What is the S&P 500 and Why Does it Matter?

The Standard and Poor’s 500, commonly referred to as the S&P 500, is a stock market index that represents the market value of 500 large, publicly traded companies in the United States. With a rich history dating back to 1957, the S&P 500 has become a widely recognized and respected benchmark for the US stock market. According to the Standard and Poor’s 500 Wikipedia page, the index is widely considered a leading indicator of the US stock market’s performance, and is often used as a proxy for the overall health of the US economy.

The S&P 500’s significance in the global financial market cannot be overstated. It is widely followed by investors, financial analysts, and the media, and is often used as a benchmark for investment portfolios. The index’s performance is closely watched by policymakers, and its movements can have a significant impact on the global economy. As a result, the S&P 500 has become an essential tool for investors and researchers, providing a broad snapshot of the US stock market and its trends.

How to Invest in the S&P 500: A Beginner’s Guide

Investing in the S&P 500 can be a great way to gain exposure to the US stock market and diversify a portfolio. For beginners, getting started with investing in the S&P 500 can seem daunting, but it’s easier than you think. There are several ways to invest in the S&P 500, including index funds, ETFs, and individual stocks.

Index funds are a popular choice for investing in the S&P 500 because they offer broad diversification and low fees. These funds track the performance of the S&P 500 index, holding a small portion of each of the 500 companies in the index. This provides investors with a low-cost way to own a piece of the US stock market. According to the Standard and Poor’s 500 Wikipedia page, index funds are a popular choice for investors due to their simplicity and cost-effectiveness.

ETFs, or exchange-traded funds, are another way to invest in the S&P 500. ETFs are traded on an exchange like stocks, offering investors the flexibility to buy and sell throughout the day. They often have lower fees than actively managed funds and provide investors with a way to gain exposure to the S&P 500 with more control over their investment.

For those who want to invest in individual stocks, the S&P 500 provides a list of 500 companies to choose from. This can be a more time-consuming and research-intensive approach, but it allows investors to pick and choose the companies they want to own. It’s essential to remember that investing in individual stocks carries more risk than investing in an index fund or ETF, as the performance of a single stock can be more volatile.

Regardless of the investment method chosen, it’s essential to have a long-term perspective and a solid understanding of the risks and rewards associated with investing in the S&P 500. By doing so, investors can make informed decisions and increase their chances of achieving their investment goals.

Understanding the S&P 500’s Market-Cap Weighting Methodology

The S&P 500’s market-capitalization weighting methodology is a critical aspect of the index’s construction. This methodology determines the weight of each constituent stock in the index, with the largest companies by market capitalization having a greater influence on the index’s performance. According to the Standard and Poor’s 500 Wikipedia page, the market-capitalization weighting methodology is designed to provide a more accurate representation of the US stock market.

The market-capitalization weighting methodology is calculated by multiplying the total shares outstanding of each company by its current stock price. The resulting market capitalization is then used to determine the company’s weight in the index. This means that companies with larger market capitalizations, such as Apple or Microsoft, have a greater influence on the index’s performance than smaller companies.

The implications of the market-capitalization weighting methodology are significant for investors. It means that the performance of the largest companies in the index has a disproportionate impact on the index’s overall performance. This can result in the index being more volatile than a equally weighted index, as the performance of a few large companies can drive the index’s movements.

Despite these implications, the market-capitalization weighting methodology has several advantages. It provides a more accurate representation of the US stock market, as the largest companies by market capitalization are often the most influential in the economy. Additionally, the methodology is transparent and easy to understand, making it easier for investors to make informed decisions.

Overall, the S&P 500’s market-capitalization weighting methodology is a critical aspect of the index’s construction. It provides a more accurate representation of the US stock market and has significant implications for investors. By understanding this methodology, investors can make more informed decisions and better navigate the complexities of the US stock market.

The S&P 500’s Sector Breakdown: A Closer Look

The S&P 500’s sector breakdown is a critical aspect of understanding the index’s composition and performance. The index is divided into 11 sectors, each representing a distinct segment of the US economy. According to the Standard and Poor’s 500 Wikipedia page, the largest sectors in the S&P 500 by market capitalization are Technology, Healthcare, and Financials.

The Technology sector is the largest in the S&P 500, accounting for approximately 27% of the index’s total market capitalization. This sector includes companies such as Apple, Microsoft, and Alphabet, which are among the largest and most influential in the world. The Healthcare sector is the second-largest, accounting for around 14% of the index’s market capitalization, and includes companies such as Johnson & Johnson and Pfizer.

The Financials sector is the third-largest, accounting for around 13% of the index’s market capitalization, and includes companies such as JPMorgan Chase and Bank of America. The remaining sectors, including Consumer Discretionary, Consumer Staples, Energy, Industrials, Materials, Real Estate, Telecommunication Services, and Utilities, make up the remaining 46% of the index’s market capitalization.

The implications of sector rotation are significant for investors. When one sector is performing well, it can drive the overall index’s performance, while a decline in that sector can have a negative impact. For example, the Technology sector’s strong performance in recent years has driven the S&P 500’s overall growth, while a decline in the Energy sector has had a negative impact.

Understanding the S&P 500’s sector breakdown is essential for investors seeking to make informed investment decisions. By analyzing the performance of each sector and identifying trends and opportunities, investors can make more informed decisions and optimize their portfolios.

The Role of the S&P 500 in a Diversified Investment Portfolio

Diversification is a fundamental principle of investing, and the S&P 500 can play a crucial role in a diversified investment portfolio. By combining the S&P 500 with other assets, investors can reduce risk, increase potential returns, and achieve optimal diversification. According to the Standard and Poor’s 500 Wikipedia page, the S&P 500 is widely considered a core holding in a diversified portfolio due to its broad representation of the US stock market.

One way to combine the S&P 500 with other assets is to use a multi-asset approach. This involves allocating a portion of the portfolio to the S&P 500, while also investing in other assets such as bonds, real estate, or international stocks. This approach can help to reduce risk by spreading investments across different asset classes, while also increasing potential returns.

Another approach is to use a sector-based approach, where the S&P 500 is combined with other sector-specific investments. For example, an investor may allocate a portion of the portfolio to the S&P 500, while also investing in sector-specific ETFs or mutual funds, such as technology or healthcare. This approach can help to increase potential returns by targeting specific sectors that are expected to perform well.

The S&P 500 can also be used as a core holding in a diversified portfolio by combining it with other index funds or ETFs. For example, an investor may allocate a portion of the portfolio to the S&P 500, while also investing in other index funds or ETFs that track different markets, such as international stocks or bonds. This approach can help to increase diversification and reduce risk, while also providing broad exposure to different markets.

In conclusion, the S&P 500 can play a vital role in a diversified investment portfolio. By combining the S&P 500 with other assets, investors can reduce risk, increase potential returns, and achieve optimal diversification. Whether using a multi-asset approach, sector-based approach, or combining the S&P 500 with other index funds or ETFs, the S&P 500 can provide a solid foundation for a diversified investment portfolio.

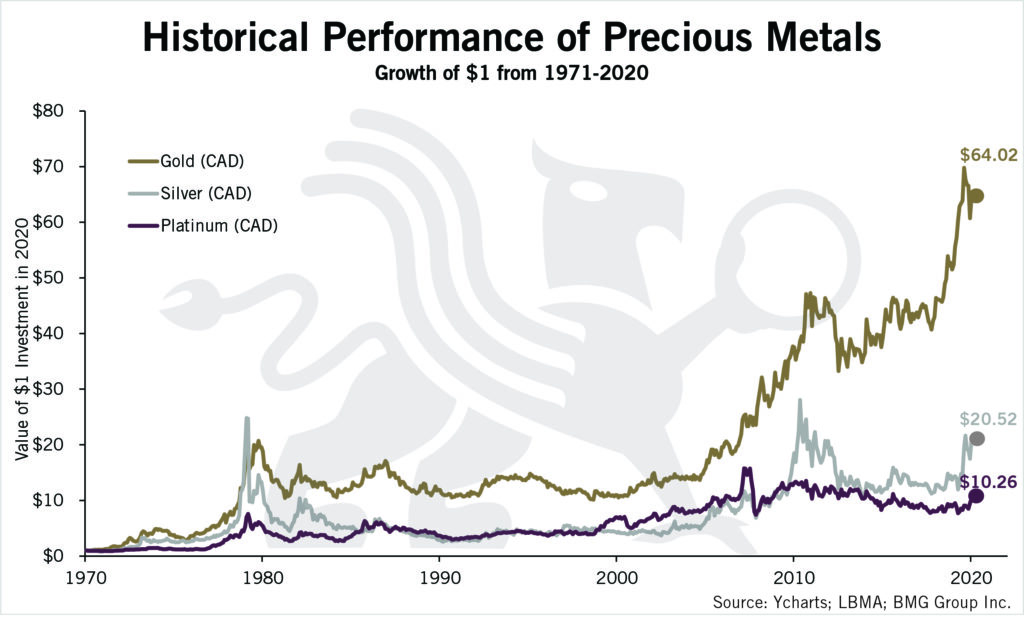

Historical Performance of the S&P 500: Trends and Insights

The S&P 500 has a rich history, with over 60 years of performance data available. Analyzing the historical performance of the S&P 500 can provide valuable insights for investors, including trends, volatility, and returns. According to the Standard and Poor’s 500 Wikipedia page, the S&P 500 has consistently outperformed other asset classes over the long term, making it a popular choice for investors.

One of the most notable trends in the S&P 500’s historical performance is its long-term upward trajectory. Despite experiencing periods of volatility and decline, the index has consistently trended upward over the long term, driven by the growth of the US economy and the performance of its constituent companies.

Another key insight from the S&P 500’s historical performance is its volatility. The index has experienced several significant declines over the years, including the 2008 financial crisis and the 2020 COVID-19 pandemic. However, it has also experienced periods of rapid growth, such as the bull market of the 1990s and the post-2008 recovery.

In terms of returns, the S&P 500 has historically provided strong performance over the long term. According to data from Yahoo Finance, the S&P 500 has returned an average of around 10% per year over the past 60 years, making it a attractive option for investors seeking long-term growth.

One of the key lessons from the S&P 500’s historical performance is the importance of a long-term perspective. While the index can be volatile in the short term, it has consistently provided strong returns over the long term, making it a popular choice for investors with a time horizon of five years or more.

Another key insight is the importance of diversification. The S&P 500 is a diversified index, comprising 500 of the largest and most successful companies in the US. This diversification helps to reduce risk and increase potential returns, making it a attractive option for investors seeking to diversify their portfolios.

The S&P 500’s Impact on the Global Economy

The S&P 500 is widely regarded as a bellwether for the global economy, and its performance has a significant impact on investor sentiment, interest rates, and economic growth. As a leading indicator of the US stock market’s performance, the S&P 500’s movements are closely watched by investors, policymakers, and economists around the world.

One of the key ways in which the S&P 500 influences the global economy is through its impact on investor sentiment. When the S&P 500 is performing well, investors tend to be more optimistic about the prospects for the economy, leading to increased investment and spending. Conversely, when the S&P 500 is declining, investors tend to be more cautious, leading to reduced investment and spending.

The S&P 500 also has a significant impact on interest rates. As a key indicator of the US economy’s performance, the S&P 500’s movements are closely watched by central banks and other policymakers. When the S&P 500 is performing well, interest rates tend to rise, as policymakers seek to slow down the economy and prevent inflation. Conversely, when the S&P 500 is declining, interest rates tend to fall, as policymakers seek to stimulate the economy.

In addition to its impact on investor sentiment and interest rates, the S&P 500 also has a significant impact on economic growth. As a leading indicator of the US economy’s performance, the S&P 500’s movements are closely watched by economists and policymakers. When the S&P 500 is performing well, it tends to indicate a strong economy, leading to increased economic growth and job creation. Conversely, when the S&P 500 is declining, it tends to indicate a weak economy, leading to reduced economic growth and job losses.

According to the Standard and Poor’s 500 Wikipedia page, the S&P 500 is widely followed by investors and policymakers around the world, and its performance is closely watched as a key indicator of the global economy’s health. As such, the S&P 500 plays a critical role in shaping investor sentiment, influencing interest rates, and affecting economic growth.

Conclusion: The Enduring Relevance of the S&P 500

In conclusion, the S&P 500 is a vital component of modern investing, offering investors a unique window into the performance of the US stock market. Through its market-capitalization weighting methodology, sector breakdown, and historical performance, the S&P 500 provides valuable insights for investors seeking to navigate the complexities of the global financial market.

As a leading indicator of the US stock market’s performance, the S&P 500 plays a critical role in shaping investor sentiment, influencing interest rates, and affecting economic growth. Its influence extends far beyond the US borders, with the S&P 500’s performance closely watched by investors, policymakers, and economists around the world.

For investors, the S&P 500 offers a range of benefits, including diversification, liquidity, and transparency. By investing in the S&P 500, investors can gain exposure to a broad range of sectors and industries, reducing risk and increasing potential returns. With its long history of performance data, the S&P 500 also provides valuable insights for investors seeking to understand the trends and patterns that shape the global financial market.

As noted on the Standard and Poor’s 500 Wikipedia page, the S&P 500 is widely regarded as a benchmark for the US stock market, and its performance is closely watched by investors and policymakers around the world. As such, the S&P 500 remains a vital component of modern investing, offering investors a unique combination of diversification, liquidity, and transparency.

In today’s fast-paced and increasingly complex global financial market, the S&P 500 remains a beacon of stability and reliability, providing investors with a trusted and widely followed benchmark for the US stock market’s performance. As investors seek to navigate the challenges and opportunities of the global financial market, the S&P 500 will continue to play a critical role, offering valuable insights, diversification, and returns for generations to come.