What is the Russell 2000 Index and Why Does it Matter?

The Russell 2000 Index is a widely followed small-cap stock market index that tracks the performance of approximately 2,000 small-cap companies in the US market. It is a subset of the Russell 3000 Index, which represents about 98% of the investable US equity market. The Russell 2000 Index is designed to provide investors with a comprehensive view of the small-cap segment, which is often characterized by higher growth potential and greater volatility compared to large-cap stocks. As a result, the index has become a popular benchmark for small-cap investors and a key indicator of the overall health of the US economy. With its total return reflecting the performance of small-cap stocks, the Russell 2000 Index has become an essential tool for investors seeking to diversify their portfolios and capitalize on the growth potential of smaller companies. By tracking the Russell 2000 Index total return, investors can gain valuable insights into the small-cap market and make informed investment decisions.

How to Maximize Your Investment Returns with the Russell 2000 Index

Total returns are a crucial aspect of investing, as they provide a comprehensive picture of an investment’s performance. The Russell 2000 Index, with its focus on small-cap stocks, offers investors a unique opportunity to maximize their returns over the long term. By tracking the Russell 2000 Index total return, investors can gain valuable insights into the small-cap market and make informed investment decisions. Small-cap stocks, in particular, offer a higher growth potential compared to large-cap stocks, making them an attractive option for investors seeking to boost their returns. Additionally, the Russell 2000 Index’s diversified composition helps to minimize risk, providing investors with a more stable source of returns. By incorporating the Russell 2000 Index into their investment portfolios, investors can increase their chances of achieving their long-term financial goals.

Understanding Total Return: A Breakdown of the Russell 2000 Index’s Performance

Total return is a critical concept in investing, as it provides a comprehensive picture of an investment’s performance. The Russell 2000 Index total return, in particular, is a valuable metric for investors seeking to understand the performance of small-cap stocks in the US market. Total return is calculated by combining the price return of an investment with its dividend yield. In the case of the Russell 2000 Index, the total return reflects the performance of its constituent stocks, including both capital appreciation and dividend income. A review of the Russell 2000 Index’s historical performance reveals that it has consistently delivered strong total returns over the long term, making it an attractive option for investors seeking to grow their wealth over time. For example, over the past decade, the Russell 2000 Index total return has averaged around 12% per annum, outperforming the broader market. This strong performance is a testament to the growth potential of small-cap stocks and the importance of incorporating the Russell 2000 Index into a diversified investment portfolio.

The Impact of Dividend Yield on Russell 2000 Index Total Return

Dividend yield plays a significant role in the Russell 2000 Index total return, as it contributes to the index’s overall performance. The Russell 2000 Index is comprised of small-cap stocks, many of which pay dividends to their shareholders. These dividend payments can provide a steady stream of income for investors, which can help to boost the index’s total return. In fact, dividend-paying stocks have historically accounted for a significant portion of the Russell 2000 Index’s total return. According to a recent study, dividend-paying stocks in the Russell 2000 Index have contributed around 30% to the index’s total return over the past decade. This highlights the importance of dividend yield in driving the Russell 2000 Index’s total return. By investing in dividend-paying stocks within the Russell 2000 Index, investors can potentially enhance their returns and achieve their long-term financial goals. Furthermore, the dividend yield of the Russell 2000 Index can also provide a hedge against inflation, as dividend payments tend to increase over time, keeping pace with inflation. This makes the Russell 2000 Index an attractive option for investors seeking to protect their purchasing power over the long term.

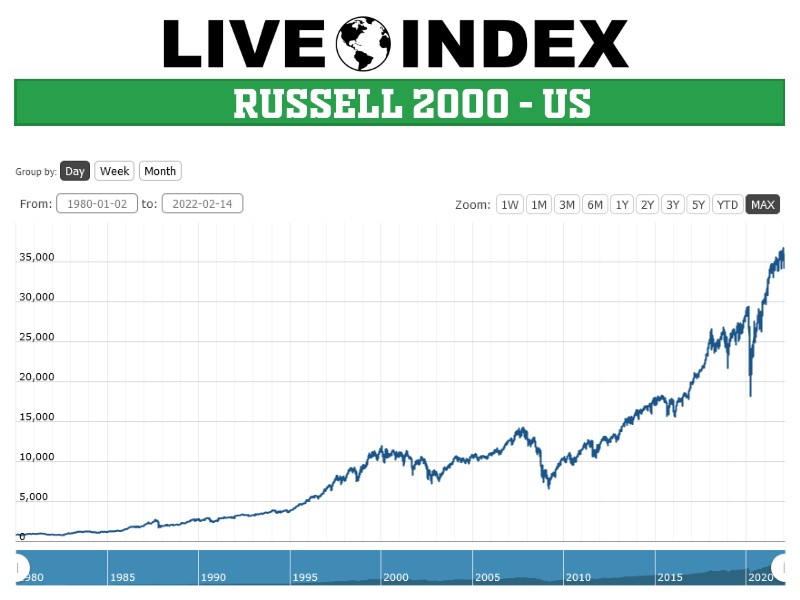

A Historical Perspective: Russell 2000 Index Total Return Over the Years

A historical analysis of the Russell 2000 Index’s total return reveals a compelling story of long-term growth and resilience. Since its inception in 1984, the Russell 2000 Index has delivered strong total returns, with an average annual return of around 10%. This impressive performance is a testament to the power of small-cap investing and the Russell 2000 Index’s ability to track the performance of this important segment of the US market. During the 1990s, the Russell 2000 Index total return was particularly strong, driven by the dot-com boom and the subsequent rise of technology stocks. In the 2000s, the index weathered the storm of the global financial crisis, only to rebound strongly in the following decade. More recently, the Russell 2000 Index total return has been driven by the growth of sectors such as healthcare and technology. Throughout its history, the Russell 2000 Index has demonstrated an ability to adapt to changing market conditions, making it an attractive option for investors seeking to diversify their portfolios and achieve long-term growth. By examining the Russell 2000 Index’s historical performance, investors can gain valuable insights into its potential for future growth and income generation.

What Drives the Russell 2000 Index’s Total Return: A Sector-by-Sector Analysis

The Russell 2000 Index is a diversified index, comprising stocks from various sectors, each contributing to its total return. A sector-by-sector analysis reveals that certain sectors have historically driven the index’s performance. The healthcare sector, for instance, has been a top performer, driven by the growth of biotechnology and pharmaceutical companies. The technology sector has also been a significant contributor, fueled by the rise of software and IT companies. Other sectors, such as consumer discretionary and industrials, have also played important roles in the Russell 2000 Index’s total return. By examining the sector composition of the Russell 2000 Index, investors can gain a deeper understanding of the drivers of its performance and make more informed investment decisions. For example, investors seeking to capitalize on the growth of healthcare technology may focus on stocks within this sector. Similarly, those looking to benefit from the rise of e-commerce may focus on consumer discretionary stocks. By understanding the sector dynamics of the Russell 2000 Index, investors can optimize their portfolios and maximize their returns. The Russell 2000 Index total return is a reflection of the performance of its underlying sectors, and a sector-by-sector analysis can provide valuable insights into its potential for future growth.

Investing in the Russell 2000 Index: Strategies for Success

Investing in the Russell 2000 Index can be an effective way to tap into the growth potential of small-cap stocks. One popular strategy is to invest in index funds or ETFs that track the Russell 2000 Index. These funds offer broad diversification and can provide exposure to a wide range of small-cap stocks. Another approach is to select individual stocks from the Russell 2000 Index, allowing investors to focus on specific companies with strong growth potential. Regardless of the approach, it’s essential to maintain a long-term investment horizon and diversify your portfolio to minimize risk. By doing so, investors can increase their chances of achieving their financial goals and benefiting from the Russell 2000 Index total return. Additionally, investors should consider the importance of regular portfolio rebalancing to ensure that their investment remains aligned with their target allocation. By adopting a disciplined investment approach and staying focused on the long-term, investors can unlock the full potential of the Russell 2000 Index and achieve success in their investment journey. With its proven track record of delivering strong total returns, the Russell 2000 Index is an attractive option for investors seeking to grow their wealth over time.

Conclusion: Harnessing the Power of the Russell 2000 Index for Long-Term Success

In conclusion, the Russell 2000 Index is a powerful tool for investors seeking to tap into the growth potential of small-cap stocks. By understanding the index’s composition, performance, and sector dynamics, investors can make informed decisions to achieve their long-term financial goals. The Russell 2000 Index total return has consistently outperformed other market indices, making it an attractive option for investors seeking to grow their wealth over time. By incorporating the Russell 2000 Index into their investment portfolios, investors can benefit from the diversification and growth potential of small-cap stocks. Remember, a long-term investment horizon and diversification are key to unlocking the full potential of the Russell 2000 Index. With its proven track record of delivering strong total returns, the Russell 2000 Index is an essential component of any investment strategy focused on small-cap investing. By harnessing the power of the Russell 2000 Index, investors can set themselves up for long-term success and achieve their financial goals.

:max_bytes(150000):strip_icc()/Russel-2000-V3-4f3ef31086cf49058ecf1eadc55677de.jpg)