Understanding the Bond Market: A Primer

Bonds are a type of investment instrument that allows entities to raise capital from investors. In exchange, investors receive regular interest payments and the eventual return of their principal investment. The bond market offers a wide range of investment opportunities, including government bonds, corporate bonds, and municipal bonds. To make informed investment decisions, it is essential to understand the bond market and its underlying mechanisms. One crucial aspect of bond investing is determining the bond’s value, which involves calculating bond price from yield. By grasping the concept of bond pricing, investors can make more accurate assessments of their investments and optimize their portfolios.

Yield: The Key to Unlocking Bond Value

Yield is a critical component in bond pricing, as it represents the total return on investment, including interest payments and capital gains or losses. In essence, yield is the rate of return an investor can expect to earn from a bond. It is calculated by considering the bond’s coupon rate, face value, and market price. Understanding yield is vital in bond pricing, as it directly affects the bond’s value. A higher yield generally corresponds to a lower bond price, and vice versa. To accurately calculate bond price from yield, investors must comprehend the intricacies of yield calculation and its relationship with bond price. By grasping this concept, investors can make informed decisions and optimize their bond portfolios.

How to Calculate Bond Price from Yield: A Step-by-Step Approach

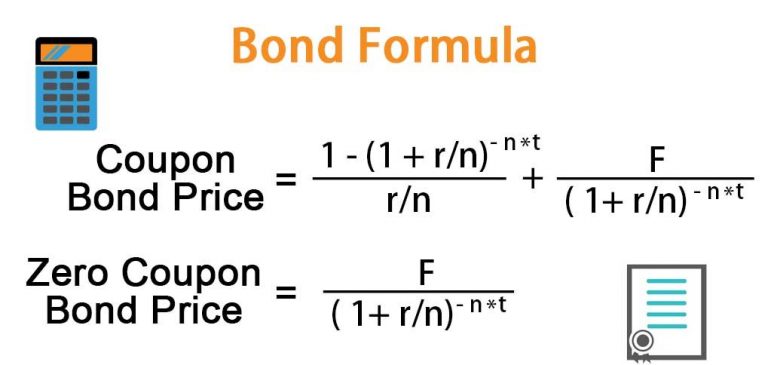

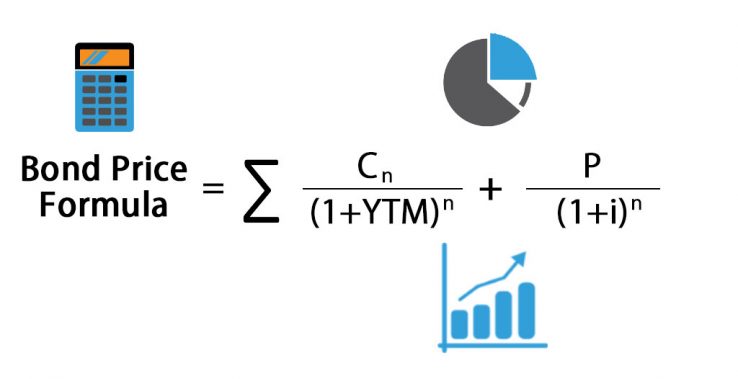

To calculate bond price from yield, investors need to understand the underlying formulas and variables involved. The bond price calculation formula is as follows: Bond Price = Face Value / (1 + Yield)^Years to Maturity. This formula takes into account the bond’s face value, yield, and years to maturity. To apply this formula, investors need to know the bond’s coupon rate, face value, and maturity date. By plugging in these values, investors can calculate the bond’s price and determine its value. For example, if a bond has a face value of $1,000, a coupon rate of 5%, and 10 years to maturity, and the yield is 4%, the bond price would be approximately $1,048. To calculate bond price from yield, investors can follow these steps:

Step 1: Determine the bond’s face value, coupon rate, and maturity date.

Step 2: Calculate the yield using the bond’s coupon rate and market conditions.

Step 3: Plug in the values into the bond price calculation formula.

Step 4: Calculate the bond price by solving the formula.

By following these steps, investors can accurately calculate bond price from yield and make informed investment decisions. It is essential to note that calculating bond price from yield is a complex process and requires a thorough understanding of bond pricing concepts. Investors should be cautious of common pitfalls, such as ignoring credit risk or using incorrect formulas, which can lead to inaccurate calculations and poor investment decisions.

The Role of Face Value, Coupon Rate, and Maturity in Bond Pricing

When calculating bond price from yield, it is essential to understand the role of face value, coupon rate, and maturity in bond pricing. These factors interact with yield to determine the bond’s value and play a critical role in investment decisions. Face value, also known as the principal amount, is the amount borrowed by the issuer and repaid to the investor at maturity. The coupon rate, on the other hand, is the interest rate paid periodically to the investor. Maturity refers to the bond’s lifespan, which can range from a few months to several decades.

The face value of a bond affects its price, as a higher face value generally results in a higher bond price. The coupon rate also impacts bond price, as a higher coupon rate increases the bond’s attractiveness to investors, leading to a higher price. Maturity, too, plays a significant role, as bonds with longer maturities tend to be more sensitive to changes in yield. When calculating bond price from yield, investors must consider these factors to accurately determine the bond’s value.

For instance, a bond with a face value of $1,000, a coupon rate of 6%, and 5 years to maturity will have a different price than a bond with the same face value and coupon rate but 10 years to maturity. The longer maturity bond will be more sensitive to changes in yield, resulting in a higher price volatility. By understanding the impact of face value, coupon rate, and maturity on bond pricing, investors can make informed decisions and calculate bond price from yield with confidence.

Real-World Examples: Calculating Bond Price from Yield in Practice

To illustrate the concept of calculating bond price from yield, let’s consider a few real-world examples. These examples will demonstrate how to apply the formulas and variables involved in bond pricing to real-world scenarios.

Example 1: Government Bond

Suppose we have a 10-year government bond with a face value of $1,000 and a coupon rate of 4%. The current market yield is 3.5%. To calculate the bond price from yield, we can use the formula: Bond Price = Face Value / (1 + Yield)^Years to Maturity. Plugging in the values, we get: Bond Price = $1,000 / (1 + 0.035)^10 ≈ $1,071. This means that the bond is trading at a premium, indicating that investors are willing to pay more than the face value to earn the 4% coupon rate.

Example 2: Corporate Bond

Consider a 5-year corporate bond with a face value of $1,000 and a coupon rate of 6%. The current market yield is 5.5%. Using the same formula, we can calculate the bond price from yield: Bond Price = $1,000 / (1 + 0.055)^5 ≈ $944. This means that the bond is trading at a discount, indicating that investors are willing to accept a lower price to earn the 6% coupon rate.

These examples demonstrate how to calculate bond price from yield in practice, using real-world scenarios and bond types. By applying the formulas and variables involved in bond pricing, investors can make informed decisions and accurately determine the value of their investments.

By understanding how to calculate bond price from yield, investors can better navigate the bond market and make informed investment decisions. Whether it’s a government bond or a corporate bond, calculating bond price from yield is a crucial step in determining the value of an investment.

Common Pitfalls to Avoid When Calculating Bond Price from Yield

When calculating bond price from yield, investors must be aware of common pitfalls that can lead to inaccurate results. These mistakes can result in poor investment decisions, ultimately affecting portfolio performance. By understanding these common pitfalls, investors can avoid costly errors and make informed investment decisions.

Ignoring Credit Risk

One of the most significant mistakes investors make is ignoring credit risk when calculating bond price from yield. Credit risk refers to the likelihood of the issuer defaulting on their debt obligations. Failing to account for credit risk can result in an inaccurate bond price, leading to poor investment decisions. To avoid this pitfall, investors must consider the issuer’s creditworthiness and adjust the bond price accordingly.

Using Incorrect Formulas

Another common mistake is using incorrect formulas when calculating bond price from yield. This can occur when investors use a formula that is not applicable to the specific bond type or scenario. For example, using a formula designed for government bonds to calculate the price of a corporate bond can lead to inaccurate results. To avoid this pitfall, investors must ensure they are using the correct formula for the specific bond and scenario.

Disregarding Market Conditions

Market conditions, such as interest rates and economic indicators, can significantly impact bond prices. Disregarding these conditions can result in an inaccurate bond price, leading to poor investment decisions. To avoid this pitfall, investors must stay up-to-date with market conditions and adjust their calculations accordingly.

By being aware of these common pitfalls, investors can avoid costly errors and accurately calculate bond price from yield. This knowledge will enable investors to make informed investment decisions, ultimately leading to better portfolio performance. Remember, calculating bond price from yield is a crucial step in determining the value of an investment, and avoiding these common pitfalls is essential for achieving success in the bond market.

Advanced Bond Pricing Concepts: Duration, Convexity, and Yield Curve

When calculating bond price from yield, it’s essential to consider advanced bond pricing concepts that can significantly impact bond value. These concepts, including duration, convexity, and yield curve, provide a more nuanced understanding of bond pricing and can help investors make informed investment decisions.

Duration: A Measure of Bond Sensitivity

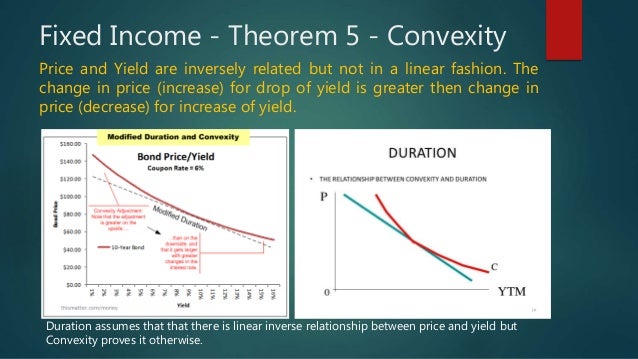

Duration measures a bond’s sensitivity to changes in interest rates. It represents the percentage change in bond price in response to a 1% change in interest rates. A bond with a higher duration is more sensitive to interest rate changes, resulting in a greater impact on bond price. Understanding duration is crucial when calculating bond price from yield, as it helps investors anticipate potential changes in bond value.

Convexity: The Bond’s Response to Interest Rate Changes

Convexity measures the curvature of the bond’s price-yield relationship. It represents the bond’s response to changes in interest rates, with a higher convexity indicating a more pronounced response. Convexity is essential when calculating bond price from yield, as it helps investors understand how the bond will respond to changes in interest rates.

Yield Curve: The Relationship Between Maturity and Yield

The yield curve represents the relationship between a bond’s maturity and its yield. It provides a visual representation of the bond market, with shorter-term bonds typically having lower yields and longer-term bonds having higher yields. Understanding the yield curve is crucial when calculating bond price from yield, as it helps investors anticipate potential changes in bond value based on maturity.

By incorporating these advanced bond pricing concepts into their calculations, investors can gain a more comprehensive understanding of bond pricing and make informed investment decisions. Remember, calculating bond price from yield is a complex process that requires a deep understanding of the underlying factors that affect bond value. By mastering these advanced concepts, investors can optimize their bond portfolios and achieve their investment goals.

Conclusion: Mastering Bond Pricing for Informed Investment Decisions

In conclusion, understanding bond pricing and yield is crucial for making informed investment decisions. By grasping the concepts outlined in this guide, investors can accurately calculate bond price from yield and make informed decisions about their bond portfolios. Remember, calculating bond price from yield is a complex process that requires a deep understanding of the underlying factors that affect bond value.

By mastering bond pricing concepts, including yield, face value, coupon rate, maturity, duration, convexity, and yield curve, investors can optimize their bond portfolios and achieve their investment goals. It is essential to avoid common pitfalls, such as ignoring credit risk or using incorrect formulas, and to stay up-to-date with market conditions to ensure accurate bond pricing.

As investors navigate the complex world of bond pricing, it is crucial to keep in mind the importance of calculating bond price from yield. By doing so, investors can unlock the true value of their bond investments and make informed decisions that drive portfolio performance. With the knowledge and tools outlined in this guide, investors can confidently calculate bond price from yield and achieve success in the bond market.