What is the Black-Scholes Model and Why is it Important?

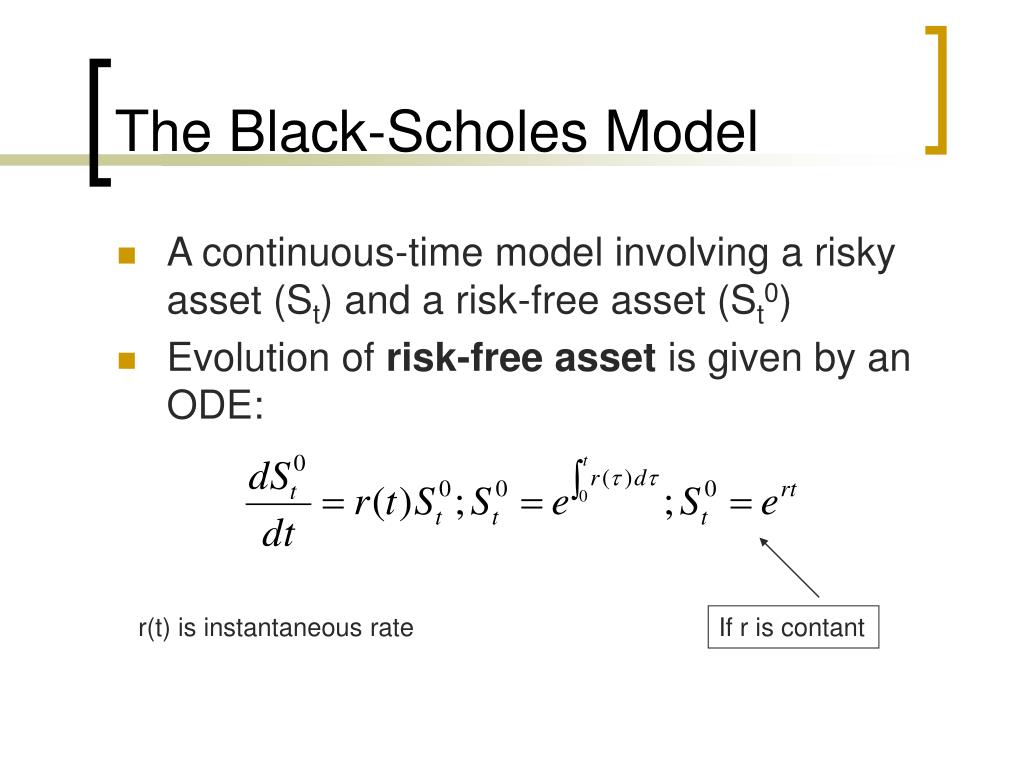

The Black-Scholes model is a widely used mathematical framework for estimating the value of a call option or a put option. Developed in the 1970s by Fischer Black and Myron Scholes, this model revolutionized the field of options trading by providing a reliable method for calculating option prices. The Black-Scholes model is important because it helps investors and traders understand the factors that influence option values, enabling them to make informed investment decisions. By using the Black-Scholes call option formula, traders can estimate the fair value of a call option, which is essential for hedging, speculation, and risk management. The model’s significance extends beyond options trading, as it has also been applied to other areas of finance, such as risk management and asset pricing. In essence, the Black-Scholes model provides a powerful tool for traders to navigate the complex world of options trading and make data-driven decisions.

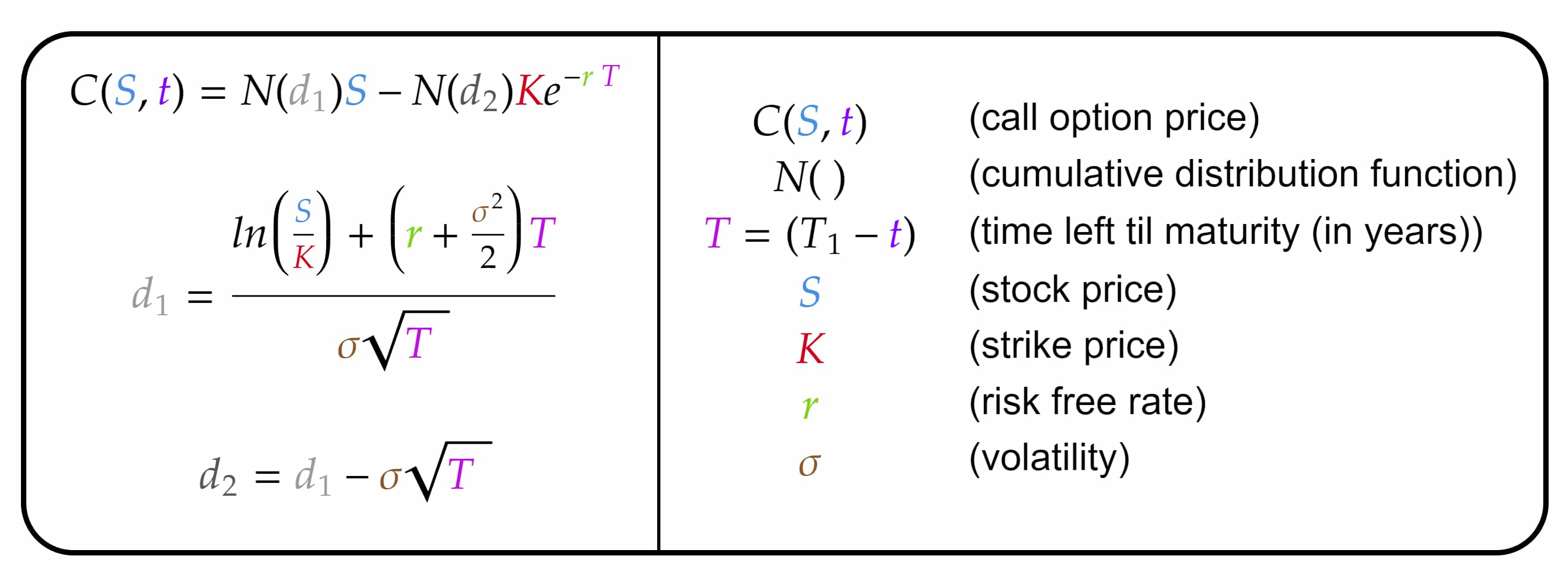

How to Calculate Call Option Values Using the Black-Scholes Formula

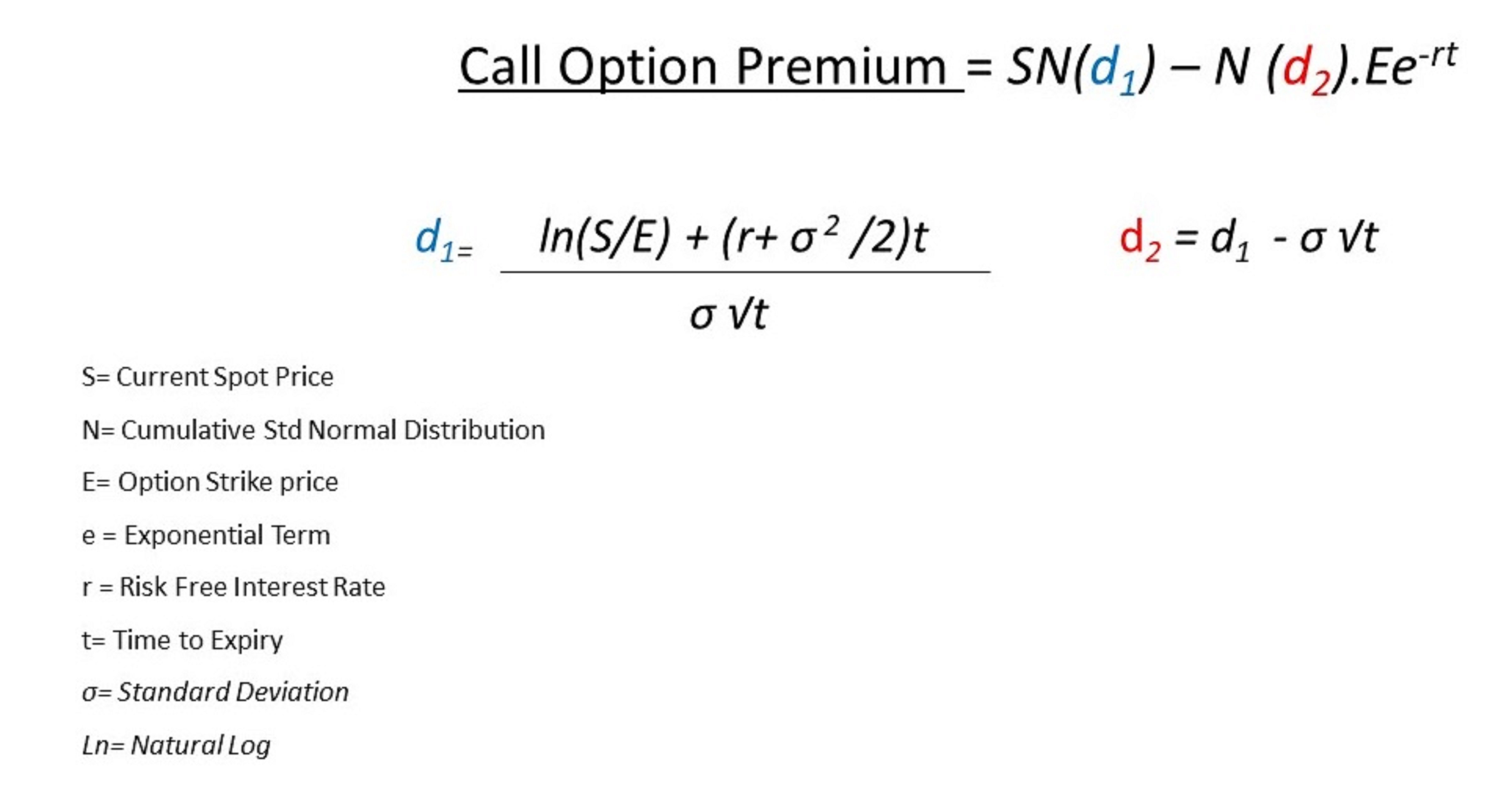

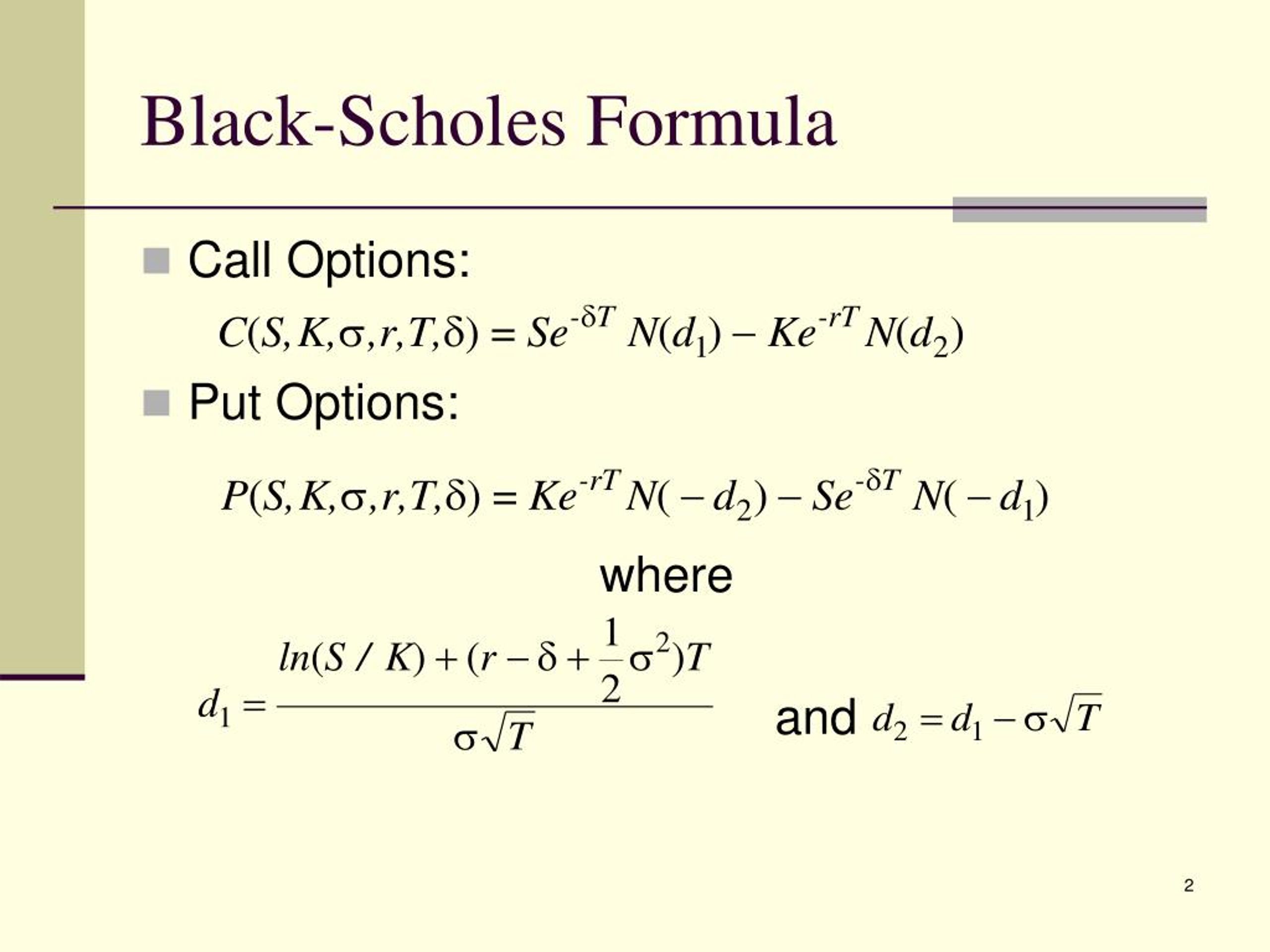

To calculate the value of a call option using the Black-Scholes formula, you’ll need to input the following variables: the underlying stock price (S), the strike price (K), the time to expiration (t), the risk-free interest rate (r), and the volatility of the underlying asset (σ). The formula is as follows:

C = SN(d1) – Ke^(-rt)N(d2)

Where:

- C is the call option value

- S is the underlying stock price

- K is the strike price

- t is the time to expiration

- r is the risk-free interest rate

- σ is the volatility of the underlying asset

- d1 and d2 are calculated using the following formulas:

- d1 = ln(S/K) + (r + σ^2/2)t / σ√t

- d2 = d1 – σ√t

- N(d1) and N(d2) are the cumulative distribution functions of the standard normal distribution

By plugging in the correct values for each variable, you can estimate the fair value of a call option using the Black-Scholes call option formula. This formula provides a powerful tool for traders to calculate option values and make informed investment decisions.

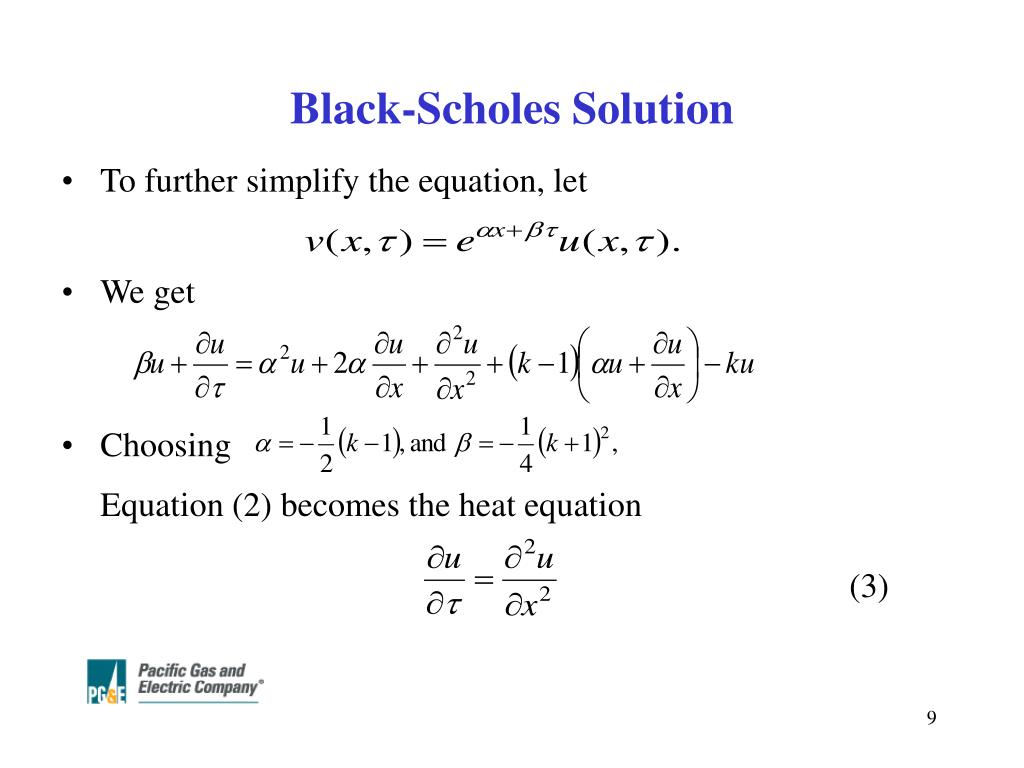

Breaking Down the Black-Scholes Call Option Formula: Variables and Assumptions

The Black-Scholes call option formula is a complex mathematical model that relies on several key variables to estimate the value of a call option. Understanding these variables and their assumptions is crucial for accurate calculations and informed investment decisions.

The five main variables in the Black-Scholes call option formula are:

- Underlying Stock Price (S): The current market price of the underlying asset, such as a stock or ETF.

- Strike Price (K): The predetermined price at which the option holder can buy or sell the underlying asset.

- Time to Expiration (t): The amount of time remaining until the option expires.

- Risk-Free Interest Rate (r): The rate of return on a risk-free investment, such as a U.S. Treasury bond.

- Volatility (σ): A measure of the underlying asset’s price fluctuations, which affects the option’s value.

The Black-Scholes model assumes that:

- The underlying asset prices follow a geometric Brownian motion.

- The risk-free interest rate is constant.

- The volatility of the underlying asset is constant.

- There are no transaction costs or dividends.

- The options are European-style, meaning they can only be exercised at expiration.

While these assumptions simplify the calculation process, they also introduce limitations to the model. For instance, the Black-Scholes model does not account for dividends, which can affect the option’s value. Additionally, the model assumes constant volatility, which is not always the case in real-world markets.

Despite these limitations, the Black-Scholes call option formula remains a powerful tool for options traders and investors. By understanding the variables and assumptions behind the model, traders can make more informed investment decisions and refine their options trading strategies.

The Role of Volatility in Call Option Pricing

Volatility plays a crucial role in call option pricing, as it directly affects the value of the option. In the Black-Scholes call option formula, volatility is represented by the symbol σ (sigma). It measures the standard deviation of the underlying asset’s price fluctuations over a given period.

A higher volatility means that the underlying asset’s price is more likely to fluctuate rapidly, making the option more valuable. This is because the option holder has a greater chance of exercising the option at a profitable price. Conversely, a lower volatility reduces the option’s value, as the underlying asset’s price is less likely to move significantly.

For example, let’s consider a call option on a stock with a current price of $50 and a strike price of $55. If the volatility of the stock is high, say 30%, the option’s value will be higher compared to a scenario where the volatility is low, say 10%. This is because the high-volatility scenario presents a greater chance of the stock price exceeding the strike price at expiration.

The Black-Scholes call option formula takes into account the volatility of the underlying asset to estimate the option’s value. The formula uses the volatility input to calculate the option’s sensitivity to changes in the underlying asset’s price, which is reflected in the option’s value.

Understanding the impact of volatility on call option prices is essential for traders and investors. By recognizing how changes in volatility affect option values, traders can adjust their strategies to maximize returns and minimize losses. The Black-Scholes call option formula provides a powerful tool for estimating option values and making informed investment decisions in the face of volatile markets.

Real-World Applications of the Black-Scholes Model

The Black-Scholes model has far-reaching implications in the world of options trading, and its applications are diverse and widespread. Investors and traders use the Black-Scholes call option formula to make informed investment decisions, manage risk, and optimize their portfolios.

One of the primary applications of the Black-Scholes model is in options pricing. By using the formula to estimate the value of a call option, traders can determine whether the option is overvalued or undervalued relative to its intrinsic value. This information can be used to make buy or sell decisions, or to adjust the size of an options position.

The Black-Scholes model is also used in risk management. For example, a trader may use the formula to estimate the potential losses associated with a particular options position. This information can be used to adjust the position size, hedge against potential losses, or implement stop-loss strategies.

In addition, the Black-Scholes model is used in portfolio optimization. By estimating the value of multiple options positions, traders can optimize their portfolios to maximize returns and minimize risk. This can involve adjusting the allocation of assets, selecting the most profitable options, or implementing diversification strategies.

Many financial institutions, including investment banks and hedge funds, use the Black-Scholes model to value and manage their options positions. The model is also used in the development of options trading strategies, such as delta-neutral hedging and volatility arbitrage.

The Black-Scholes call option formula has also been adapted for use in other financial markets, including futures, forex, and commodities. Its applications are diverse and continue to grow, as traders and investors seek to optimize their returns and manage their risk in an increasingly complex and volatile market environment.

Common Mistakes to Avoid When Using the Black-Scholes Formula

While the Black-Scholes call option formula is a powerful tool for estimating call option values, it’s not immune to errors. In fact, even small mistakes can lead to significant inaccuracies in option pricing. To avoid these pitfalls, it’s essential to understand the common mistakes that can occur when using the Black-Scholes formula.

One of the most common mistakes is incorrect input values. This can include using outdated or incorrect data for the underlying stock price, strike price, time to expiration, risk-free interest rate, or volatility. Even a small error in these inputs can result in a significant difference in the estimated option value.

Another mistake is misunderstanding the assumptions behind the Black-Scholes model. For example, the model assumes that the underlying stock price follows a geometric Brownian motion, which may not always be the case. Additionally, the model assumes that there are no transaction costs, dividends, or other market frictions, which can also lead to inaccuracies.

Furthermore, traders may also make mistakes when interpreting the results of the Black-Scholes formula. For instance, they may misinterpret the estimated option value as the actual market price, or fail to consider other factors that can affect option prices, such as market sentiment or liquidity.

To avoid these mistakes, it’s essential to carefully review the inputs and assumptions behind the Black-Scholes formula. Traders should also ensure that they have a thorough understanding of the underlying mathematics and concepts, and that they are using the formula in conjunction with other analytical tools and market data.

By being aware of these common mistakes, traders can use the Black-Scholes call option formula with confidence, and make more informed investment decisions. Remember, the Black-Scholes formula is a powerful tool, but it’s only as good as the inputs and assumptions that go into it.

Advanced Topics in Black-Scholes: Greeks and Sensitivity Analysis

For advanced options traders, the Black-Scholes call option formula is just the starting point. By delving deeper into the model, traders can gain a more nuanced understanding of the complex relationships between the underlying stock price, volatility, and option values. Two key concepts that can help traders refine their options trading strategies are the Greeks and sensitivity analysis.

The Greeks, which include Delta, Gamma, Theta, and Vega, are a set of financial metrics that measure the sensitivity of an option’s price to changes in the underlying stock price, volatility, time to expiration, and interest rates. By understanding the Greeks, traders can better manage their options positions and make more informed investment decisions.

Delta, for example, measures the rate of change of the option’s price with respect to the underlying stock price. A high Delta indicates that the option’s price is highly sensitive to changes in the underlying stock price, while a low Delta indicates that the option’s price is less sensitive. Gamma, on the other hand, measures the rate of change of the option’s Delta, providing insight into the option’s volatility.

Theta measures the rate of change of the option’s price with respect to time, while Vega measures the rate of change of the option’s price with respect to volatility. By understanding these metrics, traders can adjust their options positions to maximize returns and minimize risk.

Sensitivity analysis is another advanced concept that can help traders refine their options trading strategies. By analyzing how changes in the underlying stock price, volatility, and other factors affect the option’s value, traders can identify potential risks and opportunities. This can involve using techniques such as scenario analysis, stress testing, and Monte Carlo simulations to model different market scenarios and estimate the potential impact on option values.

By incorporating the Greeks and sensitivity analysis into their options trading strategies, traders can gain a more sophisticated understanding of the Black-Scholes call option formula and make more informed investment decisions. Whether you’re a seasoned trader or just starting out, mastering these advanced concepts can help you unlock the full potential of the Black-Scholes model and achieve greater success in the world of options trading.

Conclusion: Mastering the Black-Scholes Call Option Formula for Trading Success

In conclusion, the Black-Scholes call option formula is a powerful tool for estimating the value of call options. By understanding the formula and its components, investors and traders can make more informed investment decisions and refine their options trading strategies. From the underlying stock price to volatility, each variable plays a critical role in determining the option’s value.

By mastering the Black-Scholes call option formula, traders can gain a competitive edge in the markets and make more accurate predictions about option prices. Whether you’re a seasoned trader or just starting out, understanding the Black-Scholes model is essential for success in options trading.

Remember, the Black-Scholes call option formula is not a crystal ball, but rather a sophisticated tool that requires careful input and interpretation. By avoiding common mistakes and incorporating advanced concepts like the Greeks and sensitivity analysis, traders can unlock the full potential of the Black-Scholes model and achieve greater success in the world of options trading.

In today’s fast-paced markets, having a deep understanding of the Black-Scholes call option formula can be the key to unlocking profits and minimizing losses. By applying the concepts and techniques outlined in this article, traders can take their options trading to the next level and achieve long-term success.

:max_bytes(150000):strip_icc()/Black-Scholes-Model-FINAL-1-18b2378c6f894a15b5904289870aa532.jpg)