Understanding Option Pricing Fundamentals

Option pricing is a complex field dealing with the valuation of derivative instruments. These instruments derive their value from an underlying asset, such as a stock. A call option grants the holder the right, but not the obligation, to buy the underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). Conversely, a put option grants the right to sell the underlying asset at the strike price by the expiration date. Accurate option pricing is crucial for investors and market makers. Simpler models, like the Black-Scholes model, provide valuable insights but rely on assumptions that may not always hold true in real-world markets. The binomial tree model option pricing offers a more flexible approach, particularly when dealing with assets whose prices don’t follow a perfectly continuous distribution or when considering factors like early exercise.

Risk-neutral valuation forms the cornerstone of many option pricing models, including the binomial tree model. This approach assumes that all investors are risk-neutral; they only care about the expected return and not about risk. While this assumption simplifies calculations, it yields accurate option prices under certain conditions. The binomial tree model excels by breaking down the time to expiration into discrete time intervals. This discretization allows for the modeling of price movements that are not continuous, a more realistic representation of many asset price behaviors. This approach addresses limitations of models that assume continuous price movements, offering a more robust and versatile tool for binomial tree model option pricing.

The binomial tree model option pricing method is particularly useful because it offers a more intuitive and visual approach to pricing options compared to the Black-Scholes model. The discrete nature of the model makes it easier to understand the factors driving option prices. Furthermore, the binomial tree model can handle American-style options, which allow for early exercise, a feature not easily incorporated into the Black-Scholes framework. This adaptability and its clear visual representation of price movements makes the binomial tree model a valuable tool in a financial analyst’s toolkit. It provides a more accurate reflection of real-world market conditions, especially for options with early exercise features or underlying assets with less predictable price changes. The binomial tree model option pricing is thus preferred in many situations over simpler models.

Building Your First Binomial Tree: A Foundation for Option Pricing

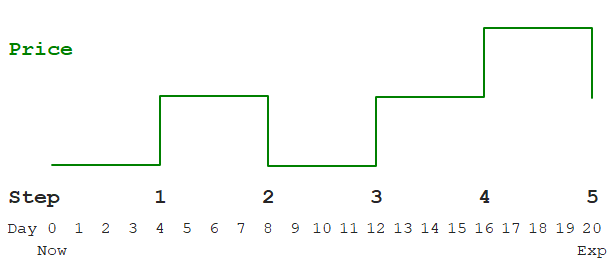

The binomial tree model option pricing is a powerful tool for valuing options. It simplifies the complex process of option valuation by breaking down the time until the option expires into discrete time steps. In each step, the underlying asset’s price can move either up or down by a predetermined factor. This creates a branching tree structure, hence the name “binomial tree.” The model uses probabilities to calculate the expected future price of the underlying asset at each node. A key concept is the risk-free interest rate, which represents the return an investor could expect from a risk-free investment over the same period. This rate is crucial for discounting future payoffs back to the present value.

Consider a simple one-step binomial tree. Suppose the current price of an asset is $100. The up factor is 1.1 (a 10% increase), and the down factor is 0.9 (a 10% decrease). The probability of an upward movement is 60%, and the probability of a downward movement is 40%. The risk-free interest rate is 5% per period. At the end of the period, the asset price could be either $110 (100 * 1.1) or $90 (100 * 0.9). Using these values, one can calculate the expected future value of the asset and then discount it back to today’s value. This basic framework forms the foundation for pricing options using the binomial tree model. The binomial tree model option pricing offers a clear, step-by-step approach for calculating option values, providing a strong alternative to other models.

The beauty of the binomial tree model lies in its iterative nature. To price options with longer maturities, the process simply involves extending the tree to multiple steps. Each step adds another layer of branching possibilities, reflecting the increasing uncertainty of the future asset price. This multi-step approach allows for more accurate option pricing by accounting for more potential price scenarios. The binomial tree model option pricing also provides a visual representation of the potential price paths, allowing for a better understanding of the factors influencing the option’s value. By understanding the probabilities associated with each price movement and discounting the expected future payoffs, one can derive a fair price for the option.

How to Price Options Using a Multi-Step Binomial Tree

To price options using the binomial tree model, one must extend the single-step model to multiple steps. Each step represents a time interval, and at each step, the underlying asset’s price can move up or down. The probability of an upward movement is denoted as ‘p’, while the probability of a downward movement is ‘1-p’. The risk-free interest rate, ‘r’, is crucial in determining ‘p’, ensuring risk-neutral valuation within the binomial tree model option pricing framework. A key aspect of the binomial tree model is its ability to handle American options, allowing for early exercise. This is achieved by comparing the value of immediate exercise with the continuation value at each node in the tree.

Consider a two-step binomial tree. The initial asset price is known. At each step, the price either moves up by a factor ‘u’ or down by a factor ‘d’. After two steps, there are three possible prices. To price a call option, one works backward through the tree. At each node in the final period, the option value is simply the maximum of zero and the difference between the asset price and the strike price. At each preceding node, the option value is the discounted expected value of the subsequent node’s values, weighted by the probabilities ‘p’ and ‘1-p’. This discounted expected value is calculated using the risk-free rate ‘r’. The same approach is used for put options, but the option value at the final nodes is the maximum of zero and the difference between the strike price and the asset price. This iterative process of binomial tree model option pricing continues until the option value at the initial node is determined. Visual representations, such as diagrams showing the tree structure and price movements, greatly aid understanding of this process. The binomial tree model option pricing approach accurately reflects the option’s value at various points.

A three-step binomial tree expands on this concept. Here, after three periods, there are four possible prices for the underlying asset. The option pricing procedure remains the same: the model calculates option values at each node using discounted expected values based on the risk-neutral probability ‘p’. Working backward from the final nodes, the binomial tree model option pricing process efficiently calculates the option’s price at the initial node, which reflects the current option price considering all possible future asset price scenarios. The complexity increases with each added step, but the resulting accuracy in binomial tree model option pricing also improves. The model’s efficiency in handling various option types and its adaptability to different market conditions make it a widely used tool in option pricing.

Incorporating Volatility and Time to Expiration in Binomial Tree Model Option Pricing

Volatility, representing the standard deviation of an asset’s returns, significantly impacts binomial tree model option pricing. Higher volatility leads to a wider range of possible future prices. This translates to a larger spread in the binomial tree, reflecting the increased uncertainty surrounding the asset’s price movements. Consequently, option prices generally increase with higher volatility, as the chance of the option finishing in the money grows. The binomial tree visually demonstrates this; higher volatility creates a broader, more expansive tree, showcasing the greater price variability. Understanding this relationship is crucial for accurate binomial tree model option pricing, allowing for the effective assessment of risk and return.

Time to expiration also plays a critical role in binomial tree model option pricing. The longer the time until the option expires, the more potential price fluctuations the underlying asset can experience. To accurately capture these fluctuations, the binomial tree needs more time steps. Each step represents a period of time. More steps provide a finer-grained representation of the asset’s price path, leading to more accurate option pricing. Conversely, fewer steps simplify calculations but sacrifice accuracy. The choice of the number of steps involves a trade-off between accuracy and computational efficiency. For options with longer maturities, a higher number of steps is generally required within the binomial tree model for option pricing to achieve satisfactory accuracy. This ensures the model adequately captures the increased uncertainty associated with longer time horizons. The binomial tree model option pricing becomes more complex, but the resulting prices are more reliable. Using fewer steps leads to faster computations, but can drastically under or over-estimate the correct option price.

In summary, both volatility and time to expiration are crucial parameters in the binomial tree model. Volatility influences the magnitude of price changes represented in the tree, directly impacting option values. Time to expiration determines the necessary number of time steps for an accurate representation of price paths. Therefore, precise modeling requires careful consideration of these factors in the binomial tree model option pricing. The interplay of these variables within the binomial tree model ensures a more realistic and accurate reflection of option values in the market. Understanding these factors is vital for effective binomial tree model option pricing and robust risk management strategies.

Adjusting for Dividends and Other Factors in Binomial Tree Model Option Pricing

The binomial tree model option pricing method readily adapts to incorporate dividends, a crucial aspect for accurately valuing options on dividend-paying stocks. Dividends reduce the underlying asset’s price on the ex-dividend date. To account for this in the binomial tree, the stock price is adjusted downward before the calculation of up and down movements in the subsequent period. The adjustment equals the present value of the dividend, discounted using the risk-free interest rate. This ensures the model reflects the actual price movements, leading to a more precise option valuation. This adjustment process is applied at each step of the binomial tree, if dividends are expected during the option’s life. This modification maintains the model’s accuracy and applicability to real-world scenarios, enhancing the binomial tree model option pricing capabilities.

Beyond dividends, the binomial tree model can also handle other factors influencing option valuation. For American options, which allow early exercise, the model requires a slight modification. At each node in the tree, the model compares the value of immediate exercise with the expected value from holding the option until expiration. The higher of these two values is used to proceed to the next step, effectively capturing the early exercise feature. This added layer of complexity makes the binomial tree model a valuable tool for pricing American options, where the Black-Scholes model, for example, struggles to provide accurate pricing due to its inability to account for early exercise. Therefore, understanding these adjustments is critical for effective binomial tree model option pricing.

Furthermore, the binomial tree model offers flexibility in handling other complexities. While a detailed explanation is beyond the scope of this section, it’s important to note the model can be adapted to accommodate features such as stochastic volatility, where the volatility itself changes randomly over time, or other factors like transaction costs and different interest rate scenarios. These advanced applications demonstrate the adaptability and power of the binomial tree model option pricing framework for a diverse array of financial instruments and market conditions. The model’s ability to accommodate these complexities further strengthens its position as a robust and versatile tool in option pricing, particularly when dealing with more intricate assets and market dynamics. This adaptability is a core strength of the binomial tree model option pricing.

Choosing the Right Number of Time Steps in the Binomial Tree Model

The accuracy of the binomial tree model option pricing hinges significantly on the number of time steps used in the model. A greater number of steps generally leads to more precise results, mirroring the continuous nature of time more closely. However, increasing the number of steps also exponentially increases the computational complexity. This trade-off is crucial for practitioners using the binomial tree model for option pricing. Each additional step requires more calculations, potentially slowing down the pricing process considerably. Finding the optimal balance is key to efficient and accurate option valuation using this model.

Consider the specific option and underlying asset when selecting the number of time steps. For options with shorter maturities, fewer steps might suffice to achieve reasonable accuracy. Conversely, for longer-dated options, a larger number of steps is generally necessary to capture the potential price fluctuations adequately. The volatility of the underlying asset also plays a role. Higher volatility often necessitates more time steps to accurately reflect the wider range of possible price movements. Sophisticated binomial tree model option pricing algorithms often employ adaptive time stepping, adjusting the number of steps based on the volatility and time to expiration of the specific option. This dynamic approach optimizes the accuracy-efficiency balance inherent in the binomial tree method.

Experimentation and comparison against other pricing models, like the Black-Scholes model (for European options), can help determine the appropriate number of steps. The binomial tree model option pricing method offers flexibility. Practitioners can start with a smaller number of steps and gradually increase them, comparing the results. When the changes become negligible, this suggests that the model has converged, and the chosen number of steps provides a suitable balance between computational efficiency and accuracy for the given option contract. This iterative approach is a practical method to determine the ideal number of steps for specific applications of the binomial tree model option pricing.

Comparing Binomial Tree Results with Black-Scholes

The binomial tree model and the Black-Scholes model are both used for option pricing, but they approach the problem differently. The Black-Scholes model uses a continuous-time approach, assuming asset prices follow a geometric Brownian motion. This provides a closed-form solution, offering fast calculation of European option prices. In contrast, the binomial tree model employs a discrete-time approach, modeling price movements as a series of upward or downward jumps. This discrete nature allows for the straightforward incorporation of factors like early exercise for American options, a feature absent in the standard Black-Scholes formulation. The binomial tree model option pricing method offers a more intuitive understanding of the underlying mechanics.

When comparing results, one should expect some discrepancies between the two models. The Black-Scholes model relies on several assumptions, including constant volatility and no dividends. Deviations from these assumptions can lead to differences in calculated option prices compared to the binomial tree model which can, to a degree, handle these variables. As the number of time steps in the binomial tree increases, the results generally converge towards the Black-Scholes price for European options, provided the binomial tree model’s inputs match those used in the Black-Scholes calculation. This convergence demonstrates the relationship between the two models, highlighting the binomial tree as a discrete approximation of the continuous-time Black-Scholes framework. The binomial tree model option pricing approach shines when dealing with American options where early exercise is a significant consideration.

For European options, where early exercise is not possible, the Black-Scholes model often provides a more efficient calculation. However, the binomial tree model’s ability to model discrete price jumps and incorporate factors like dividends makes it a valuable tool in situations where the Black-Scholes assumptions are violated. The choice between these models often depends on the specific option’s characteristics, the desired level of accuracy, and the computational resources available. The binomial tree model offers a flexible and robust method for option pricing, especially when dealing with complexities not easily handled by the Black-Scholes model. Understanding both models provides a comprehensive approach to option pricing.

Applications and Limitations of the Binomial Tree Model

The binomial tree model finds extensive application in option pricing, providing a versatile framework for valuing both European and American options. Its primary advantage lies in its intuitive approach, making the underlying mechanics relatively easy to understand. This contrasts with more complex models, offering a valuable educational tool for those learning about option valuation. Furthermore, the binomial tree model elegantly handles early exercise features inherent in American options, a capability lacking in simpler models like the Black-Scholes model. The binomial tree model option pricing methodology allows for a clear visualization of price movements over time, enhancing comprehension. This makes it particularly useful for teaching purposes and building a foundational understanding of option valuation concepts.

However, the binomial tree model is not without its limitations. The computational intensity increases significantly with the number of time steps. To achieve greater accuracy, one must increase the number of steps, which in turn demands more computational resources. This can become a significant drawback when dealing with long-dated options or complex scenarios. Another limitation arises from its reliance on discrete price movements. The model struggles to accurately capture the continuous nature of price changes in the underlying asset, leading to potential inaccuracies, especially when dealing with assets exhibiting high volatility. The binomial tree model option pricing technique is particularly suitable for options on assets with relatively stable price movements and shorter time horizons. For long-dated options or assets with highly volatile price fluctuations, more sophisticated models may be necessary to improve accuracy.

Despite these limitations, the binomial tree model remains a valuable tool in the option pricing arsenal. Its relative simplicity and ability to incorporate early exercise make it a preferred method for understanding the fundamental principles of option valuation. The choice between the binomial tree model and other models depends on the specific context. Factors to consider include the nature of the option (European or American), the time to expiration, the volatility of the underlying asset, and the desired level of accuracy. While more advanced models might offer greater precision in certain situations, the binomial tree model’s intuitive framework and practical applications ensure its continued relevance in financial modeling. The binomial tree model option pricing approach serves as a robust and insightful method, especially when educational value and a clear understanding of the underlying mechanics are paramount.