Understanding the Arithmetic Average Rate of Return

The arithmetic average rate of return is a straightforward calculation that determines the average annual return of an investment over a specified period. It’s a fundamental metric used to evaluate investment performance, providing a simple snapshot of how well an investment has done on average each year. For instance, if an investment yielded 10% in year one, 15% in year two, and 5% in year three, the arithmetic average rate of return would be the sum of these returns (30%) divided by the number of years (3), resulting in a 10% average annual return. This simple calculation makes it accessible and useful for investors of all experience levels. Understanding this average provides a benchmark against which to compare other investments and assess overall portfolio performance. Unlike the geometric average, which considers the compounding effect of returns, the arithmetic average offers a simpler, direct measure of average annual growth, particularly beneficial when evaluating investments with relatively stable returns. Using an arithmetic average rate of return calculator can significantly streamline this process. The arithmetic average rate of return, while useful, doesn’t fully capture the impact of volatility on overall returns, a factor that will be discussed later. Therefore, while readily understandable, it’s vital to consider its limitations when making critical investment decisions. An arithmetic average rate of return calculator helps in swiftly calculating this key performance indicator.

The significance of the arithmetic average rate of return lies in its simplicity and ease of interpretation. It offers a clear picture of the average annual gain or loss from an investment. This makes it an excellent tool for comparing different investments or assessing the performance of a portfolio over time. Consider a scenario where you’re comparing two investment options: one with fluctuating returns but a high arithmetic average, and another with consistently moderate returns. The arithmetic average provides a quick and easy way to compare these, making the decision-making process easier. However, it’s crucial to remember that while the arithmetic average rate of return is helpful, it should not be the sole factor in making investment decisions. Other factors, such as risk and volatility, should also be carefully considered. The ease of calculation offered by an arithmetic average rate of return calculator allows investors to focus on these other equally important aspects of their portfolio. The accessibility and simplicity of this metric make it a valuable tool in any investor’s arsenal.

Investors often use the arithmetic average rate of return in conjunction with other metrics to get a holistic view of their investment’s performance. The simplicity of this method allows for quick comparisons between different investments or strategies, while also giving a clear indication of average annual growth. However, it’s crucial to remember that the arithmetic average doesn’t take into account the order of returns, unlike the geometric average which incorporates the compounding effect of each year’s return. For volatile investments, the arithmetic average may overestimate the true average return. Nevertheless, for many everyday investment scenarios, especially those with less volatile returns, the arithmetic average provides a valuable and easily understood measure of investment performance. The use of an arithmetic average rate of return calculator can expedite the calculations needed for more informed decision-making, allowing investors to focus on other aspects of wealth management. It provides a valuable initial assessment before diving into more complex calculations.

How to Calculate Your Average Annual Investment Return

Calculating the arithmetic average rate of return manually involves a straightforward process. First, determine the total return for each investment period. This is achieved by subtracting the initial investment from the final value, including any dividends or interest earned. Next, sum the total returns for all periods. Then, divide this sum by the number of investment periods to obtain the average annual return. This average represents the typical return earned per year over the investment timeframe. For instance, consider an investment of $1,000 that grew to $1,100 in year one, and then to $1,210 in year two. The total return in year one is $100 ($1,100-$1,000), and in year two it is $110 ($1,210-$1,100). The average annual return, using the arithmetic average rate of return calculation, would be ($100 + $110) / 2 = $105 per year. Remember that using an arithmetic average rate of return calculator can significantly streamline this process, especially for longer periods or more complex investment scenarios.

To illustrate further, let’s examine a table showing investment returns over three years. Assume initial investment is $1000. Year one generated a return of 10%, year two 20%, and year three a loss of 5%. Using the arithmetic average rate of return calculation would involve these steps: Year 1 Return = $100 (10% of $1000); Year 2 Return = $220 (20% of $1100); Year 3 Return = -$55 (5% loss on $1100). The total return would then be $100 + $220 – $55 = $265. Dividing this by the three years provides an arithmetic average rate of return of approximately 8.83%. Accuracy in data entry is crucial when manually calculating the arithmetic average rate of return; even small errors can significantly skew the result. An arithmetic average rate of return calculator is designed to minimize these risks and provide accurate results efficiently.

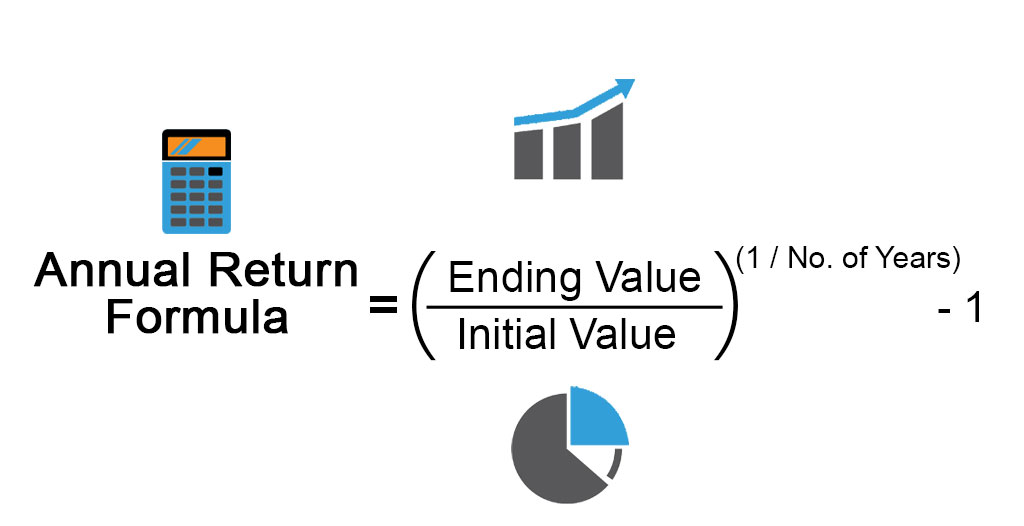

The formula for calculating the arithmetic average rate of return is: (ΣRt) / n, where ΣRt represents the sum of the total returns for each period and ‘n’ represents the number of periods. This simple formula forms the basis of many arithmetic average rate of return calculators available online. While this manual calculation method is useful for understanding the underlying principle, using an arithmetic average rate of return calculator becomes increasingly beneficial when dealing with numerous investments, fluctuating market conditions, and varying investment periods, all of which can introduce complexities and potential for error. The increased efficiency and accuracy offered by an arithmetic average rate of return calculator make it an invaluable tool for investors of all levels.

Limitations of the Arithmetic Average Rate of Return

While the arithmetic average rate of return offers a straightforward method for assessing investment performance, relying solely on this metric can be misleading, particularly when dealing with volatile investments. The arithmetic average doesn’t account for the compounding effect of returns over time; it simply averages the individual yearly returns without considering the sequence of those returns. For instance, an investment experiencing significant gains followed by substantial losses will have the same arithmetic average as an investment with consistently moderate returns, even though the final investment values differ considerably. This lack of consideration for compounding is a critical limitation, and an arithmetic average rate of return calculator, while useful for initial assessment, might not provide a complete picture of investment growth.

Consider a scenario where an investment yields 50% in year one and -50% in year two. The arithmetic average rate of return is 0%, suggesting no overall gain or loss. However, the actual investment value will be lower than the initial investment. This highlights a key weakness: the arithmetic average fails to accurately reflect the impact of volatility on overall returns. Therefore, while an arithmetic average rate of return calculator can be helpful in quickly analyzing data, investors should understand its limitations. In situations with significant volatility, a more robust metric, such as the geometric average return, provides a more accurate representation of the true investment growth. This is because the geometric average considers the compounding effect of returns, providing a more realistic picture of long-term performance and is less susceptible to distortion by extreme fluctuations. To gain a clearer understanding of your investment’s growth trajectory, utilizing both the arithmetic and geometric averages provides a more complete analysis.

The arithmetic average rate of return is a valuable tool for understanding investment performance, however, its simplicity can lead to a misinterpretation of actual investment growth, especially in volatile markets. While an arithmetic average rate of return calculator can simplify the calculation process, investors should always be aware of its inherent limitations and consider incorporating other analytical tools to assess risk and achieve a more accurate view of investment success. Understanding these limitations is crucial for making informed decisions and avoiding potential pitfalls when using an arithmetic average rate of return calculator. The use of a reliable arithmetic average rate of return calculator is often beneficial in streamlining the calculation, but it should not be the sole metric used for evaluating investment performance.

Introducing Arithmetic Average Rate of Return Calculators

Manually calculating the arithmetic average rate of return can be time-consuming and prone to errors, especially when dealing with numerous data points. An arithmetic average rate of return calculator offers a significantly more efficient solution. These calculators automate the calculation process, reducing the risk of human error and saving valuable time. Utilizing an arithmetic average rate of return calculator is particularly beneficial when managing complex investment portfolios involving multiple investments and frequent transactions. The automation provided by these tools ensures accuracy and allows for quicker analysis of investment performance.

The advantages of using an arithmetic average rate of return calculator extend beyond mere efficiency. These calculators often incorporate features that enhance the analysis process. Many calculators offer the ability to visualize data through charts and graphs, providing a clearer understanding of return trends over time. Some advanced arithmetic average rate of return calculators might even include features for comparing different investment strategies or projecting future returns based on past performance. This enhanced analytical capacity makes the arithmetic average rate of return calculator an invaluable tool for investors of all levels.

Therefore, leveraging an arithmetic average rate of return calculator streamlines the process of determining investment returns, enabling investors to focus on strategic decision-making rather than tedious manual calculations. The accuracy and efficiency offered by these tools are crucial for effective investment management, particularly for those with intricate portfolios or limited time for complex calculations. Choosing the right arithmetic average rate of return calculator will significantly enhance the overall investment analysis process.

Top Arithmetic Average Rate of Return Calculators for Effortless Return Analysis

Several excellent online arithmetic average rate of return calculators simplify the process of determining investment performance. One popular choice is Calculator X, known for its user-friendly interface and straightforward input fields. This arithmetic average rate of return calculator excels at handling various investment scenarios, providing a clear and concise result. Another strong contender is Tool Y, which offers a more comprehensive feature set, including the ability to download results in different formats and analyze multiple investments simultaneously. Tool Y’s advanced features make it an ideal choice for investors managing complex portfolios. Both calculators provide accurate arithmetic average rate of return calculations, eliminating the potential for manual calculation errors. The choice between these arithmetic average rate of return calculators often depends on individual needs and preferences.

Beyond Calculator X and Tool Y, numerous other arithmetic average rate of return calculators are available online. Many free options provide basic functionality, perfectly suitable for those with simpler investment portfolios. However, users should carefully assess the reliability and accuracy of any arithmetic average rate of return calculator before using it for critical financial decisions. Reading user reviews and comparing features can help in selecting the most appropriate tool. Consider factors like the ease of data entry, the clarity of the output, and the overall user experience when making your selection. Finding the right arithmetic average rate of return calculator ensures a more efficient and accurate investment analysis process.

Remember, while these arithmetic average rate of return calculators offer significant advantages in terms of speed and accuracy, they are tools to aid in the investment decision-making process. They should not replace sound financial judgment or professional advice. The best arithmetic average rate of return calculator is the one that best suits your specific requirements and simplifies your investment analysis without sacrificing accuracy. Always double-check your input data to ensure the reliability of the results obtained from any arithmetic average rate of return calculator.

Choosing the Right Arithmetic Average Rate of Return Calculator for Your Needs

Selecting the appropriate arithmetic average rate of return calculator depends on several key factors. The complexity of your investment portfolio plays a significant role. If you have a simple portfolio with only a few investments and infrequent transactions, a basic online arithmetic average rate of return calculator might suffice. However, those with more complex portfolios, including multiple asset classes and frequent transactions, might benefit from a calculator offering advanced features such as importing data from brokerage accounts or handling different investment types (e.g., stocks, bonds, real estate). Consider features such as ease of use; an intuitive interface is crucial, especially for users less comfortable with financial calculations. The calculator should provide clear instructions and readily understandable results. Reliability and security are also paramount; choose calculators from reputable sources to ensure the accuracy of your calculations and the safety of your data.

Another important consideration is the level of detail required in the output. Some arithmetic average rate of return calculators simply provide the final average return, while others offer more detailed breakdowns, such as annual returns or the impact of individual investments. The availability of customer support can be a significant factor. A calculator with responsive and helpful support can be invaluable if you encounter any problems or have questions about the calculation process. Finally, cost should be a consideration. Many excellent free arithmetic average rate of return calculators are available online, but some advanced calculators may require a subscription or one-time payment. Weighing these features against your specific needs will guide you towards the best tool for your investment analysis. Remember, the goal is to find an arithmetic average rate of return calculator that simplifies the calculation without compromising accuracy or security.

The following table summarizes the key differences between some hypothetical calculators to aid in your decision-making process. This comparison focuses on usability, features, and cost, helping you choose an arithmetic average rate of return calculator that best meets your specific investment analysis requirements. Remember to always verify the reliability and security of any calculator before using it with your sensitive financial data. The right arithmetic average rate of return calculator can significantly streamline your investment analysis, providing valuable insights into your portfolio’s performance. By carefully considering your needs and comparing the features of different calculators, you can make an informed choice and optimize your investment decision-making process. Efficient use of an arithmetic average rate of return calculator enables better understanding and management of investment returns.

Using a Calculator: A Practical Example with an Arithmetic Average Rate of Return Calculator

This section demonstrates how to use an arithmetic average rate of return calculator to determine the average annual return on an investment. Let’s assume an investment portfolio with the following yearly returns: Year 1: 10%, Year 2: -5%, Year 3: 15%, Year 4: 8%, and Year 5: 12%. To calculate the arithmetic average rate of return using a calculator, one would typically input these values into the designated fields. Most arithmetic average rate of return calculators provide straightforward interfaces. Simply enter each year’s return, ensuring accuracy, and the calculator will automatically compute the arithmetic average. This eliminates the manual calculations and potential for errors associated with performing the arithmetic average rate of return calculation by hand. Many calculators also offer features such as data import options from spreadsheets, making the process even more efficient for larger datasets or more complex investment scenarios. The result displayed by the arithmetic average rate of return calculator will be a single percentage figure representing the average annual return across the specified period. Remember to always double-check the entered data for accuracy before initiating the calculation.

For illustrative purposes, let’s assume our chosen arithmetic average rate of return calculator displays an average annual return of 8%. This signifies that, on average, the investment grew by 8% each year over the five-year period. It’s important to understand that this is an arithmetic average and doesn’t account for the compounding effect of returns, unlike the geometric average. However, for a quick overview of overall performance, the arithmetic average rate of return provides a valuable and easily understandable metric. The ease and speed with which an arithmetic average rate of return calculator performs this calculation, even with a large number of data points, highlights its significant advantage over manual calculation. The simplicity of using an arithmetic average rate of return calculator allows investors to focus on interpreting the results and making informed investment decisions rather than getting bogged down in complex calculations. The ability to easily recalculate with updated data offers flexibility and allows investors to track their investment performance over time using the arithmetic average rate of return calculator effectively.

Using an arithmetic average rate of return calculator simplifies the process dramatically. Instead of manually applying the formula and potentially making calculation errors, one simply inputs the data and receives the result instantaneously. This efficiency is particularly valuable when dealing with numerous investments or a long investment history. This allows investors to spend more time focusing on their investment strategy and less time on tedious calculations, making the arithmetic average rate of return calculator an indispensable tool for anyone serious about monitoring investment performance. Remember that while the arithmetic average rate of return calculator provides a helpful overview, it is crucial to consider other factors and metrics when making long-term investment decisions. Consider factors like risk tolerance, investment goals, and market conditions for a holistic view of your investments.

Maximizing Your Investment Returns: Beyond Calculations

While the arithmetic average rate of return is a valuable tool for assessing past investment performance, and an arithmetic average rate of return calculator can significantly simplify the process, it’s crucial to remember that it’s just one piece of the financial puzzle. A strong investment strategy involves a holistic approach that considers various factors beyond simply calculating historical returns. Using an arithmetic average rate of return calculator provides a clear picture of past performance, but future returns are always subject to market fluctuations and inherent risks. Therefore, relying solely on past performance to predict future outcomes can be misleading.

Diversification is a cornerstone of successful investing. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk. If one investment underperforms, others may offset those losses. Furthermore, setting realistic and achievable investment goals is essential. These goals should align with your financial situation, risk tolerance, and long-term objectives. Regularly reviewing and adjusting your investment strategy based on market changes and personal circumstances is also vital. This proactive approach ensures that your portfolio remains aligned with your financial aspirations. An arithmetic average rate of return calculator, while useful for tracking progress, shouldn’t be the sole determinant of your investment decisions.

Finally, seeking professional financial advice can provide invaluable insights. A qualified financial advisor can help you create a personalized investment plan tailored to your specific needs and risk profile. They can offer guidance on asset allocation, risk management, and tax optimization, helping you make informed decisions and navigate the complexities of the financial markets. Remember, while an arithmetic average rate of return calculator provides a convenient way to analyze historical data, responsible investing requires a broader perspective that encompasses diversification, realistic goal setting, and professional guidance. Using such tools effectively contributes to a well-rounded investment approach, but they shouldn’t replace sound financial planning and professional advice.