Understanding the Risks of Credit Default

In the world of investments, credit default is a significant risk that can have far-reaching consequences. It occurs when a borrower fails to meet their debt obligations, resulting in a default. This can have a ripple effect throughout the entire market, causing widespread losses for investors. Credit default can be particularly devastating for those who have invested in bonds, loans, or other debt securities. When a borrower defaults, the value of these investments can plummet, leaving investors with significant losses.

The impact of credit default is not limited to individual investors. It can also have a broader impact on the economy, leading to a decrease in investor confidence and a reduction in lending activity. This can have a knock-on effect on businesses and individuals, making it harder to access credit and leading to a slowdown in economic growth.

Given the potential risks associated with credit default, it is essential for investors to take steps to mitigate them. This can include diversifying their portfolios, conducting thorough research on borrowers, and hedging against credit risk. By taking these steps, investors can reduce their exposure to credit default and protect their investments in a volatile market.

How to Hedge Against Credit Risk with CDS

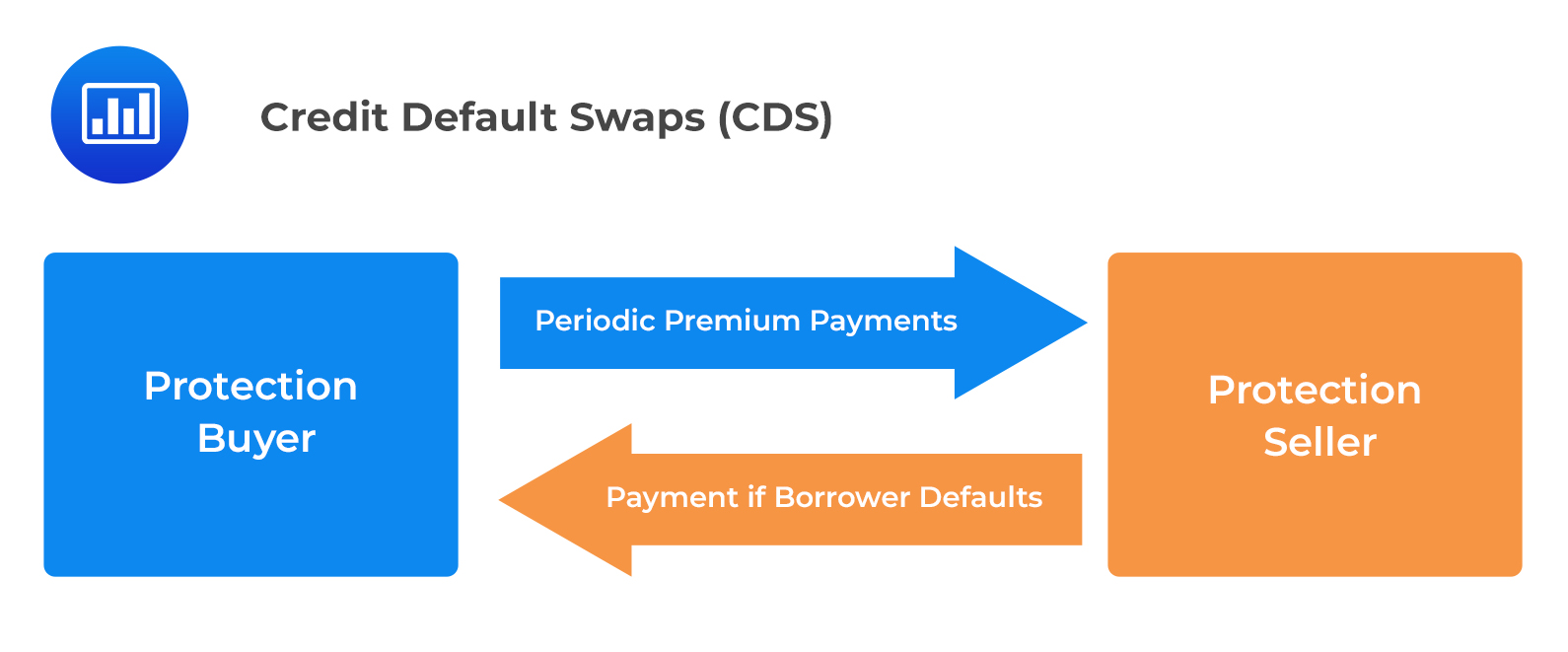

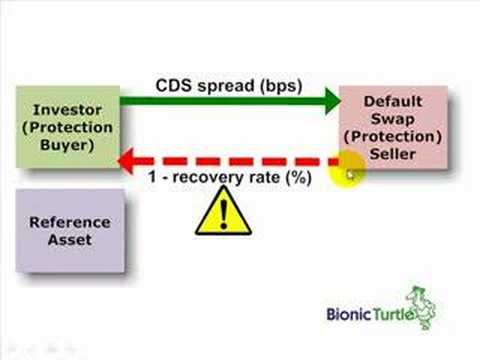

Credit default swaps (CDS) are a popular hedging strategy used to manage credit risk. A CDS is a financial instrument that allows investors to transfer credit risk to another party, providing a safeguard against potential losses. By buying credit default swaps online, investors can effectively hedge against credit risk, protecting their investments from potential defaults.

A CDS works by providing insurance against default. When an investor buys a CDS, they pay a premium to the seller, who agrees to compensate them in the event of a default. This provides a level of protection against potential losses, allowing investors to manage their credit risk more effectively.

The benefits of using CDS as a hedging strategy are numerous. They provide a flexible and efficient way to manage credit risk, allowing investors to adjust their exposure to different borrowers and industries. CDS also offer a high degree of customization, enabling investors to tailor their hedging strategy to meet their specific needs.

In addition, buying credit default swaps online can provide investors with a cost-effective way to manage credit risk. Online platforms offer a range of benefits, including lower fees, increased speed, and greater convenience. By leveraging these benefits, investors can more effectively manage their credit risk, protecting their investments and achieving their financial goals.

The Benefits of Buying Credit Default Swaps Online

In today’s digital age, buying credit default swaps online has become a convenient and efficient way to manage credit risk. Online platforms offer a range of benefits that make it easier for investors to purchase CDS and protect their investments from potential defaults.

One of the primary advantages of buying credit default swaps online is convenience. Online platforms provide investors with 24/7 access to CDS markets, allowing them to buy and sell CDS at any time. This convenience is particularly useful for investors who need to respond quickly to changes in the market.

In addition to convenience, buying credit default swaps online is also faster than traditional methods. Online platforms use advanced technology to facilitate rapid trade execution, reducing the time it takes to buy and sell CDS. This speed is essential for investors who need to react quickly to changes in the market.

Another significant benefit of buying credit default swaps online is cost-effectiveness. Online platforms often have lower fees than traditional brokers, making it more affordable for investors to purchase CDS. This cost-effectiveness is particularly important for investors who are looking to manage their credit risk without breaking the bank.

Furthermore, buying credit default swaps online provides investors with greater flexibility and customization. Online platforms offer a range of CDS products, allowing investors to tailor their hedging strategy to meet their specific needs. This flexibility is essential for investors who need to manage complex credit risk exposures.

Overall, buying credit default swaps online offers a range of benefits that make it an attractive option for investors. By leveraging the convenience, speed, cost-effectiveness, and flexibility of online platforms, investors can more effectively manage their credit risk and protect their investments from potential defaults.

What to Look for When Buying CDS Online

When buying credit default swaps online, it’s essential to consider several key factors to ensure that you’re making an informed decision. By understanding the risks and benefits associated with CDS, investors can more effectively manage their credit risk and protect their investments.

One of the most critical factors to consider when buying credit default swaps online is counterparty risk. Counterparty risk refers to the risk that the seller of the CDS will default on their obligations. To mitigate this risk, investors should carefully research the creditworthiness of the counterparty and ensure that they have a strong financial position.

Credit ratings are another important factor to consider when buying CDS online. Credit ratings provide an indication of the creditworthiness of the borrower and can help investors assess the likelihood of default. By choosing CDS with high credit ratings, investors can reduce their exposure to credit risk.

Market liquidity is also a critical factor to consider when buying credit default swaps online. Market liquidity refers to the ability to buy and sell CDS quickly and at a fair price. Investors should look for online platforms that offer high market liquidity, ensuring that they can easily enter and exit positions as needed.

In addition to these factors, investors should also consider the terms and conditions of the CDS, including the premium, notional amount, and maturity date. By carefully reviewing these terms, investors can ensure that they’re getting a fair deal and that their CDS aligns with their investment objectives.

Finally, investors should consider the fees and commissions associated with buying credit default swaps online. By choosing online platforms with competitive fees and commissions, investors can reduce their costs and maximize their returns.

By considering these factors, investors can more effectively manage their credit risk and protect their investments when buying credit default swaps online. By doing their due diligence and carefully researching the market, investors can make informed decisions and achieve their investment goals.

Top Online Platforms for Buying Credit Default Swaps

When it comes to buying credit default swaps online, investors have a range of platforms to choose from. Each platform offers unique features, fees, and user experiences that can help investors achieve their investment goals. Here are some of the top online platforms for buying credit default swaps:

Bloomberg Terminal: Bloomberg Terminal is a leading platform for buying credit default swaps online. With its advanced analytics and real-time data, investors can make informed decisions and execute trades quickly and efficiently. Bloomberg Terminal offers a range of CDS products, including single-name CDS and index CDS.

Markit: Markit is another popular platform for buying credit default swaps online. With its comprehensive database of CDS prices and analytics, investors can easily compare prices and find the best deals. Markit also offers a range of tools and resources to help investors manage their CDS portfolios.

ICE Data Services: ICE Data Services is a leading provider of CDS data and analytics. Its online platform offers investors real-time access to CDS prices, credit ratings, and market news. With its advanced analytics and customizable dashboards, investors can make informed decisions and optimize their CDS portfolios.

Tradeweb: Tradeweb is a leading online platform for buying credit default swaps. With its advanced trading technology and real-time data, investors can execute trades quickly and efficiently. Tradeweb also offers a range of tools and resources to help investors manage their CDS portfolios and mitigate risk.

CME Group: CME Group is a leading derivatives exchange that offers a range of CDS products. Its online platform provides investors with real-time access to CDS prices, credit ratings, and market news. With its advanced analytics and customizable dashboards, investors can make informed decisions and optimize their CDS portfolios.

When choosing an online platform for buying credit default swaps, investors should consider factors such as fees, commissions, and user experience. By selecting a platform that meets their needs, investors can more effectively manage their credit risk and achieve their investment goals. Whether you’re a seasoned investor or just starting out, buying credit default swaps online can be a convenient and cost-effective way to protect your investments.

Managing Your CDS Portfolio: Tips and Strategies

Once you’ve decided to buy credit default swaps online, it’s essential to manage your portfolio effectively to maximize returns and minimize risk. Here are some tips and strategies to help you do so:

Monitor Credit Ratings: Credit ratings are a crucial factor in determining the likelihood of default. Regularly monitoring credit ratings can help you identify potential risks and adjust your portfolio accordingly. By staying up-to-date with credit rating changes, you can make informed decisions and avoid potential losses.

Adjust Positions: As market conditions change, it’s essential to adjust your CDS positions to reflect new information. This may involve buying or selling CDS contracts to maintain an optimal risk profile. By regularly reviewing your portfolio, you can ensure that your CDS positions remain aligned with your investment objectives.

Diversify Risk: Diversification is a key principle of risk management. By spreading your CDS portfolio across multiple issuers, industries, and geographies, you can reduce your exposure to any one particular risk. This can help you achieve more consistent returns and reduce the impact of potential defaults.

Set Stop-Losses: Stop-losses are an essential risk management tool that can help you limit potential losses. By setting stop-losses at predetermined levels, you can automatically close out positions that move against you, minimizing potential losses.

Regularly Review and Rebalance: Regular portfolio reviews are essential to ensure that your CDS portfolio remains aligned with your investment objectives. By regularly rebalancing your portfolio, you can maintain an optimal risk profile and maximize returns.

Consider Hedging Strategies: Hedging strategies, such as delta hedging and gamma hedging, can help you manage risk and maximize returns. By incorporating these strategies into your CDS portfolio, you can reduce potential losses and achieve more consistent returns.

By following these tips and strategies, you can effectively manage your CDS portfolio and achieve your investment objectives. Remember to always do your research, set clear goals, and monitor your portfolio regularly to ensure success when you buy credit default swaps online.

Common Mistakes to Avoid When Buying CDS Online

When buying credit default swaps online, it’s essential to avoid common mistakes that can lead to financial losses. Here are some pitfalls to watch out for:

Inadequate Research: Failing to conduct thorough research on the issuer, credit ratings, and market conditions can lead to poor investment decisions. Before buying credit default swaps online, make sure to gather all relevant information and analyze it carefully.

Emotional Decision-Making: Emotional decisions can lead to impulsive buying or selling, which can result in significant losses. It’s essential to maintain a rational and objective approach when buying credit default swaps online, avoiding emotional influences that can cloud judgment.

Lack of Diversification: Failing to diversify a CDS portfolio can lead to overexposure to a particular risk. By spreading investments across multiple issuers, industries, and geographies, investors can reduce their exposure to any one particular risk and minimize potential losses.

Ignoring Counterparty Risk: Counterparty risk is a critical consideration when buying credit default swaps online. Failing to assess the creditworthiness of the counterparty can lead to significant losses in the event of default.

Not Monitoring Market Conditions: Market conditions can change rapidly, and failing to monitor them can lead to poor investment decisions. By staying up-to-date with market news and trends, investors can adjust their CDS portfolios accordingly and minimize potential losses.

By avoiding these common mistakes, investors can minimize potential losses and maximize returns when buying credit default swaps online. Remember to always conduct thorough research, maintain a rational approach, and diversify your portfolio to achieve success in the world of credit default swaps.

Conclusion: Safeguarding Your Investments with Online CDS

In today’s volatile market, protecting investments from credit default risk is crucial. Credit default swaps offer a powerful tool for managing this risk, and buying them online can provide a convenient, speedy, and cost-effective way to do so. By understanding the benefits and risks of credit default swaps, investors can make informed decisions and safeguard their investments.

When considering buying credit default swaps online, it’s essential to conduct thorough research, avoid emotional decision-making, and diversify your portfolio. By doing so, investors can minimize potential losses and maximize returns. With the right approach, buying credit default swaps online can be a valuable strategy for protecting investments and achieving long-term financial goals.

Don’t let credit default risk hold you back from achieving your investment objectives. By taking the necessary steps to mitigate this risk, you can confidently navigate the markets and achieve success. So why wait? Start exploring the world of online credit default swaps today and take the first step towards safeguarding your investments.

Remember, buying credit default swaps online is a powerful way to manage credit risk and protect your investments. With the right knowledge and approach, you can unlock the full potential of CDS and achieve financial success. So take action now and start buying credit default swaps online to safeguard your investments and secure your financial future.