Unlocking the Power of Barrier Options

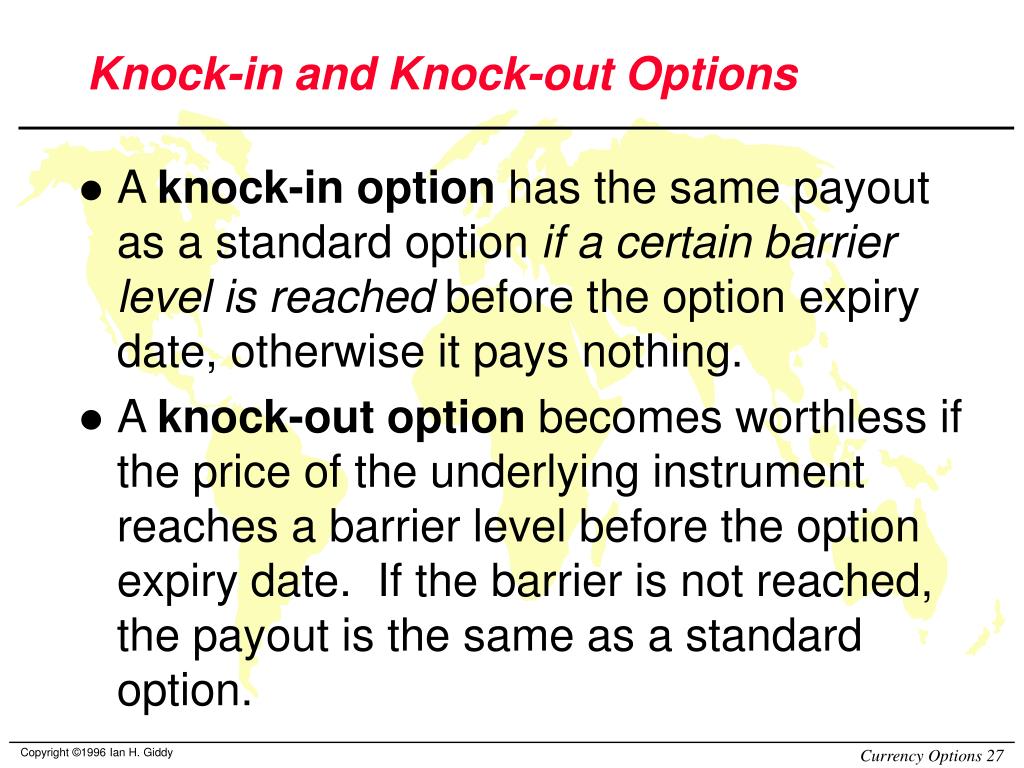

Barrier options, including knock-in and knock-out options, have become increasingly popular among options traders due to their unique characteristics and flexibility. These options allow investors to manage risk and maximize returns in a more efficient manner. A knock-in option, for instance, comes into existence only when the underlying asset reaches a predetermined price level, known as the barrier. On the other hand, a knock-out option ceases to exist when the underlying asset reaches the barrier. By incorporating knock-in and knock-out options into their trading strategies, investors can effectively limit potential losses and capitalize on market opportunities. For example, a trader may use a knock-out option to limit losses on a long position, while a knock-in option can be used to capitalize on a potential upside. By understanding how to utilize these options effectively, traders can gain a competitive edge in the markets.

Understanding the Knock-In Option: A Comprehensive Guide

A knock-in option is a type of barrier option that comes into existence only when the underlying asset reaches a predetermined price level, known as the barrier. This unique characteristic makes knock-in options an attractive tool for traders seeking to manage risk and capitalize on market opportunities. In this section, we will delve into the inner workings of knock-in options, exploring their advantages, disadvantages, and common scenarios where they are used.

One of the primary advantages of knock-in options is their ability to provide traders with a cost-effective way to manage risk. By setting a barrier at a specific price level, traders can limit their potential losses while still maintaining the potential for upside gains. Additionally, knock-in options can be used to capitalize on market volatility, allowing traders to profit from sudden price movements.

However, knock-in options also have some disadvantages. For instance, if the underlying asset never reaches the barrier, the option will expire worthless, resulting in a loss for the trader. Furthermore, knock-in options can be complex and difficult to understand, making them less accessible to novice traders.

Despite these limitations, knock-in options are commonly used in a variety of trading scenarios. For example, a trader may use a knock-in option to hedge against potential losses in a long position, or to speculate on a potential upside move in the underlying asset. By understanding how to effectively utilize knock-in options, traders can gain a competitive edge in the markets and improve their overall trading performance.

How to Use Knock-Out Options to Limit Losses

Knock-out options are a powerful tool for traders seeking to limit potential losses and protect their investments. By understanding how to effectively utilize knock-out options, traders can minimize their exposure to market volatility and maximize their returns. In this section, we will provide practical tips and strategies on how to use knock-out options to limit losses and protect investments, including examples of successful trades.

One of the primary benefits of knock-out options is their ability to provide a safety net for traders. By setting a barrier at a specific price level, traders can limit their potential losses and protect their investments from sudden market downturns. For example, a trader may use a knock-out option to limit losses on a long position, ensuring that their potential losses are capped at a specific level.

In addition to limiting losses, knock-out options can also be used to speculate on market movements. By setting a barrier at a specific price level, traders can profit from sudden price movements, while limiting their potential losses. For instance, a trader may use a knock-out option to speculate on a potential upside move in the underlying asset, while limiting their potential losses in case the asset price falls.

When using knock-out options to limit losses, it is essential to carefully consider the barrier level and the underlying asset’s volatility. A barrier set too close to the current market price may result in the option being knocked out too quickly, limiting its effectiveness. On the other hand, a barrier set too far away from the current market price may not provide sufficient protection against potential losses.

Successful traders have used knock-out options to limit losses in a variety of market conditions. For example, during the 2008 financial crisis, traders used knock-out options to limit their losses on long positions in the stock market, protecting their investments from the sudden market downturn. By understanding how to effectively utilize knock-out options, traders can gain a competitive edge in the markets and improve their overall trading performance.

The Difference Between Knock-In and Knock-Out Options: A Comparative Analysis

Knock-in and knock-out options are two types of barrier options that are often used in options trading. While they share some similarities, they also have some key differences. In this section, we will compare and contrast knock-in and knock-out options, highlighting their similarities and differences, and explaining when to use each type of option.

One of the primary differences between knock-in and knock-out options is the way they are triggered. A knock-in option comes into existence only when the underlying asset reaches a predetermined price level, known as the barrier. On the other hand, a knock-out option ceases to exist when the underlying asset reaches the barrier. This fundamental difference in how they are triggered has a significant impact on their use in options trading.

Another key difference between knock-in and knock-out options is their purpose. Knock-in options are often used to speculate on market movements or to hedge against potential losses. Knock-out options, on the other hand, are primarily used to limit losses and protect investments. By understanding the purpose of each type of option, traders can make informed decisions about which option to use in a given situation.

Despite their differences, knock-in and knock-out options also share some similarities. Both types of options are sensitive to volatility, and changes in volatility can have a significant impact on their value. Additionally, both types of options can be used to create complex option spreads and other sophisticated trading strategies.

When deciding which type of option to use, traders should consider their investment goals and risk tolerance. Knock-in options are often more suitable for traders who are looking to speculate on market movements or hedge against potential losses. Knock-out options, on the other hand, are more suitable for traders who are looking to limit losses and protect their investments. By understanding the differences between knock-in and knock-out options, traders can make informed decisions about which option to use in a given situation.

In conclusion, knock-in and knock-out options are two powerful tools that can be used in options trading. By understanding their similarities and differences, traders can make informed decisions about which option to use in a given situation. Whether you are looking to speculate on market movements or limit losses, knock-in and knock-out options can be a valuable addition to your trading strategy.

Real-World Examples of Knock-In and Knock-Out Options in Action

Knock-in and knock-out options are powerful tools that can be used in a variety of trading scenarios. In this section, we will provide real-world examples of knock-in and knock-out options in action, including case studies of successful trades and lessons learned from failed trades.

Case Study 1: Using Knock-In Options to Speculate on Market Movements

A trader believed that the price of a particular stock would increase significantly in the near future. To take advantage of this potential price movement, the trader purchased a knock-in call option with a barrier set at $50. If the stock price reached $50, the option would come into existence, allowing the trader to buy the stock at the strike price. If the stock price did not reach $50, the option would expire worthless. In this case, the stock price did reach $50, and the trader was able to buy the stock at the strike price, earning a significant profit.

Case Study 2: Using Knock-Out Options to Limit Losses

A trader had a long position in a particular stock, but was concerned about the potential for losses if the stock price fell. To limit potential losses, the trader purchased a knock-out put option with a barrier set at $40. If the stock price fell to $40, the option would cease to exist, and the trader would be forced to sell the stock at the market price. In this case, the stock price did fall to $40, and the trader was able to limit their losses by selling the stock at the market price.

Lessons Learned from Failed Trades

While knock-in and knock-out options can be powerful tools, they are not without risk. One common mistake that traders make is setting the barrier too close to the current market price. This can result in the option being triggered too quickly, limiting its effectiveness. Another common mistake is failing to adjust the trading strategy in response to changing market conditions. By learning from failed trades, traders can refine their strategies and improve their overall trading performance.

In addition to these case studies, there are many other real-world examples of knock-in and knock-out options in action. By studying these examples, traders can gain a deeper understanding of how to use these options to manage risk and maximize returns in options trading.

Knock-in and knock-out options are versatile tools that can be used in a variety of trading scenarios. By understanding how to use these options effectively, traders can gain a competitive edge in the markets and improve their overall trading performance. Whether you are a seasoned trader or just starting out, knock-in and knock-out options are definitely worth considering.

Managing Risk with Knock-In and Knock-Out Options: Best Practices

When using knock-in and knock-out options, managing risk is crucial to achieving success in options trading. In this section, we will provide best practices for managing risk when using knock-in and knock-out options, including strategies for hedging, diversification, and position sizing.

Hedging with Knock-In and Knock-Out Options

Hedging is a key risk management strategy that involves taking positions in multiple assets to reduce overall risk. When using knock-in and knock-out options, hedging can be particularly effective in managing risk. For example, a trader could purchase a knock-in call option and a knock-out put option on the same underlying asset, effectively creating a hedge against potential losses. By doing so, the trader can limit potential losses while still maintaining the potential for gains.

Diversification with Knock-In and Knock-Out Options

Diversification is another key risk management strategy that involves spreading investments across multiple assets to reduce overall risk. When using knock-in and knock-out options, diversification can be particularly effective in managing risk. For example, a trader could purchase knock-in and knock-out options on multiple underlying assets, effectively spreading risk across multiple assets. By doing so, the trader can reduce overall risk and increase the potential for gains.

Position Sizing with Knock-In and Knock-Out Options

Position sizing is a critical aspect of risk management when using knock-in and knock-out options. By adjusting the size of the position, traders can manage risk and maximize returns. For example, a trader could adjust the size of the position based on the volatility of the underlying asset, increasing the size of the position during periods of low volatility and decreasing the size of the position during periods of high volatility.

Other Best Practices for Managing Risk

In addition to hedging, diversification, and position sizing, there are several other best practices for managing risk when using knock-in and knock-out options. These include:

- Setting stop-losses and take-profits to limit potential losses and lock in gains

- Monitoring market conditions and adjusting trading strategies accordingly

- Using knock-in and knock-out options in combination with other trading strategies, such as technical analysis and fundamental analysis

By following these best practices, traders can effectively manage risk when using knock-in and knock-out options, increasing the potential for gains and minimizing potential losses.

In conclusion, managing risk is a critical aspect of using knock-in and knock-out options effectively. By following these best practices, traders can minimize risk and maximize returns, achieving success in options trading.

The Role of Volatility in Knock-In and Knock-Out Options

Volatility plays a crucial role in options trading, and knock-in and knock-out options are no exception. In this section, we will explore the impact of volatility on knock-in and knock-out options, including how to adjust trading strategies to accommodate changing market conditions.

Understanding Volatility

Volatility refers to the degree of uncertainty or risk associated with the size of changes in the price of an underlying asset. In options trading, volatility is a critical factor, as it can significantly impact the value of an option. When volatility is high, option prices tend to increase, and when volatility is low, option prices tend to decrease.

The Impact of Volatility on Knock-In Options

Knock-in options are particularly sensitive to changes in volatility. When volatility is high, the likelihood of the option being triggered increases, which can result in significant gains for the trader. However, when volatility is low, the likelihood of the option being triggered decreases, which can result in losses for the trader. To adjust to changing market conditions, traders can adjust the strike price of the option, increase or decrease the size of the position, or use other risk management strategies.

The Impact of Volatility on Knock-Out Options

Knock-out options are also affected by changes in volatility, although in a different way. When volatility is high, the likelihood of the option being knocked out increases, which can result in losses for the trader. However, when volatility is low, the likelihood of the option being knocked out decreases, which can result in gains for the trader. To adjust to changing market conditions, traders can adjust the barrier level of the option, increase or decrease the size of the position, or use other risk management strategies.

Adjusting Trading Strategies to Accommodate Changing Market Conditions

To successfully trade knock-in and knock-out options, traders must be able to adjust their trading strategies to accommodate changing market conditions. This includes:

- Monitoring market conditions and adjusting the trading strategy accordingly

- Using technical analysis and fundamental analysis to identify trends and patterns

- Adjusting the strike price or barrier level of the option to reflect changing market conditions

- Increasing or decreasing the size of the position to manage risk

By understanding the impact of volatility on knock-in and knock-out options and adjusting trading strategies accordingly, traders can maximize returns and minimize losses in options trading.

In the world of options trading, volatility is a critical factor that can significantly impact the value of an option. By understanding how volatility affects knock-in and knock-out options, traders can make informed decisions and adjust their trading strategies to accommodate changing market conditions, ultimately achieving success in options trading.

Advanced Strategies for Knock-In and Knock-Out Options Traders

Experienced traders looking to take their knock-in and knock-out options trading to the next level can employ advanced strategies to maximize returns and minimize losses. In this section, we will explore complex option spreads, iron condors, and other sophisticated techniques that can help traders achieve success in options trading.

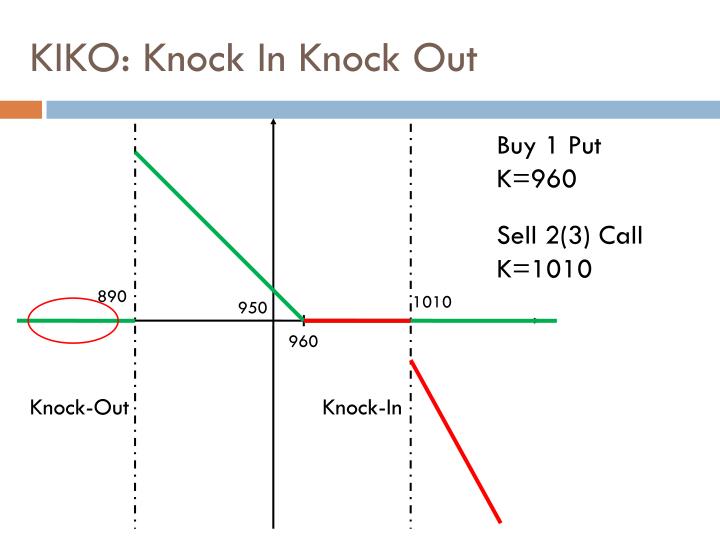

Complex Option Spreads

Complex option spreads involve combining multiple options with different strike prices, expiration dates, and underlying assets to create a customized trading strategy. For example, a trader could create a spread by buying a knock-in call option and selling a knock-out put option with a higher strike price. This strategy can help traders profit from volatility while limiting potential losses.

Iron Condors

Iron condors are a type of option spread that involves buying and selling options with different strike prices and expiration dates. This strategy can help traders profit from time decay and volatility while limiting potential losses. For example, a trader could buy a knock-in call option with a lower strike price and sell a knock-out put option with a higher strike price, while also selling a call option with a higher strike price and buying a put option with a lower strike price.

Ratio Spreads

Ratio spreads involve buying and selling options with different ratios of long and short positions. For example, a trader could buy two knock-in call options and sell one knock-out put option with a higher strike price. This strategy can help traders profit from volatility while limiting potential losses.

Volatility Trading

Volatility trading involves buying and selling options based on the expected volatility of the underlying asset. For example, a trader could buy a knock-in call option and sell a knock-out put option with a higher strike price if they expect volatility to increase. This strategy can help traders profit from changes in volatility while limiting potential losses.

Delta-Neutral Trading

Delta-neutral trading involves buying and selling options to create a delta-neutral position, which means that the trader is not exposed to changes in the underlying asset’s price. For example, a trader could buy a knock-in call option and sell a knock-out put option with a higher strike price, while also selling a call option with a higher strike price and buying a put option with a lower strike price. This strategy can help traders profit from time decay and volatility while limiting potential losses.

By incorporating these advanced strategies into their trading arsenal, experienced traders can take their knock-in and knock-out options trading to the next level and achieve success in options trading. Remember to always manage risk and adjust trading strategies to accommodate changing market conditions.

In the world of options trading, knock-in and knock-out options offer a range of advanced strategies for experienced traders. By employing complex option spreads, iron condors, and other sophisticated techniques, traders can maximize returns and minimize losses, ultimately achieving success in options trading with knock-in and knock-out options.

:max_bytes(150000):strip_icc()/dotdash_INV_final-Down-and-Out-Option_Feb_2021-01-2b26533c22b54c3088dacee7a4201d27.jpg)