Unlocking Market Insights: Choosing the Right Platform for You

Level 2 trading platforms are indispensable tools for active traders seeking a deeper understanding of market dynamics. These platforms provide access to Level 2 data, which offers a real-time view of the order book, displaying the prices and sizes of buy and sell orders at various price levels. This granular data goes beyond the basic Level 1 information, which only shows the best bid and ask prices.

Level 2 data reveals the market’s depth and order flow, offering insights into potential areas of support and resistance. By observing the size of orders clustered at specific price points, traders can gauge the strength of buying or selling interest. A large number of buy orders at a particular price level may indicate strong support, while a significant concentration of sell orders could suggest resistance. Analyzing the order book allows traders to anticipate potential price movements and make more informed decisions about entry and exit points. Identifying the best level 2 trading platform requires careful consideration.

The benefits of using a best level 2 trading platform extend beyond simply viewing the order book. These platforms often incorporate advanced charting tools, real-time news feeds, and customizable alerts, empowering traders to conduct comprehensive market analysis. By integrating Level 2 data with other technical indicators, traders can develop sophisticated trading strategies and improve their overall performance. Ultimately, the use of these platforms enables traders to make informed decisions, manage risk effectively, and capitalize on market opportunities, making the selection of the best level 2 trading platform a crucial step.

How to Analyze Level 2 Data: A Beginner’s Guide

Understanding Level 2 data is crucial for any active trader seeking an edge. This data reveals the depth of the market by displaying a real-time list of buy and sell orders at various price levels. Think of it as a window into the intentions of other market participants. The goal of finding the best level 2 trading platform is to effectively use this insight to improve trading decisions. This guide provides a step-by-step approach to interpreting this valuable information.

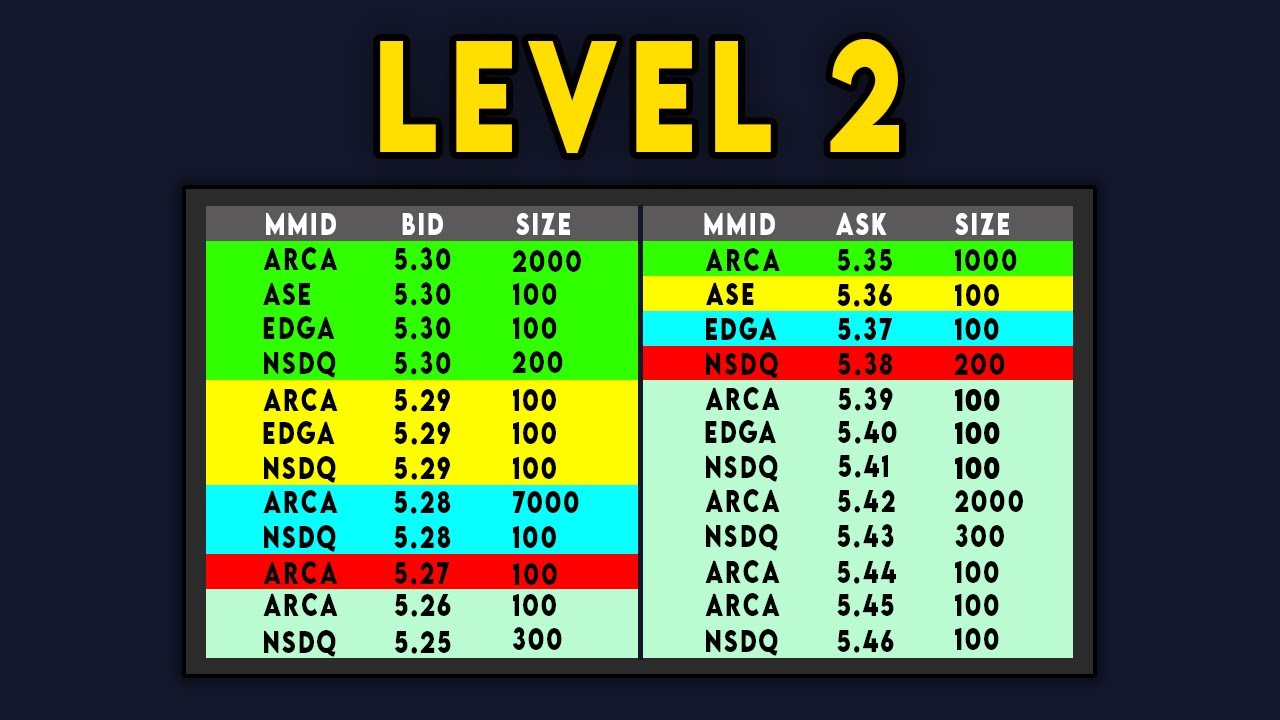

The Level 2 window is typically divided into two main columns: the “Bid” side and the “Ask” side. The Bid column shows the prices at which buyers are willing to purchase a security, along with the corresponding number of shares they want to buy at each price. Conversely, the Ask column displays the prices at which sellers are offering to sell the security and the number of shares they are offering at each price. The price at the top of the Bid column is the highest price someone is currently willing to pay (the highest bid), while the price at the top of the Ask column is the lowest price at which someone is willing to sell (the lowest ask). The difference between these two prices is known as the “bid-ask spread.” A narrower spread usually indicates higher liquidity.

Analyzing the size of orders at different price levels can provide clues about potential support and resistance. For instance, a large number of buy orders clustered at a particular price level may suggest a strong support level. If the price falls to that level, buyers are likely to step in and prevent further decline. Conversely, a significant number of sell orders at a specific price may indicate resistance. If the price rises to that level, sellers may emerge and push the price back down. Identifying these areas requires practice and careful observation. For example, imagine seeing a large bid order for 1,000 shares significantly below the current price; this might suggest a support level. Similarly, a large ask order could indicate a possible resistance point. By analyzing these factors, traders can gain a deeper understanding of market sentiment and make more informed decisions with the best level 2 trading platform available to them. Remember that Level 2 data is dynamic and requires continuous monitoring for accurate interpretation. The best level 2 trading platform should make this monitoring easy and intuitive.

Platform Showdown: Interactive Brokers Trader Workstation vs. Thinkorswim

The quest for the best level 2 trading platform often leads traders to a head-to-head comparison of industry giants. Interactive Brokers Trader Workstation (TWS) and Thinkorswim consistently rank among the top choices. Both platforms offer robust tools and functionalities designed to empower active traders. Deciding which one reigns supreme depends largely on individual trading styles, asset preferences, and technical proficiency. This section marks the beginning of an extensive platform comparison. It will explore the strengths and weaknesses of each platform. This analysis aims to provide a clear understanding of what each platform offers. The goal is to help traders make an informed decision about which platform best suits their needs.

This comparison will dissect the level 2 data capabilities of both platforms. Interactive Brokers’ TWS is known for its comprehensive market access and sophisticated order management. Thinkorswim, on the other hand, shines with its intuitive interface and powerful charting tools. Options traders will find Thinkorswim particularly appealing, with its specialized tools and in-depth analytics. Equity traders may lean towards TWS, appreciating its global market coverage and efficient order routing. Throughout the following sections, we will explore the specific features and functionalities of each platform. The exploration will include level 2 data presentation and charting tools. Also, order entry options and overall user experience will be considered. Finding the best level 2 trading platform requires a careful evaluation of these elements.

Ultimately, the choice of the best level 2 trading platform is a personal one. There is no universally superior platform. A trader’s trading style, preferred assets, and technical capabilities should guide their decision. Are you an active day trader focusing on equities? Or are you an options trader seeking advanced analytics? These are the questions to consider. The next sections will delve into the details of Interactive Brokers Trader Workstation and Thinkorswim. This will arm you with the knowledge needed to select the platform that best aligns with your trading goals. Remember to test both platforms using demo accounts before committing to a final decision. This hands-on experience will provide invaluable insights into which platform feels most comfortable and efficient for your trading style.

Interactive Brokers Trader Workstation: Deep Dive into Features and Functionality

Interactive Brokers Trader Workstation (TWS) is a robust platform favored by active traders seeking comprehensive market access and sophisticated tools. As a contender for the title of the best level 2 trading platform, TWS offers a wealth of features, but it can also present a steep learning curve for beginners. Its Level 2 data capabilities are extensive, providing a detailed view of the order book for various instruments, including stocks, options, and futures. Traders can customize the Level 2 display to show the number of market makers, order sizes, and price levels, enabling them to assess market depth and potential price movements. The platform’s charting tools are equally impressive, supporting a wide range of technical indicators and drawing tools. Traders can analyze price trends, identify support and resistance levels, and develop trading strategies based on real-time data.

Order entry options in TWS are highly flexible, allowing traders to execute a variety of order types, including market orders, limit orders, stop orders, and advanced order types such as bracket orders and trailing stop orders. This level of customization allows traders to implement precise trading strategies and manage risk effectively. However, the sheer number of features and options within TWS can be overwhelming for new users. The platform’s interface is not as intuitive as some of its competitors, and it requires a significant time investment to master its functionality. Despite its complexity, TWS remains a popular choice among experienced traders due to its powerful features, extensive market access, and competitive pricing. For those seeking the best level 2 trading platform with advanced capabilities, Interactive Brokers Trader Workstation is a strong contender, especially if the user has the time to dedicate to mastering the platform.

A key strength of Interactive Brokers Trader Workstation is its ability to handle complex trading strategies involving multiple asset classes. Active traders can easily monitor and manage their positions across different markets, using the platform’s portfolio management tools. The platform also provides access to a wide range of research and analysis tools, including news feeds, economic calendars, and analyst ratings. While TWS may not be the most user-friendly platform, its extensive features and functionality make it a powerful tool for serious traders seeking the best level 2 trading platform for their needs. Ultimately, the decision of whether or not to use TWS depends on the individual trader’s experience level, trading style, and willingness to learn a complex platform.

Thinkorswim: A Powerhouse Platform for Options and Equity Traders

Thinkorswim, offered by TD Ameritrade, stands out as a robust and feature-rich platform catering to both novice and seasoned traders, particularly those focused on options and equities. Its Level 2 data presentation is visually clear and highly customizable, allowing users to tailor the display to their specific needs. The platform provides a comprehensive view of market depth, displaying bid and ask prices with corresponding sizes, enabling traders to gauge buying and selling pressure effectively. Thinkorswim distinguishes itself as a strong contender for the best level 2 trading platform due to its sophisticated analytical tools and user-friendly interface.

Beyond Level 2 data, Thinkorswim boasts advanced charting features, including a wide array of technical indicators and drawing tools. These tools allow traders to conduct in-depth market analysis and identify potential trading opportunities. The platform’s options trading tools are particularly impressive, offering a strategy builder, probability analysis, and risk assessment tools. These resources empower traders to make informed decisions when trading options. Thinkorswim’s commitment to education is evident in its vast library of resources, including articles, videos, and webinars, designed to help traders of all levels improve their skills. The platform consistently ranks high as a top choice for the best level 2 trading platform, especially among those involved in active options trading.

The platform’s paperMoney feature is another significant advantage, providing a simulated trading environment where users can practice strategies and familiarize themselves with the platform without risking real capital. This is especially beneficial for beginners looking to learn how to interpret Level 2 data and execute trades. Thinkorswim integrates seamlessly with TD Ameritrade’s brokerage services, offering access to a wide range of asset classes, including stocks, options, ETFs, and futures. Its versatility and comprehensive suite of tools make Thinkorswim a powerful choice for traders seeking the best level 2 trading platform, capable of handling diverse trading styles and strategies. For traders prioritizing a platform with extensive educational resources and advanced options analysis tools, Thinkorswim proves to be an excellent selection for the best level 2 trading platform.

Choosing the Optimal Platform: Key Factors to Consider

Interactive Brokers Trader Workstation and Thinkorswim offer distinct advantages. Trader Workstation excels with its robust functionality and extensive data capabilities, making it a strong contender for the title of best level 2 trading platform for active traders. However, its interface might present a steeper learning curve for beginners. Thinkorswim, on the other hand, provides a user-friendly experience alongside powerful charting and options trading tools, potentially making it the best level 2 trading platform for those new to the market or focusing on options strategies. Ultimately, the ideal choice hinges on individual needs and preferences.

Selecting the best level 2 trading platform requires careful consideration of several key factors. Traders should assess their trading style, focusing on whether they primarily engage in day trading, swing trading, or long-term investing. The asset classes traded—equities, options, futures, forex—will influence platform selection. Budget constraints play a crucial role; subscription fees and commission structures vary significantly. Technical expertise also matters; some platforms boast more intuitive interfaces than others. Finally, before committing to any platform, prospective users should thoroughly explore its demo account. This allows for hands-on experience with the software’s features and functionalities, ensuring a comfortable fit before live trading commences. This trial period is invaluable in determining which platform best suits an individual’s trading style and preferences, helping identify the best level 2 trading platform for specific needs.

Beyond the core features, additional factors warrant attention. The quality of customer support is vital, particularly during critical trading moments. The availability of educational resources can significantly impact a trader’s learning curve and overall success. Integration with other trading tools and analytical services is also beneficial. Ultimately, the best level 2 trading platform is the one that empowers traders to execute their strategies effectively, manage risk responsibly, and achieve their financial goals. The decision requires careful evaluation of these factors, considering the trader’s unique needs and experience level to find the best level 2 trading platform for them.

Beyond the Basics: Advanced Level 2 Trading Strategies

Context_7: Moving beyond basic interpretation, advanced Level 2 trading strategies can significantly enhance trading performance. These strategies involve identifying subtle patterns and anomalies within the order book to anticipate market movements. One such strategy is spoofing detection. Spoofing involves placing large, non-bona fide orders to create a false sense of supply or demand, with the intention of manipulating other traders into acting. By carefully observing rapid order placements and cancellations at specific price levels on the Level 2 data, traders can learn to identify potential spoofing attempts and avoid being misled. This knowledge protects them from making decisions based on artificial market signals. A key element to consider when searching for the best level 2 trading platform is the ability to clearly visualize this activity.

Another advanced technique involves identifying iceberg orders. Iceberg orders are large orders that are hidden from the order book, with only a small portion of the order being displayed at any given time. These orders are used by institutional investors to accumulate or distribute large positions without significantly impacting the market price. Seasoned traders look for patterns in order flow, such as repeated small orders appearing at the same price level, to infer the presence of a hidden iceberg order. Understanding where large institutional players are placing their buy or sell orders can provide valuable insights into future price movements. The best level 2 trading platform will offer tools to assist in this analysis. Furthermore, traders can learn to mitigate the risk of front-running. Front-running occurs when a broker or other intermediary takes advantage of advance knowledge of a large order to execute a trade for their own profit before the large order is executed, thereby moving the price against the large order. By carefully monitoring Level 2 data and order execution speeds, traders can potentially identify and avoid brokers who may be engaging in front-running practices.

Implementing these advanced strategies requires a combination of technical skill, experience, and robust risk management. It’s crucial to emphasize the necessity of sound risk management principles. No strategy guarantees profits, and the potential for losses exists. Traders should always use stop-loss orders to limit their downside risk and only trade with capital they can afford to lose. Before deploying advanced Level 2 strategies with real capital, rigorous backtesting and paper trading are essential. Backtesting involves testing the strategy on historical data to assess its performance, while paper trading allows traders to practice the strategy in a simulated environment without risking real money. Remember, finding the best level 2 trading platform is only the first step. Continuous learning, adaptation, and disciplined risk management are crucial for long-term success in the dynamic world of trading. The best level 2 trading platform is the one that best supports your individual trading style and risk tolerance.

The Future of Order Book Analysis: Emerging Trends and Technologies

The landscape of order book analysis is rapidly evolving, driven by technological advancements and the increasing sophistication of market participants. Algorithmic trading, high-frequency trading (HFT), and the integration of artificial intelligence (AI) are poised to reshape how traders interact with and interpret Level 2 data. These emerging trends present both opportunities and challenges for those seeking to gain an edge in the financial markets, particularly when searching for the best level 2 trading platform.

Algorithmic trading systems are now capable of analyzing vast amounts of Level 2 data in real-time, identifying patterns and executing trades with incredible speed and precision. HFT firms leverage advanced algorithms and co-location strategies to capitalize on fleeting market inefficiencies revealed within the order book. The rise of AI and machine learning is further transforming order book analysis, with sophisticated models being developed to predict price movements, detect spoofing attempts, and identify hidden liquidity. These technologies enable traders to discern subtle nuances within the order book that would be impossible to detect manually. Choosing the best level 2 trading platform often means selecting one that offers robust support for these advanced analytical tools and data feeds, giving traders access to the information they need to compete in an increasingly complex market.

Looking ahead, the integration of AI into the best level 2 trading platform will likely become even more pronounced, with AI-powered tools providing personalized trading recommendations, automated risk management, and sophisticated order routing strategies. These advancements promise to democratize access to sophisticated trading techniques, empowering individual traders with the ability to compete with larger institutional players. As technology continues to advance, staying informed about these emerging trends and adapting one’s trading strategies accordingly will be essential for success in the dynamic world of order book analysis. The best level 2 trading platform of the future will be one that seamlessly integrates these new technologies, providing traders with a comprehensive and intuitive suite of tools for navigating the complexities of the modern financial markets.

(31).png)