonds they hold. Gathering accurate input data is paramount to ensure the accuracy of your yield to maturity calculation. Minor discrepancies in inputs can lead to significant variations in the calculated yield. Therefore, verifying the accuracy of the collected data from reliable sources is highly recommended. When calculating yield to maturity in Excel, using precise and verified data is essential for achieving accurate results.

Successfully calculating yield to maturity in Excel hinges on the correct identification and input of these five variables. Each piece of data plays a critical role in determining the final yield. The face value provides the repayment amount at maturity. The coupon rate establishes the periodic interest payments. The market price reflects the current value of the bond. The time to maturity specifies the investment horizon. And finally, the payment frequency clarifies how often the coupon payments are made. By carefully gathering this information and using Excel’s built-in functions, investors can efficiently and accurately determine a bond’s yield to maturity. Mastering this calculation empowers investors to make well-informed decisions when evaluating bond investments.

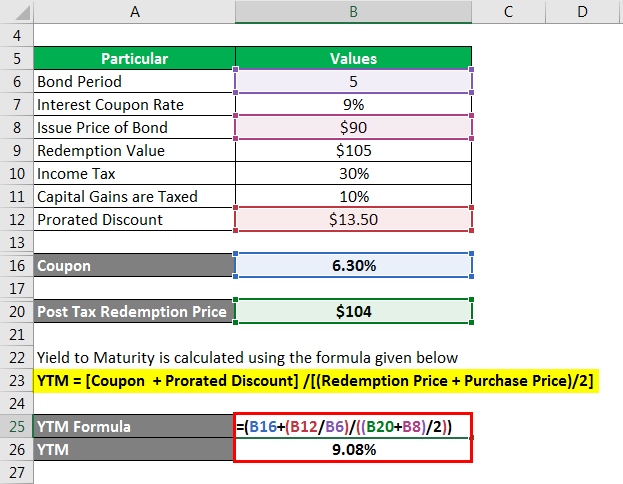

The YTM Formula: A Breakdown

The Yield to Maturity (YTM) formula, while crucial for understanding the concept, isn’t directly solvable using standard algebra. It represents the total return an investor can expect if holding the bond until it matures. The formula considers the bond’s current market price, par value, coupon payments, and time to maturity. Accurately calculating yield to maturity in excel provides an efficient solution to find the YTM.

The general YTM formula can be expressed as: Current Market Price = (Coupon Payment / (1 + YTM)^1) + (Coupon Payment / (1 + YTM)^2) + … + (Coupon Payment + Face Value) / (1 + YTM)^n. Where ‘n’ is the number of periods until maturity. The YTM is the discount rate that equates the present value of the bond’s future cash flows (coupon payments and face value) to its current market price. Because of the iterative nature of solving for the YTM (discount rate), manually calculating yield to maturity is not practical.

Because isolating YTM algebraically is challenging, an iterative process or numerical methods are typically employed. This involves making successive approximations until a YTM value is found that satisfies the equation. Excel’s RATE function provides an efficient way of calculating yield to maturity in excel by implementing this iterative process automatically. The RATE function removes the need for manual estimations, making bond valuation accessible and accurate for investors of all levels. Using Excel’s built-in functions allows for rapid and accurate calculating yield to maturity in excel, which simplifies bond analysis and decision-making.

How to Calculate Yield to Maturity Using Excel’s RATE Function

The RATE function in Excel offers a straightforward method for calculating yield to maturity in excel. This function determines the interest rate per period of an annuity. In the context of bond valuation, it effectively solves for the YTM through an iterative process, eliminating the need for manual calculations or complex algebraic solutions. The RATE function requires several inputs, each corresponding to specific bond characteristics. These inputs are Nper, PMT, PV, and FV.

Nper represents the total number of payment periods. For a bond, this translates to the time to maturity multiplied by the number of coupon payments per year. For example, a bond with 10 years to maturity and annual coupon payments would have an Nper of 10. PMT refers to the periodic payment. This is the coupon payment received each period. Calculate this by multiplying the bond’s face value by the coupon rate and dividing by the number of payments per year. For instance, a bond with a $1,000 face value and a 5% coupon rate paid annually would have a PMT of $50. PV stands for present value, which is the current market price of the bond. Enter the bond’s price as a negative value. FV represents the future value, or face value, of the bond. This is the amount the investor receives at maturity. Typically, the face value is $1,000. To implement this, open Excel and locate an empty cell. Type “=RATE(” and begin entering the parameters. The syntax is =RATE(Nper, PMT, PV, FV). Ensure to input the values accurately, paying attention to signs (PV should be negative). Press Enter to display the calculated YTM.

Here’s an example: Suppose a bond has 5 years to maturity, a coupon rate of 6%, a face value of $1,000, and is currently trading at $950. Coupon payments are annual. In Excel, the RATE function would be entered as =RATE(5, 60, -950, 1000). Excel will return the YTM. If the coupon payments were semi-annual, the inputs would need adjustment. Nper becomes 10 (5 years * 2), PMT becomes $30 ($1,000 * 6% / 2), PV remains -950, and FV remains 1000. The Excel formula then becomes =RATE(10, 30, -950, 1000). The result must be multiplied by 2 to annualize the yield, thereby calculating yield to maturity in excel for bonds with semi-annual payments. Using the RATE function accurately and adjusting for payment frequency provides a reliable way of calculating yield to maturity in excel, enabling informed investment decisions.

Handling Semi-Annual Coupon Payments in Excel

Many bonds distribute coupon payments semi-annually, twice a year, rather than annually. When calculating yield to maturity in excel for such bonds, adjustments to the inputs used in the RATE function are essential to achieve an accurate result. The RATE function in Excel expects inputs to be consistent with the payment frequency. Failing to adjust for semi-annual payments will lead to a significant miscalculation of the yield to maturity.

To correctly calculate yield to maturity in excel with semi-annual payments, modify two key inputs: Nper (number of periods) and PMT (periodic payment). First, double the ‘Time to Maturity (in years)’ to determine the total number of periods (Nper). For example, a bond with 10 years to maturity will have 20 periods (10 years * 2 payments per year). Second, halve the annual coupon payment to reflect the semi-annual payment amount. If the bond has a 6% annual coupon rate on a face value of $1,000, the annual coupon payment is $60. The semi-annual payment (PMT) will then be $30 ($60 / 2). The other inputs, PV (present value or market price) and FV (future value or face value), remain unchanged. By adjusting Nper and PMT, the RATE function accurately reflects the bond’s cash flows.

Consider a bond with a face value of $1,000, a coupon rate of 8% (paid semi-annually), a current market price of $950, and a maturity of 5 years. To calculate yield to maturity in excel, Nper would be 10 (5 years * 2), PMT would be $40 (($1,000 * 8%) / 2), PV would be -$950, and FV would be $1,000. Inputting these values into the RATE function (=RATE(10,40,-950,1000)) yields the semi-annual yield. To obtain the annual yield to maturity, multiply the result by 2. This adjusted calculation ensures an accurate representation of the bond’s yield, taking into account the semi-annual payment structure. Accurately calculating yield to maturity in excel helps investors make informed decisions.

Interpreting Your YTM Results

The calculated Yield to Maturity (YTM) is an estimate of the total return an investor can anticipate receiving if the bond is held until maturity. Understanding how to interpret this metric is crucial for informed investment decisions. A higher YTM generally indicates a more attractive investment opportunity, suggesting a greater potential return. Conversely, a lower YTM might signal a less appealing investment, possibly due to lower risk or other factors. When calculating yield to maturity in excel, the resultant value offers a comparative benchmark against other investment options.

The YTM is intrinsically linked to the bond’s current market price. An inverse relationship exists between the two: as the market price of a bond decreases, its YTM increases, and vice versa. This occurs because a lower price means the investor is paying less upfront for the same stream of future cash flows (coupon payments and face value at maturity). Therefore, the effective return on investment, represented by the YTM, is higher. Conversely, if a bond’s market price increases, the YTM decreases. Calculating yield to maturity in excel allows for quick observation of how price fluctuations impact potential returns.

To further illustrate, consider two scenarios. First, if a bond is trading at a discount (below its face value), its YTM will be higher than its coupon rate. This compensates the investor for purchasing the bond at a reduced price, ensuring a competitive return over the bond’s life. Second, if a bond is trading at a premium (above its face value), its YTM will be lower than its coupon rate. Here, the higher purchase price diminishes the overall return. Investors frequently use excel for calculating yield to maturity because it provides a swift and accurate way to compare bonds with differing coupon rates and market prices, enabling them to make well-informed investment choices. By accurately calculating yield to maturity in excel, investors are better equipped to assess risk and return profiles of diverse bond offerings.

Advanced Scenarios and Considerations

While the RATE function in Excel offers a straightforward method for calculating yield to maturity in excel, it’s crucial to acknowledge scenarios where the calculation becomes more complex. Callable bonds, for instance, grant the issuer the right to redeem the bond before its maturity date. This introduces uncertainty, as the actual time to maturity may be shorter than initially anticipated. Calculating yield to maturity in excel for callable bonds requires considering various call dates and prices, resulting in metrics like yield to worst (YTW), which represents the lowest potential yield an investor might receive.

Bonds with embedded options, such as convertibles, also complicate the YTM calculation. These options give the bondholder the right, but not the obligation, to convert the bond into a predetermined number of shares of the issuer’s stock. The potential for conversion can influence the bond’s market price and, consequently, its YTM. Accurately valuing such bonds necessitates sophisticated models that account for the value of the embedded option. Moreover, it’s important to recognize the limitations of YTM as a sole measure of bond return. YTM assumes that all coupon payments are reinvested at the same rate, which may not hold true in reality. Calculating yield to maturity in excel provides a useful estimate, but it’s essential to supplement it with other metrics, such as duration and convexity, for a more comprehensive risk assessment. These measures provide insights into a bond’s price sensitivity to interest rate changes.

Furthermore, calculating yield to maturity in excel might not fully capture the impact of changing credit spreads or liquidity premiums. Credit spreads reflect the additional yield investors demand for taking on the credit risk of the issuer, while liquidity premiums compensate investors for the ease with which a bond can be bought or sold in the market. These factors can influence a bond’s overall return profile. Therefore, while calculating yield to maturity in excel offers a valuable starting point for bond valuation, a thorough analysis should also consider these advanced scenarios and limitations to arrive at a well-informed investment decision.

Putting it All Together: Real-World Example with Excel Spreadsheet

To solidify the understanding of calculating yield to maturity in excel, let’s consider a practical example. Imagine a hypothetical bond with the following characteristics: Face Value: $1,000; Coupon Rate: 6% (paid semi-annually); Current Market Price: $950; Time to Maturity: 5 years. To calculate the YTM in Excel, first, organize the inputs. The face value is $1,000. The semi-annual coupon payment is calculated as (6% * $1,000) / 2 = $30. The current market price is $950. The number of periods (Nper) is 5 years * 2 = 10 (semi-annual periods). Now, use the RATE function in Excel. The formula will be: =RATE(Nper, PMT, -PV, FV). Input the values accordingly: =RATE(10, 30, -950, 1000). Excel will return a result. This result represents the semi-annual yield. To annualize it, multiply by 2. For instance, if Excel returns 0.036, the YTM would be 0.036 * 2 = 0.072, or 7.2%. This indicates the bond’s yield to maturity is approximately 7.2%.

This real-world example demonstrates the ease of calculating yield to maturity in excel using the RATE function. Consider another example: Bond Face Value: $1,000; Coupon Rate: 8% (paid annually); Current Market Price: $1,050; Time to Maturity: 3 years. In this case, the annual coupon payment is 8% * $1,000 = $80. The formula in Excel would be: =RATE(3, 80, -1050, 1000). The result will directly provide the annual YTM. If the result is 0.06, the YTM is 6%. Varying bond characteristics impact the YTM. Higher market prices relative to face value generally result in lower YTMs, and vice versa. Calculating yield to maturity in excel offers a precise way to assess bond investments. It empowers investors to make informed decisions.

Furthermore, when calculating yield to maturity in excel, verify the accuracy of your inputs. Small errors can lead to significant discrepancies in the calculated YTM. Use cell references instead of hardcoding values into the RATE function. This allows easy modification of the inputs and automatic recalculation of the YTM. Regularly update the market price to reflect current trading conditions. Understanding how to accurately input data and interpret the results from calculating yield to maturity in excel are critical skills for bond investors. These examples provide a solid foundation for performing these calculations effectively and efficiently. Remember, consistently practicing and refining your approach to calculating yield to maturity in excel will lead to greater proficiency and better investment outcomes.