Understanding Bond Basics

A bond is essentially a loan you make to a government or corporation. In return for lending your money, you receive regular interest payments (coupons) and the principal (face value) back at a specified date (maturity date). The coupon rate determines the interest amount. Yield to maturity (YTM) represents the total return anticipated if the bond is held until maturity. Accurately calculating the price of a bond is crucial for investors to make informed decisions, ensuring they receive a fair return on their investment. Understanding present value is key. Present value reflects the current worth of future cash flows, discounted to account for the time value of money. To calculate price of bond in excel, you’ll use present value calculations to determine the current value of those future payments.

The price of a bond fluctuates based on several factors. Changes in market interest rates directly impact bond prices. If interest rates rise, newly issued bonds offer higher yields, making existing bonds less attractive and thus reducing their price. Conversely, falling interest rates increase the value of existing bonds. Time to maturity also plays a role; bonds nearing maturity have less price fluctuation than long-term bonds. The coupon rate relative to current market rates influences price. A bond with a high coupon rate will typically be more valuable than one with a low coupon rate in a low-interest-rate environment. Therefore, knowing how to calculate price of bond in excel is essential for effective investment decisions. Investors need to understand how these variables affect a bond’s value and use this knowledge to maximize their returns. Understanding the mechanics of bond valuation is crucial for successful investing. This allows investors to compare bonds effectively and make strategic choices.

To calculate price of bond in excel effectively, accurate data input is paramount. Errors in face value, coupon rate, maturity date, or YTM will lead to inaccurate pricing and potentially flawed investment strategies. The process of calculating price of bond in excel allows investors to assess the true worth of a bond before making a purchase. This is especially important in the current volatile market environment. Therefore, mastering these calculations provides a significant advantage for any investor. This understanding empowers investors to make informed choices, potentially leading to greater financial success. The ability to calculate price of bond in excel empowers investors to actively manage risk and optimize their investment portfolios.

How to Determine the Price of a Bond Using Excel

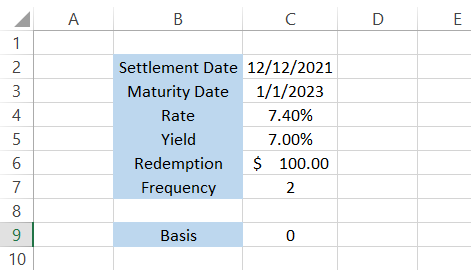

Calculating the price of a bond in Excel involves using the PV (Present Value) function. This function discounts future cash flows to their present value, reflecting the time value of money. To calculate the price of a bond in Excel, you need the following inputs: face value (FV), coupon rate, maturity date, and yield to maturity (YTM). The coupon rate determines the periodic interest payments. The YTM represents the total return anticipated on a bond if held until maturity. Accurate input data is crucial for a precise bond price calculation. Begin by setting up a spreadsheet with labeled cells for each input. For example, you might label cells for face value, coupon rate, maturity date (expressed as a number of periods), and YTM. Input the relevant bond parameters into these cells. Remember, the frequency of coupon payments will affect the number of periods and the periodic interest rate.

The core of calculating the price of a bond in Excel lies in the PV function. The PV function’s syntax is PV(rate, nper, pmt, [fv], [type]). ‘Rate’ is the periodic yield to maturity (YTM), ‘nper’ represents the total number of periods until maturity, ‘pmt’ is the periodic coupon payment (calculated as coupon rate * face value / number of payments per year), ‘fv’ is the face value (typically 1000 or 100), and ‘type’ specifies when payments are made (0 for end of period, 1 for beginning). The PV function will return a negative value, representing the price you pay to purchase the bond. Note that to calculate price of bond in excel accurately, ensure your inputs are consistent in terms of payment frequency (annual or semi-annual). Consider a bond with a face value of $1000, a 5% coupon rate, 10 years to maturity, and a YTM of 6%. The formula would look something like this: =PV(0.06/2, 20, 0.05*1000/2, 1000). This formula assumes semi-annual coupon payments. You should clearly separate the calculated inputs from the final result in your spreadsheet for clarity. This is a key step in how to calculate price of bond in excel efficiently.

To further illustrate how to calculate the price of a bond in Excel, imagine a different scenario: a bond with a face value of $1000, a 4% annual coupon rate, 5 years to maturity, and a YTM of 4.5%. In this case, the formula would be: =PV(0.045, 5, 0.04*1000, 1000). This calculates the price assuming annual coupon payments. By comparing the results from the PV function for both scenarios, you can observe how changes in YTM and other parameters impact bond prices. Understanding these relationships is fundamental when you are learning how to calculate price of bond in excel and making informed investment decisions. Remember that the accuracy of your bond pricing calculations directly depends on the accuracy of your input data. Always double-check your inputs before relying on the calculated bond price.

Calculating Bond Yield to Maturity (YTM)

Yield to maturity (YTM) represents the total return an investor can expect if they hold a bond until its maturity date. Understanding YTM is crucial for comparing different bond investment opportunities. It considers the bond’s current market price, face value, coupon rate, and time to maturity. A higher YTM generally indicates a higher potential return, but also a higher risk. To calculate YTM in Excel, the RATE function proves invaluable. This function helps investors calculate price of bond in excel accurately and efficiently. The RATE function requires inputs such as the number of periods (the bond’s life in years or half-years, depending on the payment frequency), the periodic coupon payment, the present value (the current market price of the bond), and the future value (the bond’s face value). The formula is then used to calculate the periodic yield, which is subsequently annualized to obtain the YTM.

For example, consider a bond with a face value of $1,000, a coupon rate of 5% (paid annually), five years to maturity, and a current market price of $950. To calculate the YTM in Excel, one would use the following formula: `=RATE(5,50,-950,1000)*100`. This formula yields an approximate YTM of 6.45%. Remember to adjust the number of periods and the coupon payment based on the bond’s payment frequency (annual, semi-annual, etc.). Changes in YTM directly impact a bond’s price. When YTM increases, the bond’s price decreases, and vice versa. This inverse relationship stems from the present value calculations inherent in bond pricing. Higher YTM discounts future cash flows more heavily, resulting in a lower present value (price). Conversely, a lower YTM increases the present value, leading to a higher price. Mastering the calculation of YTM is essential to accurately calculate price of bond in excel and make informed investment decisions.

Excel provides a powerful tool for analyzing the sensitivity of bond prices to changes in YTM. By altering the YTM input in the price calculation formula, investors can observe the resulting change in the bond’s price. This sensitivity analysis allows investors to understand the risk associated with fluctuations in interest rates. Moreover, understanding how to calculate price of bond in excel enables investors to proactively manage their bond portfolio and make better-informed investment decisions based on their risk tolerance and investment objectives. The ease and efficiency of Excel make it an ideal tool for performing these calculations and building an effective strategy around bond investments.

Handling Different Bond Payment Frequencies

Many bonds pay interest semi-annually, not annually. This requires adjustments to the Excel formulas used to calculate the price of a bond in Excel. To accurately calculate the price of a bond in Excel with semi-annual payments, you must modify the inputs for both the interest rate and the number of periods. The annual coupon rate should be divided by two to reflect the semi-annual payment. The total number of periods should be multiplied by two, representing the number of semi-annual periods over the bond’s life. For example, a bond with a 6% annual coupon rate paying semi-annually would use a 3% rate in the Excel calculation. A 10-year bond would have 20 semi-annual periods. The present value (PV) function in Excel will then correctly calculate the price of the bond in Excel.

Consider a bond with a face value of $1,000, a 6% annual coupon rate (3% semi-annually), 10 years to maturity (20 semi-annual periods), and a yield to maturity (YTM) of 5% (2.5% semi-annually). To calculate the price of a bond in Excel, one would use the PV function as follows: `=PV(0.025, 20, 30, 1000)`. This formula uses a semi-annual discount rate of 2.5%, 20 semi-annual periods, a semi-annual coupon payment of $30 (6% annual coupon rate /2 * $1000 face value), and a face value of $1,000. The result represents the present value, or price, of the bond, considering semi-annual payments. Remember, accurate data input is crucial for correctly calculating the price of a bond in Excel. Incorrect inputs will lead to an inaccurate bond valuation.

Adapting the Excel formulas to handle different payment frequencies ensures accurate bond pricing. This approach is crucial for making informed investment decisions. Understanding how to calculate the price of a bond in Excel for both annual and semi-annual payments is essential for any investor working with fixed-income securities. The process involves a simple adjustment to the interest rate and the number of periods within the PV function. Mastering this skill allows for precise bond valuation, enabling investors to make confident investment choices and better understand their portfolio’s performance.

Accounting for Accrued Interest

Accrued interest represents the interest earned on a bond but not yet paid. It’s crucial for calculating a bond’s price accurately. The price an investor pays is the “dirty price,” which includes accrued interest. The “clean price” excludes accrued interest. To calculate the price of a bond in excel, including accrued interest, requires understanding these two values. Accrued interest impacts the overall calculation of the bond’s value. Investors need to understand this to calculate the price of a bond in excel accurately.

Calculating accrued interest involves determining the number of days since the last coupon payment and multiplying that by the daily accrued interest. The daily accrued interest is simply the coupon payment divided by the number of days in the coupon period. For example, for a bond with a semi-annual coupon payment of $30 and a 180-day coupon period, the daily accrued interest would be $30/180 = $0.1667. If 30 days have passed since the last coupon payment, the accrued interest would be 30 * $0.1667 = $5.00. To calculate the price of a bond in excel, add this accrued interest to the clean price to arrive at the dirty price, the actual amount paid by the investor. Excel’s functions make this calculation efficient and straightforward.

To demonstrate in Excel, assume a bond with a clean price of $950 (calculated using standard bond pricing formulas) and an accrued interest of $5 (calculated as shown above). The dirty price, the price an investor will actually pay to calculate the price of a bond in excel, would be $950 + $5 = $955. This is the complete price, incorporating both the present value of future cash flows and the accrued interest. Remember to use the appropriate Excel functions, such as `DAYS` to accurately calculate the number of days since the last coupon payment and thereby calculate price of a bond in excel accurately. Properly accounting for accrued interest is essential for accurate bond valuation in Excel and for calculating the price of a bond in excel.

Analyzing Bond Prices: Sensitivity Analysis

Understanding how changes in various factors affect a bond’s price is crucial for informed investment decisions. Excel offers powerful tools to perform sensitivity analysis, allowing investors to calculate price of bond in excel under different scenarios. One effective method is using Excel’s Data Table feature. This tool allows for the quick calculation of bond prices across a range of input values, such as interest rates, time to maturity, or coupon rates. To use a data table, one would first need to calculate the bond price using the PV function, referencing cells containing these input variables. Then, a data table can be set up to systematically vary one input variable while holding others constant, generating a table showing the resulting bond prices. This provides a clear picture of the price sensitivity to each factor. Visualizing this data through charts, such as line graphs, further enhances understanding and facilitates comparisons. This helps investors understand how changes in market conditions or bond characteristics impact their investment. Remember, accurate input data is crucial for reliable results when you calculate price of bond in excel.

Another valuable technique for sensitivity analysis involves Excel’s Goal Seek tool. This function allows investors to determine what value of a specific input variable would be needed to achieve a target bond price. For example, investors might want to know what yield to maturity (YTM) would be required for a bond to reach a specific price. Goal Seek iteratively adjusts the input variable until the calculated bond price matches the desired target. This is particularly useful for determining the break-even point or for exploring various “what-if” scenarios. Using Goal Seek in conjunction with the PV function allows investors to calculate price of bond in excel accurately under various assumptions and evaluate their investment strategies effectively. The results from Goal Seek can be combined with data tables for a more comprehensive sensitivity analysis. Combining these methods offers a robust approach to assessing risk and return associated with a bond investment.

By employing both the Data Table and Goal Seek functionalities within Excel, investors can conduct a thorough sensitivity analysis to assess the impact of various factors on bond prices. This helps in making informed investment decisions and managing risk effectively. The visual representation of these analyses through charts further enhances the understanding of price sensitivity and facilitates effective communication of findings. The ability to quickly calculate price of bond in excel using these methods provides a significant advantage in bond portfolio management. These techniques are invaluable for both individual investors and professional portfolio managers alike.

Comparing Bond Investments: A Practical Example

This section demonstrates how to compare two different bonds using Excel to calculate price of bond in excel. Consider Bond A, a 5-year bond with a 4% annual coupon rate and a face value of $1,000. Bond B is a 10-year bond with a 6% annual coupon rate and the same face value. Assume a market interest rate (discount rate) of 5%. To calculate the price of each bond, one can use the PV function in Excel. For Bond A, the formula would be =PV(0.05,5,-40,-1000), resulting in a present value (price) approximately $922. The negative signs before the coupon payment and face value represent cash outflows. For Bond B, the formula would be =PV(0.05,10,-60,-1000), resulting in a price around $1,078. This calculation clearly shows Bond B, with its longer maturity and higher coupon rate, commands a higher price in the market. Remember to always accurately input data when you calculate price of bond in excel to ensure the reliability of the results.

Next, let’s analyze the impact of a change in market interest rates. Suppose interest rates rise to 6%. Recalculating the bond prices using the new discount rate (0.06), we find a new price for Bond A of approximately $886, reflecting a decline due to increased market yields. Similarly, the price for Bond B drops to approximately $980. This illustrates the inverse relationship between bond prices and interest rates. Longer-term bonds are generally more sensitive to interest rate fluctuations, as seen by the larger price change in Bond B compared to Bond A. Using Excel’s charting features, these price changes with varying interest rates can be visually represented to help in comparing bonds and calculate price of bond in excel.

Furthermore, to deepen the analysis, one can calculate the yield to maturity (YTM) for each bond using Excel’s RATE function. This provides a more comprehensive comparison as YTM considers both the coupon payments and the capital gain or loss at maturity. The formula would require adjusting inputs based on bond specifications and the calculation of the price of bond in excel. Comparing these YTM values against prevailing market rates offers another layer of insight into the relative attractiveness of each bond. By integrating these calculations and visual representations, investors can make informed decisions about bond selection. Using these methods, one can consistently and efficiently calculate price of bond in excel, leading to better investment strategies.

Advanced Bond Valuation Techniques in Excel (Optional)

Beyond the fundamental methods for calculating price of bond in excel, more sophisticated approaches exist for valuing bonds with embedded options or irregular cash flows. Callable bonds, for instance, offer the issuer the right to redeem the bond before maturity. This optionality impacts the bond’s price. Pricing callable bonds requires incorporating the probability of call and the call price into the valuation model. Excel’s built-in functions may not directly support this calculation. Specialized financial modeling software or more advanced techniques, such as binomial or Monte Carlo simulation, might be necessary to accurately calculate price of bond in excel in these cases.

Similarly, putable bonds grant the bondholder the option to sell the bond back to the issuer before maturity. This feature also adds complexity to the valuation process. Accurately calculating price of bond in excel for putable bonds requires considering the probability of put and the put price. Again, advanced techniques beyond standard Excel functions are typically required. Understanding these embedded options and their impact on bond prices is vital for making informed investment decisions.

Bonds with irregular cash flows present another challenge for standard bond pricing models. Instead of fixed periodic payments, these bonds may have varying coupon payments. Excel’s XIRR function proves useful here. This function calculates the internal rate of return for a series of cash flows occurring on irregular dates. This allows for accurate calculation of yield to maturity for bonds with uneven payments, thus aiding in the accurate calculation of the bond’s price in Excel. Mastering these advanced techniques allows for a more comprehensive understanding of bond valuation, enabling investors to make more nuanced assessments and potentially uncover attractive investment opportunities.