Understanding the Basics of Spot Rates and Forward Rates

In the realm of finance, spot rates and forward rates are two fundamental concepts that play a crucial role in investment decisions. A spot rate, also known as a zero-coupon rate, represents the current interest rate applicable to a loan or investment with a specific term. On the other hand, a forward rate is the expected interest rate at a future date, derived from the spot rate curve. The ability to calculate forward rates from spot rates is essential for investors, as it enables them to anticipate future interest rates and make informed decisions about their investments. By grasping the differences and importance of spot rates and forward rates, investors can better navigate the complexities of financial markets and make more informed investment decisions.

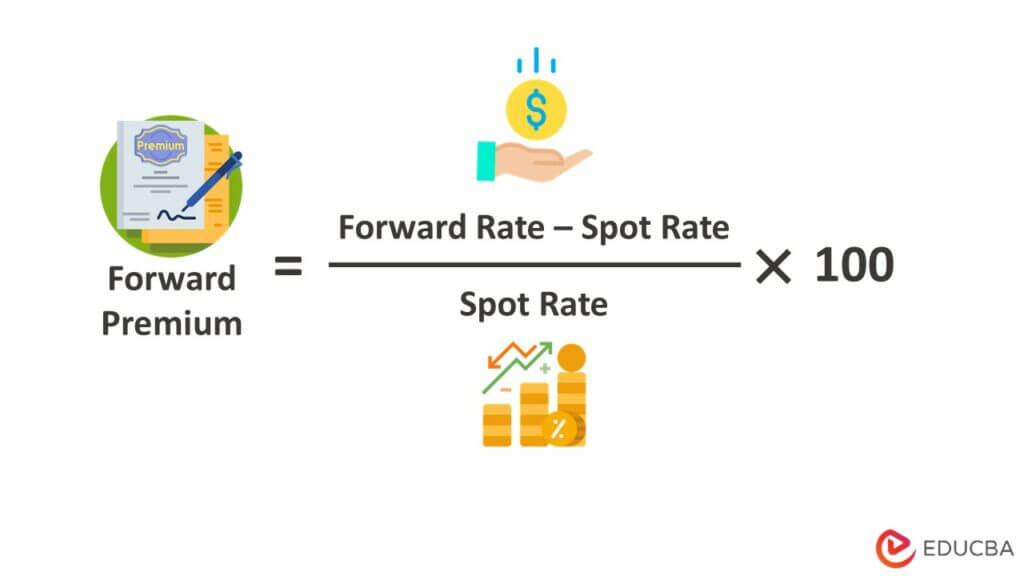

How to Calculate Forward Rates from Spot Rates: A Simplified Approach

The process of calculating forward rates from spot rates is a fundamental concept in finance. The formula for calculating forward rates is as follows: (1 + forward rate)^n = (1 + spot rate 1)^m / (1 + spot rate 2)^(m-n), where n is the time period for which the forward rate is being calculated, and m is the time period for the spot rate. To break it down, the formula involves three components: the forward rate, the spot rate 1, and the spot rate 2. Understanding each component is crucial for accurate calculations. For instance, the forward rate represents the expected interest rate at a future date, while the spot rates represent the current interest rates for different time periods. By plugging in the values for each component, investors can calculate the forward rate and gain valuable insights into future interest rates. It is essential to emphasize the importance of accuracy in these calculations, as small errors can lead to significant differences in investment decisions. By mastering the art of calculating forward rates from spot rates, investors can make more informed decisions and navigate the complexities of financial markets with confidence.

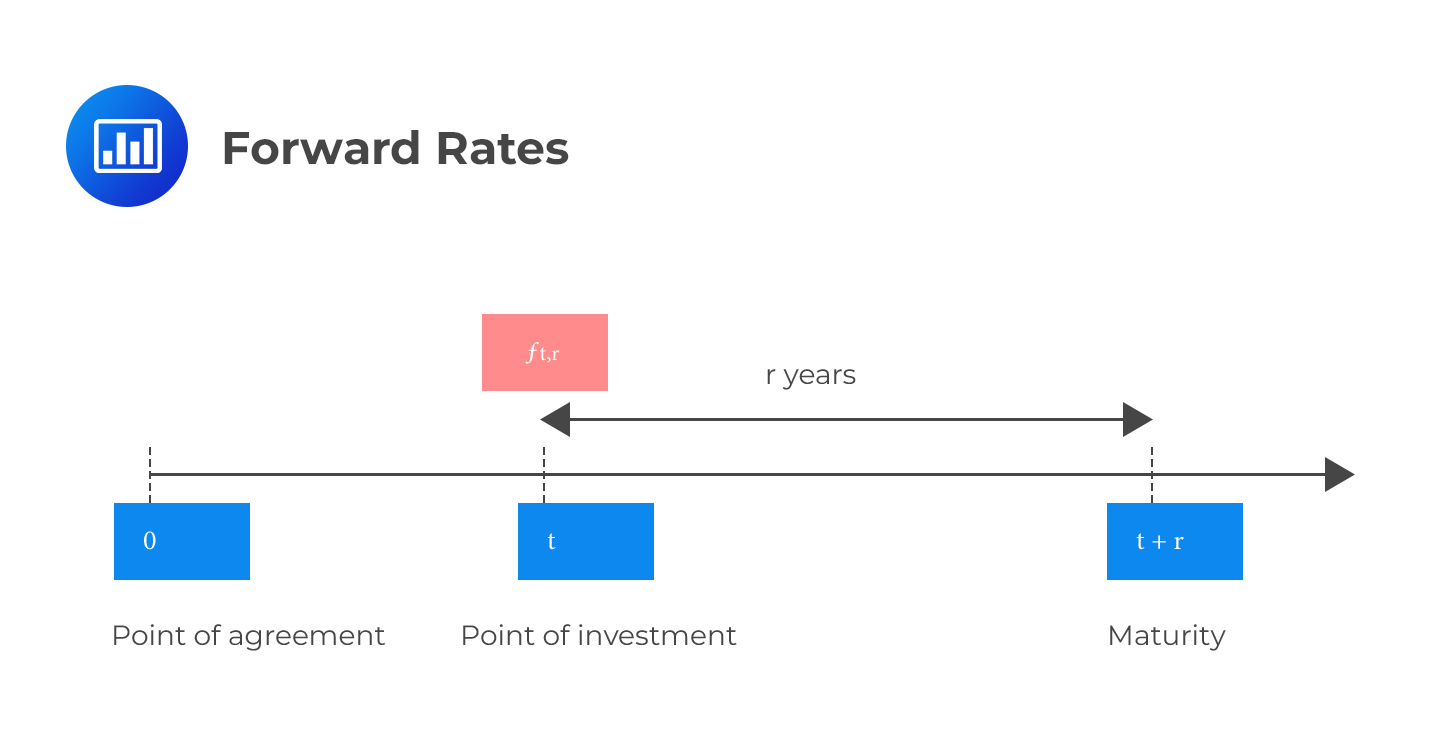

The Role of Time in Forward Rate Calculations

Time plays a crucial role in forward rate calculations, as it directly impacts the accuracy of the results. When calculating forward rates from spot rates, it is essential to consider the effects of compounding and the different time periods involved. Compounding, in particular, can significantly affect forward rates, as it takes into account the interest earned on both the principal amount and any accrued interest. To accurately calculate forward rates, investors must carefully consider the time periods involved, including the length of the investment and the frequency of compounding. For instance, a forward rate calculated over a shorter time period may be more sensitive to changes in interest rates than one calculated over a longer period. By understanding the role of time in forward rate calculations, investors can better navigate the complexities of financial markets and make more informed investment decisions. In the context of calculating forward rates from spot rates, a deep understanding of time’s impact is critical for achieving accurate results and avoiding potential pitfalls.

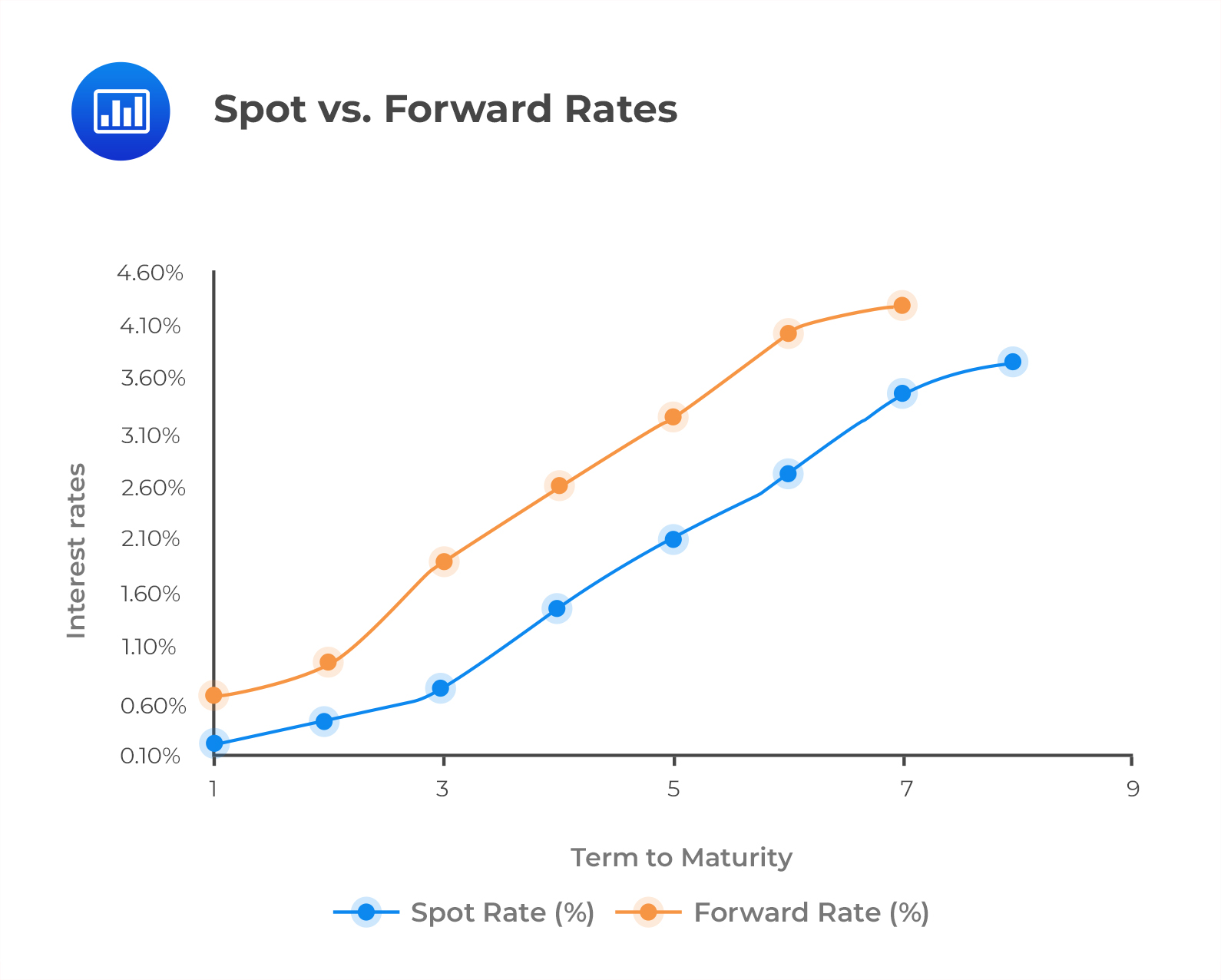

Spot Rate vs. Forward Rate: What’s the Difference?

In the realm of finance, spot rates and forward rates are two distinct concepts that serve different purposes. Understanding the differences between these two rates is crucial for making informed investment decisions. A spot rate represents the current market interest rate for a specific time period, whereas a forward rate represents the expected interest rate at a future date. The key distinction lies in their time frames: spot rates reflect current market conditions, while forward rates anticipate future market conditions. This fundamental difference has significant implications for investors, as forward rates can provide valuable insights into future interest rate movements. For instance, a forward rate can indicate whether interest rates are expected to rise or fall, allowing investors to adjust their investment strategies accordingly. By grasping the nuances of spot rates and forward rates, investors can better navigate the complexities of financial markets and make more informed decisions when calculating forward rates from spot rates.

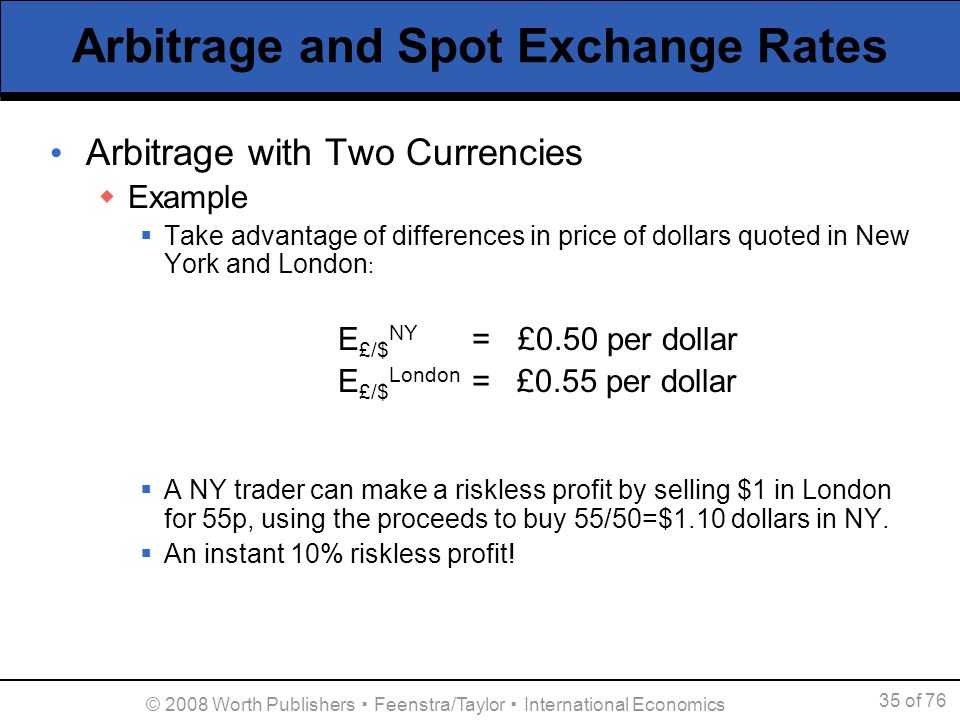

Real-World Applications of Forward Rate Calculations

Forward rate calculations have numerous practical applications in various aspects of finance, including investment analysis, risk management, and portfolio optimization. In investment analysis, forward rates are used to estimate the expected returns on investments, enabling investors to make informed decisions about their portfolios. For instance, a company considering a long-term investment project may use forward rates to estimate the project’s expected returns and determine whether it is a viable investment opportunity. In risk management, forward rates are used to assess the potential risks associated with investments and to develop strategies to mitigate those risks. Additionally, forward rates play a crucial role in portfolio optimization, as they help investors to identify the most attractive investment opportunities and to construct portfolios that maximize returns while minimizing risk. By understanding how to calculate forward rates from spot rates, investors and financial professionals can make more informed decisions and achieve their investment goals. In today’s complex financial markets, the ability to accurately calculate forward rates is essential for success.

Common Pitfalls to Avoid in Forward Rate Calculations

When calculating forward rates from spot rates, it’s essential to avoid common mistakes that can lead to inaccurate results. One of the most common pitfalls is incorrect data input, which can occur when using outdated or incorrect spot rates. Another mistake is failing to account for compounding, which can significantly impact forward rate calculations. Additionally, neglecting to consider the effects of different time periods on forward rates can lead to inaccurate results. Furthermore, using incorrect formulas or misunderstanding the underlying assumptions of the formulas can also lead to errors. To avoid these pitfalls, it’s crucial to double-check data inputs, ensure accurate compounding, and carefully consider the time periods involved. By being aware of these common mistakes, investors and financial professionals can ensure accurate forward rate calculations, which are critical for making informed investment decisions when calculating forward rates from spot rates. By taking the time to carefully calculate forward rates, investors can gain a competitive edge in the market and make more informed decisions.

Advanced Techniques for Forward Rate Calculations

While the basic formula for calculating forward rates from spot rates provides a solid foundation, there are more advanced techniques that can be employed to refine forward rate calculations. One such technique is the use of yield curves, which provide a graphical representation of the relationship between spot rates and forward rates. By analyzing yield curves, investors and financial professionals can gain a deeper understanding of the term structure of interest rates and make more informed investment decisions. Another advanced technique is bootstrapping, which involves using a series of spot rates to estimate forward rates. This method is particularly useful when dealing with complex interest rate environments or when there is a lack of available market data. Additionally, advanced statistical models, such as Monte Carlo simulations, can be used to estimate forward rates and account for uncertainty in interest rate movements. By mastering these advanced techniques, investors and financial professionals can gain a competitive edge in the market and make more accurate predictions when calculating forward rates from spot rates. By incorporating these advanced techniques into their investment strategies, investors can optimize their portfolios and achieve their investment goals.

Conclusion: Mastering Forward Rate Calculations for Informed Investment Decisions

In conclusion, calculating forward rates from spot rates is a crucial skill for investors and financial professionals seeking to make informed investment decisions. By understanding the basics of spot rates and forward rates, mastering the formula for calculating forward rates, and avoiding common pitfalls, investors can gain a competitive edge in the market. Additionally, advanced techniques such as yield curves and bootstrapping methods can be employed to refine forward rate calculations and optimize investment strategies. By accurately calculating forward rates from spot rates, investors can better navigate the complexities of financial markets, manage risk, and achieve their investment goals. Remember, accurate forward rate calculations are essential for making informed investment decisions, and by following the steps outlined in this guide, investors can unlock the secrets of forward rates and achieve success in the world of finance.