Understanding the Concept of Effective Annual Rate

When it comes to personal finance, understanding what is the effective annual rate (EAR) is crucial for making informed decisions about investments and savings. The EAR represents the rate of return on an investment or loan, taking into account the compounding of interest over a year. It’s essential to grasp that the EAR differs significantly from the nominal interest rate, which is the rate of interest charged or paid on a loan or investment without considering compounding. The nominal rate may appear attractive, but it’s the EAR that reveals the actual return on investment. For instance, a savings account with a nominal interest rate of 2% may have an EAR of 2.04% if interest is compounded daily. This distinction is vital, as it can significantly impact the growth of wealth over time. By comprehending the EAR, individuals can make more accurate comparisons between financial products and optimize their investment strategies.

https://www.youtube.com/watch?v=UayfPotFLPI

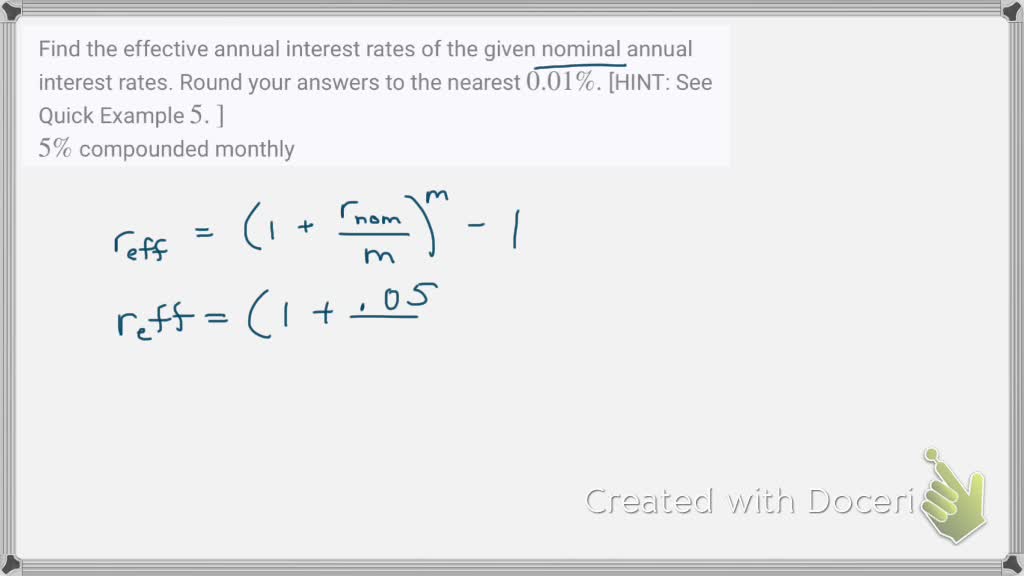

How to Calculate the Effective Annual Rate of Return

Calculating the effective annual rate (EAR) is a straightforward process that requires understanding the formula and its components. The EAR formula is: EAR = (1 + (nominal rate/n))^n – 1, where ‘n’ represents the number of times interest is compounded per year. For instance, if a savings account has a nominal interest rate of 2% compounded daily, the EAR would be calculated as: EAR = (1 + (0.02/365))^{365} – 1, resulting in an EAR of 2.04%. To illustrate this process, let’s consider an example: suppose an investment offers a nominal interest rate of 5% compounded quarterly. Using the formula, we can calculate the EAR as: EAR = (1 + (0.05/4))^4 – 1, resulting in an EAR of 5.09%. By understanding how to calculate the EAR, individuals can make informed decisions about their investments and optimize their returns.

The Impact of Compounding Frequency on Effective Annual Rate

Compounding frequency plays a crucial role in determining the effective annual rate (EAR) of an investment or loan. The frequency of compounding can significantly impact the interest earned, and understanding its effects is essential for making informed financial decisions. Daily compounding, for instance, results in a higher EAR compared to monthly or quarterly compounding, given the same nominal interest rate. This is because daily compounding involves more frequent calculations of interest, leading to a greater accumulation of interest over time. To illustrate this concept, consider a savings account with a nominal interest rate of 2% compounded daily versus one compounded quarterly. The daily compounding account would yield an EAR of 2.04%, while the quarterly compounding account would yield an EAR of 2.01%. This difference may seem small, but it can add up over time, making daily compounding a more attractive option for investors. On the other hand, credit cards often use monthly compounding, which can lead to higher interest charges for borrowers. By grasping the impact of compounding frequency on the EAR, individuals can optimize their investment strategies and make more informed decisions about their financial products.

Real-World Applications of Effective Annual Rate

In the world of personal finance, understanding the effective annual rate (EAR) is crucial for making informed decisions about investments and loans. The EAR plays a significant role in various financial products, including certificates of deposit (CDs), savings accounts, and credit cards. For instance, when investing in a CD, the EAR helps determine the total interest earned over the term of the deposit. A higher EAR can result in greater returns, making it essential to choose a CD with a competitive EAR. Similarly, when selecting a savings account, the EAR can impact the growth of the account balance over time. In the context of credit cards, the EAR can have a significant impact on the total interest paid, making it essential to understand the EAR when choosing a credit card or negotiating a loan. By grasping the concept of EAR, individuals can make more informed decisions about their financial products and optimize their returns. For example, a high-yield savings account with an EAR of 2.5% may be a more attractive option than a traditional savings account with an EAR of 1.5%. By understanding the EAR, individuals can make more informed decisions about their financial products and achieve their long-term financial goals.

Comparing Effective Annual Rates Across Financial Products

When evaluating financial products, such as high-yield savings accounts, money market accounts, and credit cards, understanding the effective annual rate (EAR) is crucial for making informed decisions. Comparing EARs across different products can help individuals identify the most competitive options and maximize their returns. For instance, a high-yield savings account with an EAR of 2.2% may be a more attractive option than a traditional savings account with an EAR of 1.8%. Similarly, a credit card with an EAR of 18.99% may be more expensive than one with an EAR of 12.99%. To effectively compare EARs, it’s essential to consider the compounding frequency, fees, and other terms associated with each product. By doing so, individuals can make more informed decisions about their financial products and achieve their long-term financial goals. For example, when choosing between a money market account with an EAR of 2.5% and a high-yield savings account with an EAR of 2.3%, understanding the compounding frequency and fees associated with each product can help individuals make a more informed decision. By grasping the concept of EAR and how to compare it across different financial products, individuals can optimize their returns and achieve financial success. Remember, what is the effective annual rate (EAR) of a financial product can significantly impact the interest earned or paid over time.

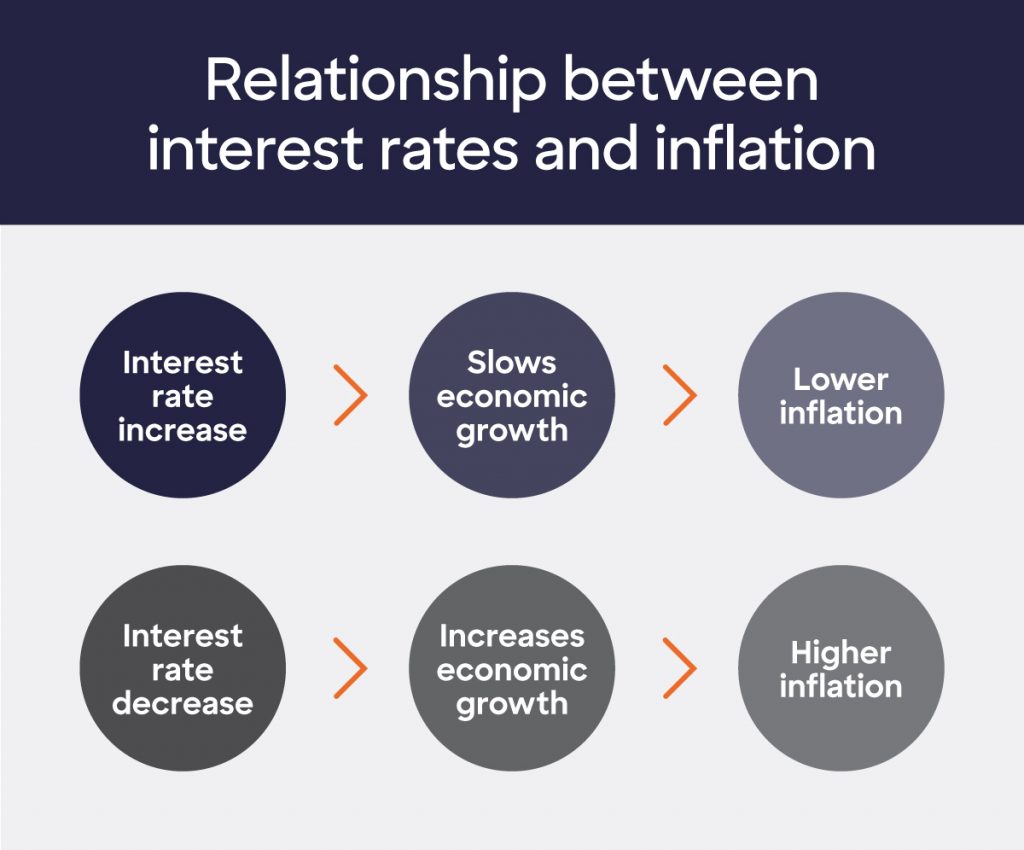

The Relationship Between Effective Annual Rate and Inflation

Inflation can have a significant impact on the effective annual rate (EAR) of a financial product, eroding the purchasing power of interest earned over time. When inflation rises, the value of money decreases, and the interest earned on investments or savings accounts may not keep pace with the increasing cost of living. For instance, if an investment earns an EAR of 4% but inflation is running at 3%, the real return on investment is only 1%. This means that the purchasing power of the interest earned is reduced, and the investor may not be able to afford the same goods and services as they could before. Understanding the relationship between EAR and inflation is crucial for making informed investment decisions and achieving long-term financial goals. By considering the impact of inflation on the EAR, individuals can adjust their investment strategies to ensure that their returns keep pace with the rising cost of living. For example, investing in assets that historically perform well during periods of inflation, such as precious metals or real estate, can help mitigate the effects of inflation on the EAR. By grasping the concept of EAR and its relationship with inflation, individuals can make more informed decisions about their investments and achieve financial success. Remember, what is the effective annual rate (EAR) of a financial product can significantly impact the interest earned over time, and understanding its relationship with inflation is crucial for achieving long-term financial goals.

Maximizing Your Returns with an Effective Annual Rate Strategy

To maximize returns, it’s essential to develop an effective annual rate (EAR) strategy that considers the compounding frequency, fees, and other terms associated with financial products. By choosing products with competitive EARs, individuals can earn more interest over time and achieve their long-term financial goals. For instance, investing in a high-yield savings account with an EAR of 2.5% can provide higher returns than a traditional savings account with an EAR of 1.8%. Additionally, considering the compounding frequency can also impact returns. Daily compounding, for example, can result in higher returns than monthly or quarterly compounding. Furthermore, minimizing fees is crucial to maximizing returns. Fees can erode the interest earned, reducing the overall return on investment. By understanding what is the effective annual rate (EAR) of a financial product and how to calculate it, individuals can make informed decisions about their investments and achieve financial success. A well-designed EAR strategy can help individuals achieve their financial goals, whether it’s saving for retirement, a down payment on a house, or a big purchase. By grasping the concept of EAR and its significance in personal finance, individuals can take control of their financial future and make the most of their hard-earned money.

Avoiding Common Pitfalls in Effective Annual Rate Calculations

When calculating the effective annual rate (EAR), it’s essential to avoid common pitfalls that can lead to inaccurate results. One of the most significant mistakes is neglecting compounding frequency. Failing to consider the compounding frequency can result in a lower EAR, leading to reduced returns on investment. For instance, a savings account with a nominal interest rate of 2% and daily compounding may have a higher EAR than a similar account with monthly compounding. Another common mistake is ignoring fees associated with financial products. Fees can erode the interest earned, reducing the overall return on investment. Understanding what is the effective annual rate (EAR) of a financial product requires careful consideration of all the terms and conditions. Additionally, failing to account for inflation can also lead to inaccurate EAR calculations. Inflation can erode the purchasing power of interest earned, reducing the real return on investment. By being aware of these common pitfalls, individuals can ensure accurate EAR calculations and make informed decisions about their investments. By grasping the concept of EAR and its significance in personal finance, individuals can avoid costly mistakes and achieve their long-term financial goals.