Demystifying Option Valuation with Spreadsheet Tools

Option pricing, a cornerstone of financial analysis, determines the theoretical value of options contracts. Among the various models available, the Black-Scholes model stands out as a foundational tool. Understanding option pricing and, specifically, the intricacies of the black and scholes model excel, is exceptionally valuable for both finance professionals and students. It provides insights into risk management, investment strategies, and market dynamics. The black and scholes model excel offers a simplified yet powerful approach to grasping these concepts.

Implementing the black and scholes model excel within a spreadsheet environment presents several advantages. It fosters a deeper understanding through hands-on application. Users can directly observe how changes in input variables impact the calculated option price. This interactive approach enhances learning and knowledge retention. Furthermore, spreadsheets offer unparalleled customization. The black and scholes model excel can be tailored to accommodate specific scenarios or incorporate additional factors beyond the basic model assumptions. This flexibility is particularly beneficial for exploring the sensitivity of option prices to various market conditions.

Moreover, utilizing spreadsheets to implement the black and scholes model excel eliminates the need for specialized software. Most individuals already have access to spreadsheet programs like Microsoft Excel or Google Sheets. This accessibility democratizes option pricing analysis, making it available to a wider audience. The ability to build and modify the model yourself fosters a greater sense of ownership and control over the valuation process. By using the black and scholes model excel, users gain not only a practical tool for option pricing but also a comprehensive understanding of the underlying principles and assumptions driving option values. This knowledge empowers them to make more informed decisions in the complex world of financial markets.

Essential Inputs for Accurate Option Pricing

Understanding the inputs for the Black-Scholes model is crucial for accurate option pricing within your black and scholes model excel implementation. The model relies on five key variables: the current stock price, the strike price of the option, the time remaining until the option’s expiration, the risk-free interest rate, and the volatility of the underlying asset. Each input plays a distinct role in determining the theoretical option price, making data accuracy paramount for model performance. Utilizing the black and scholes model excel requires careful attention to detail, especially when gathering and inputting these values.

The current stock price represents the market value of the underlying asset. This data is readily available from stock exchanges or financial data providers. The strike price is the price at which the option holder can buy (for a call option) or sell (for a put option) the underlying asset. This is specified in the option contract. Time to expiration refers to the period remaining until the option expires, typically expressed in years. It’s calculated as the number of days until expiration divided by 365. The risk-free interest rate is the theoretical rate of return of an investment with zero risk. Often, the yield on a government bond with a maturity similar to the option’s expiration date is used as a proxy. Reliable sources for this data include government websites and financial news outlets. Volatility, perhaps the most critical and challenging input, represents the expected fluctuation in the stock price over the option’s lifetime. It is usually expressed as an annualized standard deviation. Historical volatility can be calculated from past stock prices, but implied volatility, derived from market prices of options, is often preferred. Sophisticated black and scholes model excel users will explore different volatility measures to refine their pricing.

Securing accurate and up-to-date data for these inputs is essential for the reliability of your black and scholes model excel calculations. Errors in any of these values can lead to significant discrepancies between the model’s output and the actual market price of the option. Furthermore, remember that the Black-Scholes model is based on certain assumptions, such as constant volatility, which may not always hold true in real-world markets. Therefore, while a well-implemented black and scholes model excel can be a valuable tool for understanding option pricing, it should be used in conjunction with other analytical methods and a healthy dose of market awareness. Implementing the black and scholes model excel correctly begins with a firm grasp on the inputs and their impact on the final price.

How to Calculate Option Prices with Spreadsheet Formulas

This section offers a step-by-step guide to implementing the Black-Scholes formula in a spreadsheet. The Black-Scholes model excel implementation requires breaking down the complex formula into smaller, manageable parts. This approach simplifies the process and reduces the chance of errors. Each component, such as d1, d2, and the cumulative standard normal distribution, plays a crucial role in determining the option price. Understanding the purpose of each part is essential for accurate option pricing. This guide will use cell references to clearly demonstrate how to input the necessary variables and calculate both call and put option prices within your spreadsheet.

First, the formulas for d1 and d2 must be calculated. d1 is calculated as: `=(LN(StockPrice/StrikePrice)+(RiskFreeRate+Volatility^2/2)*TimeToExpiration)/(Volatility*SQRT(TimeToExpiration))`. Replace `StockPrice`, `StrikePrice`, `RiskFreeRate`, `Volatility`, and `TimeToExpiration` with the corresponding cell references in your spreadsheet. For example, if the stock price is in cell B1, the strike price in B2, and so on, the formula would be: `=(LN(B1/B2)+(B3+B4^2/2)*B5)/(B4*SQRT(B5))`. Then, d2 is simply calculated as: `d1 – Volatility*SQRT(TimeToExpiration)`. Again, use the appropriate cell references. With d1 and d2 calculated, you can now compute the call and put option prices using the Black-Scholes model excel.

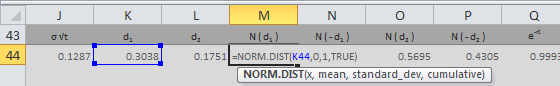

The call option price is calculated as: `StockPrice*CumulativeNormal(d1) – StrikePrice*EXP(-RiskFreeRate*TimeToExpiration)*CumulativeNormal(d2)`. In spreadsheet terms: `=B1*CumulativeNormal(d1_cell) – B2*EXP(-B3*B5)*CumulativeNormal(d2_cell)`. The put option price is calculated as: `StrikePrice*EXP(-RiskFreeRate*TimeToExpiration)*CumulativeNormal(-d2) – StockPrice*CumulativeNormal(-d1)`. In spreadsheet terms: `=B2*EXP(-B3*B5)*CumulativeNormal(-d2_cell) – B1*CumulativeNormal(-d1_cell)`. Remember to replace `CumulativeNormal()` with the appropriate spreadsheet function for the cumulative standard normal distribution (e.g., `NORM.S.DIST(x,TRUE)` in Excel). By following these steps and accurately inputting the variables, you can successfully implement the black and scholes model excel and calculate option prices in your spreadsheet.

Implementing the Cumulative Standard Normal Distribution Function

The cumulative standard normal distribution, often denoted as N(x), is a critical component within the Black-Scholes formula. It represents the probability that a standard normal random variable will be less than or equal to x. In the context of option pricing, N(d1) and N(d2) play vital roles in determining the call and put option prices, respectively. The function essentially transforms the standardized values d1 and d2 into probabilities, which are then used to weight the stock price and strike price in the Black-Scholes equation. Understanding its implementation is crucial for accurate Black-Scholes model excel calculations.

Most spreadsheet programs offer built-in functions to calculate the cumulative standard normal distribution. In newer versions of Microsoft Excel, the function `NORM.S.DIST(z, cumulative)` is used. The ‘z’ represents the value (d1 or d2 in the Black-Scholes formula) for which you want to find the cumulative probability. The ‘cumulative’ argument should be set to TRUE to return the cumulative distribution function. Therefore, if you have calculated d1 in cell A1, you would use the formula `=NORM.S.DIST(A1,TRUE)` to find N(d1). Older versions of Excel might use the function `NORMSDIST(z)`. The correct usage of this function is vital for the accurate computation of option prices within your Black-Scholes model excel spreadsheet.

If your spreadsheet program lacks a built-in function for the cumulative standard normal distribution, alternative methods can be employed. One common approach is to approximate it using polynomial expansions. Several formulas exist that provide reasonably accurate approximations. While these approximations introduce a small degree of error, they can be sufficient for many practical applications. When using such approximations, ensure you understand their limitations and potential impact on the final option price. Furthermore, always validate your Black-Scholes model excel implementation against known values to ensure accuracy, regardless of the method used for calculating the cumulative standard normal distribution. This ensures the reliability of your option pricing calculations.

Validating Your Spreadsheet Model for Accuracy

To ensure the reliability of your black and scholes model excel implementation, validation is critical. This process involves verifying that the calculated option prices from your spreadsheet align with established benchmarks. Begin by comparing your model’s output with online Black-Scholes calculators. Numerous financial websites offer these calculators, providing a convenient way to cross-reference your results. Input the same parameters—stock price, strike price, time to expiration, risk-free rate, and volatility—into both your spreadsheet and the online calculator. The resulting option prices should be nearly identical. Discrepancies, even minor ones, warrant investigation, potentially indicating errors in your formulas or data inputs.

Further validation involves testing your black and scholes model excel across a spectrum of scenarios. Systematically vary the input parameters—stock prices, volatility levels, and expiration dates—and observe the corresponding changes in the calculated option prices. For instance, increase the stock price while holding other variables constant. The call option price should increase, and the put option price should decrease. Similarly, increasing volatility should generally increase the prices of both call and put options. These tests help confirm that your model responds logically to changes in the underlying market conditions. Additionally, consider comparing your model’s output against published option prices for a specific set of inputs, if available. This provides a real-world benchmark to assess the accuracy of your black and scholes model excel.

Accuracy in the black and scholes model excel relies on consistent and meticulous testing. Beyond basic comparisons, consider creating stress tests by inputting extreme values for volatility or time to expiration. These tests can reveal potential limitations or inaccuracies in your model, particularly in edge-case scenarios. Regular validation is not a one-time activity; it’s an ongoing process. As you modify or enhance your spreadsheet, repeat the validation steps to ensure that the changes haven’t introduced any unintended errors. Thorough validation builds confidence in your model and its ability to provide accurate option pricing estimates. Remember that the Black-Scholes model is based on assumptions, and real-world market conditions may deviate from those assumptions. Therefore, validation should be complemented by an understanding of the model’s limitations.

Going Beyond Basic: Enhancements and Considerations

The basic Black-Scholes model excel is a powerful tool, but it operates under certain assumptions that may not perfectly reflect real-world market conditions. Understanding these limitations and exploring potential enhancements is crucial for a more nuanced approach to option pricing. One significant consideration is the treatment of dividends. The original Black-Scholes model excel does not account for dividends paid out by the underlying stock during the option’s lifetime. Adjustments can be made to the model by subtracting the present value of expected dividends from the current stock price. This modified approach provides a more accurate valuation for dividend-paying stocks.

Another important aspect to consider is the early exercise feature of American options. Unlike European options, which can only be exercised at expiration, American options can be exercised at any time before expiration. The Black-Scholes model excel, in its standard form, is designed for European options and may not accurately price American options, especially those on dividend-paying stocks. More complex models and numerical methods, such as binomial trees, are often used to value American options. Furthermore, the Black-Scholes model excel assumes constant volatility over the life of the option. However, in reality, volatility often fluctuates, creating a “volatility smile” or “skew,” where options with different strike prices have different implied volatilities. Ignoring this phenomenon can lead to mispricing of options. Sophisticated traders often use volatility surfaces to account for these variations in volatility.

It is essential to recognize that the Black-Scholes model excel is a theoretical model and relies on several assumptions that may not always hold true. These include the assumption of a log-normal distribution of stock prices, constant risk-free interest rates, and the absence of transaction costs or arbitrage opportunities. While the Black-Scholes model excel provides a valuable framework for understanding option pricing, it’s important to be aware of its limitations and potential biases. By understanding these advanced topics and limitations, users can apply the Black-Scholes model excel more effectively and make more informed decisions in the options market. Adjustments for dividends, awareness of early exercise features, and consideration of volatility smiles are crucial steps in moving beyond the basics of option pricing.

Harnessing Spreadsheet Software for Volatility Analysis

Spreadsheets provide a powerful environment for analyzing how volatility impacts option prices, a crucial aspect of understanding the black and scholes model excel. By constructing a sensitivity analysis table, users can directly observe the relationship between varying volatility levels and the resulting option prices. This involves setting up a table where one axis represents different volatility values (e.g., ranging from 10% to 50% in increments of 5%), and the other axis remains constant, displaying the calculated call or put option price. Recalculating the black and scholes model excel for each volatility value and populating the table allows for a clear visualization of the price sensitivity to changes in volatility.

The concept of implied volatility is central to option pricing, reflecting the market’s expectation of future price fluctuations of the underlying asset. Unlike other inputs to the black and scholes model excel, such as the current stock price or risk-free interest rate, volatility is not directly observable. Instead, it is derived from market prices of options. To calculate implied volatility in a spreadsheet, one can use iterative methods or spreadsheet solver tools. These tools adjust the volatility input in the black and scholes model excel until the model’s output (the theoretical option price) matches the actual market price of the option. This “reverse engineering” process provides valuable insights into market sentiment and helps traders assess whether options are overvalued or undervalued.

Furthermore, spreadsheets facilitate a deeper understanding of the volatility smile or skew. These phenomena, observed in real-world option markets, indicate that options with different strike prices but the same expiration date often have different implied volatilities. By plotting implied volatility against strike prices, traders can visually analyze the shape of the volatility smile or skew. This analysis can inform trading strategies and risk management decisions. The black and scholes model excel, when combined with spreadsheet tools for sensitivity analysis and implied volatility calculation, becomes a versatile platform for exploring the complexities of option pricing and volatility dynamics. Creating these visualizations and calculations provides a powerful way to understand and use the black and scholes model excel for practical market analysis.

Troubleshooting Common Implementation Pitfalls

Several common pitfalls can hinder the accurate implementation of the black and scholes model excel within a spreadsheet. One frequent issue is incorrect formula syntax. Scrutinize the formula for typos, misplaced parentheses, or incorrect cell references. Double-check that all required inputs are correctly linked to their respective cells. Ensure that the order of operations is respected, particularly within the more complex components of the black and scholes model excel formula like d1 and d2.

Data input errors represent another significant source of problems. Verify that the current stock price, strike price, time to expiration, risk-free interest rate, and volatility are all entered accurately. Pay close attention to units. Time to expiration, for instance, should be expressed in years. Volatility should be entered as a decimal. A seemingly minor error in any of these inputs can dramatically impact the calculated option price when using the black and scholes model excel. Regularly cross-reference your input data with reliable sources to prevent these errors.

Difficulties with the cumulative standard normal distribution function are also common. If your spreadsheet program has a built-in function like `NORM.S.DIST` (in Excel) or a similar function, confirm that you are using it correctly. Ensure that the input to this function (d1 or d2) is accurately calculated and that the function is returning the expected probability. If you are using an approximation method for the cumulative standard normal distribution due to the absence of a built-in function, carefully review the approximation formula and its implementation within the spreadsheet. Test the approximation against known values to ensure its accuracy. Addressing these potential problems will lead to a functional and reliable black and scholes model excel for option pricing.