What Are Depreciation and Amortization and How Do They Affect Your Business?

Depreciation and amortization are accounting methods used to allocate the cost of an asset over its useful life. These non-cash expenses are critical for understanding a company’s financial health, because while they don’t represent actual cash outflow, they significantly impact the profitability by reducing taxable income. Depreciation applies to tangible assets such as machinery, equipment, and vehicles, reflecting the wear and tear of these items over time. Amortization, on the other hand, is used for intangible assets like patents, copyrights, and trademarks, which lose value as they approach the end of their legal or contractual life. Both depreciation and amortization on the income statement are vital because they provide a more accurate reflection of a company’s earnings by matching the expense of using an asset with the revenue it generates. The strategic use of these accounting principles directly affects how a company reports its profitability and tax obligations, thus making the proper management of depreciation and amortization on income statement indispensable.

The key difference between depreciation and amortization lies in the nature of the assets they apply to. Tangible assets, having a physical presence, are subject to depreciation, which is a gradual decrease in value due to usage, wear and tear, or obsolescence. Intangible assets, lacking a physical form, are subject to amortization, which represents the allocation of their cost over the period they provide value. It is imperative to understand that both depreciation and amortization are non-cash expenses that reduce a company’s reported profit. This distinction is crucial for financial analysis, as it directly impacts the presentation of the company’s earnings on the income statement. The impact of both depreciation and amortization on income statement should be examined to properly understand a company’s financial performance and tax positions.

Understanding the principles of depreciation and amortization is essential for any business. These methods, while similar in their purpose of allocating asset costs over time, differ in their applications, which will ultimately affect the reporting and understanding of the financial statement. The accurate calculation and recording of depreciation and amortization on the income statement is necessary for companies to accurately portray their financial performance. This approach provides a true picture of a company’s earnings by reflecting the actual cost of assets being used in operations. By properly accounting for these non-cash expenses, companies can achieve more precise financial reporting that influences key financial indicators and taxes.

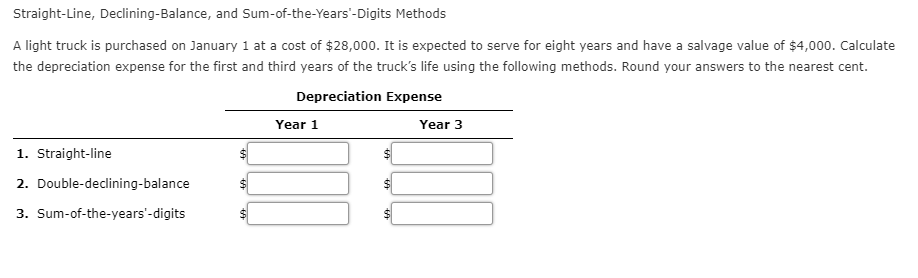

Depreciation Methods Explained: Straight-Line, Declining Balance, and Sum-of-the-Years’ Digits

Various methods exist for calculating depreciation, each impacting how the expense is recognized over an asset’s life and consequently affecting the presentation of amortization and depreciation on income statement. The straight-line method allocates the cost of an asset equally over its useful life. For example, if a machine costs $10,000 and has a useful life of 5 years, the annual depreciation expense is $2,000 ($10,000 / 5 years). This method results in a consistent expense each year. The declining balance method, an accelerated method, applies a depreciation rate to the book value of the asset. For instance, using a double-declining balance, a rate of 40% would be applied to the machine’s remaining book value each year (assuming an 8-year life), resulting in higher depreciation expenses earlier in its life. This differs significantly from the straight-line approach and changes how amortization and depreciation on income statement will appear. The sum-of-the-years’ digits method is another accelerated approach that multiplies a depreciable cost by a fraction that decreases over time. Using the same machine and its 5-year useful life, the fraction for year 1 would be 5/15 (5+4+3+2+1 = 15). In year 2 the fraction will be 4/15, and so on. These different methods show how accounting choices directly influence the profitability figures as they appear on the company’s income statement.

The different depreciation methods significantly impact the financial statements, especially when looking at the amortization and depreciation on income statement. The choice of depreciation method can lead to varying levels of reported profits. The straight-line method provides stable expenses and tends to result in a more predictable profit stream, whereas accelerated methods, such as declining balance and sum-of-the-years’ digits, lead to higher expenses in the early years of the asset’s life, lowering taxable income during that period. This can be beneficial for tax purposes but may also decrease reported profit in the initial years. It’s important to understand the implications of each method as they are applied in a business’s accounting practices, because they do have a direct impact on how a company’s profitability is represented on its income statement. The specific choice of depreciation method influences how assets are reported over their useful life and thus provides different insights to profitability, impacting the view of the overall financial health of the company. Understanding these implications is crucial for interpreting a company’s financial performance.

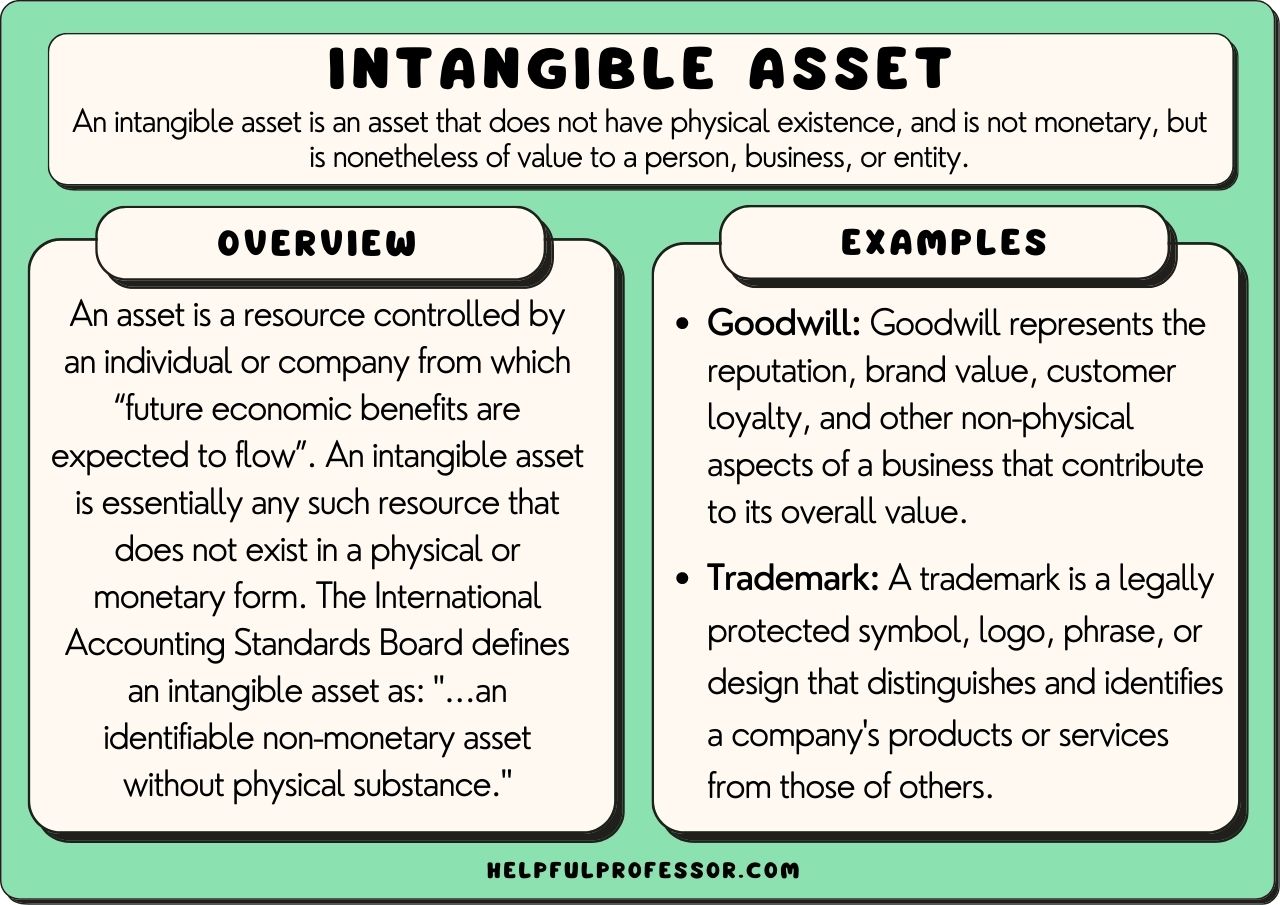

Amortization: How to Account for Intangible Assets

Amortization is the accounting practice of systematically allocating the cost of intangible assets over their useful lives, similar to how depreciation is used for tangible assets. Intangible assets are non-physical assets that provide long-term value to a business, such as patents, copyrights, trademarks, and franchise agreements. These assets are typically amortized using the straight-line method, which involves dividing the asset’s cost by its useful life to determine the annual amortization expense. For example, if a company purchases a patent for $100,000 with a 10-year useful life, the annual amortization expense would be $10,000. This expense reflects the gradual consumption of the asset’s value over time. It’s important to note that while amortization, like depreciation, does not represent a cash outflow, it is a deduction that reduces a company’s reported income, impacting the amortization and depreciation on income statement and its overall profitability. This process ensures that the cost of the intangible assets is recognized as an expense over the period in which they generate revenue for the business.

Goodwill, another type of intangible asset, requires special accounting treatment. It typically arises from the acquisition of one company by another and represents the excess of the purchase price over the fair value of the net identifiable assets acquired. Unlike other intangible assets, goodwill is not amortized on a regular basis. Instead, it is subject to an annual impairment test. If the fair value of goodwill decreases below its carrying amount, an impairment loss is recorded on the income statement. This loss, although non-cash, directly affects the company’s profitability. The proper accounting for intangible assets, including regular amortization and impairment testing, is essential for accurately reflecting a company’s financial performance. The understanding of how amortization and depreciation on income statement affect the financial statements, is critical when examining the long term performance of a business since both reduce the net profit figure. Understanding how these non cash expenses affect profits can help you evaluate the true earnings of a business, especially when analyzing its financial statements.

How to Show Depreciation and Amortization on the Income Statement

Understanding where to locate depreciation and amortization on the income statement is crucial for financial analysis. These non-cash expenses are typically positioned after the gross profit line, often grouped together under a single line item such as “Depreciation and Amortization”. This grouping simplifies the presentation while still highlighting their impact on profitability. The exact placement might vary slightly depending on the company’s industry and reporting practices, but generally, they appear before operating income. This means that both depreciation and amortization expenses reduce the reported operating profit of the business. It’s important to recognize that these are not cash outflows but rather accounting measures that reflect the consumption of an asset’s value over time. By subtracting these expenses from the revenues, the income statement reflects a more accurate picture of the company’s profitability and financial health. The presentation of amortization and depreciation on the income statement allows stakeholders to evaluate how the wearing of the company assets affect the net profits. The overall effect of these expenses is to lower the net income which further reduces the tax liability of a company.

To illustrate how the amortization and depreciation on income statement affect the reported profits, consider a simplified example. Suppose a company has revenue of $500,000 and cost of goods sold of $200,000, resulting in a gross profit of $300,000. If the company reports $50,000 in combined depreciation and amortization expenses, its operating profit would be reduced to $250,000. This figure is then used to calculate other vital metrics. It is vital to realize that while depreciation and amortization do not represent cash leaving the business in the current period, they do reduce taxable income and therefore reduce the amount of taxes a company has to pay. These deductions also provide a clear insight into the cost of using company assets which is an important part of understanding the true cost of operations and overall company health. The way that amortization and depreciation are presented on the income statement provides a clear understanding of how assets’ costs are being allocated over their useful life, impacting both the profit and the final tax liability.

The Impact of Depreciation and Amortization on Profitability and Tax Liability

The expenses of depreciation and amortization on income statement directly influence a company’s reported profitability. These non-cash deductions, while not representing actual cash outflows, effectively reduce a company’s earnings before taxes. For example, a higher depreciation expense, resulting from an accelerated method like the declining balance method compared to the straight-line method, will lead to a lower net income for a given period. This reduction in net income translates into a lower tax liability, as income taxes are calculated based on a company’s taxable profit. Conversely, if a company uses a slower method of depreciation or has low amortization expenses, the impact on the net profit will be less pronounced, leading to a higher tax burden. The choice of depreciation methods can strategically influence the short-term profitability and tax liability of the company, though the total depreciation and amortization expense over the asset’s life will remain the same. Specifically, different depreciation methods, while accounting for the same total asset value over its useful life, can shift taxable income from one year to another. Therefore, understanding how these non-cash items affect reported profits and tax liabilities is crucial for interpreting the overall financial health of a business.

To further illustrate the influence of amortization and depreciation on income statement, consider a situation where two companies, similar in all aspects except for their asset depreciation methods, report vastly different net incomes. Company A employs the straight-line method, which spreads the depreciation expense evenly, while Company B uses an accelerated method. Consequently, Company B will report lower profits in the initial years due to higher depreciation charges on the income statement, which will also reduce its tax burden. This can be particularly useful during periods of higher revenue where a business might seek to reduce its tax liability by increasing expenses. The cumulative impact of these strategies over time impacts the total taxes paid. It’s critical to evaluate not only the tax implications but also how these choices influence investor perception. Investors often scrutinize these expenses and look into the accounting choices, so a company’s income statement provides critical information. Therefore, the strategic handling of depreciation and amortization is vital in financial management, as it involves balancing both reporting obligations and optimization of tax responsibilities.

How to Select the Right Method for Your Business Assets

Choosing the appropriate depreciation and amortization methods is a critical decision that significantly impacts a company’s financial reporting and tax obligations. The selection process is not arbitrary; it requires careful consideration of several factors, including the nature of the asset, its estimated useful life, and the company’s unique operational circumstances. For tangible assets, like machinery or vehicles, various depreciation methods can be applied. The straight-line method, for instance, evenly distributes the cost over the asset’s life, providing a consistent expense each period. Conversely, accelerated methods, such as the declining balance or sum-of-the-years’ digits, recognize higher expenses in the early years of an asset’s life. The decision to use one method over another will affect the pattern of depreciation and, consequently, the amount of depreciation and amortization on income statement that is recorded each year. For example, a company may opt for an accelerated method if it anticipates that an asset will be more productive and experience greater wear and tear early in its lifespan. This selection is key to financial analysis, as different methods will result in variations in the profit margin, a very important financial ratio.

Similarly, when considering intangible assets like patents, copyrights, or trademarks, the amortization method must be carefully selected. Typically, the straight-line method is used for amortization, spreading the cost of the intangible asset evenly over its useful life. For assets like goodwill, different accounting treatments may be applied depending on the jurisdiction and accounting standards being followed. While companies have the flexibility to choose among accepted methods, it’s crucial to understand that once a method is selected, consistency in its application is required. Changing methods mid-stream can create confusion and hinder accurate financial analysis. The selection of an accounting method for amortization and depreciation on income statement should align with the asset’s true usage pattern and be consistently applied, unless there’s a justified reason for a change which is often difficult to implement. The choice of method must also be within the rules provided by local laws and jurisdictions as it impacts tax liability significantly. Companies must choose and maintain the method selected to ensure that the depreciation and amortization expenses shown on the income statement are an accurate representation of the asset’s reduced value, and in turn, the company’s financial health.

It is vital to consider the implications of these choices on the company’s financial reporting and tax obligations. The selected method of depreciation and amortization on income statement will not only affect the reported net income but also the taxable income. Different depreciation methods can lead to significantly different reported profits, which in turn affect the tax liability of the company. Therefore, a thorough understanding of the available methods and their potential impacts is essential for any business. This awareness facilitates not only precise financial reporting but also effective tax planning and enhances comparability within an industry. The goal is to select a method that is not only accurate and compliant but also reflects the economic reality of how the asset is used and consumed by the business. Therefore, a good understanding of the different methods to record depreciation and amortization expenses is crucial for managing the financial health of a business.

How Depreciation and Amortization Can Affect Financial Analysis

Depreciation and amortization are critical components in financial analysis, offering insights into a company’s asset utilization and profitability. These non-cash expenses, although not representing actual cash outflows, significantly impact key financial ratios and are scrutinized by analysts when evaluating a company’s performance. For instance, profitability ratios such as gross profit margin and net profit margin are directly affected by depreciation and amortization. A higher depreciation expense will reduce both the gross and net profit, influencing these ratios. When comparing companies, analysts must consider the different accounting policies regarding depreciation and amortization. Companies operating in the same sector might employ different depreciation methods, which can lead to variations in reported profits. Understanding these nuances is crucial for accurate comparisons, as one company might show higher profits due to lower depreciation expense, not necessarily superior operational efficiency. This makes a clear understanding of how amortization and depreciation on income statement is calculated vital in making these comparisons. Further, the amortization and depreciation on income statement can impact the debt-to-equity ratio, as they affect retained earnings.

The impact of amortization and depreciation on income statement extends to various financial metrics. Analysts often use these expenses to determine a company’s asset efficiency. For instance, ratios like asset turnover, which measures how effectively a company utilizes its assets to generate revenue, can be influenced by accumulated depreciation. Similarly, these non-cash expenses are often included when calculating EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), a metric that is often used to assess a company’s operating profitability before taking into account these non-cash charges. It is vital for analysts to adjust for differences in accounting policies to ensure comparability. For example, a company using an accelerated depreciation method will report higher depreciation expenses in the early years of an asset’s life, affecting its profitability metrics in those years. Consequently, when considering the effects of amortization and depreciation on income statement, analysts can better understand the true financial health of a business and its long-term sustainability. It’s also important to scrutinize the notes to the financial statements to ascertain the specifics regarding depreciation and amortization policies.

How to Keep Track of Your Depreciation and Amortization Schedules

Maintaining accurate records for depreciation and amortization is crucial for a business. Consistency in applying chosen methods is essential; once a method is selected, it should be used consistently for the life of the asset to ensure financial reporting accuracy. Regular updates to reflect any changes in asset usage or estimated useful life are also important. These records form the backbone for calculating the impact of amortization and depreciation on income statement figures, providing a clear audit trail. The process involves tracking the original cost of the asset, its useful life, salvage value (if any), and the method of depreciation or amortization being employed. Failing to keep these records up-to-date can result in errors in financial statements, impacting a company’s profitability presentation and potentially leading to compliance issues.

Accounting software and spreadsheets can be highly effective tools for streamlining the process of tracking depreciation and amortization schedules. These tools allow for easy calculation and record-keeping, automating many of the tedious aspects of tracking asset values and calculating depreciation and amortization on income statement reports. Software can be set up to automatically compute the yearly expense based on the selected method, keeping a running log of asset values and their related expenses. Spreadsheets, while requiring more manual input, also offer a way to easily organize this data. This detailed documentation is not only beneficial for internal financial management but also critical for external audits. Accurate records provide clear evidence of how the amortization and depreciation expenses were derived and support the figures shown in financial statements.

For each asset, whether tangible or intangible, a separate schedule should be maintained detailing the date of acquisition, the initial cost, the chosen method for amortization and depreciation on income statement, and the annual expense. This systematic approach ensures transparency and compliance with regulatory requirements. Moreover, detailed records can help in financial planning by providing a clear understanding of the ongoing expenses related to assets. Being diligent in this process avoids miscalculations and ensures that the company’s financial statements accurately reflect the impact of these non-cash expenses on its profitability and tax liability. By carefully tracking these expenses and employing technology to streamline the process, businesses can maintain financial integrity and ensure compliance with all financial reporting standards related to amortization and depreciation on income statement.