What You Need to Know About Treasury Note Quotations

Treasury notes play a vital role in the financial market, offering a low-risk investment opportunity with a fixed return. As a result, understanding treasury note quotations is crucial for investors and financial professionals alike. Treasury note quotations provide valuable insights into the market’s expectations of future interest rates, inflation, and economic growth. To make informed investment decisions, it’s essential to know how are treasury notes quoted and what these quotes represent. In essence, treasury note quotations serve as a benchmark for other investments, influencing the overall direction of the financial market. By grasping the intricacies of treasury note quotations, investors can better navigate the complex world of finance, making more informed decisions that drive growth and profitability.

Deciphering Treasury Note Quotes: A Step-by-Step Guide

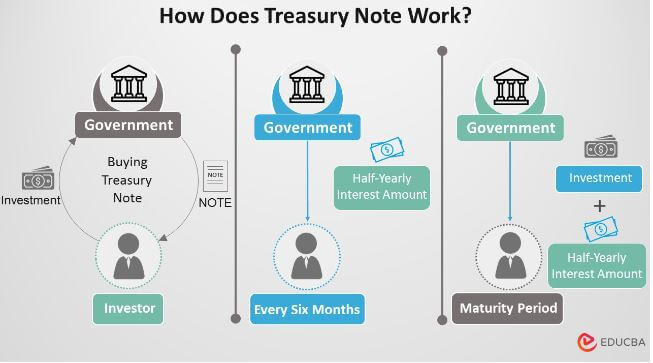

A treasury note quote is comprised of several key components that provide valuable insights into the investment’s characteristics and potential returns. To understand how are treasury notes quoted, it’s essential to break down each component and its significance. The face value, also known as the principal, is the amount borrowed by the government and repaid to the investor at maturity. For example, a $1,000 face value treasury note will return $1,000 at maturity. The coupon rate, or interest rate, is the percentage of the face value paid to the investor periodically, usually semi-annually. A 2% coupon rate on a $1,000 face value treasury note would result in $20 interest payments every six months. The maturity date is the date on which the treasury note expires, and the investor receives the face value. Finally, the yield represents the total return on investment, taking into account the coupon rate, face value, and maturity date. By grasping these components, investors can better understand how to analyze and compare treasury note quotes, making more informed investment decisions.

How to Read a Treasury Note Quote Like a Pro

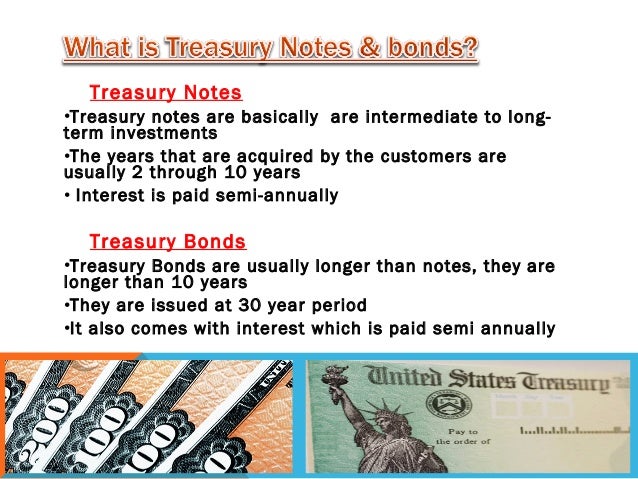

When it comes to understanding how are treasury notes quoted, it’s essential to know how to read and interpret the quotes effectively. To do so, investors should be aware of the different types of treasury notes and their corresponding quotes. For instance, Treasury bills (T-bills) have shorter maturities, typically ranging from a few weeks to a year, and are quoted differently than Treasury notes, which have longer maturities. Treasury notes are further divided into 2-year, 3-year, 5-year, 7-year, and 10-year notes, each with its unique quote structure. Additionally, investors should be familiar with the bid-ask spread, which represents the difference between the price at which buyers are willing to buy (bid) and the price at which sellers are willing to sell (ask). By understanding these nuances, investors can better navigate the complex world of treasury note quotes, making more informed investment decisions. Furthermore, it’s crucial to recognize that treasury note quotes are subject to change in response to market forces, such as supply and demand, inflation, and interest rates. By staying attuned to these changes, investors can adjust their investment strategies accordingly, maximizing returns and minimizing risk.

The Role of Auctions in Treasury Note Pricing

The auction process plays a crucial role in determining the quoted prices of treasury notes. In the United States, the Department of the Treasury’s Bureau of the Fiscal Service is responsible for conducting auctions for treasury notes. These auctions are typically held on a regular schedule, with different maturities being auctioned off on specific days. During the auction process, investors submit bids for the desired quantity of treasury notes at a specified price. The bids are then ranked from highest to lowest, and the cut-off price is determined by the highest bid that clears the auction. This cut-off price becomes the quoted price for the treasury note, influencing how are treasury notes quoted in the market. The auction process ensures that treasury notes are priced fairly and efficiently, reflecting the market’s demand and supply dynamics. Furthermore, the auction process also allows the government to raise capital at the lowest possible cost, which is then used to finance its operations and pay off debt. By understanding the auction process, investors can gain valuable insights into the pricing mechanisms of treasury notes, making more informed investment decisions.

Understanding the Impact of Market Forces on Treasury Note Quotes

Market forces play a significant role in shaping the quoted prices of treasury notes. Supply and demand, inflation, and interest rates are just a few of the key factors that influence how are treasury notes quoted. When demand for treasury notes is high, prices tend to rise, and yields decrease. Conversely, when demand is low, prices fall, and yields increase. Inflation also has a profound impact on treasury note quotes, as rising inflation expectations can lead to higher yields and lower prices. Furthermore, changes in interest rates set by central banks can influence the attractiveness of treasury notes, affecting their quoted prices. For instance, when interest rates rise, the yields on existing treasury notes become less attractive, causing their prices to fall. Understanding the interplay between these market forces is essential for investors, as it enables them to make informed decisions about their investments and navigate the complexities of the treasury note market. By recognizing the impact of market forces on treasury note quotes, investors can better anticipate changes in quoted prices and adjust their strategies accordingly, ultimately maximizing returns and minimizing risk.

Treasury Note Quotes: What Do They Really Mean?

At their core, treasury note quotes represent the market’s expectations of future economic conditions. Changes in quoted prices reflect shifts in investor sentiment, influencing how are treasury notes quoted. When treasury note prices rise, it indicates that investors are willing to accept lower yields, suggesting a decrease in inflation expectations or a flight to safety. Conversely, falling prices imply higher yields, which may signal increased inflation concerns or a rise in risk appetite. Moreover, treasury note quotes have broader implications for the economy, as they influence borrowing costs, consumer spending, and business investment. For instance, lower treasury note yields can lead to lower mortgage rates, boosting the housing market, while higher yields can increase borrowing costs, slowing economic growth. By grasping the underlying meaning behind treasury note quotes, investors can better navigate the complexities of the financial market, making more informed decisions about their investments and risk management strategies. Ultimately, understanding the significance of treasury note quotes is essential for investors seeking to maximize returns and minimize risk in an ever-changing market landscape.

Practical Applications of Treasury Note Quotes

Treasury note quotes have far-reaching implications for investors, financial professionals, and the broader economy. In practice, treasury note quotes are used to inform investment decisions, manage risk, and optimize portfolios. For instance, investors may use treasury note quotes to determine the attractiveness of a particular investment, comparing the yields of different treasury notes to make informed decisions. Additionally, treasury note quotes can be used to gauge the overall health of the economy, with changes in quoted prices reflecting shifts in market sentiment. In risk management, treasury note quotes are used to hedge against potential losses, with investors seeking to mitigate risk by investing in treasury notes with lower yields. Furthermore, portfolio optimization strategies often rely on treasury note quotes to determine the optimal allocation of assets, maximizing returns while minimizing risk. By understanding how to interpret and apply treasury note quotes, investors and financial professionals can make more informed decisions, ultimately driving better outcomes in the financial market. As the saying goes, “knowledge is power,” and grasping the practical applications of treasury note quotes is essential for unlocking the secrets of treasury note pricing and achieving success in the world of finance.

Conclusion: Mastering the Art of Treasury Note Quotations

In conclusion, understanding treasury note quotations is crucial for investors and financial professionals seeking to navigate the complexities of the financial market. By grasping the components of a treasury note quote, interpreting quotes like a pro, and recognizing the impact of market forces and auctions, individuals can make informed investment decisions and optimize their portfolios. Moreover, comprehending the meaning behind treasury note quotes and their practical applications can help investors stay ahead of the curve, mitigating risk and maximizing returns. As the financial market continues to evolve, it is essential to stay up-to-date on how are treasury notes quoted and their implications for the economy. By mastering the art of treasury note quotations, investors and financial professionals can unlock the secrets of treasury note pricing, ultimately driving better outcomes in the world of finance. With this comprehensive guide, readers are now equipped with the knowledge and tools necessary to succeed in the dynamic world of treasury note pricing.