Understanding Expected Return

Expected return represents the anticipated profit or loss from an investment. It’s a crucial element in investment decision-making, helping investors assess the potential financial gains of various investment options. Understanding expected return is vital for making informed choices across diverse asset classes, including stocks, bonds, and real estate. Accurately calculating expected return is paramount for long-term financial success, allowing investors to set realistic goals and manage risk effectively. Based on the following information, calculate the expected return to determine the potential profitability of your investments. This calculation provides a crucial benchmark against which to measure actual investment performance. The concept of expected return forms the foundation for strategic portfolio management, enabling investors to select assets that align with their financial objectives and risk tolerance. Investors should remember that the accuracy of the expected return calculation directly impacts investment outcomes. Therefore, utilizing reliable data and appropriate methodologies is essential. To determine the potential returns of a specific investment strategy, based on the following information, calculate the expected return.

Investors use the expected return to compare different investments. A higher expected return generally indicates greater potential profit. However, it’s essential to consider that higher returns often involve higher risks. The expected return is not a guarantee of future performance. It’s a prediction based on available information. Understanding the limitations of this prediction is crucial. For example, unexpected market events or company-specific issues can significantly affect actual returns. Based on the following information, calculate the expected return for a clearer understanding of the potential profit or loss. This calculation helps to visualize the potential outcomes associated with different investment strategies and risk profiles. The process of calculating expected return involves considering various factors, including historical data, market trends, and the inherent risk associated with each investment option.

The calculation of expected return plays a critical role in evaluating the merits of different investment opportunities. Investors often use this metric to compare potential returns and assess risk. A comprehensive analysis considers multiple investment options and selects those that best align with the investor’s overall financial strategy. Accurate calculation is dependent on reliable data and a robust analytical framework. Based on the following information, calculate the expected return for each potential investment before making a decision. The resulting calculations will help to inform investment decisions and portfolio allocation strategies. Thorough analysis enables informed investment choices which are essential for achieving long-term financial objectives. Remember, the anticipated return is merely an estimate, and actual results can deviate significantly due to market volatility and unforeseen circumstances.

How to Calculate Expected Return: A Step-by-Step Approach

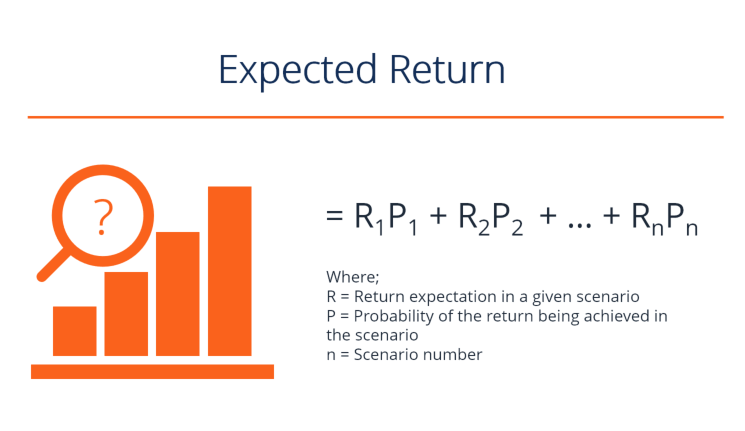

Calculating expected return involves assessing potential investment outcomes and their likelihoods. This process helps investors make informed decisions. To illustrate, consider a hypothetical stock. Suppose an analysis suggests a 10% return is possible with a 30% probability, a 5% return with a 40% probability, and a -2% return with a 30% probability. Based on the following information, calculate the expected return. The formula for calculating expected return is: Expected Return = (Probability of Outcome 1 * Return 1) + (Probability of Outcome 2 * Return 2) + (Probability of Outcome 3 * Return 3) and so on for all possible outcomes.

Applying this to our example, the calculation would be: Expected Return = (0.30 * 0.10) + (0.40 * 0.05) + (0.30 * -0.02). This simplifies to: Expected Return = 0.03 + 0.02 + (-0.006). Therefore, the expected return for this hypothetical stock is 0.044 or 4.4%. Remember, this is just an expectation. The actual return might differ significantly. The accuracy of this calculation depends heavily on the accuracy of the probability estimations and return projections. Using reliable data sources is crucial. Always consider the potential for significant deviation from the expected return.

Based on the following information, calculate the expected return for a diversified portfolio. Suppose you have a portfolio invested in three different assets: Asset A, Asset B, and Asset C. Each asset’s expected return and weight in the portfolio are as follows: Asset A (expected return 8%, weight 40%), Asset B (expected return 12%, weight 30%), and Asset C (expected return 5%, weight 30%). The portfolio’s expected return is calculated by weighting the expected return of each asset by its proportion in the portfolio. The formula is: Portfolio Expected Return = (Weight of Asset A * Expected Return of Asset A) + (Weight of Asset B * Expected Return of Asset B) + (Weight of Asset C * Expected Return of Asset C). The calculation for this portfolio’s expected return would be: (0.40 * 0.08) + (0.30 * 0.12) + (0.30 * 0.05) = 0.032 + 0.036 + 0.015 = 0.083 or 8.3%. This demonstrates how to calculate expected return for multiple assets. Accurate input data remains essential for a reliable result. Based on the following information, calculate the expected return, considering the factors already discussed will provide a clearer understanding of the investment’s potential.

Factors Influencing Expected Return

Numerous factors influence an investment’s expected return. Understanding these is crucial for making informed decisions. Risk, a key factor, represents the uncertainty of an investment’s future returns. Higher potential returns usually accompany higher risk. For example, investing in a small, rapidly growing company carries more risk than investing in a well-established, large corporation. However, the small company might offer a much higher potential return. Market conditions also play a significant role. A bull market, characterized by rising prices, generally leads to higher returns. Conversely, a bear market, with falling prices, can result in significant losses. Economic factors like inflation and interest rates influence expected returns. Inflation erodes purchasing power, reducing real returns. Interest rate increases can impact bond yields and stock valuations. The specific characteristics of an investment also affect its expected return. This includes factors like a company’s financial health, its competitive advantage, and its growth prospects. Based on the following information calculate the expected return for a diversified portfolio.

Investment characteristics significantly influence expected returns. For instance, a company’s management team’s experience and competence can affect its profitability and, consequently, its stock price. The industry in which a company operates also plays a role. A company in a growing industry is likely to have higher growth prospects than one in a stagnant or declining industry. External factors such as geopolitical events and regulatory changes can influence expected returns. Unforeseen events can significantly impact an investment’s performance, sometimes overriding even the most carefully considered projections. Based on the following information calculate the expected return, considering the impact of these unpredictable events on the overall projection. Analyzing these various influences helps investors understand the potential range of returns, including both upside potential and downside risk. Remember, a thorough understanding of these factors is essential before determining which investments suit your risk tolerance and financial objectives. Based on the following information calculate the expected return for a portfolio that includes both stocks and bonds.

To accurately project returns, investors must consider both quantitative and qualitative factors. Quantitative factors include historical data and statistical measures like standard deviation. Qualitative factors, however, are equally important. These include assessing a company’s management quality, its competitive position, and the overall economic environment. A company with strong management and a solid competitive advantage may have a higher expected return than a similar company with weaker fundamentals, even if their historical performance is comparable. Based on the following information calculate the expected return considering both quantitative and qualitative factors. Macroeconomic factors like interest rates, inflation, and economic growth forecasts also play a crucial role in shaping future returns. Understanding the interplay between these diverse factors is key to developing sound investment strategies. Remember, the accuracy of any expected return calculation hinges on the reliability of the data used and the consideration of all relevant factors. Thorough research and a realistic assessment of risks are vital in the investment decision-making process.

Analyzing Historical Data for Future Projections

Estimating future investment returns often involves analyzing historical data. Investors frequently examine past performance to predict potential future gains. However, it’s crucial to understand that past performance is not necessarily indicative of future results. Many unforeseen events can significantly impact investment returns. For example, based on the following information calculate the expected return of a company that showed strong growth in the past but experienced a sudden market downturn due to unforeseen geopolitical events, significantly impacting its profits. This illustrates the limitation of relying solely on historical data when projecting future returns. Economic shifts, technological advancements, and regulatory changes can all influence an investment’s trajectory in ways that historical data cannot always predict. Therefore, historical data should be used cautiously, serving as one factor among many when assessing potential future returns, not as a definitive predictor. To avoid misinterpretations, one should always incorporate multiple perspectives.

Using historical data effectively requires a nuanced approach. Instead of simply averaging past returns, a more sophisticated method considers the variability or volatility of those returns. Standard deviation is a statistical measure that quantifies this volatility. A higher standard deviation indicates greater risk and uncertainty regarding future returns. Based on the following information calculate the expected return, taking into account the standard deviation of returns over the past five years, to better understand the range of possible outcomes. Investors should also consider factors beyond simple numerical analysis, including qualitative aspects like management changes, evolving market trends, or competitive pressures. These can influence a company’s future prospects in ways that historical numbers alone cannot fully capture. Remember, while historical data provides valuable context, it should not be the sole basis for investment decisions.

Moreover, understanding the limitations of historical data is paramount. Extraordinary events, like global pandemics or unexpected economic shocks, are typically not reflected adequately in historical data. These events can drastically alter the landscape of investment opportunities. Therefore, to make informed decisions, investors should critically evaluate any reliance on historical trends. Based on the following information calculate the expected return, incorporating a sensitivity analysis to account for potential unforeseen events and their impact on investment performance. This approach allows for a more realistic view of future outcomes, taking into account the unpredictable nature of markets and economic conditions. Investors should avoid making predictions based solely on past returns but instead employ a robust strategy considering various factors and possible scenarios.

Incorporating Risk and Volatility

Standard deviation measures investment risk. It quantifies the dispersion of returns around the expected return. A higher standard deviation indicates greater volatility and risk. To incorporate standard deviation into a more sophisticated expected return calculation, one might use the Sharpe Ratio. This ratio adjusts the expected return for the level of risk taken. The formula considers the risk-free rate of return, the expected return of the investment, and the standard deviation. Based on the following information, calculate the expected return: A higher Sharpe Ratio suggests better risk-adjusted returns. Investors with higher risk tolerance might accept investments with higher standard deviations and potentially higher expected returns. Conversely, those with lower risk tolerance will prioritize lower standard deviations, even if it means a lower expected return. Understanding this relationship helps investors make informed decisions based on their individual risk profiles.

Calculating expected return with standard deviation involves a multi-step process. First, determine the expected return using probabilities and potential returns for each scenario. Second, calculate the variance, which is the average of the squared differences between each potential return and the expected return. The square root of the variance gives the standard deviation. Based on the following information calculate the expected return: Investors can then use this information to assess the risk-reward profile of an investment. They can compare investments with similar expected returns but different standard deviations. Or, they can compare investments with different expected returns and standard deviations to identify the most suitable option based on their own individual risk preferences.

Consider two hypothetical investments. Investment A has an expected return of 10% with a standard deviation of 5%. Investment B boasts an expected return of 15% but carries a standard deviation of 10%. Based on the following information calculate the expected return: While Investment B offers a higher expected return, its significantly higher risk might make it unsuitable for risk-averse investors. The choice depends on the investor’s risk tolerance. This illustrates how standard deviation helps refine the expected return analysis, providing a more comprehensive view of an investment’s potential and inherent risks. Understanding risk and volatility is crucial for making sound investment decisions. Accurate assessment allows for the building of a suitable investment portfolio. Using this framework, investors can make decisions that better align with their financial goals and risk profiles.

Diversification and Portfolio Optimization

Diversification is a cornerstone of successful investing. By spreading investments across different asset classes—such as stocks, bonds, real estate, and commodities—investors can reduce the overall risk of their portfolio. This is because the returns of different asset classes tend to move independently. When one asset class underperforms, others may perform well, mitigating overall losses. To illustrate, consider a portfolio based on 50% stocks and 50% bonds. If the stock market experiences a downturn, the bond portion may offer stability, reducing the overall portfolio’s volatility. Based on the following information calculate the expected return for this diversified portfolio, taking into account the individual expected returns and weighting of each asset class. A well-diversified portfolio can potentially offer a higher risk-adjusted expected return compared to a portfolio concentrated in a single asset class. Understanding how diversification impacts expected return is essential for long-term investment success.

Portfolio optimization techniques aim to construct a portfolio that maximizes expected return for a given level of risk, or minimizes risk for a target expected return. These techniques often involve sophisticated mathematical models and algorithms. However, even a basic understanding of diversification can significantly improve investment outcomes. For example, consider two hypothetical portfolios: Portfolio A, heavily weighted in technology stocks, and Portfolio B, diversified across various sectors and asset classes. Portfolio A might have a higher potential expected return in a booming tech market, but it also carries significantly higher risk. Portfolio B, while potentially offering a lower expected return in a specific sector’s bull market, demonstrates greater resilience to market downturns. Based on the following information calculate the expected return for both portfolios, considering the risk profiles and asset allocations. The choice between these portfolios depends on the investor’s risk tolerance and investment goals. Investors should carefully consider their individual circumstances before making investment decisions.

Sophisticated portfolio optimization techniques, such as Markowitz’s mean-variance optimization, use statistical methods to determine the optimal asset allocation that maximizes expected return for a given level of risk (or minimizes risk for a given expected return). These methods often require detailed historical data and assumptions about future market behavior. While these techniques can be powerful tools, they are not without limitations. The accuracy of the results depends heavily on the quality and reliability of the input data and the validity of the underlying assumptions. Remember, past performance is not necessarily indicative of future results. Based on the following information calculate the expected return using a mean-variance optimization model, incorporating historical data and risk tolerances. Understanding the strengths and weaknesses of different portfolio optimization techniques is crucial for making informed investment decisions.

Long-Term Investment Strategies and Expected Return

Long-term investing is crucial for achieving desired expected returns. A longer time horizon allows for weathering market fluctuations. Investors with longer time horizons can typically tolerate greater risk. This is because they have more time to recover from potential losses. Based on the following information calculate the expected return of a diversified portfolio over 20 years, considering historical data and various asset classes. Understanding the time horizon’s impact on risk tolerance is essential for making informed investment decisions. This understanding helps investors align their investment choices with their financial goals. For example, a retiree might prioritize preservation of capital, choosing lower-risk investments with lower expected returns. Conversely, a young investor might favor higher-risk, higher-return options.

The power of compounding significantly impacts long-term investment success. Compounding means earning returns not only on the initial investment but also on accumulated returns. Over time, this effect accelerates wealth growth. To illustrate, consider investing $10,000 annually. With a conservative 7% annual return, the investment grows substantially over decades. Based on the following information calculate the expected return over 30 years, incorporating the effect of compounding. This contrasts sharply with shorter-term investing where the benefit of compounding is less pronounced. Therefore, a long-term perspective is critical for maximizing the potential for growth. The consistent reinvestment of returns is key to unlocking the full potential of compounding. Investors should carefully consider their risk tolerance and investment time horizon before making decisions.

To effectively utilize long-term investment strategies, investors should consider diversification. Diversification reduces risk by spreading investments across different asset classes. This approach minimizes the impact of poor performance in one area. Based on the following information calculate the expected return for a portfolio diversified across stocks, bonds, and real estate. Analyzing historical data can inform investment decisions. However, it’s crucial to remember that past performance doesn’t guarantee future results. Unforeseen events can significantly impact returns. Long-term strategies focus on consistent investment over extended periods, aiming to average out short-term volatility. This strategy aims for superior returns compared to short-term trading or frequent portfolio adjustments. A well-defined investment plan, aligned with long-term financial goals, is essential for success. Regular review and adjustment of the plan help navigate changing market conditions.

Beyond the Numbers: Qualitative Factors to Consider

While precise quantitative analysis is essential for projecting investment returns, a comprehensive approach necessitates incorporating qualitative factors. These non-numerical aspects significantly influence the accuracy and reliability of any expected return calculation. Understanding a company’s management team, their experience, and their strategic vision provides crucial context. A strong, experienced leadership team generally indicates better prospects for future success. Based on the following information calculate the expected return, but remember that the numbers alone do not tell the whole story.

Industry trends and competitive landscapes also play a pivotal role. Analyzing market share, technological advancements, and regulatory changes within the sector helps investors assess a company’s potential for growth. A burgeoning industry with positive growth projections typically suggests a higher potential return. Macroeconomic conditions, such as interest rates, inflation, and overall economic growth, further impact investment performance. Understanding these factors and their influence on specific sectors allows for a more nuanced assessment of risk and return. Based on the following information calculate the expected return, considering these broader economic forces. Ignoring these aspects could lead to inaccurate projections, even with flawless calculations.

Therefore, investors should always consider the bigger picture. Thorough due diligence involves examining financial statements, industry reports, and conducting independent research. Seeking professional financial advice is crucial, especially for complex investment decisions. Financial advisors provide expertise and guidance, helping investors navigate the complexities of financial markets and make informed decisions based on their individual risk tolerance and financial goals. Based on the following information calculate the expected return, but always remember to supplement your quantitative analysis with a thorough qualitative assessment. A balanced approach, combining quantitative analysis with qualitative insights, leads to more robust and reliable investment projections.

:max_bytes(150000):strip_icc()/ExpectedReturn-4196761-Final-25b2aa6c16ce4a89a778a1e55302136b.jpg)