Why Financial Literacy Matters in Today’s Economy

Financial literacy is the foundation of achieving long-term financial stability. Without it, individuals are more likely to make poor financial decisions, leading to debt, financial insecurity, and even bankruptcy. On the other hand, possessing a deep understanding of personal finance, investing, and money management enables individuals to make informed decisions, avoid costly mistakes, and achieve financial prosperity. In today’s complex and fast-paced economy, financial literacy is more crucial than ever. It is essential to prioritize financial education and seek out the best book for financial management to guide individuals in their financial journey. By doing so, individuals can take control of their financial lives, make smart investment decisions, and secure a brighter financial future.

How to Take Control of Your Finances: A Step-by-Step Approach

Taking control of one’s finances is a crucial step towards achieving long-term financial stability. By following a step-by-step approach, individuals can effectively manage their money and make progress towards their financial goals. The first step is to set clear and achievable financial goals, such as paying off debt, building an emergency fund, or saving for retirement. Next, it is essential to track expenses to understand where money is being spent and identify areas for improvement. Creating a budget is also a critical step, as it helps to allocate resources effectively and make conscious financial decisions. Additionally, individuals should prioritize needs over wants, avoid impulse purchases, and automate savings to ensure consistent progress towards their financial objectives. By following these steps and seeking guidance from the best book for financial management, individuals can take control of their finances and achieve financial prosperity.

The Role of Financial Management Books in Achieving Success

Financial management books play a vital role in providing guidance and insights for effective money management. These books offer a wealth of knowledge and expertise from experienced authors who have spent years studying and practicing financial management. By reading the best book for financial management, individuals can gain a deeper understanding of personal finance, investing, and money management, enabling them to make informed financial decisions. Financial management books also help individuals stay up-to-date with the latest financial trends and strategies, ensuring they are well-equipped to navigate the complex world of finance. Moreover, these books provide actionable advice and real-life examples, making it easier for individuals to apply financial management principles in their daily lives. With the right financial management book, individuals can overcome common financial challenges, achieve financial stability, and secure a brighter financial future.

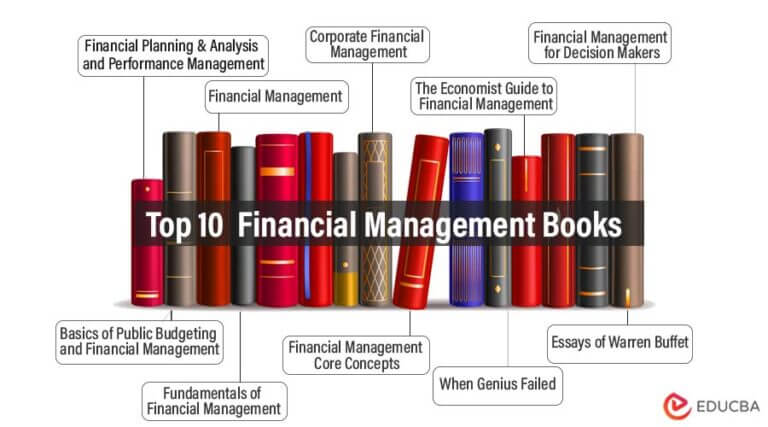

Top-Rated Financial Management Books: A Review of the Best

When it comes to finding the best book for financial management, there are numerous options available. However, some books stand out from the rest due to their comprehensive guidance, actionable advice, and proven track records. Three top-rated financial management books that are highly recommended are “The Total Money Makeover” by Dave Ramsey, “Your Money or Your Life” by Vicki Robin and Joe Dominguez, and “The Intelligent Investor” by Benjamin Graham. “The Total Money Makeover” provides a step-by-step guide to getting out of debt and building wealth, while “Your Money or Your Life” offers a holistic approach to managing finances and achieving financial independence. “The Intelligent Investor”, on the other hand, is a classic in the investing space, providing timeless wisdom on value investing and long-term wealth creation. These books have been widely praised for their clarity, simplicity, and effectiveness in helping individuals achieve financial stability and success. By reading these top-rated financial management books, individuals can gain a deeper understanding of personal finance, investing, and money management, and make informed decisions to secure their financial futures.

What to Look for in a Financial Management Book

When searching for the best book for financial management, it’s essential to know what to look for. A good financial management book should provide actionable advice, be relevant to your financial situation, and be written by an author with credible credentials. The author’s expertise and experience in the field of finance are crucial in ensuring that the book provides valuable insights and practical guidance. Additionally, the book should be easy to understand, with clear and concise language that makes complex financial concepts accessible to readers. It’s also important to consider the book’s relevance to your financial situation, whether you’re a beginner or an experienced investor. Look for books that offer tailored advice and strategies for your specific financial goals and circumstances. By considering these factors, you can find a financial management book that provides the guidance and support you need to achieve long-term financial success.

How to Apply Financial Management Principles in Real Life

Applying financial management principles in real life requires discipline, patience, and a willingness to make changes to one’s financial habits. One of the most effective ways to start is by creating a budget that accounts for all income and expenses. This involves tracking expenses, identifying areas of waste, and making adjustments to allocate resources more efficiently. Investing wisely is also crucial, and this can be achieved by diversifying investments, setting clear financial goals, and avoiding get-rich-quick schemes. Managing debt is another critical aspect of financial management, and this can be done by prioritizing debt repayment, consolidating debt, and communicating with creditors. Additionally, building an emergency fund, avoiding lifestyle inflation, and staying informed about personal finance can help individuals apply financial management principles in real life. By following these practical tips and strategies, individuals can take control of their finances and make progress towards achieving long-term financial success. Remember, the best book for financial management is only as good as the actions taken to apply its principles in real life.

Common Financial Management Mistakes to Avoid

When it comes to financial management, there are several common mistakes that can hinder progress towards achieving long-term financial success. One of the most critical mistakes to avoid is overspending, which can lead to debt and financial instability. Not having an emergency fund is another mistake that can leave individuals vulnerable to financial shocks. Failing to diversify investments is also a common mistake, as it can lead to significant losses in the event of market fluctuations. Other mistakes to avoid include not tracking expenses, not having a budget, and not staying informed about personal finance. By being aware of these common mistakes, individuals can take steps to avoid them and make progress towards achieving financial stability. Remember, the best book for financial management can only provide guidance, but it’s up to the individual to avoid these common mistakes and make informed financial decisions.

Achieving Long-Term Financial Success: A Roadmap to Prosperity

In conclusion, achieving long-term financial success requires a combination of financial literacy, effective money management, and a well-planned strategy. By following the steps outlined in this article, individuals can take control of their finances, avoid common mistakes, and make progress towards achieving financial stability. Remember, the best book for financial management can only provide guidance, but it’s up to the individual to stay disciplined, patient, and informed. By doing so, individuals can create a roadmap to prosperity, achieve long-term financial success, and secure a brighter financial future. Whether it’s through creating a budget, investing wisely, or managing debt, the key to success lies in making informed financial decisions and staying committed to one’s financial goals. With the right mindset and approach, anyone can achieve financial freedom and prosperity.