What are Monetary Aggregates and Why Do They Matter?

In the realm of economics, understanding the money supply is crucial for making informed decisions. Monetary aggregates, such as M1 and M2, play a vital role in this process. But what exactly are monetary aggregates, and why are they important? In essence, monetary aggregates refer to the different measures of the money supply in an economy. They provide a snapshot of the amount of money circulating in the economy, which is essential for central banks to implement effective monetary policies. By tracking monetary aggregates, policymakers can gauge the economy’s performance, identify potential risks, and make data-driven decisions to promote economic growth and stability. As we explore the question of are savings deposits M1 or M2, it’s essential to appreciate the significance of monetary aggregates in shaping our understanding of the economy.

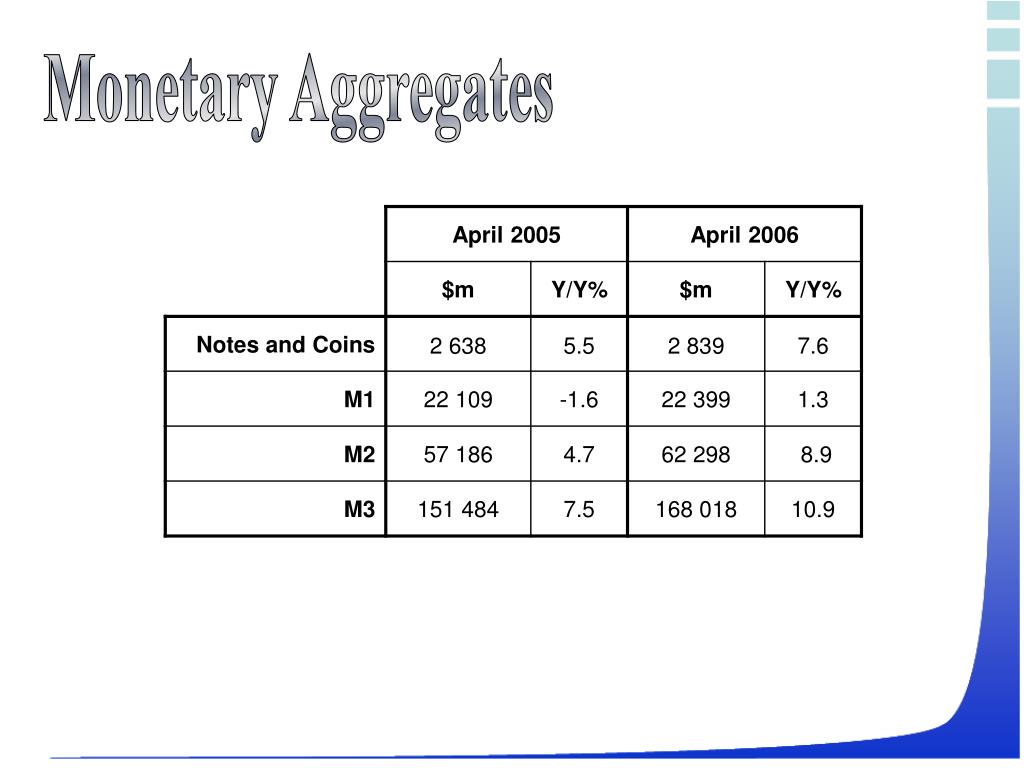

Breaking Down M1: The Most Liquid Form of Money

M1, also known as the narrow money supply, is the most liquid form of money in an economy. It consists of physical currency, such as coins and banknotes, as well as checking accounts and other checkable deposits. These components are highly liquid, meaning they can be easily converted into cash or used to make transactions. The characteristics of M1, including high liquidity and low risk, make it an essential component of the money supply. Understanding M1 is crucial in determining the answer to the question, are savings deposits M1 or M2, and its implications for investors and policymakers. By grasping the concept of M1, individuals can make informed decisions about their financial investments and savings strategies.

How Savings Deposits Fit into the M1 Picture

Savings deposits play a significant role in the M1 monetary aggregate, as they are considered a highly liquid and accessible form of money. These deposits, which are typically held in savings accounts, are easily convertible into cash or used to make transactions. The liquidity and accessibility of savings deposits make them an essential component of M1, as they can be quickly converted into cash or used to facilitate economic transactions. The inclusion of savings deposits in M1 is crucial in understanding the answer to the question, are savings deposits M1 or M2, and its implications for investors and policymakers. By recognizing the role of savings deposits in M1, individuals can better comprehend the dynamics of the money supply and make informed decisions about their financial investments.

Introducing M2: A Broader Measure of Money Supply

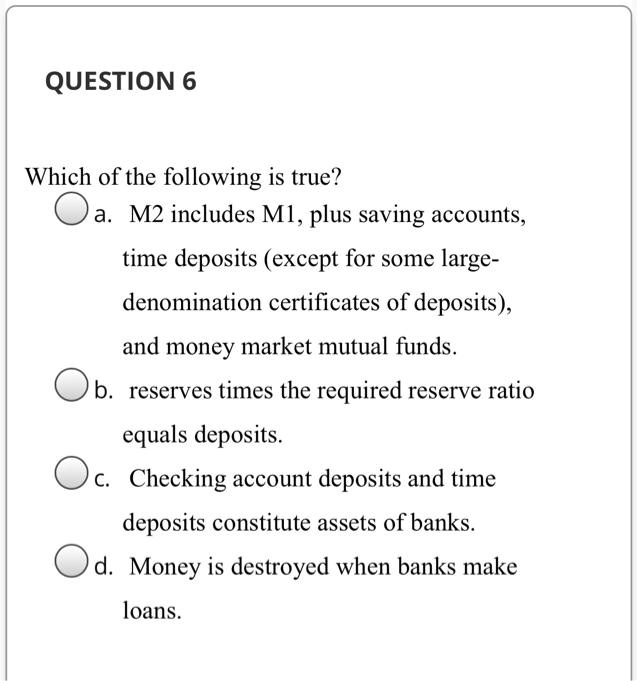

M2 is a broader measure of the money supply, encompassing a wider range of assets than M1. In addition to the components of M1, M2 includes savings deposits, money market funds, and other less liquid assets. These assets, while still relatively liquid, are less accessible than those in M1 and carry a slightly higher risk. The inclusion of savings deposits in M2 is particularly noteworthy, as it highlights their dual nature as both highly liquid and slightly less accessible than other M1 components. Understanding the composition and characteristics of M2 is crucial in answering the question, are savings deposits M1 or M2, and its implications for investors and policymakers. By recognizing the differences between M1 and M2, individuals can better navigate the complexities of the money supply and make informed financial decisions.

Are Savings Deposits M1 or M2? The Answer Revealed

The question of whether savings deposits are M1 or M2 is a common source of confusion. The answer lies in their unique characteristics, which allow them to be classified as part of both monetary aggregates. Savings deposits are considered M1 because of their high liquidity and accessibility, making them easily convertible into cash or used for transactions. However, they are also included in M2 due to their slightly lower liquidity and higher risk compared to other M1 components. This dual classification has significant implications for investors and policymakers, as it affects the way they approach monetary policy and investment decisions. Understanding the answer to the question, are savings deposits M1 or M2, is crucial in navigating the complexities of the money supply and making informed financial decisions.

How to Make Sense of M1 and M2 in Your Financial Decisions

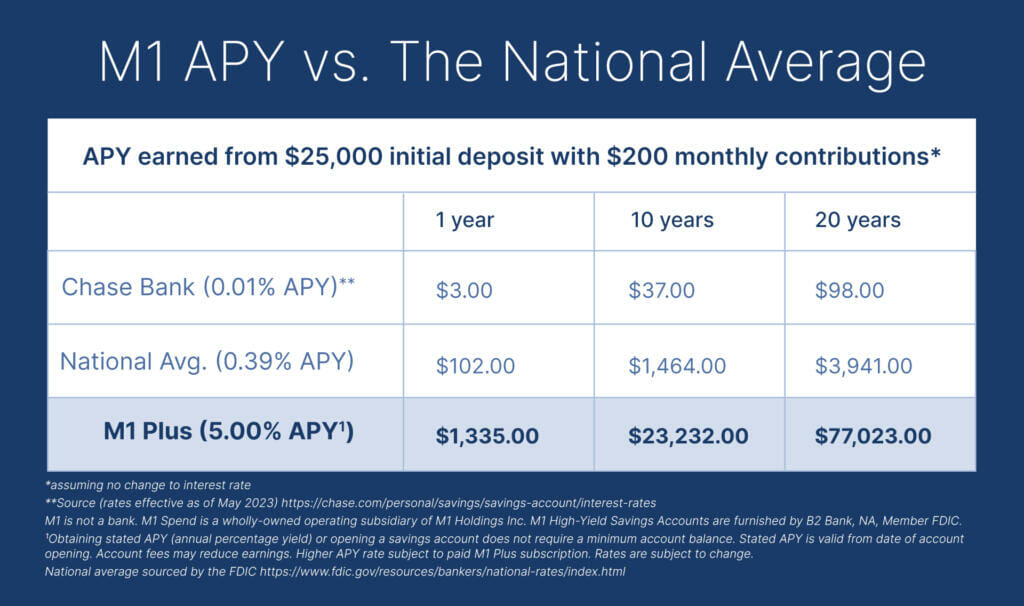

Understanding the differences between M1 and M2 is crucial in making informed financial decisions. When choosing between savings accounts and investments, it’s essential to consider the liquidity and risk associated with each option. M1 components, such as physical currency and checking accounts, offer high liquidity and low risk, making them ideal for short-term savings and everyday transactions. On the other hand, M2 components, including savings deposits and money market funds, offer slightly lower liquidity and higher risk, making them more suitable for longer-term savings and investments. By recognizing the characteristics of M1 and M2, individuals can make more informed decisions about their financial portfolios and optimize their returns. For instance, if an individual is looking for a low-risk, liquid savings option, an M1-based savings account may be the best choice. However, if they are willing to take on slightly more risk in pursuit of higher returns, an M2-based investment may be more suitable. By understanding the answer to the question, are savings deposits M1 or M2, individuals can better navigate the complexities of the money supply and make more informed financial decisions.

The Importance of Understanding Monetary Aggregates in a Changing Economy

Understanding M1 and M2 is crucial in navigating the complexities of a changing economy. As economic conditions shift, the money supply and monetary aggregates can have a significant impact on inflation, recession, and monetary policy. For instance, during periods of high inflation, central banks may increase interest rates to reduce the money supply and curb inflationary pressures. In this scenario, understanding the composition of M1 and M2 can help investors and policymakers anticipate the effects of monetary policy changes on the economy. Similarly, during recessions, understanding the role of monetary aggregates can inform decisions on fiscal policy and stimulus packages. Furthermore, as the economy evolves, new financial instruments and technologies can alter the composition of M1 and M2, making it essential to stay up-to-date on the latest developments. By grasping the concepts of M1 and M2, individuals can better navigate the intricacies of the economy and make more informed financial decisions. The answer to the question, are savings deposits M1 or M2, takes on added significance in this context, as it can inform decisions on savings and investment strategies in response to changing economic conditions.

Conclusion: M1, M2, and the Role of Savings Deposits

In conclusion, understanding the monetary aggregates M1 and M2 is crucial for making informed financial decisions and navigating the complexities of the economy. The distinction between M1 and M2, including the role of savings deposits in both, provides valuable insights for investors, policymakers, and individuals alike. By recognizing the characteristics of M1 and M2, including their liquidity, risk, and composition, individuals can make more informed decisions about their financial portfolios and optimize their returns. The answer to the question, are savings deposits M1 or M2, highlights the importance of considering the nuances of monetary aggregates in personal financial decisions. As the economy continues to evolve, understanding M1 and M2 will remain essential for making sense of monetary policy shifts, economic changes, and the ever-changing landscape of financial instruments. By grasping the concepts of M1 and M2, individuals can take control of their financial futures and make more informed decisions in an increasingly complex economic environment.