Introduction to the Black Scholes Calculator in Excel

The Black-Scholes model is a cornerstone of options pricing. It provides a robust framework for estimating the theoretical value of European-style options. Understanding this model is crucial for anyone involved in options trading or financial analysis. Building a black scholes calculator in excel offers several advantages. It allows for customized calculations, ensuring transparency in the process. Furthermore, creating your own black scholes calculator in excel is cost-effective compared to using proprietary software or online tools, which may have limitations or hidden fees. This guide empowers you to build your own reliable and flexible pricing tool. A well-built black scholes calculator in excel becomes an invaluable asset for informed decision-making.

Constructing a black scholes calculator in excel is a practical skill. This approach promotes a deeper understanding of the underlying model mechanics. You gain control over the input variables and observe their direct impact on the final price. This hands-on approach contrasts with relying on external calculators. External tools often lack the transparency needed to truly grasp the Black-Scholes dynamics. Your personalized black scholes calculator in excel offers a clear, step-by-step path to accurate option valuation. You can easily modify inputs to explore various scenarios and refine your understanding.

This comprehensive guide will walk you through the process of building a powerful black scholes calculator in excel. It is designed for both beginners and experienced users seeking to improve their options valuation skills. You will learn how to input and manipulate data effectively. You will also learn to interpret the results accurately. The black scholes calculator in excel you create will be a valuable tool for your financial analysis. It will significantly improve your understanding of options pricing and allow for more informed investment decisions.

Decoding the Black-Scholes Formula: Essential Inputs Explained

The Black-Scholes model is a cornerstone for option pricing, and understanding its inputs is crucial for building a functional black scholes calculator in excel. The formula calculates the theoretical price of European-style options, considering several key factors. These inputs are the stock price, strike price, time to expiration, risk-free interest rate, and volatility. Each element plays a vital role in determining the option’s value. For a practical black scholes calculator in excel, accurate data is paramount.

The current stock price is the market price of the underlying asset. The strike price is the price at which the option holder can buy (call) or sell (put) the asset. Time to expiration refers to the period remaining until the option expires, expressed in years. The risk-free interest rate represents the return on a risk-free investment, such as a government bond, over the option’s lifetime. Finally, volatility measures the degree to which the price of the underlying asset is expected to fluctuate. This is arguably the most critical and complex input for a black scholes calculator in excel.

To ensure the reliability of your black scholes calculator in excel, obtain data from reputable sources. Financial websites like Yahoo Finance, Google Finance, or Bloomberg provide real-time stock prices and historical data. The yield on government bonds can serve as a proxy for the risk-free interest rate. Keep in mind that the accuracy of your option price calculation depends heavily on the quality of these inputs. Understanding these components is a fundamental step toward mastering option pricing using the black scholes calculator in excel.

Crafting the Excel Template: Setting Up Your Spreadsheet

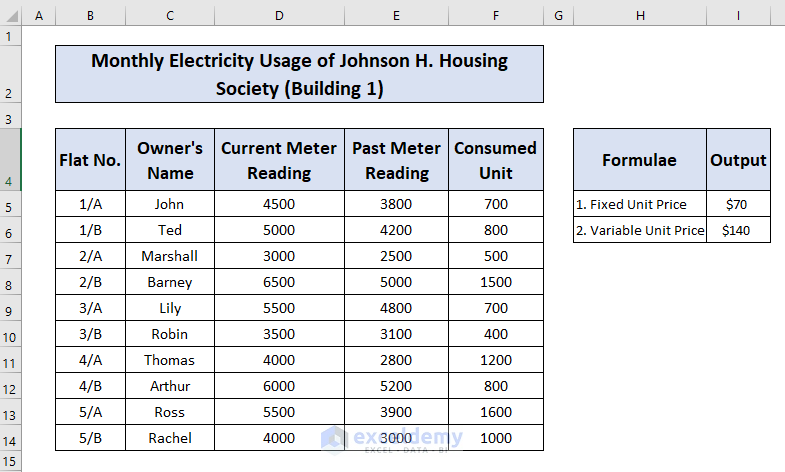

Creating a well-organized Excel spreadsheet is crucial for building a functional and easy-to-use black scholes calculator in excel. This involves setting up labeled cells for each input variable required by the Black-Scholes model. Begin by opening a new Excel worksheet. In the first column (Column A), create labels for each input: “Stock Price,” “Strike Price,” “Time to Expiration (Years),” “Risk-Free Interest Rate,” and “Volatility.” These labels clearly identify the purpose of each cell. In the adjacent column (Column B), enter the corresponding values for each input. For example, if the stock price is $150, enter “150” in cell B1, next to the “Stock Price” label in A1. It’s good to use cell B7 for the Call option price and B8 for the Put option price calculated by the black scholes calculator in excel.

Pay close attention to units. Time to expiration should be expressed in years (e.g., 0.5 for six months). The risk-free interest rate and volatility should be entered as decimals (e.g., 0.05 for 5%). Format these cells appropriately by selecting the cells and using the “Number” formatting options on the “Home” tab. This ensures consistent data entry and reduces the risk of errors. Use percentage formatting for volatility and interest rate. The “Accounting” format is generally a good option for stock and strike prices. Proper formatting enhances readability and prevents misinterpretation of the input values in your black scholes calculator in excel.

To enhance usability, consider adding a clear title to your spreadsheet, such as “Black-Scholes Option Pricing Calculator.” You can also add comments to each input cell explaining the data source or any specific considerations. For instance, you might add a comment to the “Volatility” cell stating, “Use implied volatility from options chain.” Using colors strategically can also improve the visual appeal and organization of your spreadsheet. For example, you can shade the input cells a light color to distinguish them from the output cells. Here’s a basic layout that allows you to build a black scholes calculator in excel: A1: Stock Price, B1: [Enter Stock Price], A2: Strike Price, B2: [Enter Strike Price], A3: Time to Expiration (Years), B3: [Enter Time to Expiration], A4: Risk-Free Interest Rate, B4: [Enter Interest Rate], A5: Volatility, B5: [Enter Volatility], A7: Call Option Price, B7: [Call Option Price Formula], A8: Put Option Price, B8: [Put Option Price Formula]. This structured approach lays a solid foundation for implementing the Black-Scholes formula in Excel.

Implementing the Formula: Excel Functions for Calculation

The core of creating a black scholes calculator in excel lies in accurately translating the Black-Scholes formula into Excel’s syntax. This involves utilizing several built-in functions to represent the mathematical components of the model. For a call option, the formula is: Call Price = S * N(d1) – X * EXP(-r * T) * N(d2), and for a put option: Put Price = X * EXP(-r * T) * N(-d2) – S * N(-d1). Where: S = Current stock price, X = Strike price, r = Risk-free interest rate, T = Time to expiration (in years), and N(x) = Cumulative standard normal distribution function.

First, calculate d1 and d2, which are intermediate variables. In Excel, d1 can be calculated as: `=(LN(S/X)+(r+0.5*Volatility^2)*T)/(Volatility*SQRT(T))`. Similarly, d2 is: `=d1-(Volatility*SQRT(T))`. Replace “S”, “X”, “r”, “Volatility”, and “T” with the actual cell references in your spreadsheet where these values are stored. For example, if the stock price is in cell B2, the strike price in B3, and so on, the formula would be adjusted accordingly. The `LN` function calculates the natural logarithm, and `SQRT` calculates the square root. The `EXP` function calculates the exponential value, crucial for discounting the strike price back to present value.

Next, calculate N(d1) and N(d2), which represent the cumulative standard normal distribution of d1 and d2, respectively. Excel provides the `NORMSDIST` function for this purpose. The formula for N(d1) is: `=NORMSDIST(d1)`, and for N(d2) is: `=NORMSDIST(d2)`. Again, replace “d1” and “d2” with the cell references where you calculated those values. Finally, the black scholes calculator in excel calculates the call option price using the formula: `=B2*NORMSDIST(E2)-B3*EXP(-B4*B5)*NORMSDIST(F2)`, assuming the stock price is in B2, the strike price in B3, the risk-free rate in B4, time to expiration in B5, N(d1) in E2 and N(d2) in F2. Similarly, the put option price can be calculated using: `=B3*EXP(-B4*B5)*NORMSDIST(-F2)-B2*NORMSDIST(-E2)`. Ensuring these formulas are correctly entered is crucial for an accurate black scholes calculator in excel.

Calculating Volatility: Historical vs. Implied Approaches

Volatility plays a crucial role within the Black-Scholes model. It significantly impacts the option price calculated by your black scholes calculator in excel. Understanding how to determine volatility is therefore essential. There are two primary approaches: historical volatility and implied volatility.

Historical volatility is derived from past stock price fluctuations. It reflects how much the stock price has moved in the past. To calculate historical volatility in your black scholes calculator in excel, you can use the `STDEV.S` function. First, gather a series of historical stock prices. Then, calculate the percentage change between each consecutive price. Finally, apply the `STDEV.S` function to these percentage changes. This will give you the historical volatility, typically expressed as an annualized figure. Remember to annualize the volatility by multiplying by the square root of the number of periods in a year (e.g., √252 for daily data, assuming 252 trading days in a year). The accuracy of your black scholes calculator in excel depends on quality historical data.

Implied volatility, conversely, is derived from market option prices. It represents the market’s expectation of future volatility. It cannot be directly calculated within your black scholes calculator in excel without iterative solving methods. Instead, implied volatility is typically found using online resources such as financial websites or brokerage platforms. These resources use the Black-Scholes model (or other models) to back out the implied volatility, given the market price of the option and the other Black-Scholes inputs. Using implied volatility in your black scholes calculator in excel can provide a more forward-looking option valuation compared to using historical volatility. However, it is important to recognize that implied volatility is influenced by market sentiment and supply/demand factors, and it does not guarantee future actual volatility. Choosing between historical and implied volatility for your black scholes calculator in excel depends on your investment strategy and market outlook.

Analyzing Option Prices: Interpreting Results and Sensitivity

Understanding the output from your black scholes calculator in excel is crucial for informed decision-making. The calculator provides an estimated fair price for the option, but it’s essential to recognize that this is just one factor to consider. The model’s output represents a theoretical value, influenced by the input parameters. Higher volatility generally translates to higher option prices, reflecting the increased uncertainty and potential for profit or loss. A longer time to expiration also tends to increase the option price, as there’s more opportunity for the underlying asset’s price to move significantly. The relationship between the stock price and the strike price is also paramount. A call option becomes more valuable as the stock price rises above the strike price, while a put option gains value as the stock price falls below the strike price.

Analyzing how the option price changes with respect to variations in the input variables is key to understanding risk and potential reward. These sensitivities are often referred to as “the Greeks.” Delta measures the change in option price for a $1 change in the underlying asset’s price. Gamma measures the rate of change of Delta. Theta measures the time decay of an option, or how much the option’s value decreases each day as it approaches expiration. Vega measures the option’s sensitivity to changes in volatility. Rho measures the option’s sensitivity to changes in interest rates. While a full implementation of the Greeks within the black scholes calculator in excel may be complex, understanding these concepts is vital for options trading and risk management. Even without calculating the Greeks directly in your spreadsheet, you can use Excel’s Scenario Analysis tool to observe how the option price changes under different scenarios for stock price, volatility, and time to expiration. This allows you to assess the potential impact of various market conditions on your option positions and refine your trading strategies.

Excel’s Scenario Manager is a powerful tool to perform sensitivity analysis. This feature allows you to define different scenarios by changing the input variables in your black scholes calculator in excel and observing the resulting option price. For instance, you can create scenarios for “Bullish,” “Bearish,” and “Neutral” market conditions, each with different stock prices and volatility levels. By comparing the option prices under these scenarios, you can gain a better understanding of the potential risks and rewards associated with the option. This analysis also provides a visual representation of how sensitive the option price is to changes in each input variable. Furthermore, it reinforces the understanding that the black scholes calculator in excel provides a theoretical price, and market conditions may cause deviation.

Troubleshooting and Validation: Ensuring Accuracy of Your Model

Building a reliable Black Scholes calculator in Excel requires careful attention to detail. Several common errors can creep into your model, leading to inaccurate option price calculations. One frequent mistake is incorrect formula entry. Double-checking all formulas, especially those involving nested functions like `NORMSDIST` and `EXP`, is crucial. Ensure that cell references are accurate and point to the correct input variables. A misplaced parenthesis or a wrong cell reference can throw off the entire calculation. A Black Scholes calculator in Excel is highly sensitive to formula errors.

Another common pitfall involves incorrect data input. Always verify the accuracy of your input data, such as the stock price, strike price, time to expiration, risk-free interest rate, and volatility. Use reliable sources for these inputs and be mindful of unit conversions (e.g., ensure the risk-free rate is expressed in the same time units as the time to expiration). Volatility, in particular, can be challenging to estimate. If using historical volatility, make sure you’re using an appropriate time period and calculation method. Regularly validating your Black Scholes calculator in Excel is essential.

To validate your Black Scholes calculator in Excel, compare its output with online Black-Scholes calculators or financial software. Numerous free online calculators are available for this purpose. If the results differ significantly, meticulously review your formulas and input data. A systematic approach to debugging is essential. Break down the formula into smaller parts and check the intermediate results. For example, calculate d1 and d2 separately before calculating the call and put option prices. Utilize Excel’s auditing tools to trace precedents and dependents of cells, helping you identify the source of errors. Also, consider testing your Black Scholes calculator in Excel with extreme or boundary values to see if the results are reasonable. This helps in identifying potential flaws in the model’s logic and ensures the reliability of your Black Scholes calculator in Excel.

Beyond the Basics: Enhancing Your Option Pricing Tool

To elevate your black scholes calculator in excel, consider incorporating several advanced features. Error handling is crucial; the `IFERROR` function gracefully manages unexpected inputs or calculation errors, preventing the spreadsheet from displaying unsightly error messages. Instead, it can display a user-friendly message, guiding the user toward correcting the input. Visualizing option prices through charts offers another layer of insight. Excel’s charting tools can create dynamic graphs that illustrate how option prices change with varying stock prices, volatility, or time to expiration. This visual representation facilitates a more intuitive understanding of option price sensitivities.

A significant enhancement to any black scholes calculator in excel involves calculating implied volatility. While this article primarily focuses on pricing options given volatility as an input, determining implied volatility, which reflects market expectations, provides valuable information. An iterative process, like the Newton-Raphson method, can be implemented using VBA (Visual Basic for Applications) within Excel to solve for implied volatility. This allows users to input market option prices and back-solve for the volatility the market is pricing in. Such functionality transforms the black scholes calculator in excel into a more powerful analytical tool.

It’s essential to acknowledge the limitations of the Black-Scholes model when expanding your black scholes calculator in excel. The model assumes constant volatility, no dividends, and efficient markets, assumptions that don’t always hold true in reality. For instance, incorporating dividend adjustments, such as the Black-Scholes Merton model, can improve accuracy for dividend-paying stocks. Furthermore, exploring more advanced models, such as stochastic volatility models or jump-diffusion models, can address some of the Black-Scholes model’s shortcomings. While these are beyond the scope of a basic Excel implementation, understanding their existence is vital for informed option trading and risk management. Remember to always validate results from your black scholes calculator in excel against other sources and understand its assumptions.

Advanced Strategies: Combining Options with the Black Scholes Calculator in Excel

Context_9: Explore advanced strategies that can be implemented using the black scholes calculator in excel. These strategies move beyond simple call or put buying and involve combining multiple options contracts to achieve specific risk-reward profiles. Consider strategies like covered calls, protective puts, straddles, strangles, and butterfly spreads. Explain how the black scholes calculator in excel can be used to evaluate the potential profitability and risk of these strategies under different market conditions. Discuss the importance of understanding the underlying assumptions of the Black-Scholes model when applying it to complex options strategies.

Delve into how a black scholes calculator in excel aids in visualizing the potential outcomes of these strategies. For example, with a covered call, the calculator can help determine the optimal strike price to maximize income while limiting upside potential. For protective puts, the calculator can assess the cost of insurance against a potential decline in the underlying asset’s price. Furthermore, discuss how to use the calculator to analyze the impact of time decay (Theta) and volatility changes (Vega) on the overall profitability of these strategies. Creating scenarios within Excel, using varying stock prices and volatility assumptions, allows traders to stress-test their strategies and understand their potential vulnerabilities. The black scholes calculator in excel becomes a valuable tool for informed decision-making, guiding the selection of appropriate strike prices and expiration dates to align with specific investment goals and risk tolerance. Consider the limitations of the black scholes calculator in excel when market conditions deviate significantly from the model’s assumptions.

Explain the importance of considering transaction costs, commissions, and slippage when evaluating the profitability of options strategies using a black scholes calculator in excel. These costs can significantly impact the overall return, especially for strategies involving multiple legs or frequent trading. Highlight the need to adjust the calculator’s output to reflect these real-world expenses. Moreover, emphasize the ongoing monitoring and adjustment of options strategies based on market movements and changes in implied volatility. The black scholes calculator in excel should be used as a dynamic tool, regularly updated with current market data to ensure accurate pricing and risk assessment. By integrating the black scholes calculator in excel into a broader options trading framework, traders can enhance their ability to manage risk, optimize returns, and navigate the complexities of the options market with greater confidence.