What Happens When You Call a Bond?

In the world of bond investing, calling a bond is a crucial concept that can significantly impact both the bondholder and the issuer. But what does calling a bond mean, exactly? In essence, it refers to the issuer’s right to redeem the bond before its maturity date, typically at a predetermined price. This can occur when interest rates fall, making it more cost-effective for the issuer to refinance their debt. When a bond is called, the issuer returns the face value of the bond to the bondholder, along with any accrued interest. This can be both beneficial and detrimental to the bondholder, depending on the circumstances. For instance, if interest rates have fallen since the bond was issued, the bondholder may be forced to reinvest their money at a lower rate, resulting in a lower return on investment. On the other hand, if the bondholder is holding a bond with a high coupon rate, calling the bond may allow them to reinvest their money at a higher rate. Understanding the implications of calling a bond is vital for investors seeking to maximize their returns and minimize their risks.

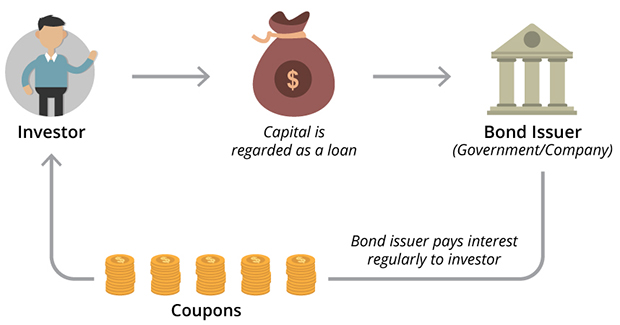

Understanding Bond Terminology: A Crash Course

Before diving into the world of callable bonds, it’s essential to understand the fundamental terminology associated with bonds. This foundation will help investors navigate the complexities of bond investing and make informed decisions. Key terms to grasp include face value, coupon rate, and maturity date. The face value, also known as the principal, is the amount borrowed by the issuer and repaid to the bondholder at maturity. The coupon rate, expressed as a percentage, represents the annual interest paid to the bondholder. Finally, the maturity date marks the end of the bond’s life, at which point the issuer repays the face value. Understanding these basic concepts is crucial for grasping the concept of calling a bond and its implications for both the bondholder and the issuer. By familiarizing themselves with these terms, investors can better comprehend the bond market and make more informed investment decisions.

How to Identify Callable Bonds in Your Portfolio

Identifying callable bonds in a portfolio is crucial for investors seeking to manage their risk and maximize their returns. To do so, it’s essential to understand the key features and characteristics of callable bonds. One way to identify callable bonds is to review the bond prospectus, which outlines the terms and conditions of the bond. Look for language indicating that the bond is callable, such as “callable” or “redeemable.” Additionally, check the bond’s indenture, which outlines the bond’s terms and conditions, for any call provisions. Investors should also review the bond’s pricing supplement, which provides detailed information on the bond’s features and risks. Furthermore, investors can check the bond’s rating and credit reports to determine if the issuer has a history of calling bonds. By carefully reviewing these documents and understanding the key features of callable bonds, investors can make informed decisions about their investments and avoid potential pitfalls. Remember, understanding what does calling a bond mean is vital in identifying callable bonds in a portfolio.

The Pros and Cons of Callable Bonds: Weighing the Risks and Rewards

Callable bonds offer a unique set of advantages and disadvantages that investors must carefully consider before investing. One of the primary benefits of callable bonds is the potential for higher yields. Since callable bonds carry a higher level of risk due to the possibility of early redemption, issuers often offer higher interest rates to compensate investors for this risk. Additionally, callable bonds can provide investors with an opportunity to reinvest their capital at higher interest rates if interest rates rise. However, callable bonds also come with significant risks. The primary risk is the possibility of early redemption, which can result in investors being forced to reinvest their capital at lower interest rates. This can be particularly problematic in a falling interest rate environment, where investors may struggle to find alternative investments with comparable yields. Furthermore, callable bonds can be less liquid than non-callable bonds, making it more difficult for investors to sell their bonds before maturity. Understanding what does calling a bond mean is crucial in weighing the pros and cons of callable bonds. By carefully evaluating the potential risks and rewards, investors can make informed decisions about whether callable bonds are suitable for their investment portfolios.

What Triggers a Bond Call: Understanding the Issuer’s Perspective

When an issuer decides to call a bond, it’s often driven by specific circumstances that make it beneficial for them to refinance or retire the debt. One of the primary reasons issuers call bonds is a decline in interest rates. If interest rates fall significantly, issuers may be able to refinance their debt at a lower cost, reducing their borrowing expenses and improving their financial performance. Another reason issuers might call a bond is to take advantage of refinancing opportunities. If market conditions change, issuers may be able to secure better terms or more favorable financing options, making it advantageous to call the bond and refinance. Additionally, issuers may call a bond to manage their debt profile, reduce their debt burden, or optimize their capital structure. Understanding what does calling a bond mean from the issuer’s perspective is essential for investors to appreciate the motivations behind a bond call. By recognizing the triggers that lead to a bond call, investors can better anticipate and prepare for the potential impact on their investments.

The Impact of Calling a Bond on Your Investment Strategy

When a bond is called, it can have a significant impact on an investor’s overall strategy. One of the primary concerns is the potential for reinvestment risk. When a bond is called, investors may be forced to reinvest their capital at lower interest rates, which can reduce their returns and affect their investment goals. To mitigate this risk, investors may need to diversify their bond portfolios to minimize their exposure to callable bonds. Additionally, investors may need to adjust their investment horizon and cash flow expectations, as the early redemption of a bond can alter their expected returns and income streams. Understanding what does calling a bond mean is crucial in navigating these challenges. By recognizing the potential impact of a bond call on their investment strategy, investors can proactively manage their portfolios and make informed decisions to achieve their investment objectives. This may involve rebalancing their portfolios, adjusting their asset allocation, or exploring alternative investment opportunities to minimize the effects of a bond call.

Callable Bonds vs. Non-Callable Bonds: Which is Right for You?

When it comes to bond investing, one of the key decisions investors face is whether to opt for callable bonds or non-callable bonds. Understanding the differences between these two types of bonds is crucial in making informed investment decisions. Callable bonds offer higher yields to compensate for the risk of early redemption, but they also come with the uncertainty of when the bond might be called. Non-callable bonds, on the other hand, provide a fixed return until maturity, but typically offer lower yields. Investors must weigh the trade-offs between these two options and consider their individual financial goals, risk tolerance, and investment horizon. For instance, investors seeking higher returns and willing to take on the risk of early redemption may prefer callable bonds. In contrast, investors prioritizing predictability and stability may opt for non-callable bonds. Knowing what does calling a bond mean and understanding the implications of callable bonds can help investors make informed decisions and optimize their bond portfolios.

Conclusion: Navigating the Complex World of Callable Bonds

In conclusion, understanding what does calling a bond mean is crucial for investors looking to navigate the complex world of bond investing. By grasping the concept of callable bonds, investors can make informed decisions about their investment portfolios and optimize their returns. From identifying callable bonds in a portfolio to weighing the pros and cons of these investments, investors must consider the potential risks and rewards of callable bonds. By recognizing the impact of calling a bond on their investment strategy and comparing callable bonds with non-callable bonds, investors can develop a comprehensive approach to bond investing. Ultimately, a deep understanding of callable bonds can help investors achieve their financial goals and build a successful investment portfolio. Whether you’re a seasoned investor or just starting out, unlocking the secrets of callable bonds can help you make the most of your investment dollars.