Understanding the Basics of Bond Yields

Bond yields are a crucial aspect of fixed-income investments, providing investors with a comprehensive understanding of their potential returns. In essence, a bond yield represents the total return on investment, encompassing the interest income and any capital gains or losses. This metric is essential in investment decisions, as it helps investors evaluate the performance of their bond portfolios and make informed decisions. There are various types of bond yields, including bond equivalent yield and discount yield, each with its unique characteristics and applications. In this article, we’ll delve into the world of bond yields, exploring the differences between bond equivalent yield vs discount yield and their practical applications in real-world scenarios.

What is Bond Equivalent Yield?

Bond equivalent yield is a type of bond yield that represents the annualized yield of a bond, taking into account the compounding effect of interest. It’s calculated by converting the semi-annual yield of a bond into an annualized yield, providing a more accurate representation of the bond’s return. This yield type is particularly useful for investors seeking to compare the returns of bonds with different coupon payment frequencies. For instance, in a scenario where an investor is evaluating two bonds with similar coupon rates but different payment frequencies, the bond equivalent yield helps to level the playing field, enabling a more informed investment decision. By understanding bond equivalent yield, investors can make more accurate assessments of their bond portfolios and optimize their investment strategies.

Unraveling the Mystery of Discount Yield

Discount yield, also known as discount rate, is a type of bond yield that represents the rate of return on a bond when it’s purchased at a discount to its face value. This yield type is particularly relevant for investors seeking to capitalize on undervalued bonds. The discount yield is calculated by subtracting the purchase price from the face value and dividing the result by the purchase price, then multiplying by the number of years until maturity. In contrast to bond equivalent yield, discount yield focuses on the return generated by the discount rather than the coupon payments. For instance, if an investor purchases a bond with a face value of $1,000 at a discount of $900, the discount yield would be higher than the bond equivalent yield, as it takes into account the capital gain from the discount. Understanding the nuances of discount yield is crucial for investors seeking to optimize their returns in the bond market, particularly when considering bond equivalent yield vs discount yield.

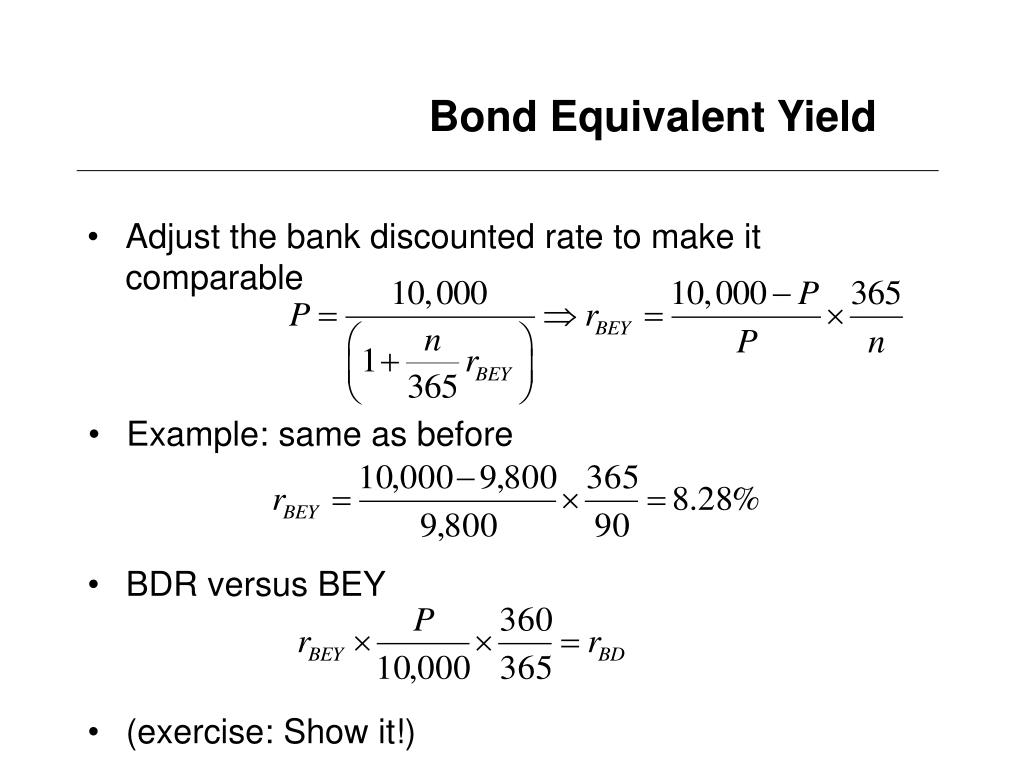

How to Calculate Bond Equivalent Yield vs Discount Yield

Accurate calculations are crucial when evaluating bond investments, and understanding how to calculate bond equivalent yield and discount yield is essential for making informed decisions. Here’s a step-by-step guide to calculating these yields:

Bond Equivalent Yield Formula: (Coupon Rate / Face Value) x (1 + (Days to Maturity / 365))

Discount Yield Formula: (Face Value – Purchase Price) / Purchase Price x (1 / Years to Maturity)

Let’s consider an example to illustrate the calculation of bond equivalent yield vs discount yield. Suppose an investor purchases a bond with a face value of $1,000, a coupon rate of 5%, and a maturity period of 5 years. If the bond is purchased at a discount of $900, what are the bond equivalent yield and discount yield?

Using the formulas above, the bond equivalent yield would be approximately 5.26%, while the discount yield would be around 6.11%. This difference highlights the importance of understanding the nuances of each yield type when making investment decisions.

Inaccurate calculations can lead to misguided investment decisions, emphasizing the need for precise calculations when evaluating bond equivalent yield vs discount yield. By mastering these calculations, investors can make more informed decisions and optimize their returns in the bond market.

Key Differences Between Bond Equivalent Yield and Discount Yield

When evaluating bond investments, it’s essential to understand the distinctions between bond equivalent yield and discount yield. While both yields provide valuable insights into a bond’s performance, they differ in their calculation methods and applications. Here, we’ll delve into the key differences between bond equivalent yield vs discount yield, highlighting their implications on investment decisions.

Calculation Methods: The primary difference lies in their calculation methods. Bond equivalent yield focuses on the coupon rate and face value, whereas discount yield is based on the purchase price and face value. This distinction affects the yield values, with bond equivalent yield typically being lower than discount yield.

Application Scenarios: Bond equivalent yield is more suitable for evaluating bonds with regular coupon payments, whereas discount yield is ideal for bonds purchased at a discount to their face value. Investors seeking to capitalize on undervalued bonds should focus on discount yield, while those prioritizing regular income streams should consider bond equivalent yield.

Yield Values: As mentioned earlier, bond equivalent yield tends to be lower than discount yield. This is because bond equivalent yield is based on the coupon rate, which may not reflect the bond’s true market value. Discount yield, on the other hand, takes into account the capital gain from the discount, resulting in a higher yield value.

Investment Decisions: Understanding the differences between bond equivalent yield and discount yield is crucial for making informed investment decisions. By recognizing the strengths and weaknesses of each yield type, investors can optimize their returns, manage risk, and diversify their portfolios effectively. In the context of bond equivalent yield vs discount yield, investors must consider their investment goals and objectives to determine which yield type is most relevant to their strategy.

Real-World Applications of Bond Equivalent Yield and Discount Yield

In the world of bond investing, understanding the practical applications of bond equivalent yield and discount yield is crucial for making informed decisions. These yields play a vital role in various investment scenarios, including portfolio management, risk assessment, and return optimization. Here, we’ll explore the real-world applications of bond equivalent yield vs discount yield, highlighting their significance in different investment contexts.

Portfolio Management: Bond equivalent yield and discount yield are essential tools for portfolio managers seeking to optimize their bond portfolios. By analyzing these yields, managers can identify undervalued bonds, adjust their portfolios to minimize risk, and maximize returns. For instance, a portfolio manager may use bond equivalent yield to evaluate the performance of a bond with regular coupon payments, while discount yield can help identify bonds with potential for capital appreciation.

Risk Assessment: Bond equivalent yield and discount yield also play a critical role in risk assessment. By comparing these yields, investors can gauge the creditworthiness of bond issuers and assess the likelihood of default. This information enables investors to make informed decisions about their bond investments, mitigating potential risks and maximizing returns.

Return Optimization: In the pursuit of optimal returns, bond equivalent yield and discount yield are invaluable tools. By analyzing these yields, investors can identify opportunities for yield enhancement, such as investing in bonds with higher yields or taking advantage of undervalued bonds. For example, an investor may use bond equivalent yield to identify bonds with higher yields, while discount yield can help identify bonds with potential for capital appreciation.

In the context of bond equivalent yield vs discount yield, understanding their real-world applications is essential for making informed investment decisions. By recognizing the significance of these yields in various investment scenarios, investors can optimize their returns, manage risk, and achieve their investment objectives.

Common Mistakes to Avoid When Calculating Bond Yields

When calculating bond equivalent yield and discount yield, investors often make mistakes that can lead to inaccurate results and poor investment decisions. To avoid these pitfalls, it’s essential to understand the common errors that can occur during the calculation process. Here, we’ll identify the most frequent mistakes and provide tips on how to avoid them, ensuring that investors can make informed decisions with confidence.

Mistake 1: Incorrectly Calculating the Coupon Rate: One of the most common mistakes is incorrectly calculating the coupon rate, which can lead to inaccurate bond equivalent yield and discount yield values. To avoid this, ensure that the coupon rate is calculated correctly, taking into account the bond’s face value and coupon payments.

Mistake 2: Failing to Account for Compounding: Compounding is a critical aspect of bond yield calculations, and failing to account for it can result in inaccurate yields. Make sure to consider the compounding frequency and period when calculating bond equivalent yield and discount yield.

Mistake 3: Ignoring the Bond’s Maturity Date: The bond’s maturity date plays a crucial role in calculating bond equivalent yield and discount yield. Ensure that the maturity date is accurately accounted for to avoid mistakes in yield calculations.

Mistake 4: Confusing Bond Equivalent Yield with Discount Yield: Investors often confuse bond equivalent yield with discount yield, leading to incorrect calculations and investment decisions. Understand the differences between these yields and use them appropriately to avoid mistakes.

By avoiding these common mistakes, investors can ensure accurate calculations of bond equivalent yield vs discount yield, making informed investment decisions and optimizing their returns. Remember, accurate calculations are crucial in bond investing, and attention to detail can make all the difference in achieving investment goals.

Maximizing Returns with Bond Equivalent Yield and Discount Yield

When it comes to optimizing investment returns, understanding the nuances of bond equivalent yield vs discount yield is crucial. By leveraging these yields effectively, investors can create a robust investment strategy that balances risk and return. Here, we’ll offer expert advice on how to maximize returns using bond equivalent yield and discount yield, including strategies for risk management and diversification.

Risk Management: One of the primary benefits of bond equivalent yield and discount yield is their ability to help investors manage risk. By analyzing these yields, investors can identify bonds with higher credit ratings, lower default risk, and more stable returns. This information enables investors to create a diversified portfolio that minimizes risk and maximizes returns.

Diversification: Diversification is a critical component of any investment strategy, and bond equivalent yield and discount yield can play a vital role in this process. By investing in bonds with different yields, maturities, and credit ratings, investors can create a diversified portfolio that reduces risk and increases potential returns. For example, an investor may use bond equivalent yield to identify high-yield bonds with shorter maturities, while discount yield can help identify bonds with lower yields but higher credit ratings.

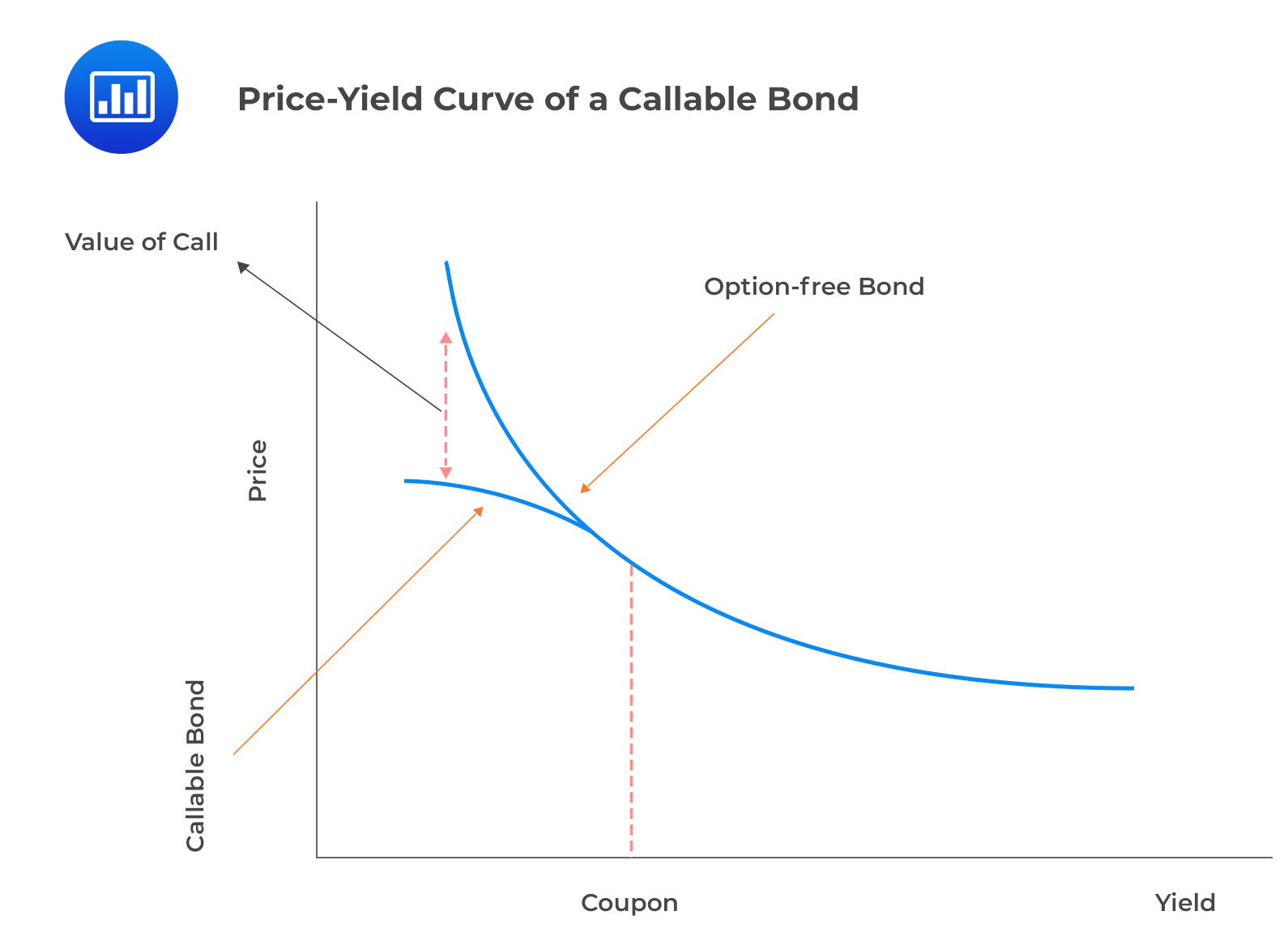

Yield Curve Analysis: Bond equivalent yield and discount yield can also be used to analyze the yield curve, which is a critical component of bond investing. By analyzing the yield curve, investors can identify opportunities for yield enhancement, such as investing in bonds with higher yields or taking advantage of undervalued bonds. For instance, an investor may use bond equivalent yield to identify bonds with higher yields at the short end of the yield curve, while discount yield can help identify bonds with lower yields at the long end of the curve.

By incorporating bond equivalent yield and discount yield into their investment strategy, investors can optimize their returns, manage risk, and achieve their investment objectives. Remember, understanding the nuances of these yields is critical to making informed investment decisions, and by following these expert tips, investors can unlock the full potential of bond investing.